The UK Pet Dietary Supplement market is poised to reach a value of USD 224.8 million in 2025, and further expand at a CAGR of 9% to reach USD 531.8 million by the year 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 224.8 million |

| Industry Value (2035F) | USD 531.8 million |

| CAGR (2025 to 2035) | 9% |

The United Kingdom's pet dietary supplement market is observing remarkable development, chiefly due to the surge in pet ownership, the rise of pet health consciousness, and the high demand for functional supplements. Pet owners nowadays increasingly emphasize their pets' wellness leading to a higher request for dietary supplements that promote health, digestion, joint function, and immunity.

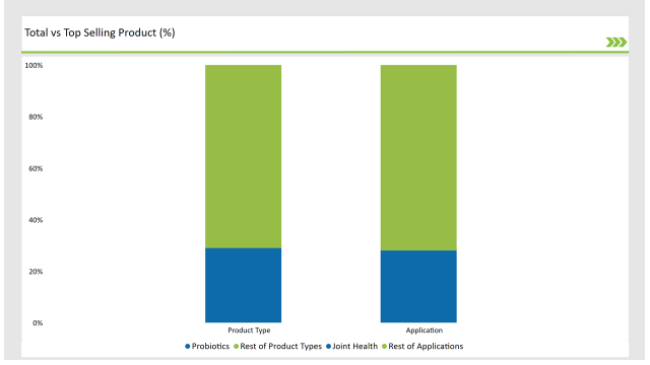

Among the most prominent product lines, probiotics take the lead since they have a huge 29% share in the market. These are the supplements that promote gut health, increase immunity, and aid digestion in pets especially in dogs and cats.

However, the other category also playing the most significant role is joint health, which takes up 28% of the market. Joint health supplements, in fact, have become a must for the elderly pet owners who want to do preventive maintenance and therapeutic interventions for problems such as arthritis and mobility disorders that are very common and on the rise.

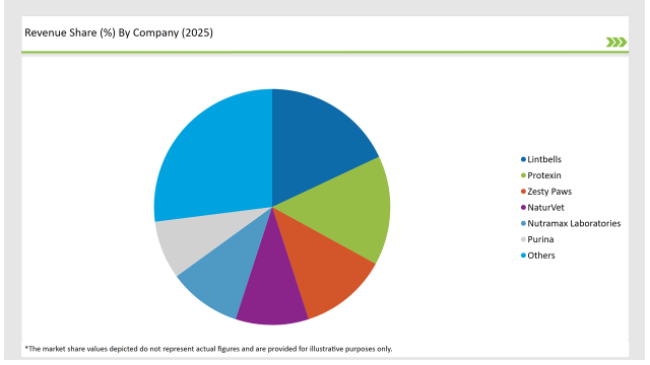

Prominent actors in the UK pet dietary supplement business are Lintbells, Protexin, Zesty Paws, NaturVet, Nutramax Laboratories, and Purina. These firms are leaning towards the diversification of their product lines while also using ingredients that are clinically proven, and they are involved with digital marketing in order to promote the benefits of supplements to pet owners.

The market is set to diversify despite the trying circumstances resulting from the marked increase in the cost of products and due to different regulation standards, the expansion is anticipated to rise due to more consumer spending on pet healthcare services.

The availability of pet supplements through e-commerce channels, veterinary clinics, and the local stores stocking various range of products retailers is another route leading to market accessibility and growth.

Explore FMI!

Book a free demo

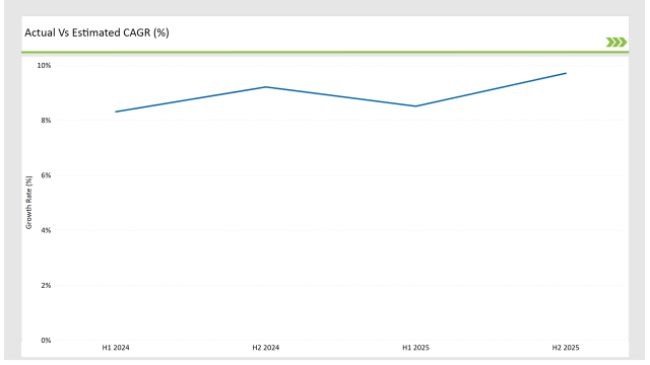

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Pet Dietary Supplement market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | Lintbells launched a new probiotic supplement targeting digestive health in senior dogs. |

| Oct 2024 | Purina expanded its veterinary supplement range to include joint support chews for cats. |

| Sep 2024 | Protexin introduced an advanced probiotic blend aimed at improving gut health in both dogs and cats. |

| Aug 2024 | Nutramax Laboratories partnered with leading UK veterinary clinics to promote omega-3 supplements for joint health. |

| Jul 2024 | Zesty Paws entered the UK market with a range of functional pet supplements, focusing on immunity and mobility. |

Prebiotic Probiotics and Shifting Focus on Pet Gut Health

The establishment of probiotics as an answer to this gut-health-immunity dilemma makes pet probiotics a hot topic. As pet owners become more aware of conditions like digestive disorders, food sensitivities, and gastric issues, probiotics are sold more than ever.

