The UK plant based preservatives market is forecasted to achieve a market value of USD 332.4 million by 2025, witnessing consistent expansion to approximately USD 689.5 million by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 7.6% during the projected period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size (2025) | USD 332.4 million |

| Projected UK Value (2035) | USD 689.5 million |

| Value-based CAGR (2025 to 2035) | 7.6% |

The UK industry surrounding plant-based preservatives is witnessing substantial growth due to the increasing need for natural and clean-label options for food preservation.

There is a growing tendency among customers to search for herbs and spices, plant extracts, and essential oils owing to their antimicrobial and antioxidant benefits instead of synthetic preservatives. As for the market volume, the liquid format takes a lead because it is easy to use in processed foods and beverages.

Some of the more important growth drivers include the creation of multifunctional preservatives with prolonged shelf life, increasing investment into research and development of natural extraction techniques, and new regulations that are more supportive of plant-based products.

Cross-industry competition is strong with innovation leadership among Tate & Lyle, Kerry Group, and IFF International Flavors & Fragrances using preservatives tailored for specific applications such as bakery, dairy, and meat substitutes.

Explore FMI!

Book a free demo

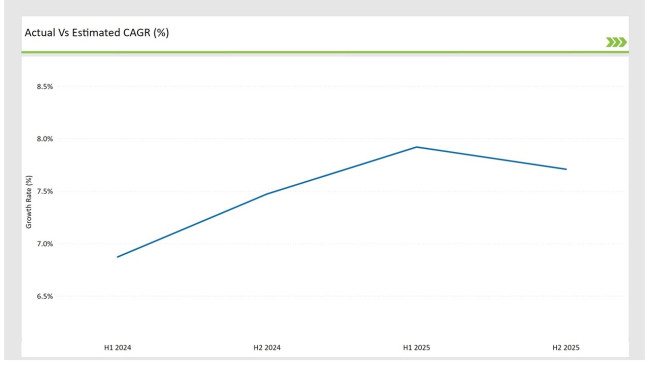

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Plant-Based Preservatives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 6.9% |

| H2 Growth Rate (%) | 7.5% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 7.9% |

| H2 Growth Rate (%) | 7.7% |

For the UK market, the Plant-Based Preservatives sector is projected to grow at a CAGR of 6.9% during the first half of 2024, with an increase to 7.5% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 7.9% in H1 and reach 7.7% in H2.

| Date | Details |

|---|---|

| Dec-2024 | Green Preservatives Ltd secured £10M funding to scale up production of rosemary-based preservatives. The company's natural extracts demonstrate equivalent efficacy to synthetic preservatives in meat alternatives. |

| Oct-2024 | Kemin Food Technologies opened a new plant extract facility in Wales focusing on natural preservation. The facility specializes in producing standardized botanical extracts for food preservation. |

| Aug-2024 | Naturex UK launched a new range of plant-based preservatives derived from British-grown herbs. The products offer clean-label solutions for extending shelf life in processed foods. |

| May-2024 | Kalsec Europe acquired herb extraction specialist HerbalTech UK for £15M. The acquisition includes proprietary technology for producing highly effective plant-based antimicrobials. |

| Mar-2024 | Givaudan Active Beauty established a natural preservatives research center in Cambridge. The facility focuses on developing new plant-based preservation systems for cosmetics and food applications. |

Rising Adoption of Herbs & Spices for Clean-Label Preservation

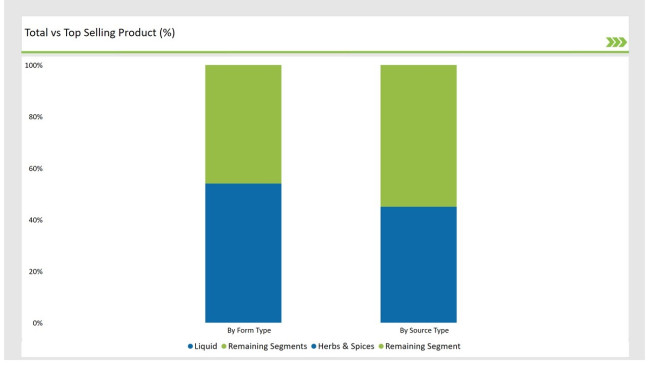

The food industry in the United Kingdom has kept up with modern standards which regard the use of natural preservatives and extracts for microbial issues as crucial. As a consequence, they dominate the market at a staggering 45.2%. Clean label ingredients are in vogue and food manufacturers are turning to rosemary, thyme, oregano extracts, and even olive oil for their antimicrobial qualities.

This is how large food manufacturers are shedding their corporate skins to keep up with regulatory changes. Modern proteins are particularly jumping at the opportunity attend to these changes by replacing orthodox synthetic preservatives with plants ones to achieve a more natural shelf life for their products.

Liquid Formulation Dominates Due to High Solubility & Versatility

Even though there is a significant portion of the market that is made up of solid plant based preservatives (31%), the United Kingdom still predominantly utilizes these liquids. These preservative liquids stand at the top in popularity because the grow in the industry.

