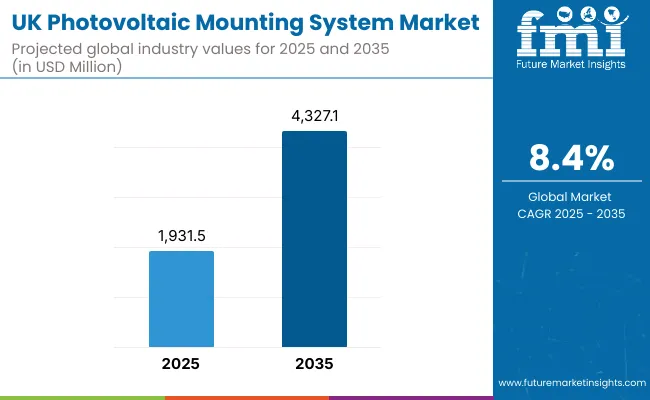

UK photovoltaic mounting system market is expanding fast with the country's ambitious decarbonization plan and the acceleration of the roll-out of solar energy infrastructure. With the rise of solar rooftop and utility solar installations, there is increased demand for durable, long-lasting, low-cost mounting systems for domestic, commercial, and industrial solar applications. In 2025, the market was approximately USD 1,931.5 million and it is predicted that it will progress much more reaching USD 4,327.1 million in 2035, exhibiting a vigorous CAGR of 8.4% within the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,931.5 Million |

| Industry Value (2035F) | USD 4,327.1 Million |

| CAGR (2025 to 2035) | 8.4% |

Solar mounting systems structural pivot points for solar panels and their optimal tilt and stability are evolving with new solar technology innovations. Lightweight aluminum frame construction, tilting adjustment systems, and corrosion-resistant coatings are fast becoming the norm. Behind the scenes, government-backed incentives and green building regulations are driving solar installation demand, which is positively driving mounting system market growth.

With the 2050 net-zero target committed to the UK, solar PV will take a significant slice of the UK renewable energy pie. The mounting systems market will experience growth due to increasing investment in building-integrated photovoltaics (BIPV), ground-mounted solar farms, and carport-integrated solar buildings. Premium offerings such as tracking systems and floating solar mounts are gradually gaining traction in niche markets.

Solar expansion is picking up pace in the North East as councils and businesses switch to clean energy. Project capacity is shaped by the space constraints of city centers like Newcastle, but brownfield regeneration and industrial rooftops provide room for high rates of fixed-tilt and flat-roof mounting solutions. Community solar projects encouraged by local councils and energy cooperatives also push localized deployment.

North West where Manchester and Liverpool cities are situated is witnessing growing demand for solar PV systems installed on rooftops and as ground-mounted structures on public sector buildings, warehouses, and residential housing. Solar PV systems, fueled by clean energy and regeneration activity in the region, are creating growing demand for robust, corrosion-resistant mounting frames to support them to resist fluctuating weather conditions and wind loads.

The West Midlands is turning out to be a solar infrastructure focus region, where the massive business estates and logistics parks are now turning to solar to help alleviate carbon emissions. Mounting structures utilized here include industrial roof mounting, warehouse complex mounting, and commercial building mounting. Local building regulations in the area are compelling the use of solar-ready infrastructure, thus incorporating solar PV mounting structures into new projects.

The East Midlands Leicester, Nottingham, and Derby are aggressively seeking their renewable energy base. Councils are rolling out clean energy schemes such as solar PV encouraged on school buildings, council buildings, and farm buildings. The low lying nature of the area also makes it suitable for ground-based PV installations on derelict land, allowing for fixed-frame and tilt adjustable mounts to have maximum exposure to sunlight.

South East, which includes London, Reading, and Oxford, is the UK's most dynamic solar market due to strong policy support, high electricity prices, and green awareness. Solar on roof tops is flourishing in residential and commercial markets with a growing trend towards consolidated schemes in housing estates.

