The UK Human Milk Oligosaccharides market is expected to reach USD 4.6 million in 2025 and is projected to reach a total value of USD 10 million by 2035. This represents a compound annual growth rate (CAGR) of 8.1% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.6 million |

| Industry Value (2035F) | USD 10 million |

| CAGR (2025 to 2035) | 8.1% |

A rapid rise is being experienced by the UK Human Milk Oligosaccharides (HMO) market, which mainly results from the increasing need for infant nutrition solutions that closely resemble the composition of human breast milk. HMOs are the primary ingredient in infant formula and they have prebiotic characteristics that aid in the digestion of food and the development of the immune system. As scientific studies continue to confirm the advantages of HMOs, the market is witnessing higher acceptance not only in infant nutrition products but also in adult nutrition products.

The key players in the field are the ones, who bring the innovation to the UK market by putting their money into fermentation-based production, clinical trials, and formulation technologies. They are also widening their HMO product portfolios which are intended for the health of children, functional food applications, and personalized dietary supplements.

The regulatory agencies such as the UK Food Standards Agency (FSA) and the European Food Safety Authority (EFSA) have the main responsibility of establishing the standards of safety and efficacy that must be met by HMOs. The strong demand for evidence-based infant nutrition options and the progress in synthetic biology are promoting further development.

Despite dealing with high production costs, regulatory barriers, and formulation stability challenges, the market is showing growth due to the rise in consumer awareness, the adoption of effective manufacturing methods, and the increase in research regarding the benefits of HMOs in addition to infant health.

Explore FMI!

Book a free demo

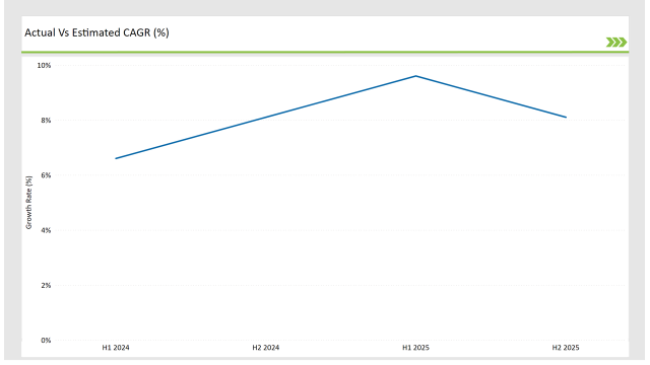

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Human Milk Oligosaccharides market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | Abbott introduced a new HMO-enriched infant formula targeting improved digestion and immune system development. The product is formulated based on the latest clinical research on early-life nutrition. |

| Oct 2024 | FrieslandCampina expanded its HMO production capacity in the UK to meet the rising demand for premium infant formula. The expansion aims to enhance supply chain efficiency and reduce production costs. |

| Sep 2024 | DuPont launched a new range of 2’-FL and LNnT HMOs designed for functional food and dietary supplement applications. The launch aligns with the growing trend of HMOs being used beyond infant nutrition. |

| Aug 2024 | BASF partnered with UK universities to conduct research on the role of HMOs in adult gut health. The study aims to explore potential applications in digestive health and immunity. |

| Jul 2024 | Chr. Hansen introduced a fermented HMO solution to improve bioavailability and enhance gut microbiome development in infants. The company aims to differentiate through advanced formulation techniques. |

The Expansion Supported by Functional Foods and Supplements

HMOs were initially confined to infant formulas, but the idea of their use in adult functional foods and supplements is now gaining traction. The newest studies have confirmed their role in the enhancement of gut health, immune support, and cognitive performance.

SMEs are currently working on projects involving the inclusion of HMOs in sports nutrition, gut microbiome promotion, and cognitive health traditional to age. The driving force of this diversification is the release of products, which help the manufacturers to create premium, science-backed ones that target a broader consumer audience, not only the baby section.

Function of Bio fermentation at the HMO Production

Barriers of scalability and economic efficiency have to be addressed in HMO production, which was a problem. Progress in fermentation technology has made it feasible not only to produce HMOs at a commercial scale with higher purity but also to increase bioavailability.

Companies such as DuPont and BASF are refocusing their efforts on fermentation-sourced HMOs that are more consistent, more economical, and better compliant with regulations. This transition will involve less reliance on synthetic processes and instead mate sure the way of keeping the sustainable development course while increasing the accessibility to HMOs in different food sectors and dietary supplements.

