The UK Probiotic Supplements market is estimated to be worth USD 596.5 million by 2025 and is projected to reach a value of USD 1,844.5 million by 2035, growing at a CAGR of 7.5% over the assessment period 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 596.5 million |

| Industry Value (2035F) | USD 1,844.5 million |

| CAGR (2025 to 2035) | 7.5% |

The UK probiotics market, driven by the rise of consumer awareness of gut health, immunity, and all-around well-being, is experiencing huge growth. The increase in digestive health disorders, along with the consuming preference for functional foods and dietary supplements, has been the demand driver for the probiotic form of products.

Probiotics are live microorganisms that provide health benefits when consumed in adequate amounts; for example, they help to restore the gut flora, which in turn gives the host several health benefits like better digestion, stronger immune system, and lower risk of gastrointestinal diseases.

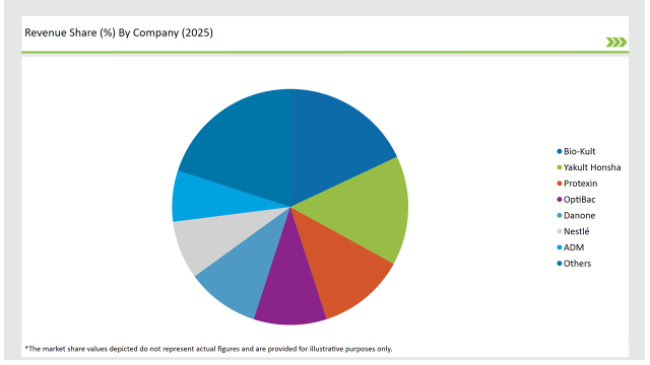

The UK March probiotics Key players are Bio-Kult, Yakult Honsha, Protexin, OptiBac, Danone, Nestlé and ADM. These companies are not only expanding their product lines and investing in clinical research but also using digital marketing strategies to meet the needs of the growing health-conscious consumer pool.

The market is further driven by probiotic supplements, which are now becoming common among already existing folks who are fitness enthusiasts and the elderly veer towards natural alternatives for gut health. Another emerging trend in the non-diary shift is the use of plant-based probiotics, with a vegan-friendly probiotic formulation demand icing a significant cake.

Defensive quality standards established by the UK Food Standards Agency (FSA) are impacting the probiotic supplement area which, in turn, ensures product effectiveness and safety.

Even amid some hurdles such as the lack of consumer knowledge on special strain benefits and high product prices, the market seems to thrive being aided by novel techniques in formulating materials, and the wider distribution of probiotics in shops and on the internet.

Explore FMI!

Book a free demo

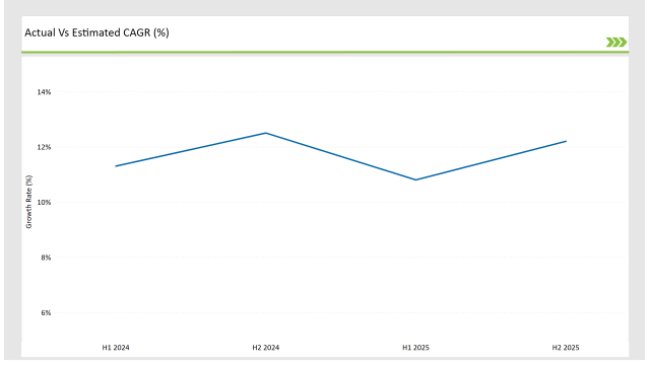

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Probiotic Supplements market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | Bio-Kult launched a new range of vegan probiotic supplements targeting gut health and immunity. |

| Oct 2024 | Boots expanded its probiotic supplement portfolio to include more clinically validated strains. |

| Sep 2024 | OptiBac introduced a personalized probiotic formulation using AI-driven gut microbiome analysis. |

| Aug 2024 | Yakult Honsha partnered with fitness influencers to promote probiotic benefits through social media campaigns. |

| Jul 2024 | Holland & Barrett reported a 30% increase in online sales of probiotic supplements in the UK. |

Increasing Demand for Gut Health and Immunity Support

These days, UK citizens have started to adopt a more integrated and holistic approach to their health. As a result, they are now mainly turning to probiotic supplements as a way of improving their gut health and supporting their immune system.

The pandemic-related health-conscious turn has fostered a rise in the public's knowledge about the gut-immune relationship, therefore creating the natural demand for the scientifically-taught probiotic formulations. Citizens are choosing preventive medications, with probiotics standing out as a natural cure to digestive issues and thus support immune function. The rise in digestive problems such as IBS and bloating is another plus point for the demand acceleration.

Breakthroughs in Probiotic Strains and Formulation Techniques

Research in probiotics is giving rise to more targeted strains and innovations that are longer-lasting start-ups. Strain-specific formulations for digestive health, stress reduction, and metabolic support are some of the popular ones.