Mounting systems in this sector must be adaptable enough to handle everything from a broad spread of installations anything from historic structures that require non-invasive mounts to modern mansions that require minimalist and clean mounts. The system is also seeing early uptake of solar carport systems and intelligent tracking mounts for big mansions as well as university campuses.

Limitations on Planning and Land Capacity for Large PV Installations

In spite of robust country undertakings to solar power, PV large-scale installation within the UK is confronted with land use policy, local approval, and competition for agricultural farm space. Ground mounting system permits are subject to the risk of denial or delay based on appearance issues, environmental sensitivity, or local opposition, in the English countryside and Scotland and Wales regions. Such limitations restrict utility-scale solar projects' scalability and therefore directly influence demand for mounting systems for open field applications.

Variable Weather Conditions Affect System Design

The UK's maritime climate high rain frequency, cloud cover, and wind fluctuation increases photovoltaic system design complexity. PV mounting systems need to be wind resistant, corrosion resistant, and have optimal tilt angles to achieve maximum yield under low solar irradiance conditions. Climatically imposed design constraints add project complexity and in some instances increase up-front costs relative to installations in sunnier geography locations.

Volatile Steel and Aluminum Prices Drive Mounting System Expenses

Since the solar project mounting structure usually represents 10-15% of the overall solar project cost, price uncertainty in steel and aluminum directly impacts PV project economics. 2021 to 2023 price spikes were triggered by global supply chain bottlenecks, inducing cost uncertainty among UK developers and installers. Price volatility introduces budgeting, procurement, and contract enforcement difficulties for small and medium-sized EPC companies.

Accelerated Renewable Energy Commitments and Policy Support

The UK's legally binding 2050 net-zero carbon target and intermediate targets to de-carbonize electricity generation by the 2030s has spurred record solar momentum. Solar developers are being incentivized by growing incentives and greater clarity with more framework-like frameworks towards larger deployment volumes in policy initiatives like the Contracts for Difference (CfD) and planning regime reform on-going. This policy windfall will fuel demand for robust, large-scale, standardized mounting system technology.

Industrial and Commercial Rooftop PV Installations Growth

With the desire for commercial property managers to cut energy costs and gain ESG compliance, rooftop solar on industrial buildings, logistics parks, and warehouses is becoming popular. Roof-mounted systems with low-profile and ballasted mounting systems that are specifically configured for flat rooftops are also gaining traction, especially in urban areas including Greater London, Manchester, and Birmingham. The development is driving the demand for light, modular and speed-to-install mounting systems.

Integration with Energy Storage and Agrivoltaics

Increased adoption of hybrid solar-plus-storage systems and agrivoltaics is raising new design issues for PV mounting structures. Adjustable-tilt and high-mounting systems are being considered for dual-purpose agricultural land, where shade tolerance and farm equipment access are primary concerns. These niche but expanding markets offer opportunities for manufacturers to provide specialized mounting products that address changing land-use needs and energy resilience objectives.

Innovation of Smart and Prefabricated Mounting Technologies

Local UK engineering companies and foreign suppliers are also investing heavily in prefabricated mount systems, minimizing on-site working time and enhancing project schedules. While in the meantime, smart racking technology with tracking or cable-in-rack management is becoming increasingly popular among high-capacity solar farms. All these innovations are enhancing efficiency, lowering operating expenses, and enhancing investors' interest in PV installations to ensure long-term performance and reliability.

From 2020 to 2024, the UK PV mounting system market experienced steady growth on the back of post-pandemic economic stimulus policies, reinstatement of CfD scheme for solar farms, and increasing power tariffs. These years experienced some hiccups like volatility in the steel price, delayed imports due to Brexit, and the slower-than-anticipated rate of approvals for utility-scale projects.

