The UK pharmaceutical intermediate market is expected to reach USD 1,156.0 million in 2025 and is projected to reach a total value of USD 1,553.2 million by 2035. This represents a compound annual growth rate (CAGR) of 3.0% during the forecast period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size (2025) | USD 1,156.0 million |

| Projected UK Value (2035) | USD 1,553.2 million |

| Value-based CAGR (2025 to 2035) | 3.0% |

The creation of a platform for innovation in which development of new APIs and new processes that require specialty intermediates could be achieved. Companies' advancement in new drugs results in demand for quality intermediates, therefore supporting growth within the sector.

Furthermore, investment and collaboration within pharmaceutical R&D in the UK on an international scale enhance competitiveness within the international market and grow opportunities for the home and exports markets.

Explore FMI!

Book a free demo

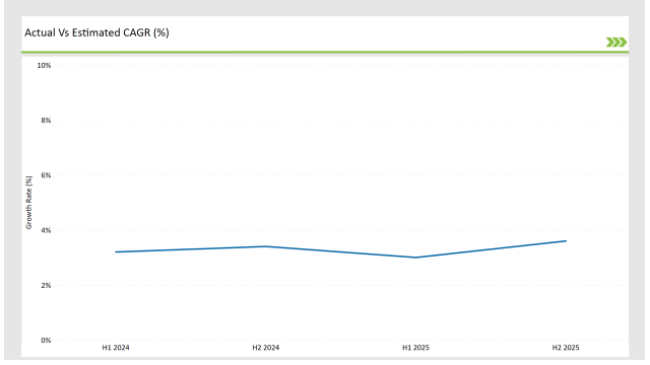

The table below provides a comparative detailed analysis of the variation in CAGR for six months over the base year 2024 and the current year 2025, exclusively for the UK pharmaceutical intermediate market.

This is a semiannual analysis that throws light on major changes in the market dynamics. The pattern for revenue realization will be highlighted as well, to enable stakeholders better understand the direction of growth for the year. H1 shall mean January-June and H2 shall represent July-December.

H1 signifies period from January to June, H2 Signifies period from July to December

The pharmaceutical intermediate market is predicted to grow 3.2% in H1 2024 and register an increase of 3.4% for the second half of the year. In terms of growth rates, the rates are expected to decline slightly, at 3.0% in H1 2024 and increase in H2 with a growth of 3.6%.

This pattern exhibits that in 2025-first half, this price went lower by 16 basis points to the first half of 2024. Meanwhile, in 2025- second half, this price compared to the last half of the year 2024 went 20 basis points lower.

These figures show that the UK pharmaceutical intermediate market is dynamic and changing as per regulatory change and innovations due to the complexity of the intermediate. This semi-annual breakdown is critical for businesses planning their strategies to capitalize on the anticipated growth and navigate the complexities of the market.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Strategic Collaboration: Cambrex is emphasizing on making strategic collaborations for expansion of their production capabilities |

| 2024 | Launch: BASF is mainly focusing on Launch of Complex Intermediates to the Market |

| 2024 | International Conferences: Aceto Corporation is participating in the conferences along with other Pharmaceutical intermediate manufacturers which are focusing on participating in international conferences |

Rising Prevalence of Disease Anticipate Demand for Complex Intermediates in Country

Treatments require pharmaceuticals produced through special intermediates for all chronic diseases. As these diseases become increasingly prevalent and resistant to therapies, pharmaceuticals invest heavily in the research and development of new treatments, resulting in increasing output of highly complex intermediates.

Besides this, the growing concentration on personalized medicine for age-related disorders involves greater personalization of therapies, thereby requiring advanced intermediates. These factors, when combined, ensure continuous growth in the pharmaceutical intermediates market since more and more intermediates are required for the formulation of effective drugs.

Brexit and Trade Adaptations Anticipate Growth of Pharmaceutical Intermediates Market in UK

The new trade agreements and regulatory independence of the UK, post-Brexit, have opened up opportunities for growth in the pharmaceutical intermediates market. While it had its setbacks during the transition period, with changed trade barriers and customs procedures with the EU, it nonetheless enabled the UK to negotiate independent trade deals with non-EU countries.

This expansion in trade relationships increases demand for UK-produced pharmaceutical intermediates at an increased rate globally. Thus, the UK can meet international market needs and, therefore, accelerate the growth of its pharmaceutical intermediates sector.

