The UK Hydrolyzed Vegetable Protein market is poised to reach a value of USD 74 million in 2025, and further expand at a CAGR of 8.2% to reach USD 173.2 million by the year 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 74 million |

| Industry Value (2035F) | USD 173.2 million |

| CAGR (2025 to 2035) | 8.2% |

The UK Hydrolyzed vegetable protein (HVP) market is showing considerable growth due to the increasing movement of the consumers to plant-based diets and natural flavoring solutions. Hydrolyzed vegetable protein is a product that is obtained from a variety of plant sources, such as soy, wheat, and corn, and acts as a widely used flavor enhancer in different kinds of processed foods, sauces, and seasonings.

As the popularity of clean-label and allergen-free products is growing, HVP is becoming a quite popular choice for food manufacturers who are trying to cope with changing consumer tastes.

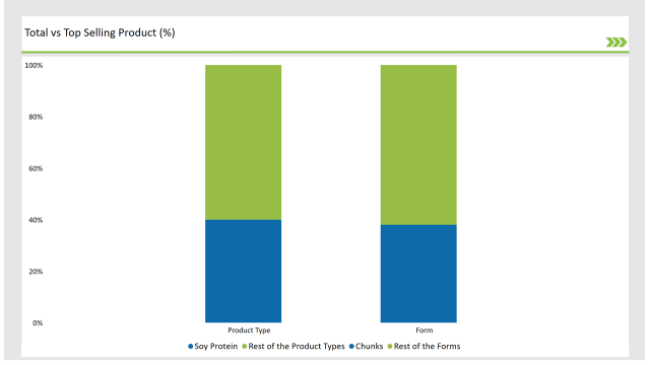

Soy protein completely dominates the UK HVP market and owns 40% of the product type share. The popularity of protein soy lies in its high protein content, its cost-effectiveness, and the fact that it can be applied everywhere in cooking.

Chunks accounted for 38% of the market share of the by form due to their main application in meat alternatives and ready-to-eat foods. Given that these chunks resemble meat and have a similar texture to meat- they are mostly added to vegan and vegetarian products.

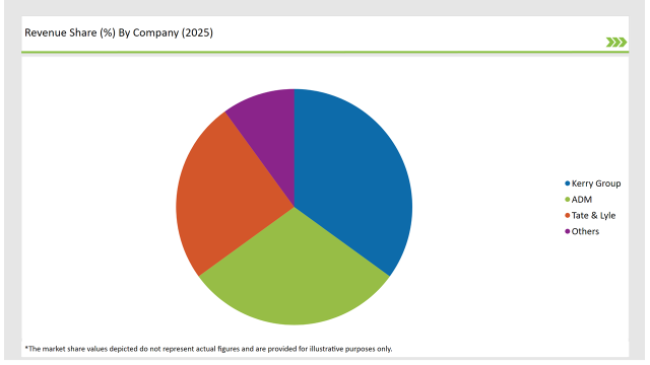

The UK market is mostly comprised of Kerry Group, Tata & Lyle, and ADM as the dominant players, who always aim to deliver tailored and innovative HVP solutions. Furthermore, they are putting resources in the state-of-art processing technologies to improve the capability of the HVP as well as to introduce it into other categories of food.

The market is influenced by the developmental aspect of environmental awareness of consumers towards plant-based proteins. The low-carbon footprint of HVP production compared to the traditional animal-resourced flavoring agents, is in line with the UK government environmental ambitions. Along with this, the legislative framework that supports innovation in plant-based foods and the trend toward convenience foods, have simultaneously spurred HVP adoption in the UK.

The continued process of innovation in the food industry, mostly driven by plant-based components, gives the UK Hydrolyzed vegetable protein market a strong upward trajectory, facilitated by the introduction of new technologies and the expanding range of products that are targeted at health-focused customers.

Explore FMI!

Book a free demo

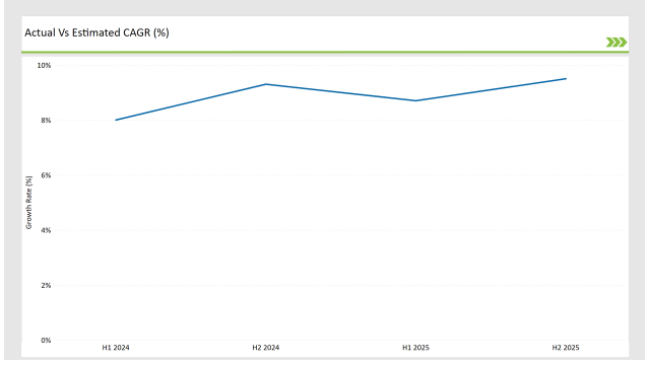

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Hydrolyzed Vegetable Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Kerry Group introduced a new range of organic soy-based HVP targeted at clean-label food manufacturers. This product aims to address the growing demand for natural flavoring agents in ready meals and sauces. |