In looking ahead to 2025 to 2035, the market will grow rapidly. Solar on domestic rooftops will be supported by changes to the Building Regulations and net-zero ambitions of business, and large solar parks will expand under simplified permitting. Modular system technologies, corrosion-resistant coatings, and AI-powered design tools will characterize the next generation of mountings. Local manufacturing and recycling of mounting components might become a sustainability priority, in alignment with the UK's green industrial plan circular economy aims.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Sourcing Strategy | Dependent on imported mounting components, particularly from China, Germany, and Spain |

| End-Use Dominance | Rooftop solar led growth across residential and small-scale commercial segments |

| Production Trends | Minimal domestic manufacturing; steel and aluminum price volatility affected margins |

| Price Trends | Volatile due to raw material price swings and global supply chain disruptions |

| Technology Integration | Basic fixed-tilt and ballasted mounting systems dominate the market |

| Environmental Focus | Sustainability considered in energy generation, but less so in mounting material lifecycle |

| Supply Chain Risks | Exposed to import bottlenecks, Brexit-related documentation delays, and overseas price fluctuations |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Sourcing Strategy | Rise of UK-based assembly units and regional supply partnerships to improve lead times and reduce emissions |

| End-Use Dominance | Increased deployment in utility-scale solar farms, agrivoltaics, and commercial-industrial installations |

| Production Trends | Local sourcing of materials and development of prefabrication units for standardized mounting solutions |

| Price Trends | Stabilization via local partnerships, economies of scale, and raw material contracts secured under green procurement |

| Technology Integration | Growth of smart tracking systems, AI-supported design platforms, and hybrid mounting for solar and storage applications |

| Environmental Focus | Full alignment with circular economy policies, including use of recycled materials, local fabrication, and end-of-life plans |

| Supply Chain Risks | Mitigated through domestic warehousing, supplier diversification, and long-term strategic sourcing agreements |

Greater London takes the lead in PV mounting system uptake across the UK thanks to its progressive climate policies, densely packed urban space, and focus on roof-mounted solar panel deployment.

Commercial complexes, residential housing, and public buildings are increasingly utilizing rooftop PV systems fueled by sophisticated mounting solutions to make optimal use of available space and optimize sun capture. London's drive towards net-zero ambitions and green building codes is driving investments in cutting-edge mounting structures particularly adjustable and light-weight solutions adaptable to diverse rooftop geometries.

| Sub-region | CAGR (2025 to 2035) |

|---|---|

| Greater London | 8.7% |

The photovoltaic mounting system market in Scotland is growing at a steady pace, while government incentives and strong national support for renewable energy are driving this growth. Solar installation is burgeoning for residential and agricultural assets, even in the face of harsh environmental conditions.

In rural parts of the country or coastal areas with substantial land conditions, ground-mounted systems are becoming ever more prevalent in turnkeys, as sizes are becoming larger in scale. Climatic conditions in the Edinburgh and Glasgow urban centers are paving the way in Scotland to rooftop systems that are integrated as either private or public housing based with corrosion-resistant mounting products capable of withstanding inappropriate winds.

| Sub-region | CAGR (2025 to 2035) |

|---|---|

| Scotland | 8.3% |

Wales is experiencing increased demand for photovoltaic mounting systems in domestic, commercial, and community-initiated solar projects. The scenic and semi-rural nature of the region permits wider application of ground-mounted and dual-tilt installations, especially in energy cooperatives and greenfield developments.

In urban centers like Cardiff and Swansea, mounting systems are designed to suit space-restricted rooftops and heritage buildings, employing minimally invasive and adjustable technologies. Government incentives for low-carbon housing and local energy schemes continue to drive adoption ahead.

| Sub-region | CAGR (2025 to 2035) |

|---|---|

| Wales | 8.1% |

Yorkshire and the Humber are becoming major solar infrastructure regions, backed by industrial-scale solar farms and public-private investment in sustainability. The region's large land resources provide an ideal location for fixed-tilt and tracking ground-mounted systems employed in commercial and utility-scale applications.