Regulatory Issues and Clinical Validation, Key Factors for Market Growth

Regulatory organizations like the UK FSA and EFSA are making sure that health claims about HMO consumption are adequately tested in clinical trials. As more proof emerges about the role of HMOs in immune health, digestion, and cognitive function, regulatory approval is widening, increasing consumer confidence.

Companies that are investing in clinical trials and regulatory approval are optimizing their competitive advantage to position the products as premium, led by evidence solutions in the child and adult nutrition market.

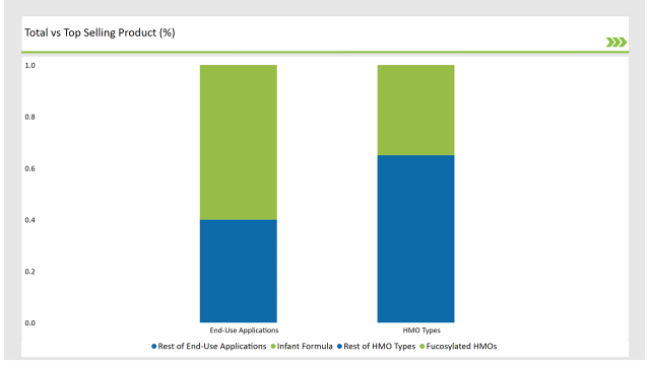

% share of Individual categories by Product Type and Applications in 2025

Fucosylated HMOs Elevating the sales across the country.

Fucosylated HMOs are the leading form in the UK market, accounting for 35% of sales and are due to their prebiotic properties, immune-facilitating effects, and resemblance to naturally occurring HMOs in human milk. Moreover, they support the proliferation of those beneficial bacteria in the gut such as Bifidobacterium and thus, babies have better prevention against infections. The advancement of research related to personalized infant nutrition drives fucosylated HMOs that are used to foster different stages of development in babies.

Infant Formula: The Dominant Application

HMO infant formulas account for 60% of the total UK market share since the goal is to overcome human milk's intricate medium-chain carbohydrate composition. Since more mothers are using formula feeding or mixed feeding, the demand for scientific and bioactive-enriched formulas is raised. Progress in the making of synthetic HMO products and bio fermentation is the reason why producers of HMO are more effective and cheaper in the end.

Note: above chart is indicative in nature

The UK Human Milk Oligosaccharides market is very much in competition, with the major companies focusing on biotechnological advancements, clinical research, and strategic partnerships. Other major companies like Abbott, Friesland Campina, DuPont, BASF, Chr. Hansen, and Nestlé are investing in synthetic biology and fermentation technologies, aiming to increase HMO production and thereby enhance product efficacy.

The companies, seeing the demand for premium infant nutrition on the rise, are forming collaborations with the manufacturers of infant formula to co-brand their products. The market diversification is additionally driven due to the application of HMO in functional foods and adult dietary supplements.

By continuing the investment in the fermentation-based production process, and obtaining the regulatory approvals as well as scientific validation, the UK HMO market will be in an upward trajectory in the coming years.

Within the Forecast Period, the UK Human Milk Oligosaccharides market is expected to grow at a CAGR of 8.1%.

By 2035, the sales value of the UK Human Milk Oligosaccharides industry is expected to reach USD 10 million.

Key factors propelling the UK Human Milk Oligosaccharides market include the increasing demand for premium infant nutrition, and expansion of HMO applications into functional foods and adult dietary supplements.

Prominent players in the UK Human Milk Oligosaccharides manufacturing include Abbott, Friesland Campina, DuPont, BASF, Chr. Hansen, and Nestlé. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Fucosylated, Silylated, Non-fucosylated Neutral

Infant Formula, Dietary Supplements.

A detailed analysis of the Australia Licorice Root industry and growth outlook covering form, and application segment

UK Licorice Root Industry Analysis from 2025 to 2035

USA Licorice Root Industry Analysis from 2025 to 2035

A detailed analysis of the Australia Mezcal industry and growth outlook covering product, source, concentration, and distribution channel segment

Comprehensive Analysis of Europe Mezcal Market by Product, Source, Concentration, Distribution Channel and Country through 2035

Comprehensive Analysis of ASEAN Mezcal Market by Product, By Source, By concentration, By sales Channel and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.