The UK Plant-Based Pet Food Market is poised to reach a value of USD 1,163.6 million in 2025, and further expand at a CAGR of 9.7% to reach USD 2,945.6 million by the year 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,163.6 million |

| Industry Value (2035F) | USD 2,945.6 million |

| CAGR (2025 to 2035) | 9.7% |

The UK plant-based pet food market is really super growing in the last few years, and this happened mainly due to consumer’s strong desire to have sustainable and ethical alternatives to the traditional animal-based pet foods.

That is why the situational picture like this is rising: meat production as it is associated with meat consumption is a major environmental cause, the number of pet owners is quickly increasing, and the trend of giving humans food to pets is now shifting towards humanized pet diets that pets can eat.

Finally, the difference is that plant-based pet food is just another alternative that is more suitable for people and adds nutrients that your pet can get without endangering his health or the pleasure of eating.

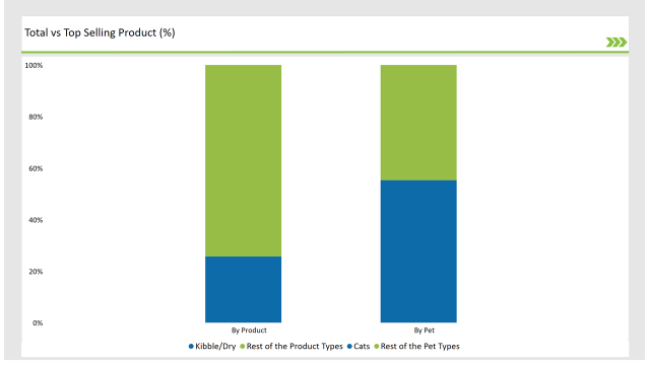

The market is controlled by dry kibble, which was one of the products with 25.7% of market share. Such features such as the product being practical, cost-effective, and having a long-term shelf life are among the key drivers of the trend. Even though you can take any pet type, such as dogs, but it is cats that account for the largest proportion of consumers (55.3%) in the market.

This is due to a large number of cats and the fact that people do tend to choose the option of plant-based food that features the health benefits related to the needs for cat’s nutrition such as taurine and amino acids respectively. Therefore, iot is the case that plant-based food can accommodate certain nutritional requirements for cats that absolute carnivores sometimes need.

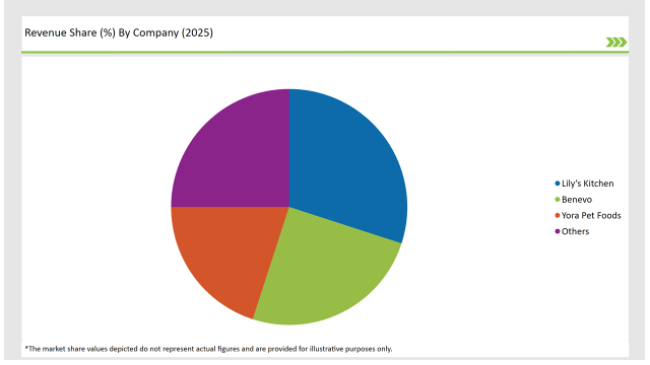

Major players in the UK market comprise Lily's Kitchen, Benevo, and Yora Pet Foods who are constantly striving to bring about innovative products with higher protein content, balanced nutrients, and good taste among the plant-based pet foods.

They back sustainable sourcing such as pea protein, sweet potatoes, and lentils, which add to their products' health benefit and environmental value. Along the rise of the new brands concentrating mainly on premium plant-based offerings, the market has further diversified.

The growth of plant-based pet foods is also evident in the rise of online retail, from where consumers are more likely to purchase their niche pet food. In addition, government ventures promoting sustainability and advertising the health benefits of the environment have enabled the use of these pet foods. Moreover, the trend of consumers adapting their diets to healthier ones has also been the cause of pet owners trying to discover plant-based alternatives for their dogs.

Explore FMI!

Book a free demo

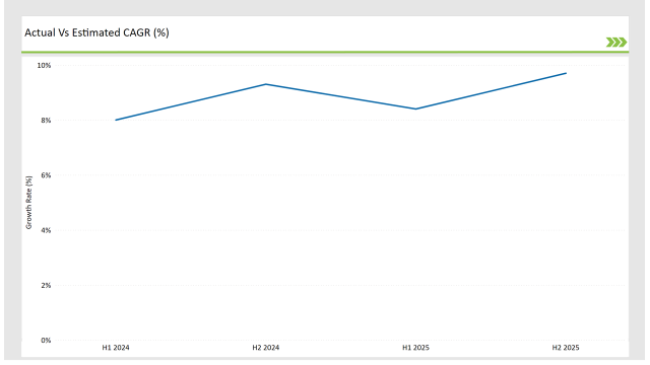

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Plant based Pet food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| March 2024 | Lily’s Kitchen introduced a new range of plant-based kibble enriched with omega-3 for feline health. |

| June 2024 | Benevo launched a premium wet food line targeted at senior pets with enhanced nutritional benefits. |

| August 2024 | Yora Pet Foods announced a partnership with leading UK pet retailers to expand their plant-based product availability. |

| September 2024 | A new study by PDSA revealed increasing consumer trust in plant-based pet foods, driving adoption rates. |

| December 2024 | Benevo expanded its e-commerce platform to offer subscription-based delivery services for plant-based pet food. |

