UK Mezcal sales will reach approximately USD 31.2 million by the end of 2025. Forecasts suggest the market will achieve a 6.9% compound annual growth rate (CAGR) and exceed USD 60.9 million in value by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 31.2 million |

| Industry Value (2035F) | USD 60.9 million |

| CAGR (2025 to 2035) | 6.9% |

The UK mezcal market is on a steady rise, the main driving force being the gradually increasing consumer interest in high-end and artisanal spirits. Mezcal, which is the traditional spirit of Mexico, is now popular in the UK because of the unique smoky taste, hand-made production, and increasing demand for agave-based spirits. The cocktail culture growth and demand for quality, small-batch spirits imply the positioning of mezcal as a desirable alternative to tequila.

Evolving consumer preferences seeking distinctive and original drinks have also impacted the market. As the trend for premium drinking extends to the alcoholic beverage industry, it has led to higher demand for the most exclusive mezcal brands. The majority of consumers in the UK are eager to pay a higher price for such mezcals that, for instance, grow in a single origin, and they are made thanks to traditional methods.

The growth of mezcal bars, specialized retailers, and e-commerce platforms has played a significant role in market development. Besides, brands are applying digital marketing, organizing educational tasting events, and collaborating with cocktail chefs to promote and engage consumers.

Alongside the challenges supposing the import duty, supply chain problems, and the fact the consumer knows less about mezcal than tequila, the UK mezcal market is still growing. The export of sustainable and organic products that imbibe life in the environment will reach success especially when these products are available in stores across the country.

Explore FMI!

Book a free demo

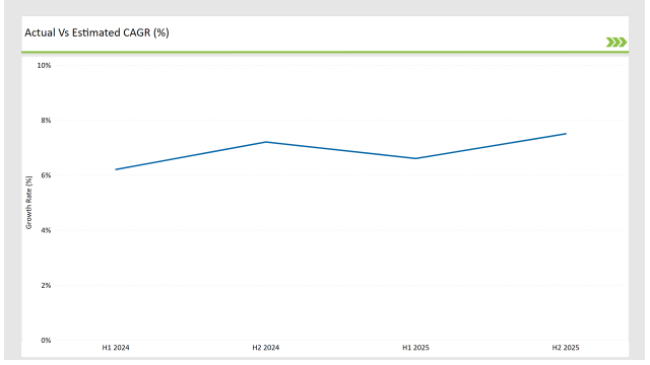

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Mezcal market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | The Lost Explorer launched an exclusive aged mezcal line in the UK, targeting premium consumers. |

| Oct 2024 | Ojo de Dios Mezcal partnered with UK cocktail bars to introduce mezcal-infused cocktail menus. |

| Sep 2024 | Ilegal Mezcal expanded its UK distribution, securing listings in major retail chains. |

| Aug 2024 | The UK Spirits Alliance reported a 20% increase in mezcal sales compared to the previous year. |

| Jul 2024 | Sustainable mezcal brand Pensador introduced a limited-edition mezcal aged in oak barrels for the UK market. |

The Premiumization and the Jump of Craft Mezcal

The development of the consumer market towards high quality and craft distillation has been a motivational factor for the growing demand for top-notch mezcal. The approach to the traditional way of the single pot distillation of the clay pot, the pit-roasting method, and the exclusive sourcing of agave attract UK customers.

Mezcal producers are the ones that tend to be moreprice exclusive by offering small-batch and limited-edition products, which, by the way, demonstrate rare agave species and traditional production methods. This also means that producers have to pay more attention to quality.

In addition to strong branding, the companies are using the technique of aging to develop different products such as reposado and añejo mezcal. The aged mezcals, in particular, have complex flavors that appeal to the bourbon and rum drinkers who seek to taste smoky and aged spirits.

The Expansion of Mezcal Cocktail Culture in the UK

The cocktail culture in the UK is welcoming mezcal, with bartenders trying new recipes with the spirit that lends it a more smoked and savory profile. Drink mixing masters elaborating on classic drinks like the Negroni, Old Fashioned, and Margarita by adding mezcal to them are the real stars here. A cocktail marketing campaign about mezcal and collaboration with the best mixologists to spread it all over the UK are the main marketing strategies.

Pubs and restaurants are also starting to include mezcal-tasting flights which would allow the customers to palate few types of drinks and show the different varieties of the agave plant. The evolution of agave-based cocktails and the growing popularity of mixology are not being noted only in cocktail bars but also at the kitchens where people, after sometimes curiosity, learn to make with mezcal cocktails.

Sustainable and Ethical Sourcing in Mezcal Production

Sustainability-consciousness is the key factor to form the picture of a mezcal producer as such that always stands ethically, sourcing, and producing eco-friendly products. Brands contribute to this with the help of initiatives like reforestation of agave fields, fair-trade practices, and bottling in an environmentally friendly way. The demand for spirits with the right morals is increasing among UK consumers therefore sustainability is the competitive edge for mezcal brands.

Some producers are also working on reducing waste partially by using the byproducts of agave as compost, animal feed, or biodegradable packaging. The commitment to sustainability manifests also in the transparent supply chain where the consumer knows about the origin and the production process of the mezcal.

