UK Oral Clinical Nutrition Supplement sales will reach approximately USD 602.3 million by the end of 2025. Forecasts suggest the market will achieve a 6% compound annual growth rate (CAGR) and exceed USD 1,082.4 million in value by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 602.3 million |

| Industry Value (2035F) | USD 1,082.4 million |

| CAGR (2025 to 2035) | 6% |

The UK oral clinical nutrition supplement market is currently undergoing considerable progression following the increasing realization of the role of nutrition in addressing various health issues. These supplements are primarily applied in dietary management of people with specific nutritional needs such as disease-related malnutrition (DRM), surgical recovery, as well as age-related nutritional inadequacies.

The market's development is boosted by the expansion of the elderly population, the increase in chronic diseases, and the introduction of new specialized formulas designed to satisfy unique nutritional needs.

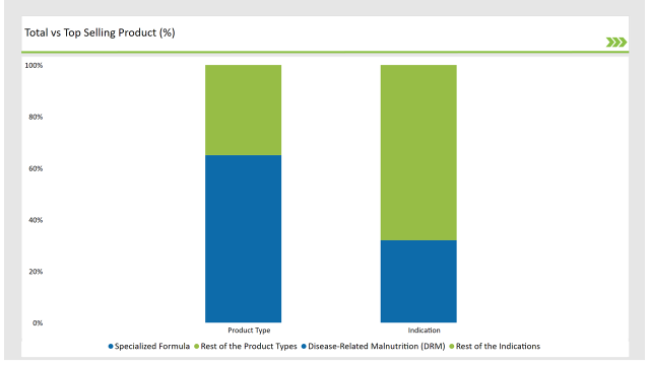

Products with specialized formulae are the clear market leaders, with a dominating 65% share that reflects their inherited characteristics that are used for disease management such as baked renal gluten-free cookies or hyperazotemia cookies.

Market drivers such as Nutricia (Danone), Abbott Nutrition, and Nestlé Health Science are innovating with high-calorie, protein supplements specifically for patients who have nutritional deficiencies. The companies are also working on the topic of product accessibility, that is, they are looking for partners among healthcare providers and retail channels.

Factors that are shaping the UK market include the undergoing shift in public sector healthcare expenditure by increasing its share to nutritional interventions, government assurance for its support, and the use of modern technology such as ready-to-drink bottles and powdered formulations that aid in delivering these supplements.

Besides, digital health initiatives are being instrumental in creating the awareness of clinical benefits of nutrition that is directly related to the growth of this market.

Explore FMI!

Book a free demo

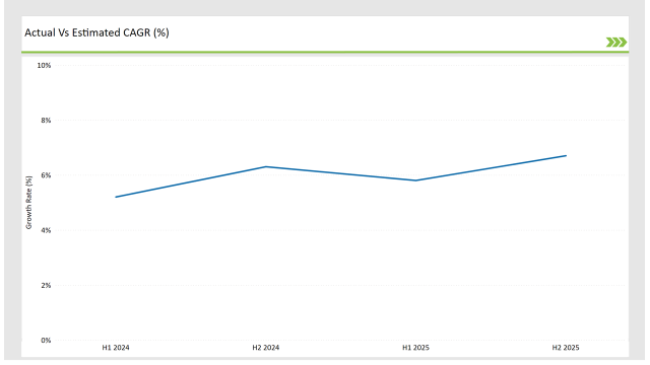

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Oral Clinical Nutrition Supplement market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | Nestlé Health Science launched a new high-protein ready-to-drink formula targeting elderly patients with DRM in the UK. |

| April 2024 | Abbott Nutrition expanded its UK portfolio with a liquid supplement enriched with omega-3 and prebiotics for surgical recovery. |

| August 2024 | Nutricia (Danone) partnered with NHS Trusts to enhance the distribution of disease-specific nutrition products. |

| October 2024 | Vitaflo International introduced a new powdered formulation aimed at children with chronic nutritional deficiencies in the UK. |

| December 2024 | Fresenius Kabi opened a new manufacturing facility in the UK to meet the growing demand for specialized clinical nutrition products. |

Tailored Nutrition Solutions for DRM Patients

Disease-related malnutrition (DRM) is a significant focus area in the UK clinical nutrition market. Companies like Nutricia (Danone) and Abbott Nutrition are developing targeted supplements that address specific deficiencies in patients with chronic conditions, post-surgery recovery, and cancer treatment.

These solutions not only enhance recovery rates but also reduce hospital stays, providing both medical and economic benefits. The growing adoption of these products in NHS Trusts highlights their critical role in patient care.