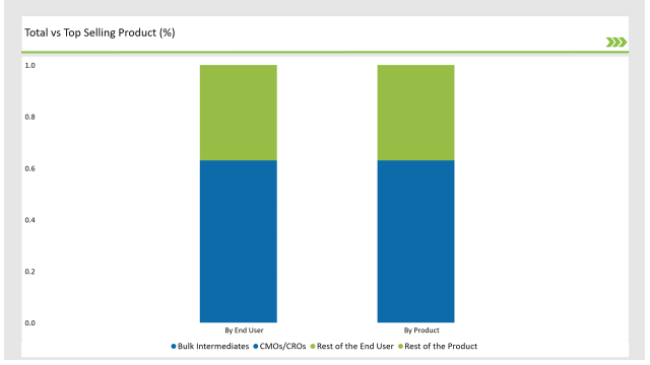

% share of Individual categories by Product Type and End User in 2025

Bulk drug intermediates records significant surge in the market owing to its growing adoption in manufacturing of dietary supplements

Bulk intermediates are particularly of great importance in view of the growing trend for cost containment in healthcare because these intermediates allow large-scale production at reduced costs, especially for APIs. This is particularly important in the case of generics, where price control is one of the decisive factors.

This, in turn, fuels demand for bulk intermediates. In addition, the tight legal framework in the UK enforces a higher standard of quality of the intermediates. In such a way, these intermediates are an appealing product from both the domestic and international point of view.

Integration of digital and automation technologies increases production efficiency and scalability, while partnerships between pharmaceutical companies and CMOs mean reliable, agile supply chains. All these factors combine to support the predominance of bulk drug intermediates within the UK pharmaceutical intermediate market.

Emphasis on outsourcing their production facilities has aided CMOs to hold dominant position

At the end-user level, CMOs dominate the market, holding about 62.9% of the UK pharmaceutical intermediate market. Now, several factors explain such dominance. Firstly, CMOs offer cost efficiency to firms by offering to outsource production instead of investing in costly manufacturing facilities. In this way, the pharmaceutical firms can concentrate their resources on research and development.

CMOs ensure scalability and flexibility in dealing with complex manufacturing processes, besides specialized expertise, which is highly essential as the demand for generics and biologics increases. Moreover, CMOs are highly capable in the regulatory and quality compliance areas to make the manufacture of intermediates safe and efficient, at reduced risk, time to market, and regulatory approvals.

Because they can adapt to the evolution of market demand and have the expertise in handling large-scale production, they are the perfect partner for pharmaceutical companies that want to address global market demand. In addition, their innovative capability in terms of manufacturing processes is another factor enhancing the bargaining power of CMOs.

Note: above chart is indicative in nature

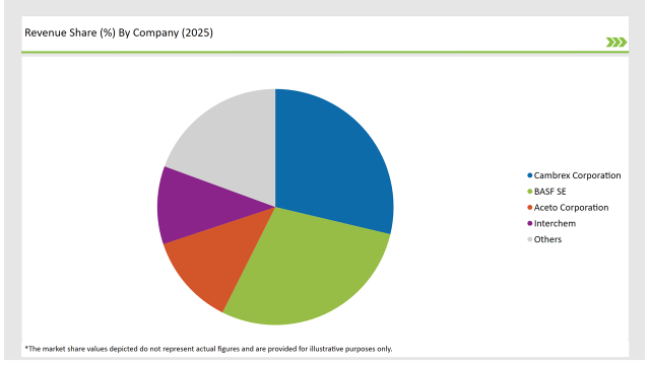

The UK pharmaceutical intermediate market is moderately fragmented, with a mix of multinational corporations and regional players contributing to a dynamic competitive environment. Companies like Cambrex Corporation, BASF SE, Aceto Corporation, Interchem, Cambrex Corporation, Arkema Inc. dominate the market by leveraging advanced technologies for streamlining their production process.

The competitive landscape of the UK pharmaceutical intermediate market features a blend of major multinational corporations and innovative regional companies.

By 2035, the UK pharmaceutical intermediate market is expected to grow at a CAGR of 3.0%.

By 2035, the sales value of the UK pharmaceutical intermediate industry is expected to reach USD 1,553.2 million.

Key factors propelling the UK pharmaceutical intermediate market include the growing investment towards R&D of new complex intermediate for therapeutic drug products.

Prominent players in the UK pharmaceutical intermediate manufacturing include BASF SE, Cambrex Corporation, Interchem, Arkema Inc, Pfizer, BMSetc, Midas Pharma GmbH, Chiracon GmbH, Codexis, Inc, A.R. Life Sciences Private Limited, Dishman Group and Dextra Laboratories Limited.

The industry includes chemical intermediates, bulk drug intermediates and custom intermediates.

Available in forms branded drug intermediates, and generic drug intermediates.

The industry is divided into analgesics, anti-inflammatory drugs, Cardiovascular Drugs, Anti-diabetic Drugs, Antimicrobial Drugs, Anti-cancer Drugs and others.

The industry is classified by end user as biotech and pharma companies, research laboratory and CMOs/CROs

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.