Creating Custom Plant-Based Diets for Cats

A trend that can surely be mentioned as distinguishing in the plant-based pet food segment of the UK is the development of diet customization only for cats. By identifying the specific nutrients' needs of cats, companies such as Lily’s Kitchen have tried to come up with cat-propeller products with the addition of necessary nutrients i.e. taurine, arachidonic acid, and vitamin B12.

This kind of product is the best way to solve the controversy of whether obligate carnivores can eat a plant-rich diet or not by giving them the right nutrients and at the same time making another step toward sustainability. These improvements are the results of a scientific commitment to finding out the best way for pet care.

Arrival of Insect-based proteins

Insect-based protein products are one of the new things in the plant-based pet food market. For example, Yora Pet Foods, which is the largest company in this field, plays a key role by producing formulas with the integration of both insect protein and plant-based ingredients that are extremely digestible for pets.

Black soldier fly larvae which is a main ingredient used is a sustainable protein source offering animals higher value nutrients while protecting the environment. This idea is quite innovative and has found a good audience among eco-minded people, and it will most likely go even further in the future.

Subscription Services for Plant-Based Pet Food

The switch to digital channels has led to the rise of subscription-based delivery models for plant-based pet food. For example, Benevo has taken advantage of this by providing a neat subscription model that guarantees regular deliveries of quality healthy products.

This form of business model grows customer loyalty and, in addition, is the source of information about preferences and consumer buying habits. Moreover, these services mostly provide the opportunity to choose specific combinations of nutrients that are best for the pet.

% share of Individual categories by Product Type and Pet Type in 2025

Kibble/Dry: The Preferred Product Type

Kibble or dry dog food products account for a quarter of the UK plant-based pet food market, making them the most popular format. The reasons for high demand for dry food are its easy way of preparing, price, and stability. Furthermore, with the technological progress involved making it more that’s even tastier and makes pets more open to it.

A host of firms including Lily’s Kitchen have gotten on the fast-track to success due to the introduction of new utility-dry food products with higher protein in pet food choosing their specific. The products were aimed like grain-free and gluten-free kibble to health-conscious pet owners who were searching for high-quality alternatives.

Cats: The Leading Consumer Segment

Cats compressed plant-based diet product consumption in the UK by the highest 55.3%. This was because of the fast pace of cat ownership and rising of the number of the products with information about the essential nutrients for the cat. The addition of essential amino acids and vitamins to products has made it easier to talk about plant-based diets for cats.

The brands such as Yora Pet Foods are focusing on making exclusive formulas to meet those aims; therefore, the nutrition is balanced and the taste is suitable. The progress in the availability of plants, particularly targeting cats in online and physical stores, has also helped a lot in this area.

Note: above chart is indicative in nature

The UK Plant-Based Pet Food Market is moderately fragmented, with both well-established brands and new entrants in the fray. Top Tier 1 producers like Lily's Kitchen, Benevo, and Yora Pet Foods have a huge share of the market and are on the rise thanks to their solid distribution channels and a wide variety of new products.

Tier 2 players focus on niche segments like senior pets or insect-based formulas that help them to build loyal customer bases. The companies are adopting sustainability messaging, as well as expanding their online presence, in order to differentiate themselves and stay competitive. Subscription models and partnerships with veterinary nutritionists help these brands to stand out.

Besides that, the increased research and development of plant-based formulas which improve nutrition and taste are tools utilized by getting bigger and expanding the sector. The competitiveness of the market is also affected by the change in consumer behavior, which forces brands to consider more and more the transparency, quality of ingredients, and the use of eco-friendly packages.

Within the forecast period, the UK Plant based Pet food market is expected to grow at a CAGR of 9.7%.

By 2035, the sales value of the UK Plant based Pet food industry is expected to reach USD 2,945.6 million.

Kibble/Dry, Dehydrated Food, Treats and Chews, Freeze-Dried Raw, Wet Food, and Frozen.

Cat, Dog, Birds, and Others

Store-based Retailing and Online Retailers.

Calcium Caseinate Market Analysis by End Use Application and Functionality Through 2025 to2035

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.