The UK Probiotic Ingredients market is currently valued at around USD 314.7 million, and is anticipated to progress at a CAGR of 7.9% to reach USD 672.2 million by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 314.7 million |

| Industry Value (2035F) | USD 672.2 million |

| CAGR (2025 to 2035) | 7.9% |

In the probiotic ingredient sector in the UK, the growth is predictable and positive as it is primarily the consumers' awareness of gut health, digestive wellness, and immune system support that drives it.

The most popular types of strains for probiotics are the Lactobacillus strains and Bifidobacterium strains, which are the most popular probiotic strains, comprising 75% of the market share because of their extensive health benefits and frequent use in food and supplements.

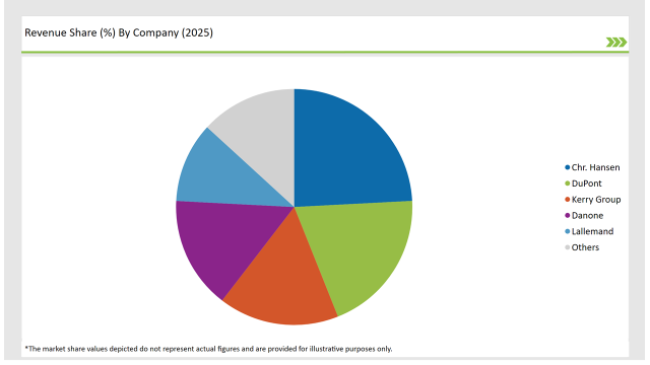

Market players are focused mostly on scientific research, clinical trials, and advanced formulation technologies. The UK probiotic ingredients market is highly competitive, with anchor players like Chr. Hansen, DuPont, Kerry Group, Danone, Lallemand, and Yakult unceasingly coming up with innovations to cater to the demand for functional probiotic solutions.

As regulatory scrutiny shifts up a notch, manufacturers are shifting their effort towards the strains shown in clinical studies to offer real health benefits. Enterprise expansion including the building of production facilities and the establishment of strategic alliances with food and supplement brands forms the basis of improved market penetration. The trend of the high-potency, shelf-stable, and targeted probiotic solutions is another factor that intensifies the competitive landscape.

The innovation of probiotic research, strain development, and new delivery formats has allowed the UK probiotic ingredients market to achieve unprecedented growth.

Explore FMI!

Book a free demo

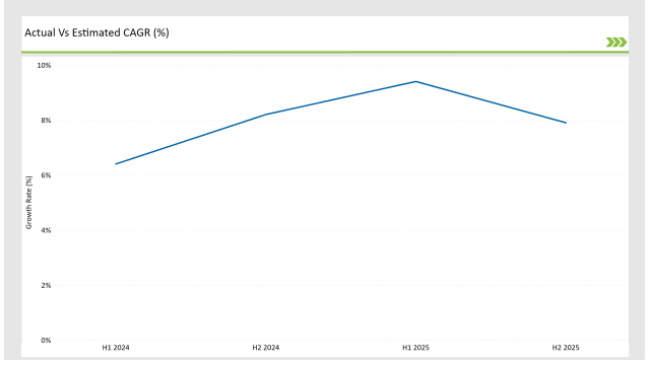

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Probiotic Ingredients market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | Chr. Hansen introduced a heat-stable probiotic strain for use in functional beverages and plant-based dairy alternatives. The strain is designed to survive high-temperature processing, expanding formulation possibilities. |

| Oct 2024 | Kerry Group launched a clinically backed probiotic supplement targeting digestive health and stress management. The product was developed in response to increasing demand for gut-brain axis solutions. |

| Sep 2024 | DuPont expanded its UK-based probiotic production facility to enhance local supply and meet the growing demand for high-potency probiotic strains. The investment is aimed at improving production efficiency and sustainability. |

| Aug 2024 | Danone reformulated its probiotic yogurt range with new bacterial strains, emphasizing scientifically validated digestive and immune benefits. The company is focusing on UK consumers seeking evidence-based functional foods. |

| Jul 2024 | Lallemand collaborated with UK dietary supplement brands to launch new probiotic capsules featuring delayed-release technology. This innovation ensures probiotics reach the intestines effectively, enhancing their efficacy. |

Probiotics are not just for the gut anymore

Probiotic applications are entering the UK market not only through digestive health, and now they are going even further. Immune support, stress management, cognitive and skin health are among the new applications of probiotics.

