The UK Potato Flakes market is currently valued at around USD 85.9 million, and is anticipated to progress at a CAGR of 4.2% to reach USD 129.6 million by 2035.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size (2025) | USD 85.9 million |

| Projected UK Industry Value (2035) | USD 129.6 million |

| Value-based CAGR (2025 to 2035) | 4.2% |

The UK potato flakes market is on an upward trajectory, driven by growing consumer demand for convenient and versatile food products that fit into their hectic lifestyles. Potato flakes are dehydrated mashed potatoes and are revered for their long shelf life, the most premium way of their along of the preparation, and the property of their keeping the original flavor and texture of the potatoes. These characteristics have made them a fundamental ingredient in the cooking styles of most households and industries.

Potato flakes are mainly included in the list of components needed to cook snacks, instant mashed potatoes, soups, sauces, and bakery items. Beyond their typical role as a base ingredient, they also help in improving the texture and consistency of processed foods. Their incomparability in several applications creates a market benefit, thus they are necessary for both food service operators and retail customers.

Over the years, McCain Foods, Idahoan Foods, and Lamb Weston have been the major manufacturers in the market as they lead it. Their efforts revolve mainly around wanting to do things more efficiently, introducing other products as well as enhancing their distribution network which will guarantee a steady influx of potato flakes in the UK. For example, some makers have come up with new flavored potato flakes or pre-mixed with other vegetables for anyone who wants to cook it easily.

Changes in dietary preferences also have their impact on the British market, such as the expansion of vegetarian and plant-based diets. Potato flakes are derived from plants and thus suit these schemes.

Consequently, they are increasingly chosen by producers who aspire to do clean-label and gluten-free product forms. Potato flakes, which are gaining entrance to the retail, foodservice, and food processing sectors, continue to be on track for persistently increasing demand.

Explore FMI!

Book a free demo

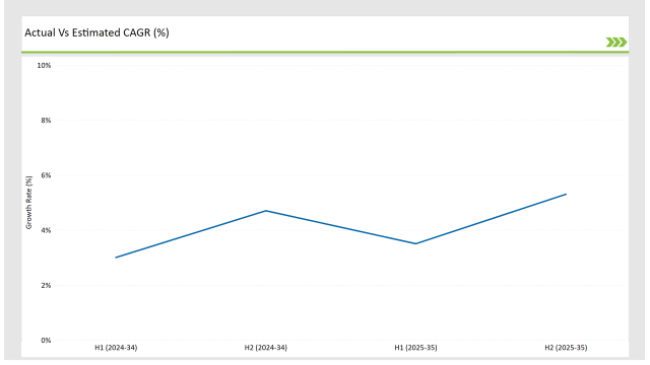

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Potato Flakes market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| March 2024 | Potato prices in the UK surged significantly, with English whites reaching £505 per tonne (a 159% year-on-year increase) and English Maris Piper hitting £600 per tonne (a 192% rise). This sharp increase was attributed to tight supplies and strong market demand. |

| May 7, 2024 | The Mintec Benchmark Prices reported English White potatoes at £630/MT, marking a 90% year-on-year increase, while English Maris Piper potatoes were priced at £660/MT, up by 120% year-on-year. Limited stocks and anticipated harvest delays contributed to these elevated prices |

| June 11, 2024 | The global potato flake market was valued at USD 8,056.80 million, with frozen potato flakes accounting for 56.7% of the market share. The food service/HoReCa industry was identified as a predominant user, making up 44.1% of the market share. |

| September 14, 2024 | The baked potato experienced a revival in the UK, largely due to TikTok influencers like the Spud Bros in Preston. Their innovative toppings and viral content attracted a younger audience, boosting the popularity of baked potatoes nationwide |

| December 10, 2024 | The average cost of a UK Christmas dinner rose by 6.5% compared to the previous year, driven by significant increases in vegetable prices, including a 16.3% jump in potato prices. |

The Most Popular Brightest of Innovations in Flavored Potato Flakes

Flavored potato flakes are commercialized in the UK format as consumers are on the lookout for new tastes for home cooking and snacking. Manufacturers are stepping in with flavored mixes of these potato flakes such as garlic, herb, cheese, and chili among others.

To this end, McCain Foods has made significant strides by the introduction of pre-seasoned potato flake blends where the consumer and chef received utmost simplicity with this innovation. One of the plus aspects of these innovations given by the companies is that they can stand out among the competition.

Rise in Demand from Quick-Service Restaurants (QSRs)

In the UK, the quick-service sector has emerged as one of the most significant markets for potato flakes, with many restaurants deploying them in toppings, mash, cocktails, and savory pie fillings.

QSRs have a regard for the potato flakes primarily because of how easy to prepare the products are, the guaranteed stable quality, and of course, the time savings they offer during the cooking peak times. Renowned foodservice providers’ partnerships with manufacturers like Lamb Weston provide superior quality designed specifically for bulk use in high-demand settings.

