The UK Prenatal Vitamin Supplement market recorded sales of USD 28.5 million in 2025. Over the assessment period from 2025 to 2035, the global market is projected to expand at a compound annual growth rate (CAGR) of 8.4%, resulting in a market size of USD 63.8 million by the end of 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 28.5 million |

| Industry Value (2035F) | USD 63.8 million |

| CAGR (2025 to 2035) | 8.4% |

The UK prenatal vitamin supplement market is expanding due to the increasing realization of maternal health among both pregnant women and health professionals. Prenatal vitamins are especially developed for the supply of nutrients like folic acid, iron, calcium, and vitamin D that are essential for fetal growth and the health of the mother.

The supplementation with prenatal supplements in the UK is experiencing a significant rise as birth rates increase and preventive healthcare is given a higher priority.

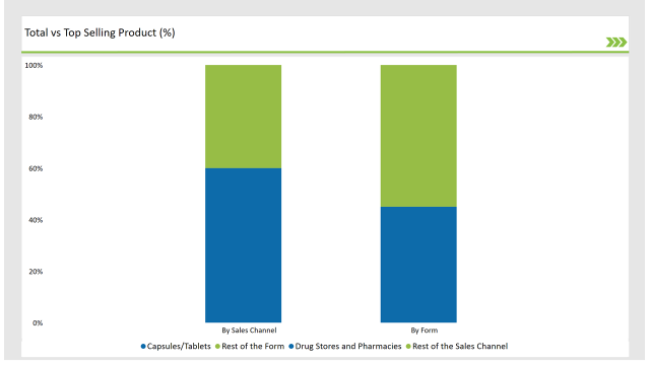

By form, capsule and tablet formulations hold the major share of the market, with a 45% contribution. The formats are selected as they are more convenient, they allow the patient to take exactly the right dose, and they are more accessible.

Many women opt for the capsule/tablet solution because of the comfort they provide and their compatibility with everyday routines. By sales channel, pharmacies and drug stores are the main points of distribution, which proves their reliability and proximity to the consumers who seek for professional advice.

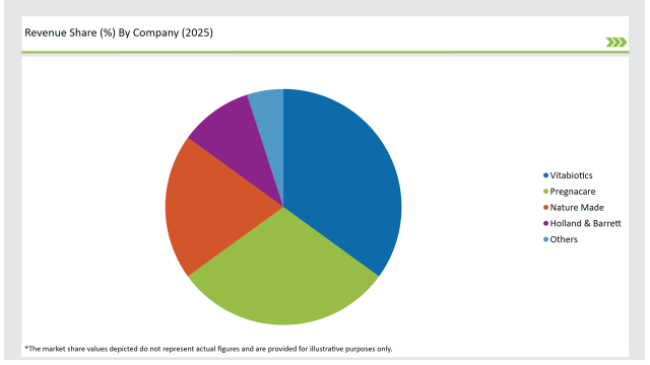

The market in the UK is led by big names like Vitabiotics, Pregnacare, and Nature Made that offer a selection of prenatal supplements especially designed for different consumer needs. These firms are very active in the market, continually launching products that include even more nutrients like omega-3 fatty acids and probiotics, which boosts their attractiveness.

The market is additionally influenced by the growing consumer interest in clean-label and allergen-free products. A lot of expectant mothers are searching for batches that are without artificial additives and allergens, which corresponds to the overall health and wellness market trends. Also, the e-commerce platforms are emerging as the main growth driver, providing ease of purchase, competitive pricing, and a range of products.

With public relations campaigns developed by healthcare professionals and organizations such as the NHS that highlight the critical need for prenatal nutrition, the market will further grow. Not only the advancements in product designs but also the expansion to retail will most probably be the main drivers of the UK prenatal vitamin supplement market.

Explore FMI!

Book a free demo

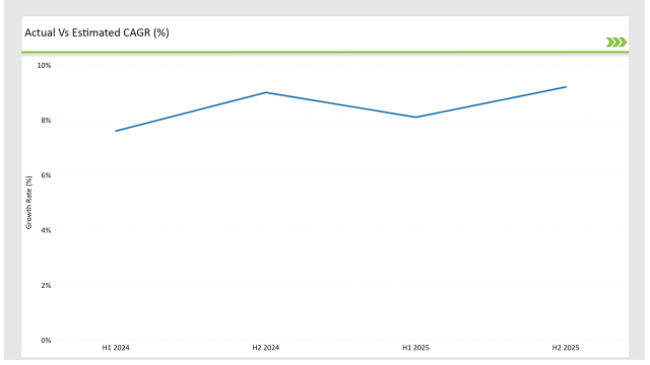

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Prenatal Vitamin Supplement market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | Vitabiotics launched a new prenatal supplement line enriched with choline to support brain development in fetuses. The product was introduced in capsule and tablet forms to cater to consumer preferences. |

