The UK Network Function Virtualization (NFV) market will grow significantly over the next decade as demand for cloud-based network services, rapid 5G expansion, and scalable networking solutions rise. The market will reach USD 3,039.4 million in 2025 and expand at a CAGR of 9.9%, hitting USD 7,812.0 million by 2035.

Market Attributes and Growth Projections

| Attributes | Values |

|---|---|

| Estimated UK Market Size in 2025 | USD 3,039.4 million |

| Projected UK Market Size in 2035 | USD 7,812.0 million |

| Value-based CAGR from 2025 to 2035 | 9.9% |

Explore FMI!

Book a free demo

The table below shows the semi-annual growth rate of the market, reflecting industry trends:

| Particular | Value CAGR |

|---|---|

| H1 2024 | 9.3% (2024 to 2034) |

| H2 2024 | 9.7% (2024 to 2034) |

| H1 2025 | 9.8% (2025 to 2035) |

| H2 2025 | 10.2% (2025 to 2035) |

The market shows periodic fluctuations in CAGR over semi-annual periods, indicating industry adjustments. The sector recorded a 40 BPS increase from H1 2024 (9.3%) to H2 2024 (9.7%), demonstrating growing confidence in NFV adoption. H1 2025 (9.8%) saw a slight increase, while H2 2025 (10.2%) marked stronger momentum in NFV-driven network transformation.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | BT Group expands NFV-based cloud-native 5G network solutions to enhance connectivity. |

| Oct-24 | Vodafone UK acquires a UK-based NFV technology provider to strengthen network automation. |

| Mar-24 | Capita partners with UK enterprises to accelerate AI-driven NFV deployment. |

| Sep-24 | Ericsson UK launches NFV-powered security solutions for UK-based data centers. |

| Dec-23 | Ofcom announces new regulations to support NFV adoption among telecom operators. |

Expansion of 5G Networks and Telecom Modernization

Telecom operators across the UK including BT, Vodafone, and Three UK embrace Network Function Virtualization (NFV) as the UK shoots towards accelerating 5G network expansion. The proliferation in mobile data traffic pushes upon NFV to enable not only dynamic network slicing, but real-time traffic management, and automated resource allocation as well.

Other forces, including the UK government initiatives and the Open RAN adoption, further drives NFV as they move USA agencies away from proprietary hardware via programs the likes of Project Gigabit. The expansion of rural broadband and proliferation of IoT create demand for a new virtualized infrastructure that can support low-latency applications, smart cities, its ecosystems and the connected industries.

NFV enables UK telecom companies to scale network resources, deploy services with speed, and accelerate edge computing capabilities to serve increased connectivity requirements intense in cities.

Growing Demand for Cloud-Based and Edge Computing Solutions

UK businesses are shifting from hardware-dependent networking architectures to cloud-hosted network functions using NFV for better scalability, flexibility, and cost efficiency. UK telcos deploy NFV-based network functions as a service (NaaS) in partnership with public cloud providers such as AWS, Microsoft Azure and Google Cloud.

NFV advancements for ultra-low latency applications for auto, smart grid and other use cases grow. October 2023. NFV robustly boosts network optimization in real time, workload balancing and remote infrastructure management as the UK shift toward 5G-powered private networks in manufacturing, logistics and energy, making NFV even more relevant to next-gen digital ecosystems.

Integration of AI and Automation in NFV Deployments

The AI and machine learning are implemented within NFV orchestration and MANO for automation and predictive maintenance, the UK telecom operator enterprise combines both to optimize its network infrastructure. The AI-based NFV platforms ensure self-healing networks by efficiently detecting faults and optimizing bandwidth in real-time, minimizing human intervention and improving service reliability.

BT and Vodafone deploy artificial intelligence intention-based networking (IBN) to enable automatic adjustment of network configuration per traffic demand. AI also helps improve NFV ecosystems by identifying threats and preventing service disruption. With the advancement of AI based analytics, predictive automation helps UK businesses in tackling and minimizing the effects of network downtime, operational costs, and resource wastage ensuring a more resilient and efficient virtualized network.