The steady growth of the holistic wellness market is the foremost reason for manufacturers to invent combinations of probiotics which offer a wide range of health benefits. This new trend is easily noticeable in the sports nutrition, women's health, and child-friendly probiotic formulations areas like where probiotics are made specifically for muscle recovery, hormonal balance, and baby gut health.

Delivery Systems and Formulations of Probiotics Breakthroughs

Formulating the probiotics partly depends on stabilizing and ensuring the survival of the product throughout processing, transportation, and shelf life. Thanks to the technologies of microencapsulation, freeze-drying, and probiotics of spore-forming strains which have improved the survival rate of probiotics in unfavorable environmental conditions.

Such breakthroughs make it possible to use many probiotic strains in new kinds of vegetable and fruit foods, including those exposed to high-acid and heat-treatments. Furthermore, the interest in probiotic strains that can withstand extreme pH conditions is constantly rising thus the field of pharmaceuticals and functional beverages seem to be opened wide for the introduction of probiotics.

The Most Important Organic Marketing Strategy

Advent of personalized nutrition means a multi-D probiotic that will be of great benefit to its consumer. This has led to the development of strain-specific formulations for the treatment of such conditions as IBS, lactose intolerance, and stress-related digestive issues.

The companies have begun to use the AI-driven health tracking and microbiome testing services for providing tailored probiotic solutions that are in line with the trend of personalized health and wellness. Additionally, the brands have added for the first time, pre-and probiotic combinations in their products in an idea to enhance the effectiveness of probiotics and make sure that they reach gut in optimal condition.

% share of Individual categories by Product Type and Applications in 2025

Among the bacterial strains of probiotics, particularly Lactobacillus and Bifidobacterium strains, form 75% of the market being that they are well known for their health benefits and application in tension of food and supplements.

The studies that are being conducted have also revealed that the use of the next-generation probiotic strains such as Akkermansia muciniphila and Faecali bacterium, which are beneficial for metabolic health and inflammation control are on the rise.

As the number of individuals diagnosed with digestive disorders and those with immunity problems, the drive for manufacturers to create extremely potent and narrow-aimed bacterial probiotic formulas is accentuated.

The food & beverage industry represents the largest share of the probiotics ingredient market, reaching 45%, and is primarily concentrated in dairy products, drinks, and meat alternatives.

The increasing prevalence of gut-friendly products such as kombucha and probiotic snacks has acted as a magnet for the market growth with the aim of manufacturers adding health benefits to their products. Furthermore, the development of plant-based dairy substitutes is a significant reason for the inclusion of probiotics in vegan-friendly and lactose-free products.

Note: above chart is indicative in nature

The UK probiotic ingredient market is highly competitive, and the key players are heavily invested in scientific research, clinical trials, and the development of advanced formulation technologies. Key companies such as Chr. Hansen, DuPont, Kerry Group, Danone, Lallemand, and Yakult are always finding new ways to innovate and be the first to meet the high consumer demand for functional probiotic solutions.

With growing regulatory scrutiny, manufacturers have started to focus on evidence-backed probiotic strains which have been clinically proven to have health benefits. Alongside this, businesses are increasing the number of production facilities and are engaging in strategic partnerships with popular food and supplement brands to boost market penetration. The move towards high-potency, shelf-stable, and targeted probiotic solutions will continue to create competition in the sector.

The UK probiotic ingredients market will remain on its course of steady growth owing to the sustained investment in probiotic research, strain development, and innovative delivery formats.

Within the Forecast Period, the UK Probiotic Ingredients market is expected to grow at a CAGR of 7.9%.

By 2035, the sales value of the UK Probiotic Ingredients industry is expected to reach USD 672.2 million.

Key factors propelling the UK Probiotic Ingredients market include rising consumer awareness of gut health, expanding functional food applications, and advancements in probiotic stability technologies.

Prominent players in the UK Probiotic Ingredients manufacturing include Chr. Hansen, DuPont, Kerry Group, Danone, Lallemand, and Yakult. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Bacterial, Yeast

Powder, Granules, Capsules, Gel, Others

Food & Beverage, Animal Feed, Dietary Supplements, Cosmetics & Personal Care.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.