The UK Meal Replacement Products market is forecasted to reach USD 1,341.5 million in 2025, with strong momentum projected for the next decade. By 2035, the industry is expected to grow to USD 2,462.9 million, driven by rising health-conscious consumers, growing demand for weight management solutions, and increased interest in plant-based nutrition. The sector is anticipated to expand at a compound annual growth rate (CAGR) of 6.3% from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size (2025) | USD 1,341.5 million |

| Projected UK Market Value (2035) | USD 2,462.9 million |

| Value-based CAGR (2025 to 2035) | 6.3% |

Due to the extremely busy lifestyles that modern consumers keep, the industry of Meal Replacement Products in the UK is also growing because the consumers need quickly prepared yet highly nutritious meals. The market has also seen entry for vegans, fitness seekers, and nutrition patients due to the increase of plant-based as well as functional meal replacements.

High-protein, sugar-free, and prebiotic-enriched high formulations are differentiating the most at the front under Huel, MyProtein, and SlimFast. The competition is cutthroat with lines blurring between digital-first brands and direct-to-consumer sales, subscription services, supermarket and specialty store sales - and using all of the above.

Explore FMI!

Book a free demo

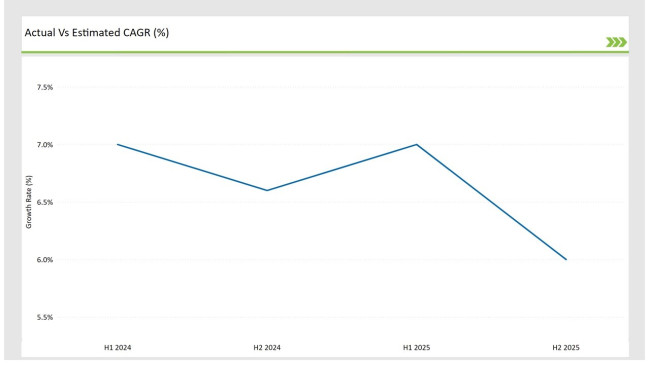

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Meal Replacement Products market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 7.0% |

| H2 Growth Rate (%) | 6.6% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 7.0% |

| H2 Growth Rate (%) | 6.0% |

For the UK market, the Meal Replacement Products sector is predicted to grow at a CAGR of 7.0% during the first half of 2023, with an increase to 6.6% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 7.0% in H1 but is expected to rise to 6.0% in H2.

These figures illustrate the dynamic and evolving nature of the UK Meal Replacement Products market, impacted by factors such as the shift toward plant-based and functional nutrition, consumer preference for convenient meal options, and increased online retail sales. This semi-annual breakdown is critical for businesses planning their strategies to capitalize on the anticipated growth and navigate the complexities of the market.

| Date | Event Details |

|---|---|

| Oct-2024 | The UK Food Standards Agency (FSA) implemented new labeling regulations requiring clear ingredient sourcing and nutritional transparency for all meal replacement products. |

| Aug-2024 | Huel expanded its ready-to-drink meal replacement line , launching a high-protein, gut-friendly variant with added prebiotics. |

| Jun-2024 | MyProtein (The Hut Group) acquired a plant-based meal replacement startup , strengthening its vegan-friendly and sustainable product portfolio . |

| Mar-2024 | SlimFast (Glanbia) partnered with major UK supermarkets to introduce low-carb, keto-friendly meal replacements to cater to the growing demand for weight management solutions . |

| Jan-2024 | Maximuscle (GSK) launched a sports-focused meal replacement powder , fortified with electrolytes and muscle-recovery nutrients , targeting fitness enthusiasts and athletes . |

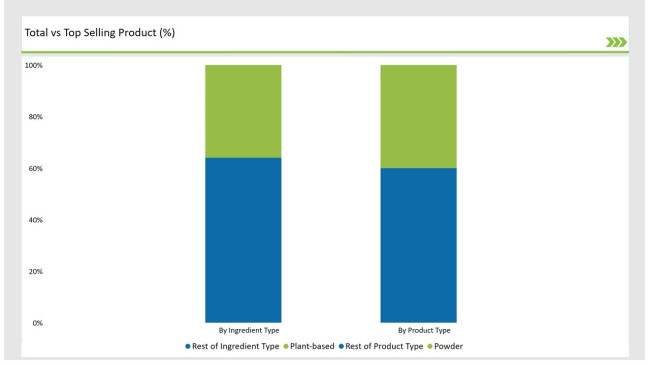

| By Product Type | Market Share |

|---|---|

| Powder | 40% |

| Remaining segments | 60% |

The powdered meal replacement category remains the most popular, but RTDs are growing the fastest. These new RTDs are satiating the nutrition cravings of active consumers and busy professionals who are in need of an on-the-go solution.