Rising Adoption of Open-Source NFV and Open RAN Initiatives

In the UK open-source NFV projects have been adopted for a vendor neutral and cost effective networking approach. The government advocates Open RAN adoption so more NFV vendors can be competitive and provide new innovation. Deploying Open RAN-based NFV solutions significantly reduces dependence on proprietary hardware, while NFV vendors and cloud service providers ensure that their products will work together (Vodafone UK and Three UK). ETSI and ONF foster UK-based cooperation to assist open-source NFV deployment continued to champion SDN integration.

SEI leaders will know that networking will be fast developed when organizations will embrace NFV-driven multi-cloud strategies, deploying VNFs across multiple cloud providers to increase cost efficiency and service agility in an ever-evolving digital landscape.

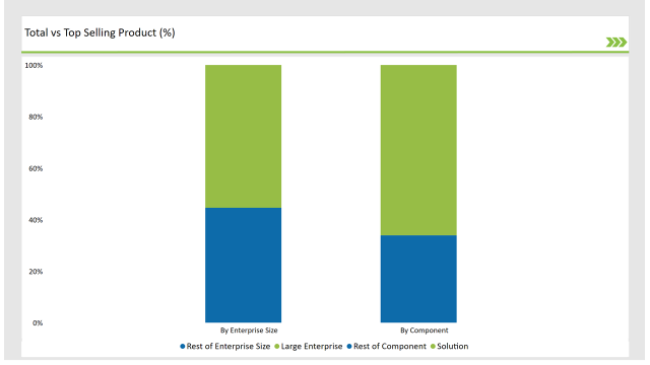

| Component | Market Share (2025) |

|---|---|

| Solution | 66.1% |

| Services | 33.9% |

Solutions dominate the UK NFV market with a 66.1% market share in 2025, as telecom providers and enterprises deploy NFV solutions for virtualized network functions and service orchestration. The services segment accounts for 33.9%, covering consulting, integration, and managed services essential for NFV deployment success.

| Enterprise Size | Market Share (2025) |

|---|---|

| Large Enterprise | 55.4% |

| Others | 44.6% |

Large enterprises hold a 55.4% market share in 2025, investing in NFV-based infrastructure to enhance network efficiency and security. The others segment, accounting for 44.6%, includes smaller businesses leveraging NFV to scale IT operations cost-effectively.

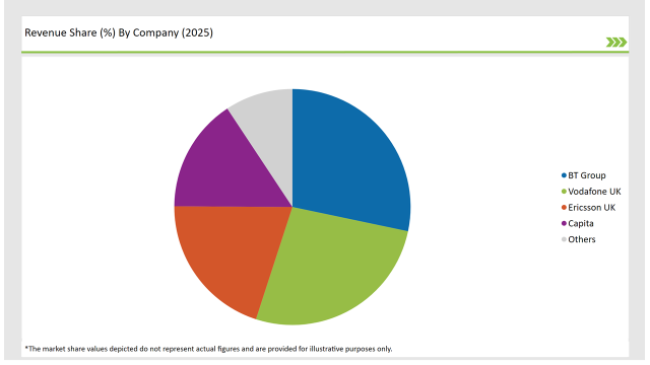

| Vendors | Market Share (2025) |

|---|---|

| BT Group | 28.3% |

| Vodafone UK | 26.7% |

| Ericsson UK | 20.1% |

| Capita | 15.6% |

| Others | 9.3% |

The market will expand at a CAGR of 9.9% from 2025 to 2035.

The industry will reach USD 7,812.0 million by 2035.

Key drivers include 5G deployment, cloud-based NFV adoption, and AI-driven network automation.

London and the South East lead in NFV adoption due to a high concentration of telecom and data center hubs.

Major players include BT Group, Vodafone UK, Ericsson UK, and Capita.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.