The UK Omega 3 market is expected to reach USD 327.1 million by 2025, with continued expansion projected to push its value to USD 678.6 million by 2035. This represents a compound annual growth rate (CAGR) of 7.6%, driven by the increasing demand for heart health supplements, rising vegan alternatives like algal oil, and growing pharmaceutical applications.

The industry is witnessing product diversification, with companies launching plant-based omega-3 sources, functional food applications, and innovative delivery formats such as gummies and emulsions.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size in 2025 | USD 327.1 million |

| Projected UK Industry Size in 2035 | USD 678.6 million |

| Value-based CAGR from 2025 to 2035 | 7.6% |

Considerable growth in the UK Omega 3 market stems directly from the increase in consumer concern towards cardiovascular and cognitive health. While the use of dietary supplements still leads, the fortified food and beverage sector has begun to emerge as a market with substantial growth potential.

Industry movements to note are the development of plant-based and algal oil omega-3s, greater use of functional omega-3-containing foods, and new innovations in soft-gel encapsulation and microencapsulation technologies. Companies at the forefront like Holland & Barrett, Vitabiotics Ltd, and Seven Seas Ltd have used sustainability, higher level formulations, and specially focused marketing as a means to improve their share within the highly contested UK Omega 3 market.

Explore FMI!

Book a free demo

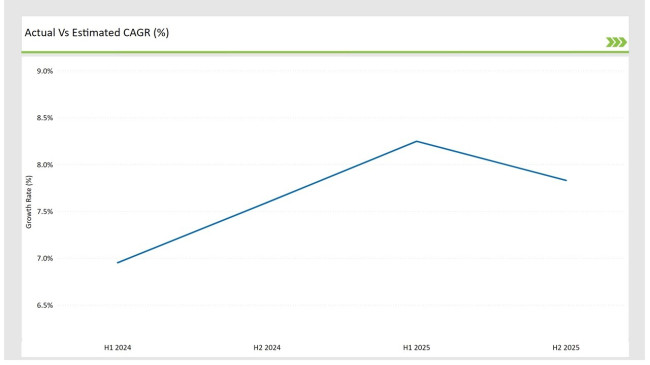

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Omega 3 market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 7.0% |

| H2 Growth Rate (%) | 7.6% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 8.2% |

| H2 Growth Rate (%) | 7.8% |

For the UK market, the Omega-3 sector is projected to grow at a CAGR of 7.0% during the first half of 2024, with an increase to 7.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 8.2% in H1 and reach 7.8% in H2.

| Date | Details |

|---|---|

| Nov-2024 | BASF Nutrition acquired Scottish algae oil producer OmegaTech for £40M. The deal includes a cutting-edge facility producing high-DHA omega-3 oils from microalgae. |

| Sept-2024 | Seven Seas launched a new range of vegan omega-3 supplements sourced from British-grown algae. The products provide equivalent DHA levels to fish oil with improved sustainability credentials. |

| July-2024 | Croda International expanded their Hull facility to increase omega-3 concentration capabilities. The expansion doubles their capacity to produce highly concentrated fish oil omega-3s for pharmaceutical applications. |

| Apr-2024 | Marine Biosciences UK opened a new omega-3 extraction facility in Aberdeen Science Park. The facility uses proprietary technology to produce ultra-pure EPA and DHA from sustainable fish sources. |

| Feb-2024 | GSK Consumer Healthcare introduced a new children's omega-3 supplement line using British-sourced fish oils. The products feature improved taste masking technology for better compliance. |

Growing Demand for Plant-Based Omega-3 Alternatives

With growth in ethical consumption habits, the shift to vegan and vegetarian sources of omega-3 is increasing in the UK. Consumers seeking plant based options and wanting to avoid fish oil due to allergies or dietary preferences are turning to algal oil based omega-3 because it is free from compromise on EPA/DHA.

Top supplement brands Holland & Barrett and Vitabiotics Ltd are seeking to capture the emerging vegan target market by expanding their range of algal and allergen free flaxseed products. As more people strive towards sustainable sourcing and worry about the environment, the use of non-marine omega-3 products is expected to increase drastically.

Rise of Functional Omega-3-Enriched Foods and Beverages

Omega-3 has gone beyond supplements purposes, as it is now incorporated in foods and beverages with emphasis on neuromuscular and cardio functions. Brands are doing omega-3 fortified yogurt, dairy free ice creams, and baked goods to make it accessible to the general population.

Simply Supplements and Seven Seas Ltd are focusing on emulsified omega-3, because of its medicinal applications, so they can have food with higher levels of omega-3. This has been made possible due to the increasing focus on preventative medicine modification of omega-3 capsules has made every food supplement easier than ever.

