The UK Herbs and Spices market is expected to reach USD 9,314.7 million in 2025 and is projected to experience a steady year-over-year growth of 6.9%, reaching a total value of USD 14,744.7 million by 2035. This represents a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated Industry Size in 2025 | USD 9,314.7 million |

| Projected Value in 2035 | USD 14,744.7 million |

| Value-based CAGR from 2025 to 2035 | 4.7% |

Herbs and spices market in the UK which is increasing at a constant rate has the main factor driving it is the consumer preference for the natural flavoring agents along with the growing interest in global cuisines. Herbs and spices are a must in cooking, that is; they are not only the source of flavor but also of aroma and health benefits.

The market features an extensive variety of products like dried and fresh herbs, whole and ground spices, spice blends, and exotic imports. The top spices in the UK also include black pepper, turmeric, cumin, and paprika, while the most widely used fresh and dried herbs are basil, thyme, and rosemary which are common in UK homes and restaurants.

The UK food processing sector is a major user of spices and herbs to enhance the flavor of packaged foods, ready-to-eat meals, and snacks. Besides, the growing plant-based and organic food styles have been fueling the demand for products that utilize herbs and spices as the only natural alternative to synthetic additives.

Prominent players and suppliers in the UK herbs and spices sector are Schwartz (McCormick & Company), Fuchs Group, Bart Ingredients, and TRS Foods. The companies that are staying true to the commitment of diversifying product portfolios, improving product quality, and are involved in sustainable sourcing to meet the changing consumer needs.

Forces that influence the UK herbs and spices market are a demand for functional foods that have advantages for health such as the inclusion of turmeric and ginger, attempts to promote diversity in cuisines, and increased control of the food chain regarding tracing and sustain ability. The introduction of innovations like specialty spice blends for certain dishes and green packaging makes it possible for suppliers to enhance their market share.

Explore FMI!

Book a free demo

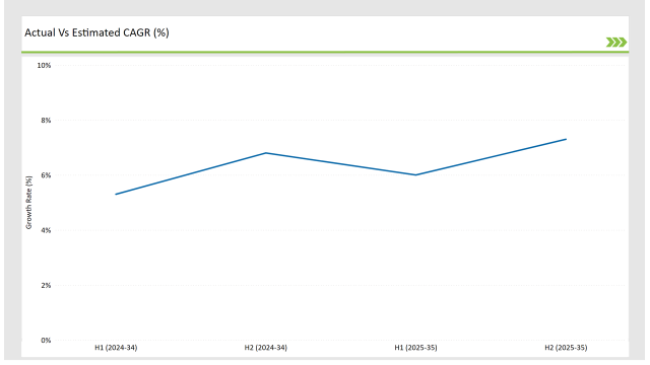

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Herbs and Spices market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| July 16, 2024 | Brusco Food Group released their Herbs and Spices Market Report 2024, providing insights into key ingredients and expected pricing. |

| December 2, 2024 | Typhoo Tea was acquired by Supreme in a £10.2 million deal, diversifying into the drinks sector. |

| November 18, 2024 | Aldi launched two Christmas-inspired hot sauces: Brussels Sprouts Hot Sauce and Spiced Cranberry Hot Honey Sauce. |

| October 27, 2024 | FSA recalled 136 products, including seasonings, due to mustard contamination with peanuts, traced to an Indian supplier. Consumers with peanut allergies were advised to avoid affected products. |

| October 6, 2024 | FSA reported fake ingredients in spices like oregano, black pepper, and turmeric sold in the UK. Adulterants included olive leaves, lead oxide, and chalk. Consumers advised to buy spices from trusted brands and perform basic authenticity tests. |

Rise of Ethnic and Fusion Styles

The crowding of ethnic and fusion dishes in the UK has driven this fact, which has meant using an extensive range of spices and herbs. Today, spices like cumin, coriander, and cardamom are found in almost all homes in the country as they are used in the popular Middle Eastern, Indian, and Asian delicacies. A number of companies, including TRS Foods and East End Foods, are riding on the bandwagon by offering excellent and traditional spice blends.

Emphasis on Organic and Sustainable Spices

Spices that are organic and sustainably obtained are preferred by consumers in the UK. There is a high demand for the turmeric, black pepper, and cinnamon certified as organically produced because these products are believed to have health advantages. Companies like Bart Ingredients and Fuchs Group which is aligned with the ethos of environmentally conscious people are stressing on the acquisition of spices in an ethical way and eco-friendly production procedures to win the trust of responsible consumers.