Innovation in Ready-to-Consume Formulas

The convenience of ready-to-drink (RTD) formats has become a significant trend in the UK market. Manufacturers are investing heavily in developing RTD supplements enriched with essential nutrients to cater to patients with limited mobility or those in post-surgical recovery. This segment is particularly popular among elderly patients, who prefer convenient solutions that eliminate the need for preparation.

Growth of Pediatric Nutrition Supplements

Pediatric nutrition is emerging as a vital category in the UK. Companies like Vitaflo International are creating specialized supplements for children with chronic illnesses or growth deficiencies. These products often come in flavors and formats designed to improve palatability and compliance among younger patients. With rising awareness among parents and healthcare providers, pediatric-focused products are expected to see continued growth.

% share of Individual categories by Product Type and Applications in 2025

Specialized Formula: Dominating the Market with Tailored Solutions

Specialized formula products are the leading 65% share in the UK oral clinical nutrition supplement market. These products are specially formulated to address the individual needs of patients with such conditions as DRM, post-surgical recovery, and chronic diseases.

The popular products in this category include high-calorie, high-protein supplements for the elderly and patients who are recovering from major surgeries. The advancements in nutrient formulation and delivery formats are the main drivers for segment expansion.

Disease-Related Malnutrition (DRM): Addressing a Critical Healthcare Need

Disease-related malnutrition contributes to 32% of the market, highlighting the increasing prevalence of chronic diseases and age-related nutritional deficiencies in the UK.

Products specifically targeting DRM by offering the needed micronutrients that are lost through conditions such as cancer, gastrointestinal disorders, and extended hospital stays. The market’s reach is expanding as producers increasingly ally with healthcare professionals to ensure that the products are on shelves in hospitals and clinics.

Note: above chart is indicative in nature

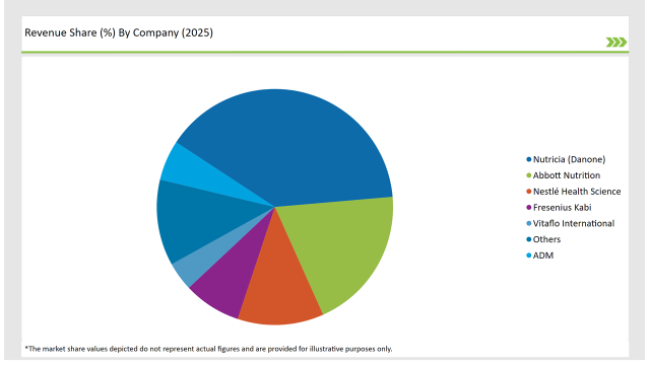

The UK oral clinical nutrition supplement industry is relatively stable and dominated by Tier 1 companies like Nutricia (Danone), Abbott Nutrition, and Nestlé Health Science that account for a significant share of the market. These manufacturers capitalize on their wide distribution channels, strong research and development prowess, and cooperation with healthcare professionals to assert dominance in the market.

Tier 2 players like Fresenius Kabi and Vitaflo International focus on niche segments which include pediatric and disease-specific nutritional products. Firms are constantly studying the market for new opportunities and, as such, they are engaging in product innovation, like ready-to-drink formulas and powdered supplements, as well as expanding their manufacturing capabilities.

They are also working closely with related parties like the NHS Trusts through strategic partnerships which serve to further their position in the UK market. Small companies are finding their niches by focusing on underrepresented groups among the patients, particularly in pediatric and special disease areas.

Within the forecast period, the UK Oral Clinical Nutrition Supplement market is expected to grow at a CAGR of 6%.

By 2035, the sales value of the UK Oral Clinical Nutrition Supplement industry is expected to reach USD 1,082.4 million.

The UK oral clinical nutrition supplements market is driven by the growing demand for specialized nutritional products that can address the unique dietary needs of patients, particularly the elderly and those with chronic health conditions. Factors like the aging population, the rise of malnutrition-related diseases, and the increasing focus on personalized healthcare are propelling the growth of this market as healthcare providers seek effective, evidence-based nutritional solutions.

Prominent players in the UK Oral Clinical Nutrition Supplement manufacturing include Nutricia (Danone) Abbott Nutrition Nestlé Health Science Fresenius Kabi Vitaflo International.

Standard Formula, Specialized Formula

Disease-Related Malnutrition (DRM), Renal Disorders, Hepatic Disorders, Oncology Nutrition, Diabetes and Others.

Liquid, Semi-solid, and Powder.

Prescription-based, and Over-the-Counter.

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

A detailed analysis of the Australian Vitamin Premix industry and growth outlook covering vitamin type, form, and end user segment

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.