The probiotics help to fight off the bloating problem, improve stool consistency, and ultimately pets will have healthier gut and immune system too. Some of the companies are now turn their focus to using multi-strain formulations instead of a single strain one, thus improving efficacy and getting a better gut microbiota balance.

Joint Health Formulations: Older Age and Demand

As the average lifespan for pets has grown, although, like humans, there has been an accompanying growth in arthritis and hip dysplasia, it is interesting to see a resulting increase in public awareness of pet mobility issues. Pet owners are increasingly looking for prevention through products that do not involve surgery.

Some manufacturers even incorporate these ingredients into their products like collagen and green-lipped mussel extracts to offer enhanced support. With the recent development of soft and flavored joint chews or gel forms, there is an easy way for pet parents to include the supplements in the everyday diets of their fur friends.

The Rise of Online Shopping and Subscription-Based Supplement Services

The web store arena is an important part of the expansion of the pet dietary supplement sector. Many brands are riding on DTC strategies, delivering subscriptions of supplements to pet owners to guarantee a consistent pet diet.

Online platforms now allow pet owners to buy from a wider choice of health products, making it easier to buy supplements for specific health conditions. Moreover, veterinary clinics and pet specialty retailers are providing digital offerings to satisfy the increasing demand for premium pet supplements.

% share of Individual categories by Product Type and Applications in 2025

Probiotics: The Most Popular Supplement for Pet Health

UK pet dietary supplement marked by probiotics which represent 29% of the share. These supplements are very much in vogue for the promotion of gut microbiota, support digestion, and also stay for a long time with a firmer immune system in pets. The increasing number of veterinarians who recommend them and the information spreading through media have increased the sale of probiotics.

Probiotic supplements will now also be available together with prebiotics, fiber, and digestive enzymes. Multi-strain probiotics, which are now among the most promising probiotics, are available to animals with sensitive stomachs or those who are recovering from antibiotic treatments.

Joint Health Supplements: Compulsory for Older Pets

Among the older dogs are those with joint health issues which represent 28% of the pet market. The main products with good demand in the market are glucosamine, chondroitin, MSM, and omega-3 fatty acids as they promote joint lubrication and reduce inflammation.

Advanced formulations like turmeric-based anti-inflammatory supplements are becoming widely accepted as a natural alternative. Joint health problems specific to breed and size have been accounted for by the recent emergence of these targeted health support supplements.

Note: above chart is indicative in nature

The UK pet dietary supplement scene is a mixture of the usual price competition and the innovation race with big players in the market being involved in R&D work, the extension of the distribution network, and the introduction of a new product line as a way to mark the territory.

The main players are Lintbells, Protexin, Zesty Paws, NaturVet, Nutramax Laboratories, and Purina. These companies are the ones that rely on science to create formulations that help pets lead healthier lives.

The functional supplement market has increased the communication of pet supplement manufacturers with veterinarians and the companies have been busy with collaborations. Brands are progressively opting for the environmentally friendly packaging of goods and opting for ingredients sourced from nature to align with being eco-conscientious trends.

The emergence of retailer brands as low-cost alternatives has done nothing to mitigate competition but stands it on its head. Through the growing popularity and use of subscription-based wellness plans dedicated to pets, together with e-commerce platforms for pets eked out by suppliers for pet buyers wheel up the market to a level of sustained development.

Veterinary-endorsed supplements and tailored nutrition solutions will continue to drive consumer preference for high-quality, specialized pet dietary supplements.

Within the Forecast Period, the UK Pet Dietary Supplement market is expected to grow at a CAGR of 9%.

By 2035, the sales value of the UK Pet Dietary Supplement industry is expected to reach USD 531.8 million.

Key factors propelling the UK Pet Dietary Supplement market include the Growing awareness among pet owners about the importance of holistic pet care, including the use of dietary supplements to support their pets' overall health and well-being. Increasing prevalence of pet health issues, such as obesity, joint problems, and skin conditions, leading pet owners to seek out specialized supplements to address these concerns.

Prominent players in the UK Pet Dietary Supplement manufacturing include Lintbells, Protexin, Zesty Paws, NaturVet, Nutramax Laboratories, and Purina. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Cat, Dog, Birds, Others

Glucosamine, Probiotics, Multivitamins, Omega 3 fatty acids, Others

Joint Health, Digestive Health, Weight Management, Skin and Coat Health, Dental Care, Others.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.