Functional Foods Impacting Demand

The popularity of certain spices for their health effects such as the anti-inflammatory characteristics of turmeric and the digestive benefits of ginger is the factor that has brought them into the mainstream functional food stir. Turmeric lattes, ginger shots, and cinnamon-infused teas have become very famous, and producers are quick to exploit these trends by offering new health products. This new focus has led to a growth in the powdered and capsule form of spices in the nutraceutical sector.

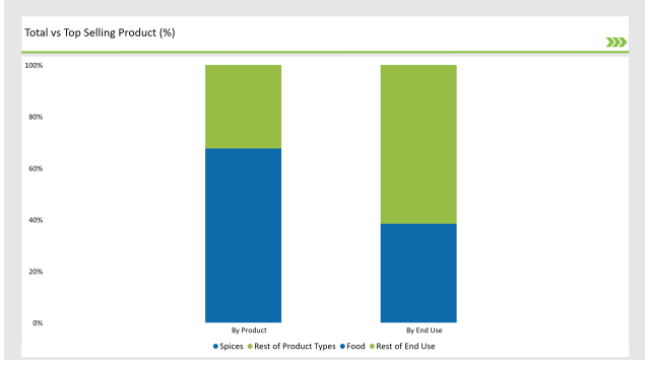

% share of Individual categories by Product Type and Applications in 2025

Spices are thriving in the UK and they occupy a significant segment in the food market, being the main products utilized in home cooking, food processing, and restaurants. Well-liked spices include black pepper, turmeric, paprika, cumin, and cinnamon, while the interest in exotic varieties like za'atar and sumac is increasing.

Companies like Schwartz and TRS Foods have benefited from the introduction of new packaging such as travel-sized, easy-to-use spice mixes, and specialty blends based on customer needs. Additionally, the shift towards spices that are sustainably sourced has received strong public interest as companies are choosing to promote their fair-trade and organic certifications as a means to connect with environmentally conscious customers.

The UK herbs and spices market is a noteworthy area for the food processing industry in this regard. The company has a vast variety of condiments and routes available for processing, such as soups, snacks, and ready-to-eat meals. Pepped-up snacks, mixers for dressing, and frozen meal seasoning are some of the popular applications.

For example, McCormick is joining forces with food manufacturers to develop custom spice blends that match specific recipes while also being clean-label. The growing demand for plant-based foods has resulted in the additional request for spices and herbs as natural flavor enhancers in vegan and vegetarian food items.

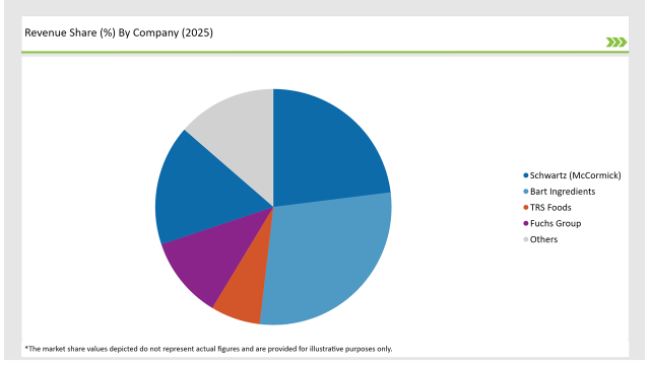

2025 Market share of UK Herbs and Spices suppliers

Note: above chart is indicative in nature

Key stakeholders in the herbs and spices market in the UK are Schwartz (McCormick), Bart Ingredients, TRS Foods, and Fuchs Group. These companies are focused on innovating, being environmentally friendly, and diversifying product lines. Schwartz has released new spice blends and meal kits for global cuisines, while Bart Ingredients stresses organic and sustainably sourced herbs and spices.

TRS Foods obtains a niche in the ethnic food segment through a wide range of original spices. Strategic partnerships with food manufacturers, launching special organic products, and the use of packaging that is environmentally friendly are some of the initiatives helping these companies to stay ahead of the curve.

By 2025, the UK Herbs and Spices market is expected to grow at a CAGR of 4.7%.

By 2035, the sales value of the UK Herbs and Spices industry is expected to reach USD 14,744.7 million.

By product type industry has been categorized into Herbs, Spices, Paprika and Cumin

Key forms like Powder & Granules, Flakes, Paste, Whole or Fresh are included in the report.

End use applications like Food processing, Beverage, Food Service and Retail Sales are included in the report.

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

USA Aqua Feed Additives Market Analysis from 2025 to 2035

Comprehensive Analysis of Europe Fish Meal Market by Product Type, Application, Source, and Country through 2035

Comprehensive Analysis of ASEAN Fish Meals Market by Product Type, by Application, Source, and Region through 2035

A Detailed Analysis of Brand Share Analysis for Fungal Protein Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.