Original Food Products made with Potato Flakes

The quest for the utmost and unique food products in the market has triggered a rise in potato flakes for the production of new delicacies in the UK. Some of the new potato-flailed items being introduced are Protein-enriched snacks, gluten-free variety made, and even pie crusts that can be eaten with plant meats.

Together with the potatoes, Idahoan Foods is also marketing blueberry protein snacks that create the space for the waves of new flake applications coming from health-oriented consumers. These product feats show the quest for new levels of creativity with the food markets that potato flake will always be a part of.

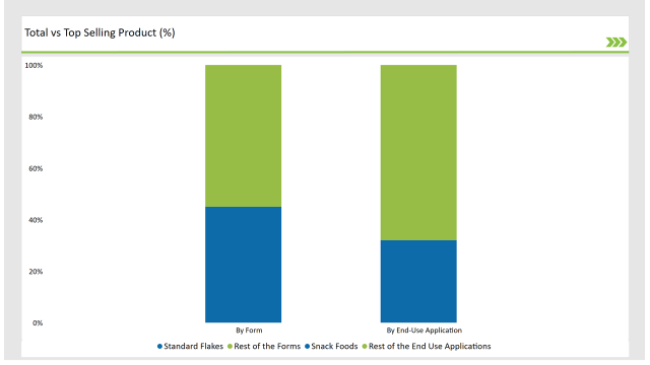

% share of Individual categories by Type and Applications in 2025

The Dominance of Standard Potato Flakes

The standard type of potato flakes has been leading the UK market for a long time. Bean consumers' favorite o that no one can ever take away classic and potato flakes varieties resist the changes. In the UK, tradition potato flakes are still the top choice of people for many reasons.

For one, the classic flakes have not only been a part of the UK's food culture, but they have also been a constant in British homes for legacy families that have used them for such meals as mashed, casseroles, and diversified comfort dishes. The standard flakes' texture and flavor, which are both reliable, offer nostalgia and tradition to a lot of customers' minds. So consumers were happy with that.

Potato Flakes are Elevating the UK Snack Food Market

The demand for potato-based products, particularly potato flakes, is on an upward trend in the UK snack food market, and thus the latter is benefiting the most from this. At the same time that consumers are turning to snacks that are more complex and flavorful, like potato flakes that are enhancing the overall snacking experience.

Hero of this story is the sought-after potato flakes because manufacturers according to the trend for more expensive healthier snacks are using them in very different ways. To facilitate the transition to a new product range, potato flakes have been utilized as a base ingredient in new offerings like potato chips and crackers, as well as baked goods and dips.

Note: above chart is indicative in nature

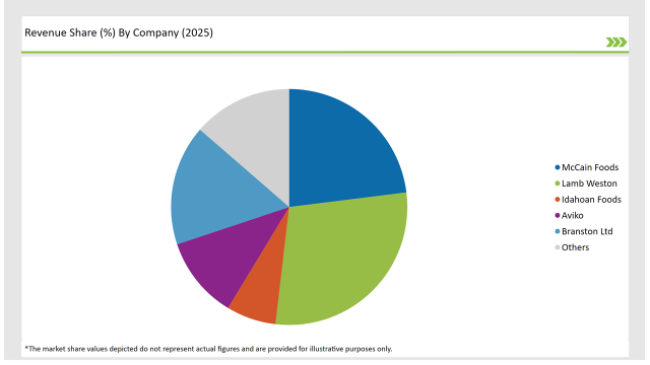

Leading companies in the UK potato flakes sector, like McCain Foods, Lamb Weston, Idahoan Foods, and Aviko have turned to product diversification as a way of maintaining their market positions. The latest initiatives are the introduction of pre-seasoned and protein-enriched potato flake products by Idahoan Foods and frozen flakes for bulk use by Lamb Weston.

Furthermore, these companies are utilizing their alliance with quick-service restaurants and food manufacturers to their benefit and increase sales. McCain Foods, being the market leader by a long way, constantly innovate with flavored potato flakes and the ready-to-cook solutions thus maintaining their position in both retail and foodservice channels.

Prominent players in the UK Potato Flakes manufacturing include Aviko UK Lamb Weston/Meijer McCain Foods (GB) Ltd Branston Ltd Greenvale AP Tesco Sainsbury's Waitrose Baxters Food Group Jas Bowman & Sons Ltd.

The UK potato flakes market is experiencing a surge in popularity, driven by a confluence of factors including the demand for convenience, culinary creativity, health and wellness trends, versatility, and premiumization.

The industry includes various flakes types such as Standard Flakes, Mashed Potato Pellets, Powder/Granules and Specialty Flakes.

Conventional and Organic.

Key applications like Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, and Others.

Key sales channels like B2B/Industrial, Wholesale, Retail, and Online are included in the report.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Yeast Extract Market Analysis by Type, Grade, Form, and End Use

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.