Furthermore, manufacturing and logistics hubs in Leeds and Sheffield are installing PV arrays on large rooftops, driving demand for strong, scalable mounting structures. The region's emphasis on energy independence and net-zero ambitions guarantees consistent market momentum.

| Sub-region | CAGR (2025 to 2035) |

|---|---|

| Yorkshire and the Humber | 8.4% |

In the changing landscape of the United Kingdom's renewable energy sector, rooftop photovoltaic (PV) mounting systems have emerged as the dominant product type, signaling a broader trend towards decentralized, consumer-driven energy production. As the UK government pledges to put 2050 net-zero goals and increases its focus on electrification of heat and transport, adoption for rooftop solar systems has increased most significantly in residential, commercial, and public sector buildings.

Its expansion has brought the rooftop mounting structure segment to the limelight of the photovoltaic sector because of its applicability to already existing infrastructure, high-rate installation capability, and versatility to small- as well as medium-scale installations. Concentration in urban areas in key UK cities such as London, Birmingham, Manchester, and Glasgow has rendered efficient utilization of space unavoidable.

Rooftop mounting systems have offered the most viable solution for such environments so that building owners and property developers can access solar power without encroaching on available land. With stringent land-use regulations and mounting pressure to reduce urban carbon footprint, rooftops have emerged as hubs for installing PV systems. These systems enable local generation and consumption of power, reducing transmission losses and taking pressure off the national grid.

Public and private sector investment in energy-efficient buildings has also aided the rooftop sector. Through initiatives like the Green Homes Grant (prior to its cancellation) and ongoing support from initiatives like the Smart Export Guarantee (SEG), domestic householders and commercial property owners have been incentivized to invest in rooftop solar.

Local authorities and housing associations have also turned to rooftop PV as a way of saving energy costs and meeting EPC requirements, particularly in council houses and renovated public buildings. Rooftop solar take-up has also been encouraged by falling component prices and developments in mounting technology. Light, modular designs now allow easier installation on pitched roofs as well as flat roofs, even previously excluded due to structural constraints.

Development of ballast-based and non-penetrating mounts has uncovered new markets in listed buildings and high-density housing schemes where roof integrity and planning consents are paramount. These trends have made rooftop systems a first-choice option for installers and EPC (Engineering, Procurement, and Construction) contractors seeking scalable, cost-effective solutions.

The commercial and industrial rooftops have also emerged as an important driver of growth. Due to rising electricity prices, and a desire to prove ESG (Environmental, Social and Governance) credentials, warehouses, distribution centers and office blocks across the UK are increasingly adopting solar panels.

Grocery store chains, logistics providers, and retail mega corporation’s have also begun their own sustainability programs which include rooftop PV installation on their footprint. Such initiatives have created demand for custom mounting structures for large-area, high-output installations.

In the health and education sectors, under mounting pressure to decarbonize and lower operational costs, rooftop solar installations have firmly established themselves. Schools, universities, and NHS facilities are leveraging funding streams and power purchase agreements (PPAs) to install PV on existing roofs, turning unused space into a revenue and resilience generating asset. Mounting system producers have responded by providing product ranges prioritizing safety, reliability, and compliance with architectural standards for public buildings.

The UK's climatic conditions have also had an impact on the rooftop market. Products need to resist high winds, intermittent snow load, and fluctuating angles of sun exposure. British Standards (e.g., BS EN 1991 and MCS 012) have thus guided product development, leading to robust mounting structures designed for the UK's climatic conditions.

This has established a competitive edge for manufacturers who provide certified systems that satisfy these performance requirements. Forward, the rooftop market is set to remain at the forefront of the UK photovoltaic mounting system market, driven by increasing energy-aware consumers, favorable regulation, and sectoral electrification. As smart grid integration, battery storage, and peer-to-peer energy trading develop, rooftop-mounted solar will continue to be a key driver of the nation's shift towards a decentralised, low-carbon energy future.

The B2B channel now constitutes the most significant path to market in the UK photovoltaic mounting system market, mirroring the increasing scale, sophistication, and professionalization of solar deployment in commercial, industrial, and institutional markets.

