The UK Licorice Root market is expected to reach USD 102.7 million in 2025 and is projected to experience a steady year-over-year growth of 2.7%, reaching a total value of USD 134 million by 2035. This represents a compound annual growth rate (CAGR) of 2.7% during the forecast period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size (2025) | USD 102.7 million |

| Projected UK Industry Value (2035) | USD 134 million |

| Value-based CAGR (2025 to 2035) | 2.7% |

The growth in the UK licorice root market stems from the various benefits offered by licorice extracts in multiple industries such as pharmaceuticals, food and beverages, cosmetics, and tobacco products.

Licorice root is a plant product, specifically from the Glycyrrhiza plant, which has a reputation for being sweet, healing, and umami. In the UK extract of licorice root prevails and it is highly esteemed as it has the concentrated form that provides a higher suitability for being used in industrial applications.

The tobaccos industry is among the biggest end-users of licorice root in the UK, where it serves the role of the flavoring and smoothing agent in tobacco products like cigarettes and cigars. The candy industry is also a significant user licorice is a regular in traditional sweets and herbal teas.

Besides that, the fact that consumers are becoming more and more informed about the health benefits associated with licorice, including its ability to support digestion and to prevent inflammation has brought about its increased application in herbal remedies and wellness products.

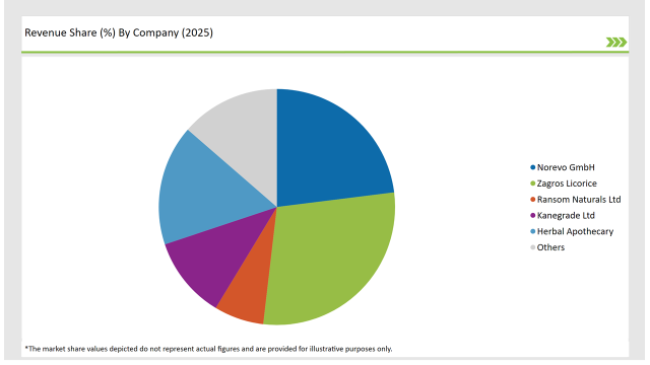

Some major players in the UK licorice root market include Ransom Naturals Ltd, Norevo GmbH,and Zagros Licorice, all four of which aim at providing the best quality industrial extracts tailor made for the specific needs of the industry. These companies apply innovation to satisfy the need for high purity licorice extracts mainly through efficient extraction methods and global suppliers' alliances.

The market adjusts as consumer trends change in favor of natural materials as well as the scrutiny increases on the practices of raw material sourcing. Manufacturers on the other hand are concentrating on the expansion of their portfolios and the adherence to the laws that dictate the contents of glycyrrhizin, in licorice products as the demand flourishes in sectors like tobacco and wellness.

Explore FMI!

Book a free demo

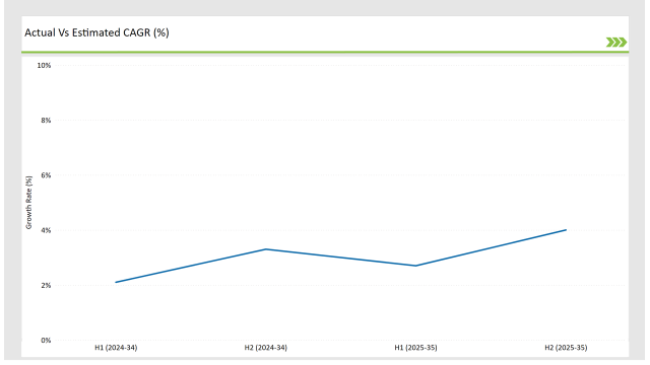

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Licorice Root market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2025 | The UK Food Standards Agency (FSA) issued a consumer advisory regarding the consumption of licorice root products. Due to reports of potential health risks associated with excessive intake, particularly elevated blood pressure, the FSA recommended moderation and advised individuals with hypertension to consult healthcare professionals before consuming licorice-based products. |

| November 2024 | A UK-based confectionery company announced the launch of a new range of licorice-infused chocolates, aiming to blend traditional British chocolate craftsmanship with unique flavors. This product launch reflects a growing trend of incorporating licorice into various culinary applications beyond traditional sweets. |

| October 2024 | Researchers at a leading UK university published findings on the potential anti-viral properties of compounds extracted from licorice root. The study suggested that these compounds could inhibit the replication of certain viruses, prompting interest in further pharmaceutical research and potential therapeutic applications. |

| September 2024 | The British Herbal Medicine Association updated its guidelines on the use of licorice root in herbal remedies. The new guidelines emphasize standardized dosing and highlight potential interactions with common medications, aiming to ensure safe consumption among the public. |

| August 2024 | A UK-based organic farming cooperative reported an increase in licorice root cultivation to meet rising demand from herbal tea manufacturers. This shift indicates a growing consumer preference for natural and organic ingredients in beverages. |

Increased Usage of Licorice in Premium Tobacco Products

Licorice root is widely adopted in the tobacco industry for mixing its sweet flavor with a new ingredient and making products smoother. Offering cigars and chewing tobacco, which are premium and flavored tobaccos, combinations of thyme and licorice extracts are used most often for their natural sweetness and balancing of bitterness.