These plant extracts from citrus fruits, cloves, and even green tea are known to be some of the best in the UK because they actively battle against microbial growth. The more sedentary powdered substitutes are on the other hand ideal osteoporosis patients as they are for most food seasonings and dry meals.

| By Source Type | Market Share |

|---|---|

| Herbs & Spices | 45.2% |

| Remaining Segments | 54.8% |

The herbs & spices segment persists as the most important and the most valuable, growing because of the trust put by consumers in traditional natural preservatives such as rosemary and garlic extracts.

The increasing acceptance of multicultural food also propelled their use. On the other hand, there is a growing acceptance of plant extracts and essential oils, but they are still restricted by cost and the ability to scale up, especially in the manufacturing of high volume food products.

| By Form Type | Market Share |

|---|---|

| Liquid | 54.3% |

| Remaining Segments | 45.7% |

Liquid plant preservatives classified by region are still the most used in the united kingdom because of their effectiveness in beverages, dairy products, and sauces. Their high solubility, uniform incorporation, and uncomplicated inclusion make them the first choice for many manufacturers.

Their counterpart in powdered form, although still significant, is increasingly being concentrated in the processed dry food market, restraining their potential to expand further. As the demand for convenience and ready to eat food increases, liquid-based options are expected to continue leading the charge in the coming years.

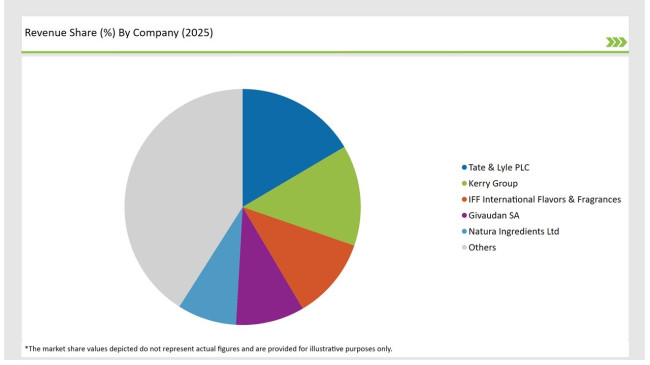

Due to solid R&D and well-established distribution systems, a large proportion of the UK plant-based preservatives industry is controlled by MNCs. Players that dominate the market such as Tate & Lyle, Kerry, and IFF International Flavors & Fragrances hold the most significant market share, portraying the use of advanced extraction technologies and broadening their ingredient portfolios.

Regional players like Natura Ingredients Ltd and Treatt PLC serve niche markets that are focused on specific food processors in the UK, providing regionally proprietary ingredients and catering to more defined needs. It is hierarchical in nature, with small firms addressing niche markets on the bottom and larger industries on top controlling the majority share.

| Company Name | Market Share |

|---|---|

| Tate & Lyle PLC | 16.5% |

| Kerry Group | 13.8% |

| IFF International Flavors & Fragrances | 11.2% |

| Givaudan SA | 9.4% |

| Natura Ingredients Ltd | 8.1% |

| Other Players | 41.0% |

Important participants in the UK plant-based preservatives industry pay closer attention to the procurement of raw material linked with Asian and European plant farms due to sustainability and traceability. As the regions with the required infrastructure are able to support large scale ingredient processing, Tate & Lyle, and Kerry Group have concentrated manufacturing hubs in the Midlands and Southeast England.

IFF and Givaudan SA do this through their subsidiaries in the UK by directly working alongside dairy, bakery and beverage manufacturers to provide all-in-one preservative solutions. While wholesale ingredient suppliers are the primary source for distributing the products, direct B2B and e-commerce stores are rapidly increasing within the UK food production industry.

By 2025, the UK plant based preservatives market is expected to grow at a CAGR of 7.6%, driven by the increasing demand for clean-label, natural food preservation solutions.

By 2035, the UK plant-based preservatives industry is projected to reach a total market value of USD 689.5 million, nearly doubling its size from 2025.

Key factors fueling the market include rising demand for natural preservatives in processed foods, increasing consumer preference for organic and clean-label products, and stricter regulations against synthetic additives in food preservation.

Within the UK, London and the South East lead in the adoption of plant-based preservatives, owing to a higher concentration of health-conscious consumers and food manufacturers emphasizing natural ingredients.

The major players in the UK plant-based preservatives sector include Tate & Lyle PLC, Kerry Group, IFF International Flavors & Fragrances, Givaudan SA, Natura Ingredients Ltd, Kemin Industries, Kalsec Inc., Finlays Group, Treatt PLC, and Firmenich SA.

Herbs & Spices, Plant Extracts, Fruits & Vegetables, Essential Oils

Liquid, Powder, Others

Bakery & Confectionery, Dairy & Frozen Products, Snacks & Beverages, Meat & Poultry, Sauces & Dressings

Antimicrobial, Antioxidant, Anti-enzymatic, Others

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Nuts Market Analysis by Nut Type, Product Type, Distribution channels, End-use Industry, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.