Bars are also selling well, but the long-standing high protein, low sugar trend has compelled many manufacturers to alter their recipes, which other brands are doing. New developments are driven on the basis of prebiotics and clean-label trends.

| By Consumer Type | Market Share |

|---|---|

| Weight Management | 48% |

| Remaining segments | 52% |

The weight management segment dominates the UK meal replacement industry because of the sales generated by dieters and those who practice intermittent fasting. Meanwhile, the sports nutrition market is also growing rapidly, driven by the fitness boom, high-protein diet trends, and increasing demand for muscle recovery meal replacements.

The catering of clinical nutrition products is still very sparse, mostly targeting elderly and medical patients, whereas the general wellness meal replacement market is expanding due to heightened concern about health and busy lifestyles.

Rise of Plant-Based Meal Replacements in the UK Market

The increase in replacement meal products which are free from both meat and dairy products is a clear indication of a rise in demand for vegan options. Huel and MyProtein are increasing the number of plant-based products they offer and use protein from peas, soy, and oats to produce nutritionally balanced meals.

Such changes are also consistent with the growing preference for plant-based, cruelty-free, and allergen-friendly foods. Brands are also adding alternative sources of protein, Vitamins, and minerals to target health-conscious and flexitarian consumers.

Subscription-Based and Online Retail Driving Market Expansion

As direct-to-consumer (DTC) sales take off, meal replacement brands are concentrating on subscription-based systems and upping their digital marketing efforts. Brands like Huel and Protein Works focus on customer retention through personalized nutrition plans, AI recommendations, and loyalty programs.

There is a strong preference of consumers for bulk-purchase discounts and complete ease of accessing their favorite products online; so, retailing is fast shifting towards ecommerce. This trend is putting pressure on traditional supermarket based selling models and forces brands to improve their engagement and marketing e-commerce activities.

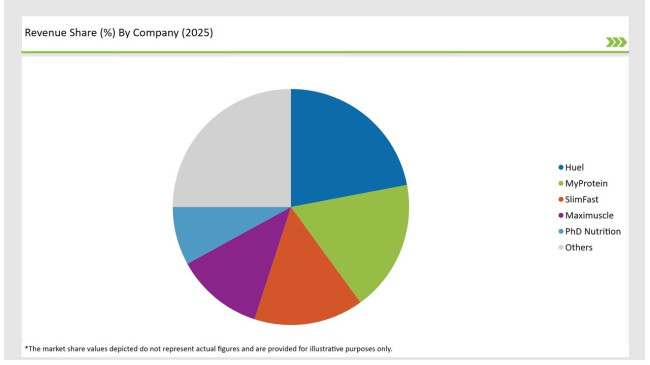

The market for meal replacement products in the UK rests in the hands of a moderately concentrated competition with a blend of multi-national corporations (MNCs) with regional brands. There are core competitors in Huel, MyProtein (The Hut Group) and SlimFast (Glanbia), who have a significant market share as a result of high brand recognition, strong e-commerce activity, and advances made in plant and functional nutrition.

Large MNCs control the mainstream market, but niche corporations like Protein Works and Grenade are emerging strongly as they cater high-protein bars, keto shakes, and meal replacement products aimed at better gut health.

| Company | Market Share |

|---|---|

| Huel | 22.0% |

| MyProtein (The Hut Group) | 18.0% |

| SlimFast (Glanbia) | 15.0% |

| Maximuscle (GSK) | 12.0% |

| PhD Nutrition | 8.0% |

| Other Players | 25.0% |

In the UK, leading meal-replacement brands focus on diversification of their ranges, improving the DTC approach, and optimizing their supply-chain logistics. Meal replacements by Huel and those by MyProtein, (The Hut Group) are clean-label and primarily plant-based ones, with facilities for regional-based manufacturing centers paired with international cross-border e-commerce distribution channels.

SlimFast and Maximuscle (GSK) have been focusing on the weight loss and sports nutrition sectors, exploiting the strong supermarket chains in the UK. Companies are responding to the increasing demand from consumers for health solutions through clean functional foods, transparent ingredients, and eco-friendly packaging.

By 2025, the UK Meal Replacement Products market is expected to grow at a CAGR of 6.3%.

By 2035, the UK Meal Replacement Products industry is projected to reach USD 2,462.9 million.

The UK Meal Replacement Products market is driven by rising health-conscious consumers, growing demand for weight management solutions, increased adoption of plant-based nutrition, and the expansion of online retail channels.

Regions such as London and the South East lead in consumption due to high urbanization, busy lifestyles, and increased demand for convenience nutrition solutions.

Prominent manufacturers in the UK Meal Replacement Products industry include Huel, MyProtein (The Hut Group), SlimFast (Glanbia), Maximuscle (GSK), and PhD Nutrition.

Ready-to-Drink, Powder, Bars, Others

Plant-Based, Dairy-Based, Mixed Source

Weight Management, Sports Nutrition, Clinical Nutrition, General Wellness

Supermarkets/Hypermarkets, Online Retail, Convenience Stores, Specialty Stores

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.