| April 2024 | Nature Made expanded its UK operations by partnering with leading drugstore chains, increasing accessibility for its premium prenatal vitamins. This partnership aims to enhance retail availability across the country. |

| June 2024 | Pregnacare introduced a vegan-friendly prenatal supplement featuring plant-based DHA, targeting health-conscious and vegan consumers. This product aligns with the growing demand for sustainability and inclusivity in healthcare. |

| September 2024 | A collaboration between Boots Pharmacy and leading supplement brands launched an awareness campaign focusing on the importance of folic acid during pregnancy. This initiative included in-store promotions and educational materials. |

| November 2024 | Holland & Barrett unveiled a private-label prenatal supplement range, focusing on affordability and clean-label ingredients to attract budget-conscious consumers. The product is now available across its UK outlets. |

Targeted Nutrient Profiles for Personalized Needs

A highly developed movement in the UK prenatal vitamin market is the formation of customized nutrients profiles addressing the particular health issues of expectant mothers. To illustrate, products with choline and DHA have been well received and are fast becoming a common sight as they are linked to the development of the baby’s brain. Vitabiotics has aced this innovation by the introduction of the special formulations for separate pregnancies.

The Interest in Vegan and Allergen-Free Products is Rising

The vegan and allergen-free types of prenatal dietary supplements market is on a rise, as the buyers turn to engage more with their own global and dietary ethical issues. The plant-based DHA supplement of Pregnacare has been launched as the answer to express the brand’s commitment to these changing preferences. It is clear that this is an upcoming trend, as more manufacturers are expected to follow suit by introducing these products into the niche markets.

Growth in Subscription-Based Models

Subscription models for prenatal vitamin supplements are becoming a relevant trend in the UK. Companies provide monthly delivery services ensuring that expectant moms have a steady stock of the products. These services offer individualized recommendations, based on needs, that boost customer loyalty and convenience.

% share of Individual categories by Form and Sales Channel in 2025

Capsules and tablets take up 45% of the UK prenatal vitamin supplement market share. Their leadership is because of being easy to use, exact dosing, and a wider range of channels both in stores and online.

Vitabiotics and Nature Made are some of the major brands that deal with this segment by making the most of their creative and technical expertise; this includes formulations fortified with essential nutrients like folic acid and iron. The fact that capsules and tablets are compact and easy to carry around makes them more attractive to busy expectant mothers.

Drug Stores and Pharmacies have a major share in the sales of prenatal vitamin supplements in the UK market. The drug stores as well as pharmacies are the most reliable sources for health care products and carry a good number of brands.

The big chains such as Boots and Holland & Barrett distribute a number of brands while they also expand with their private labels. Friendly promotion and health education are effective tools in driving sales and engagement in this channel.

Note: above chart is indicative in nature

UK's prenatal vitamins and supplements supply market is moderate partly and has both global and local manufacturing companies trying to fulfill the need of the customers.

The dominant players are Tier 1 companies such as Vitabiotics, Pregnacare, and Nature Made powering the market by their diverse product ranges, their cutting-edge science and their robust distribution channels. Smaller Tier 2 and Tier 3 players focus on eco-friendly solutions like organic, vegan, and allergen-free supplements to carve a niche.

For maintaining the competitive edge, major R&D investments are made by leading companies to improve the effectiveness and attractiveness of their products. Pharmacies and e-commerce platforms are being linked to further expand their market presence.

For instance, the Nature Made partnership with UK drugstores has massively amplified its retail outlet spread. At the same time, the private label launch from Holland & Barrett shows that the movement of economical and clean-label products contributing to the market dynamics is increasing.

As consumers get more informed about prenatal health, the UK market is slated for further innovations and expansion thereby reinforcing its status within the global healthcare industry.

Key factors propelling the UK Prenatal Vitamin Supplement market include Increasing awareness about the importance of prenatal nutrition for maternal and fetal health. Growing demand for personalized and specialized prenatal supplements to meet the unique nutritional needs during pregnancy.

Prominent players in the UK Prenatal Vitamin Supplement manufacturing include Vitabiotics, Pregnacare, Holland & Barrett and Nature Made. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Available in forms like Capsule/Tablets, Gummies, Powders, Liquids, Others.

Online, Drug Stores and Pharmacies, Hospital & Clinics, Hypermarkets/Supermarkets, Convenience Stores, Health and Wellness Stores, Specialty Stores, Departmental Stores.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.