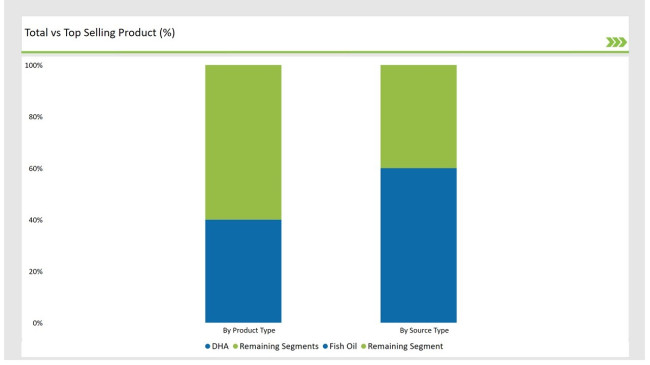

| Product Type | Market Share |

|---|---|

| DHA (Docosahexaenoic Acid) | 40% |

| Remaining Segments | 60% |

DHA Dominates as the Preferred Omega-3 for Cognitive and Cardiovascular Health

DHA dominates the UK Omega 3 sector because of its established importance for cognitive and cardiovascular health. Its aforementioned uses alone has escalated its need considerably. EPA (Eicosapentaenoic Acid) is making growth in sports and heart health supplements, while ALA (Alpha-Linolenic Acid) from flax and chia seeds continues to be underserved because of its poor absorption relative to ocean sourced products.

| Source Type | Market Share |

|---|---|

| Fish Oil | 60% |

| Remaining Segments | 40% |

Fish Oil Continues to Dominate While Algal and Krill Oil Gain Traction

For its high value of EPS and DHA, fish oil is the main source of omega-3 oil in the UK. Algal oil is understood to be proliferating among the vegan and eco-conscious consumers, however. In addition, krill oil is making strides in the premium supplement segment for it is considered to have the best absorption. On the other spectrum of plant derived nutrition are the flax and chia omega-3 sources, which are adopted much slower compared to those sourced from marine life.

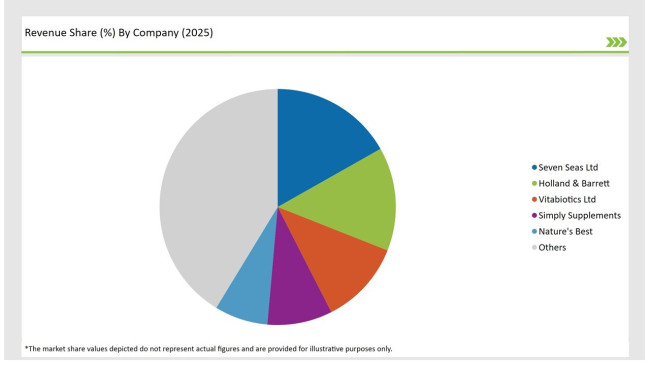

The market for omega-3 in the UK is comperatively less concentrated, because it contains a mix of big international supplement companies and local health-centered brands. Due to aggressive retail distribution and customer base expansion, Seven Seas Ltd, Holland & Barrett, and Vitabiotics Ltd have come to monopolize the market.

On the other hand, Simply Supplements and Nature's Best provide products to specific markets expecting higher grade, customized omega-3. This change also drives innovation in the production of alga oil omega-3, as there is a shift towards more sustainable and plant-based sources.

| Company | Market Share (%) |

|---|---|

| Seven Seas Ltd | 16.8% |

| Holland & Barrett | 14.2% |

| Vitabiotics Ltd | 11.5% |

| Simply Supplements | 8.9% |

| Nature’s Best | 7.3% |

| Other Players | 41.3% |

It is easy to see why firms such as Seven Seas, Vitabiotics, Holland & Barrett and Simply Supplements have a stranglehold on the Omega 3 Market in the UK. Health supplements are extremely easy to sell and are in high demand allowing the business to thrive in the industry.

They would have a peak return on investment from the manufacturing and distribution hubs stationed across England and Scotland. To go along with their large retail stores, they also focus on direct online sales which further helps them reach their target of UK consumers seeking top notch omega-3 supplements. All of them source fish oil omega-3 from sustainable fisheries and are investing in the low cost, vegan-friendly algal oil alternatives campaign.

By 2025, the UK Omega 3 market is expected to grow at a CAGR of 7.6%, fueled by rising consumer awareness of heart and brain health benefits.

By 2035, the UK Omega 3 industry is projected to reach USD 678.6 million, driven by increasing demand for plant-based and sustainable omega-3 sources.

The UK Omega 3 market is expanding due to growing adoption of functional foods, increased preference for vegan alternatives, rising awareness of cardiovascular health, and advancements in microencapsulation for improved omega-3 stability.

London and South East England dominate omega-3 consumption, with strong demand from urban health-conscious consumers, while Scotland leads in marine-based omega-3 production and innovation.

Major players in the UK Omega 3 market include Seven Seas Ltd, Holland & Barrett, Vitabiotics Ltd, Simply Supplements, and Nature’s Best, alongside emerging companies investing in sustainable algae-based omega-3 production.

DHA, EPA, ALA

Fish Oil, Algal Oil, Krill Oil, Flaxseed, Chia Seeds

Soft Gels/Capsules, Oil, Gummies, Powder

Dietary Supplements, Food & Beverages, Pharmaceuticals, Pet & Animal Feed

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Nuts Market Analysis by Nut Type, Product Type, Distribution channels, End-use Industry, and Region through 2025 to 2035

Korea Fusion Beverage Market Analysis by Beverage Type, Ingredient Profile, Distribution Channels, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.