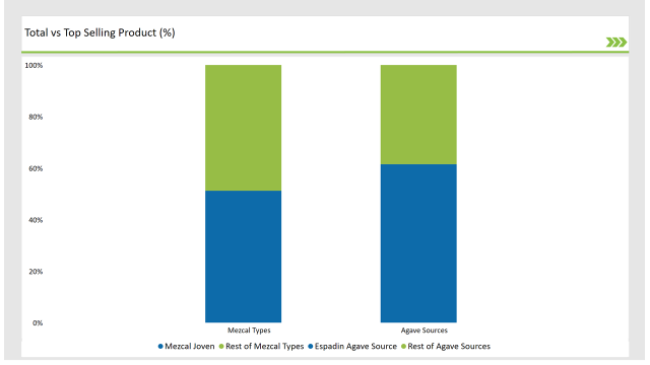

% share of Individual categories by Product Type and Source in 2025

Mezcal Joven: The Dominator in the UK Market

The most booming variant in the UK is Mezcal Joven. It retains the lion's share of the market by being a youthful, unaged tequila variant. It is a very versatile drink and is very common in cocktails, which makes it attractive for both professional bartenders and home consumers. The brands target these consumers through the release of limited editions of Joven mezcal, which feature agave strains and production techniques that are not normally found.

Besides being a topping with cocktail mezcal, Joven varieties are also more accessible and cheaper than the aged ones. People who are at the stage of introduction to tequila are more likely to be encouraged to use Joven expressions first and then go for aged varieties. The general rise in cocktail culture possessions have put Joven out as a representative spirit in the bar industry where bartenders who need to have a smoky raw base mix with it.

Espadin: The Preeminent Source of Agave in Mezcal Production

Espadin still holds the highest rank as the agave source for mezcal production, being the dominant type with a total of 61.5% of the market share. Its relatively short maturation period will make it the number one choice for mezcal producers who are looking to increase production. While other wild agave species are being promoted for their unique flavors, Espadin-based mezcal leads the market thanks to the quality and availability it offers.

Producers are now even trying out new fermentation and distillation techniques to get the best out of the Espadin-based mezcal. Some brands are using the ancestral production of tahona, stone crushing, and pit-roasting, to create traditional flavors that fit in with the latest band wagon of connoisseur gusts.

Also, the growing range of single-varietal Espadin products marks the ongoing drive for transparency in mezcal production. The customers' demand for knowing the type of the agave used in the spirits they consume is rising; this forces the producers to label the products and the harvesting, fermenting, and aging processes precisely.

Note: above chart is indicative in nature

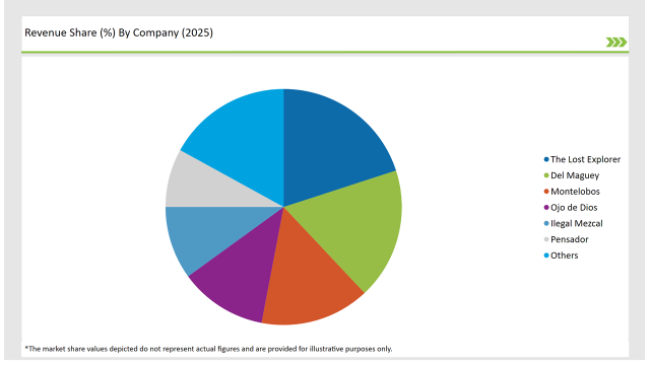

The UK mezcal market can be described as moderately competitive, given that there are both already-existing brands and newly-formed craft distilleries that look for their own share of the cake. The Lost Explorer, Del Maguey, Montelobos, Ojo de Dios, Ilegal Mezcal, and Pensador are some of the major players in this market. Even with the differences in the market sector, these brands still focus on authenticity, premium positioning, and sustainable production practices which make them stand out.

The significant interest, which is a result of the growing popularity of mezcal, is being concretized by importers and distributors who are now starting to expand and add more expressions into their already present portfolios. Online platforms for retailing are also a priority aside from the increase in the off-trade distribution from the specialty spirits shops.

The market will continue to expand with the increasing number of UK consumers exploring agave spirits beyond tequila. Brands will capture a larger market share through strategic collaborations with premium cocktail bars, exclusive mezcal-tasting events, and educative campaigns about the whole production process.

Within the Forecast Period, the UK Mezcal market is expected to grow at a CAGR of 6.9%.

By 2035, the sales value of the UK Mezcal industry is expected to reach USD 60.9 million.

Prominent players in the UK Mezcal manufacturing include The Lost Explorer, Del Maguey, Montelobos, Ojo de Dios, Ilegal Mezcal, and Pensador. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Vidrio, Others

Espadin, Tobala, Tobaziche, Tepeztate, Arroqueno, Others

100% Agave Mezcal, Blends

On-Trade Channel, Off-Trade Channel.

A detailed analysis of the Australia Licorice Root industry and growth outlook covering form, and application segment

UK Licorice Root Industry Analysis from 2025 to 2035

USA Licorice Root Industry Analysis from 2025 to 2035

USA Lactase Industry Analysis from 2025 to 2035

USA Snack Pellets Industry Analysis from 2025 to 2035

USA Monoprotein Industry Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.