| April 2024 | Tate & Lyle expanded its UK operations with a new production line for chunks, enhancing capacity to meet the rising demand for meat substitutes. This investment aligns with the company’s sustainability goals. |

| June 2024 | ADM launched a wheat-based HVP variant enriched with umami flavors, catering to manufacturers of soups and seasonings. This product has gained traction for its ability to deliver depth in flavor profiles. |

| September 2024 | A study by The Plant-Based Foods Association UK highlighted a 15% year-over-year increase in the use of HVP in plant-based meat products. The study also noted strong consumer preference for chunks as a form of HVP. |

| November 2024 | Kerry Group partnered with a leading UK retailer to launch a private-label range of plant-based ready meals featuring soy-based HVP chunks as a key ingredient. |

The Growth of the Chunks in the Meat Substitutes

Chunks, the form that has achieved growth in UK the markets by far, is mostly due to their application in the meat substitutes. These chunks that replicate the texture and mouthfeel of real meat are key ingredients for vegan and vegetarian dishes. Advances in the sensory qualities of HVP chunks adding to the product functionality so that rapid increase, of the demand for high-quality plant-based alternatives, will be satisfied.

Introducing Umami-Rich Variants

Umami-rich HVP variants, mainly in sauces, soups, and seasonings, are making their first appearance in the UK market. For instance, ADM is focusing on wheat-based HVP formulations that provide a robust umami flavor, addressing the growing demand for depth and complexity in plant-based food flavors.

Partnership with Private-Label Brands

Private-label brands are progressively augmenting HVP in their line of products, particularly the ready meals and snacks. Collaborations between HVP producers and distributors have proven that affordability and being innovative are the keys to the plant-based sector. For example, a partnership of the Kerry Group with UK retailers is evident in HVP chunks playing a role in promoting plant-based options.

% share of Individual categories by Product Type and Form in 2025

Soy Protein: The Leading Product Type

Soy protein constitutes the largest share in the HVP market, taking up 40% of the overall market. Its high protein content, affordability, and versatile applications make it the preferred choice among manufacturers. Soy-based HVP is extensively used in meat substitutes, seasonings, and snacks, offering a robust flavor profile and functional benefits. Companies like Kerry Group are investing in organic soy-based HVP to meet the growing demand for clean-label ingredients.

Chunks: A Popular Form

Chunks weigh 38% in the UK HVP market by form, based on the high popularity of their application in plant-based meat products and ready-to-eat meals. Delivering the mouthfeel and sight of real meat has given them the chance to be among the main ingredients in the vegan and vegetarian food. The leading players are upgrading styles and flavors in the HVP chunks for specialized quality products that seek to cater the demand for high-quality plant-based alternatives.

Note: above chart is indicative in nature

The UK Hydrolyzed vegetable protein market is moderately consolidated, with a mix of global and local manufacturers driving innovation and competition. Tier 1 players like Kerry Group, ADM, and Tate & Lyle dominate the market through their advanced processing capabilities and extensive distribution networks.

Tier 2 companies focus on niche applications, such as organic and gluten-free HVP, to carve out a distinct market presence. To maintain their competitive edge, manufacturers are investing in R&D to develop innovative HVP formulations that cater to evolving consumer demands. Collaborations with food manufacturers and private-label brands further strengthen market presence.

For example, Tate & Lyle’s recent expansion in HVP chunk production highlights the growing demand for meat substitutes. The strong focus on clean-label, allergen-free, and sustainable products keeps driving innovation in the UK HVP market, with the key players widening their portfolio in response to the different industry requirements

Within the forecast period, the UK Hydrolyzed Vegetable Protein market is expected to grow at a CAGR of 8.2%.

By 2035, the sales value of the UK Hydrolyzed Vegetable Protein industry is expected to reach USD 173.2 million.

Chunks, Slice, Flakes, Granules

Soy Protein, Wheat Protein, Pea Protein, Rice Protein, Chia Protein, Flax Protein, Corn Protein

Household, Commercial, Food Industry, Animal Feed

Direct (B2B) and Indirect (B2C)

Lecithin and Phospholipids Market Analysis by Product Type, Form, Nature, Function and Application Through 2035

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.