The UK Lactic Acid market is anticipated to reach USD 246.0 million in 2025, with sustained demand across food, pharmaceuticals, and biodegradable polymer applications fueling its expansion. By 2035, the market is projected to grow to USD 482.2 million, demonstrating a compound annual growth rate (CAGR) of 7.0%.

Market growth is primarily driven by the increasing adoption of bio-based lactic acid, expansion of biodegradable plastics, and rising demand for lactic acid in functional foods and cosmetics.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size (2025) | USD 246.0 million |

| Projected UK Industry Value (2035) | USD 482.2 million |

| Value-based CAGR (2025 to 2035) | 7.0% |

The lactic acid market in the UK is rapidly growing due to the need for natural food preservatives, biodegradable polymers, and its increasing uses in cosmetics and pharmaceuticals. There's a high requirement for food-grade lactic acid in fermented food products and as acidulants, whereas industrial-grade lactic acid is picking up due to use in production of biodegradable plastics.

Lactic acid manufacturers are trying to gain a competitive edge through the use of novel fermentation methods, collaborative deals with biopolymer companies, and producing lactic acid from biomass.

Many large companies are now competing on the market by boosting productivity through enhanced supply chain control and responsible sourcing while expanding their portfolios. The market is also shifting toward bio-based lactic acid with changes in regulation that favor sustainable, non-GMO, and eco-friendly ingredients.

Explore FMI!

Book a free demo

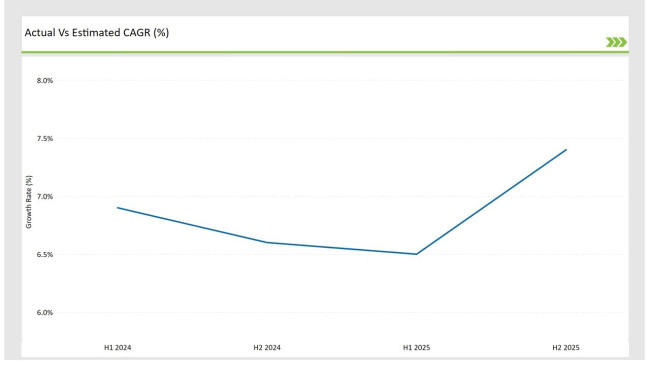

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Lactic Acid market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 6.9% |

| H2 Growth Rate (%) | 6.6% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 6.5% |

| H2 Growth Rate (%) | 7.4% |

For the UK market, the Lactic Acid sector is predicted to grow at a CAGR of 6.9% during the first half of 2024, with a change to 6.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly vary to 6.5% in H1 but is expected to change to 7.4% in H2.

These figures illustrate the dynamic and evolving nature of the UK Lactic Acid market, impacted by factors such as the shift toward bio-based lactic acid, increasing demand for biodegradable packaging, and rising consumer awareness about natural preservatives. This semi-annual breakdown is critical for businesses planning their strategies to capitalize on the anticipated growth and navigate the complexities of the market.

| Date | Event Details |

|---|---|

| Dec-2024 | Corbion launched a new bio-based lactic acid range , targeting the biodegradable plastics and personal care sectors for sustainable solutions. |

| Oct-2024 | The UK Food Standards Agency (FSA) updated regulatory standards on lactic acid use in fermented foods and probiotics , ensuring compliance with clean-label requirements. |

| Aug-2024 | Jungbunzlauer announced a £20 million investment in expanding its UK lactic acid production facility , increasing capacity for food and beverage applications. |

| Jun-2024 | Galactic partnered with a UK-based biopolymer manufacturer to develop PLA (polylactic acid) solutions for sustainable packaging alternatives. |

| Mar-2024 | Tate & Lyle introduced a high-purity lactic acid ingredient for functional food and dietary supplement applications , responding to increased consumer demand for gut health solutions. |

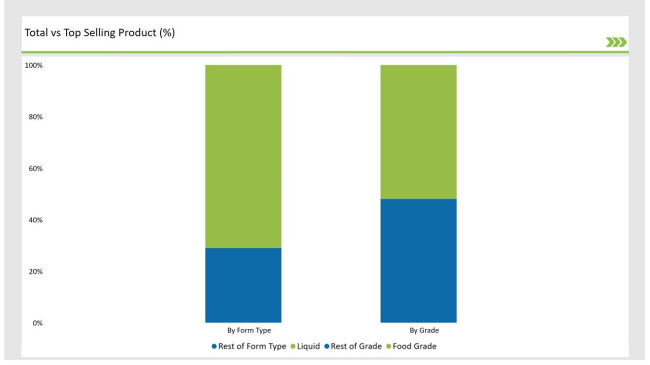

| By Grade | Market Share |

|---|---|

| Food Grade | 43% |

| Remaining segments | 57% |

In the UK, lactic acid food products have the largest share of the market owing to its considerable use in dairy, bakery, and fermented food. Its adoption has also been helped by the clean label trend and increasing needs for natural acidulants for food processing.