The encapsulation technology is another way of advancing probiotic viability, ensuring better absorption and consequently, increasing efficacy. Scientific studies that prove the utility of probiotics have built consumer confidence to a greater extent, and thus led the pharmaceutical companies to invest more in R&D.

Online Sales and Retail Pharmacies are Expanding the Distribution Channels

The UK probiotic supplements market is 32% retail pharmacies and drug stores, as these are still the most common channels for buying them. Moreover, probiotics are e-commerce platforms, DTC, and pharmacy retail chains, that are pushing probiotic supplements to the fore by increasing the availability of these products in supermarkets and health shops. Brands of probiotic cures are going through a subscription model, where consumers pay a regular fee to receive their probiotic delivery.

In addition, supermarkets along with health stores are expanding their probiotic product lines, making it user-friendly for the public to find high-quality formulations. The online sales of probiotics are also on the rise, where most of the leading retailers launch the exclusive probiotic lines through their online platforms to meet the customers associated with the demand for personalized nutrition.

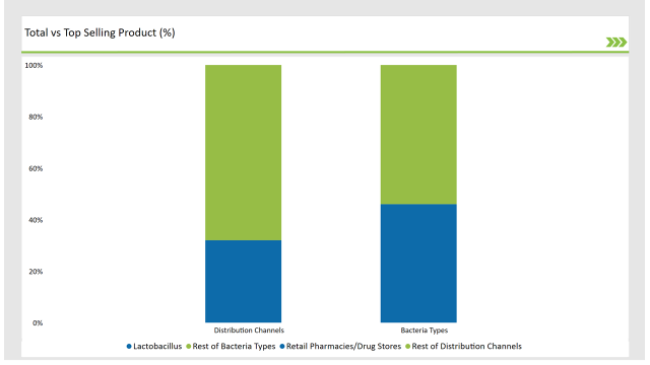

% share of Individual categories by bacteria Type and distribution channel in 2025

Lactobacillus dominates the market with 46% of the UK probiotic supplements share due to the extensive list of the health benefits it has. This bacterial strain has a tremendous role to play in the balancing of the gut flora, improving the digestion process, and enhancing the immune function.

Lactobacillus-based probiotic supplements are widely utilized in the treatment of irritable bowel syndrome (IBS), lactose intolerance, and inflammatory bowel diseases (IBD). With an increasing number of consumers looking for specific gut health remedies, manufacturers focus on the newly developed formulas of high-potency Lactobacillus which have better stability and effectiveness.

Retail pharmacies and drug stores continue to be the main distribution channel, accounting for about 32% of the total probiotic supplement sales in the UK. Most buyers would prefer to buy probiotics in a trusted pharmacy chain, where they can have the assistance from an expert on the selection of the right supplement.

Note: above chart is indicative in nature

The UK probiotic supplement sector is moderately competitive, marked by key providers proclaiming focus on product innovation, clinical research, along with digital marketing strategies that are meant for consumer needs. The leading names in this sector for instance are Peer-Bioxulin, Yakult, Protexin, OptiBac, Danone, Nestlé, and ADM.

These manufacturing companies are actively sparing money on their R&D to come up with the best probiotic formulations with long shelf life, multi-strain effects, and finally, increased bioavailability. The preponderance of the online is a good brand that dethrones brands from the sites of superintendent and prescriptions.

Personalized probiotic solutions are also being offered by the brands through the subscription models online, direct-to-consumer (DTC) and the brands focus. Besides that, the pharmaceutical sector is demonstrating a growing interest in probiotic applications, with many players in the field looking into the possible association of probiotics with drugs along with the aim of improving the efficacy.

Sustainability is a priority, and brands are investing in eco-friendly probiotic packaging and minimizing plastic waste. The market structure is redefined as a result of the abandonment of the previous method by more health-centered individuals, who go after good quality probiotics that have scientific proof.

Within the Forecast Period, the UK Probiotic Supplements market is expected to grow at a CAGR of 7.5%.

By 2035, the sales value of the UK Probiotic Supplements industry is expected to reach USD 1,844.5 million.

Key factors propelling the UK Probiotic Supplements market include Increasing awareness among consumers about the health benefits of probiotics, such as improved gut health and immune function. Rising prevalence of digestive issues and the growing trend towards preventative healthcare, driving the demand for probiotic supplements.

Prominent players in the UK Probiotic Supplements manufacturing include Peer-Bioxulin, Yakult, Protexin, OptiBac, Danone, Nestlé, and ADM. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Capsules, Tablets, Powder, Liquid

Lactobacillus, Bifidobacterium, Streptococcus, Others

Retail Pharmacies/Drug Stores, Online Retail, Supermarkets/Hypermarkets, Health Food Stores.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.