As the solar market transitions to a maturing market, mounting system suppliers and manufacturers alike are relying more on B2B relationships to help them firm up high-volume orders, work together on tailored engineering solutions, and make their products a standard part of long-term renewable development pipelines.

At the core of the B2B channel's success lies the development of large-scale solar installers, EPC contractors, and project developers that manage complex solar rollouts across many sites and geographies. Such players require mounting solutions that not only meet demanding technical specifications but also project timelines, financing arrangements, and regulatory compliance. B2B manufacturers have thus invested in dedicated account managers, customization, and post-installation support that all foster long-term relationships and continuity of projects.

Buying strategies throughout the UK commercial real estate, manufacturing, logistics, and retail markets have increasingly looked to renewable energy as a hedging strategy against fluctuating electricity prices and an expression of corporate social responsibility. This transformation has resulted in direct interaction between building owners, facility managers, and mounting system suppliers.

B2B business is typically defined by comprehensive site surveys, structural engineering advice, and integration with existing energy management systems. The mounting system is not seen any more as a commodity but as a main infrastructure component which has an impact on energy performance and asset worth.

The B2B channel has also made it easier for international component suppliers and manufacturers to access the UK marketplace with streamlined access, increasing the range of mounting solutions available to the UK market. With global supply chains hanging around pandemic-related disruptions, UK distributors and developers have established business liaisons with European and Asian manufacturers offering quick lead times, price competitiveness, and product certification compliance.

These have offered guaranteed continuous availability of standardized and customized mounting systems in project sets. Public sector institutional procurement has been at the forefront of funding the B2B channel. NHS estate regeneration, school decarburization programmes, government tenders, and local council renewable energy schemes have all facilitated bulk orders of photovoltaic systems and mounting infrastructure. B2B suppliers who operate within these schemes successfully can become strategic allies to meeting net-zero specifications, especially when they are capable of delivering integrated solutions involving design, logistics, and maintenance.

Financing arrangements have also facilitated the B2B channel of sale. Power Purchase Agreements (PPAs), operating leases, and energy-as-a-service models typically involve experienced developers who purchase mounting systems along with turnkey solar installations. These funding arrangements rely on consistent performance and long longevity terms that the B2B market is uniquely positioned to offer in the form of engineering warranties, extended warranties, and technical due diligence.

B2B distribution and channel marketing strategies emphasize lesser consumer exposure and greater relationship development, technical expertise, and services. Trade fairs, industry conventions, and green summits are central to the launching of growing technologies, while procurement websites and technical webinars help in educating engineers and procurement officers regarding the new norms and installation procedures.

Performing manufacturers in the B2B sector distinguish themselves based on modularity, installation ease, and flexibility to accommodate different roofing materials, geographic regions, and load profiles. Many manufacturers now provide software-assisted design tools for structural load simulation and array configuration optimization according to wind, snow, and tilt variables important functionalities for engineering firms and solar consultants tasked with designing compliant, efficient PV systems.

In the coming times, the UK photovoltaic mounting system market's B2B sales channel will continue to grow. As institutional and commercial energy users stretch their decarburization strategies and the solar project pipeline increases, B2B interactions will continue to steer product innovation, market conventions, and value-added services. It is here that those system suppliers who are investing in strong B2B channels, elastic support services, and innovation will remain ahead of the UK solar transformation.

The UK photovoltaic mounting system market is changing very fast due to the nation's ambitious solar ambitions under the Net Zero 2050 strategy. As rooftop solar installations in residential, commercial, and public buildings, as well as ground-mounted solar farms, increase there is increased demand for robust, light, and wind-resistant mounting systems. Market forces are influenced by domestic producers, European system providers, and specialty engineering companies delivering bespoke racking, tracking, and hybrid applications. Government inducements, code changes for buildings, and investment by energy companies and real estate developers are shaping procurement strategy and technological development.