Lactic acid for probiotics is also increasing in popularity as pharmaceutical-grade lactic acid and industrial lactic acid for bioplastics and cosmetics is growing. Furthermore, as plant-based foods become more prevalent, lactic acid’s antimicrobial properties, alongside its major role in pH regulation, will stimulate further expansion.

| By Application | Market Share |

|---|---|

| Food & Beverages | 37% |

| Remaining segments | 63% |

The strongest demand for lactic acid comes from food and beverage manufacturers, especially in the production of fermented foods, dairy substitutes, and functional beverages. Plant based dairy producers have started using lactic acid as a natural acidifier and probiotic enhancer.

The demand for such applications continues to grow. In parallel, the use of biopolymers and biodegradable plastics is growing at an accelerated pace due to the demand for environmentally sustainable substitutes for fossil-fuel-based materials.

Expansion of Lactic Acid in Bioplastics and Sustainable Packaging

Lactic acid is also playing an important role in solving the growing problem of plastic waste by aiding in the development of biodegradable packaging. Polylactic acid (PLA), which is produced from lactic acid, is being used in food packaging, disposable tableware, and compostable food containers.

Businesses in the UK are actively working with biopolymer producers to produce these multi-use sustainable packages as a response to regulation which seeks to control single use plastic waste.

Lactic Acid’s Role in Gut Health and Functional Foods

The demand for ingredients that promote gut health has increased lactic acid consumption in functional beverages, dietary aids, and probiotic preparations. The new trend towards plant based and fermented functional foods is expanding the use of lactic acid in dairy-free yogurts, health drinks, and kombucha. With the shift in focus towards digestive health, high purity lactic acid is being added to fortified and functional food products to meet the needs of health-conscious consumers.

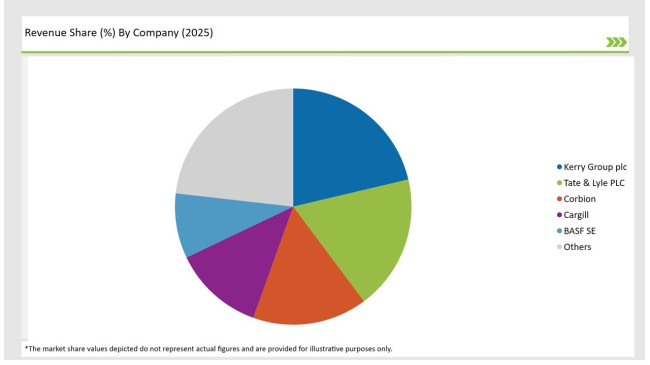

The competitiveness in innovation within the UK Lactic Acid market stems from a combination of multinational corporations and regional manufacturers. Corbion, Jungbunzlauer, and Galactic are the key players in this market as they possess powerful production and distribution across the globe, as well as investing heavily on bio lactic acid technologies.

At the same time, modest UK based manufacturers are focusing on niches such as food grade lactic acid and plastics that are biodegradable. Competition in the market is gradually increasing as consolidation comes in the form of strategic partnerships and investment in more advanced fermentation methods.

| Company | Market Share (%) |

|---|---|

| Corbion | 19.3% |

| Jungbunzlauer | 15.8% |

| Galactic | 13.6% |

| Tate & Lyle | 11.9% |

| Cargill | 9.7% |

| Other Players | 29.7% |

Jungbunzlauer & Cargill’s expansion in supply chains through sugar and corn assets improves cost-effective lactic acid production. Corbion & Galactic integrations of clean label foods rest on the expansion of their operational facilities towards bio based fermentation processes.

These industry leaders with the help of major investment are developing new products to increase their focus on plastic, particularly PLA biopolymers due to the growing eco-friendly movement.

Finally, Tate & Lyle are utilizing their know-how in functional ingredients and lactic acid by incorporating it into a health food fortification base. Such companies have built regional production centers in Europe with a focus on supporting hubs in logistics, distribution, and research in the United Kingdom.

By 2025, the UK Lactic Acid market is expected to grow at a CAGR of 7.0%, driven by demand for biodegradable plastics and natural food preservatives.

By 2035, the UK lactic acid market is projected to reach USD 482.2 million, fueled by sustainable production and expanding applications in functional foods and personal care.

Key factors influencing the UK Lactic Acid market include increased adoption of bio-based lactic acid, regulatory support for biodegradable plastics, and rising demand for functional and fermented food products.

Within the UK, London and the South East lead in lactic acid consumption, owing to higher demand from the food, beverage, and personal care industries.

Prominent manufacturers in the UK Lactic Acid market include Corbion, Jungbunzlauer, Galactic, Tate & Lyle, Cargill, BASF SE, Henan Jindan Lactic Acid Co., and DuPont.

Food Grade, Pharmaceutical Grade, Industrial Grade.

Liquid, Powder.

Synthetic, Bio-Based.

Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Biodegradable Plastics, Others.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.