Some manufacturers, notably British American Tobacco, have a narrow line of products whose blends with licorice are exclusive to them, and in that, it helps them capture a wider market.

Advancement of Extraction Techniques

The inventiveness of extraction technologies is responsible for the transformation of the licorice root sector. Supercritical CO2 extraction and other similar technologies permit manufacturers to obtain the products always in the same way without affecting the natural ingredient of licorice.

Companies like Zagros Licorice have followed this route to achieve the demands of industrial customers in the UK, including tobacco manufacturers for high-quality standards. At the same time, these improvements have also made the extraction of licorice more effective and simpler to do on a larger scale.

Greater Emphasis on Application-Specific Solutions

The trend is for more companies to manufacture tailored licorice extracts for specific applications instead of the one-size-fits-all product. This is especially true in the fields of tobacco and pharmaceuticals where the two sides of the industry are collaborating.

Products are being designed with specific, required levels of glycyrrhizin and certain flavors in mind, like Ransom Naturals Ltd. which has adapted its products to meet the needs of the tobacco industry for richer flavors and smoother products that will keep them competitive in the evolving market.

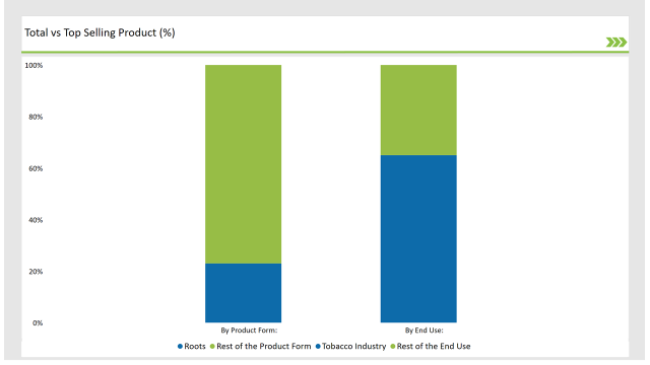

% share of Individual categories by Product Type and Applications in 2025

The Dominance of Licorice Root Extracts in the UK's Industrial Landscape

Licorice root extracts dominate the UK market as the preferred product form due to their high concentration, making them efficient for industrial applications. These extracts are widely used in tobacco products to enhance their flavor and texture while reducing resistance.

Their small size makes shipping and stocking more convenient, which causes even more demand. Norevo GmbH is a leading producer of liquid and powdered extracts which help to maintain the necessary quality and assure stability. Extracts are also being used in the pharmaceutical industry and in the production of herbal teas thus expanding their relevance to the market.

How Licorice Root Extracts are Shaping the UK's Smoking Experience

The tobacco industry is the largest consumer of licorice root extracts in the UK, ever. Licorice mainly plays the role of a bitter tobacco balancing agent and a smoky feel component in key ingredients for both cigarettes and cigars. With the introduction of premium and flavored varieties, the need for top-end licorice extractions increased.

For companies like British American Tobacco who use constant formulations of licorice to meet consumers' choices for flavor and scent, that has been a developing period. Moreover, the application of licorice has formed strategic innovation in the department of flavored products.

Note: above chart is indicative in nature

Norevo GmbH, Zagros Licorice, and Ransom Naturals Ltd. are the frontrunners in the UK licorice root market thanks to their superior honey extracts which are produced for industrial applications. These companies invest in high-end extraction technology and partner with entities that are involved in the development of tobacco and pharmaceutical sectors in order to make custom-made solutions.

Ransom Naturals Ltd. holds a customized version of its products for regulatory compliance reasons, while Zagros Licorice enjoys high-yielding products opting for the cutting-edge technology. The availability of raw materials is ensured by a bond with global suppliers, while innovation in product offerings serves as the backbone for competition in the market.

Within the forecast period, the UK Licorice Root market is expected to grow at a CAGR of 2.7%.

By 2025, the sales value of the UK Licorice Root industry is expected to reach USD 102.7 million.

Roots, Extracts, Blocks, Powder, Paste, and Others.

Food and Beverage Industry, Tobacco Industry, Pharmaceutical Industry, Cosmetic Industry, Dietary Supplements.

A detailed analysis of the Australia Mezcal industry and growth outlook covering product, source, concentration, and distribution channel segment

Comprehensive Analysis of Europe Mezcal Market by Product, Source, Concentration, Distribution Channel and Country through 2035

Comprehensive Analysis of ASEAN Mezcal Market by Product, By Source, By concentration, By sales Channel and Region through 2035

USA Snack Pellets Industry Analysis from 2025 to 2035

USA Non-Alcoholic Malt Beverages Industry Analysis from 2025 to 2035

USA Monoprotein Industry Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.