Recent Development

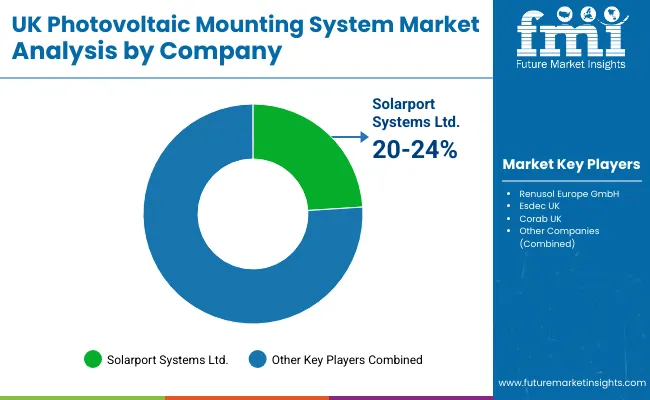

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Solarport Systems Ltd. | 20 - 24% |

| Renusol Europe GmbH | 14 - 18% |

| Esdec UK | 12 - 16% |

| Corab UK | 8 - 12% |

| Other Players | 30 - 36% |

| Company Name | Key Offerings/Activities |

|---|---|

| Solarport Systems Ltd. | A UK-based manufacturer specializing in ground-mount systems for utility-scale and commercial solar parks. Offers steel and aluminum mounting frames compatible with various soil types. Active in projects supporting community energy schemes. |

| Renusol Europe GmbH | Supplies rooftop PV mounting systems for pitched and flat roofs. Known for fast-install kits and integrated solutions for residential retrofitting. Strong distribution presence across England and Wales. |

| Esdec UK | Focuses on rail-less, modular rooftop mounting systems. Works closely with EPCs and solar installers to support warehouse and logistics center PV deployments. |

| Corab UK | Provides steel-based PV mounting systems for residential and commercial rooftops. Recently entered the UK market via partnerships with local energy co-ops and housing developers. |

Other Key Players

On the basis of product type, the United Kingdom Photovoltaic Mounting System Market is categorized into Rooftop, Ground Mounted, and Carport Mounting Structure.

On the basis of sales channel, the United Kingdom Photovoltaic Mounting System Market is categorized into Business to Business (B2B) and Business to Customer (B2C).

On the basis of material type, the United Kingdom Photovoltaic Mounting System Market is categorized into Aluminum, Steel, and Others.

On the basis of technology, the United Kingdom Photovoltaic Mounting System Market is categorized into Fixed and Tracking.

On the basis of end use, the United Kingdom Photovoltaic Mounting System Market is categorized into Residential, Commercial (Offices, Recreational Areas, Educational Institution, Hospitality, Healthcare Facilities, Others) Industrial, and Municipal and Government Facilities, and others.

The overall market size for the Photovoltaic Mounting System Market in the United Kingdom was USD 1,931.5 Million in 2025.

The UK Photovoltaic Mounting System Market is projected to reach USD 4,327.1 Million by 2035.

The growing push toward decarbonization, supportive government policies for solar energy deployment, and the surge in rooftop and utility-scale solar installations will be the key drivers of demand in the UK market.

The top 5 sub regions powering the UK Photovoltaic Mounting System Market Are Greater London, Scotland, Wales, Yorkshire and the Humber.

Rooftop and Business to business(B2B) are expected to lead the UK Photovoltaic Mounting System Market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Photovoltaic Mounting System Market Analysis - Size, Share, and Forecast 2025 to 2035

Europe Photovoltaic Mounting System Market – Trends & Forecast 2025 to 2035

Semiconductors in Solar PV Power Systems Market Growth - Trends & Forecast 2025 to 2035

Demand for Sterile Water Treatment System in UK Size and Share Forecast Outlook 2025 to 2035

Demand for AGV Intelligent Management Systems in UK Size and Share Forecast Outlook 2025 to 2035

Photovoltaic Silane Coupling Agent Market Size and Share Forecast Outlook 2025 to 2035

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Photovoltaic Grade High Purity Crystalline Silicon Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA