UK Frozen Food sales will reach approximately USD 19,395.1 million by the end of 2025. Forecasts suggest the market will achieve a 6.7% compound annual growth rate (CAGR) and exceed USD 36,933 million in value by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 19,395.1 million |

| Industry Value (2035F) | USD 36,933 million |

| CAGR (2025 to 2035) | 6.7% |

The UK frozen food market is benefiting from the constant pace of growth, which is a result of changing consumer habits, a high need for frozen food that can be prepared in a simpler way, and the impact of continuous improvements in freezing technologies.

The soaring tendency towards ready meals with much less cooking time has been one of the main factors for achieving this market goal. Frozen foods, specifically ready meals, which are not only easy to prepare, but also offer long-lasting shelf life, less food wastage, and consistent nutrition, have become a very important item in modern grocery stores.

The main players in the UK market are Nomad Foods, Birds Eye, Iceland Foods, McCain Foods, Greenyard Frozen, and Bakkavor. Those companies invest heavily in product innovations, eco-friendly packaging design, and extending their frozen food project's borders in order to meet consumer preferences.

The high level of home consumption experienced due to the rise of hybrid working trends, an increase in vegan and plant-based frozen meal offerings, and the request for healthier frozen options are some of the factors driving market growth. Furthermore, the application of individual quick freezing (IQF) technology has led to better quality products, nutrient retention, and increased customer confidence in frozen items.

Apart from assets like infrastructure costs of cold storage and bamboo stock that compete with fresh products, the UK frozen food market continues to thrive. The new premium quality frozen meals, frozen broths with a restaurant feel, and frozen international cuisines in restaurant kits are equally in line with the drive of sales. Collaboration with supermarkets on a strategic basis and the opening of frozen food R&D should be the principal support over the next years.

Explore FMI!

Book a free demo

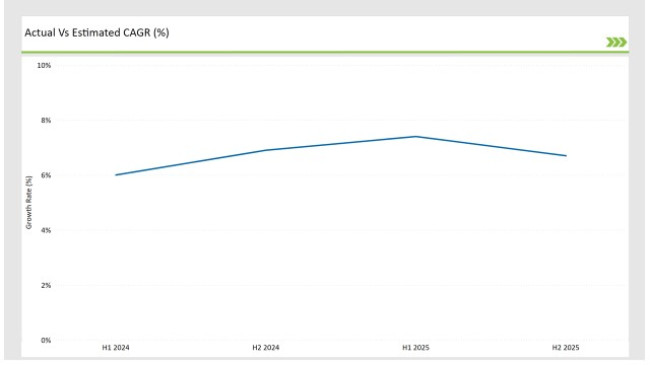

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Frozen Food market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | A leading UK frozen food retailer launched a new plant-based frozen meal range targeting health-conscious consumers. |

| Oct 2024 | A major supermarket chain announced a partnership with a frozen food brand to expand premium frozen meal offerings. |

| Sep 2024 | A UK-based food company invested in an advanced IQF facility to enhance frozen food production efficiency. |

| Aug 2024 | A frozen pizza manufacturer introduced a gourmet frozen pizza line featuring artisanal ingredients. |

| Jul 2024 | A frozen seafood brand expanded its distribution network to increase market penetration across the UK. |

Premium Frozen Meals Rising as a Trend

As people's favorite meal changes to restaurant-styled meals at home, the premium frozen food range is consequently one of the leading growth drivers. The companies are launching gourmet frozen meals prepared with premium ingredients and outstanding flavors to meet both health-oriented and hurrying customers. The increasing inclusion of organic, gluten-free, and high-protein frozen meals is also a trend, which is changing the way one looks at frozen food.

Breakthroughs in Individual Quick Freezing (IQF) Technology

IQF technology is becoming popular among frozen foods in the UK as it offers the benefit of retaining the flavor, texture, and nutrients of the food products. This process greatly minimizes the formation of ice crystals thus creating a higher quality product. IQF is notably advantageous in frozen fruit, vegetable, seafood, and meat products, thus consumers have access to more natural and fresher ones.

Proliferating Demand for Environmentally Friendly Packaging in Frozen Foods

Taking into account, the need for a sustainable approach in the frozen food market, the manufacturers are working on the reduction of plastic use and the introduction of recycled and biodegradable packaging materials. The chipset launches are aligned with customer preferences for eco-friendly products with an emphasis on compostable tray and paper wrap packaging. Supermarkets have also picked up on this trend and emphasized eco-friendly presentations of frozen products and are taking steps to reduce their carbon footprint.

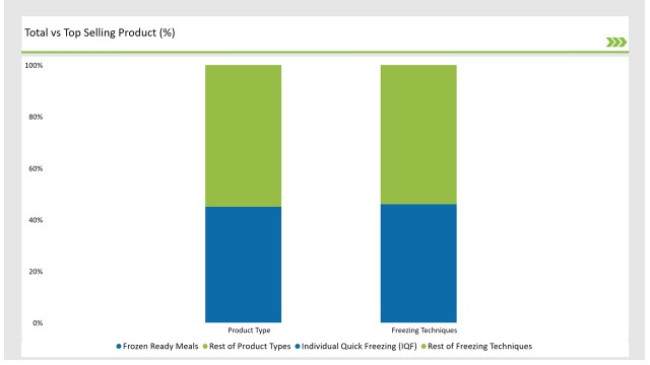

% share of Individual categories by Product Type and Freezing Technique in 2025

Ready-made frozen meals constitute 45% of the UK frozen food market upheld by the factors such as convenience, affordability, and changing dietary behaviors. The higher spectrum of frozen meal options including ethnicities, low calories, and high-protein selections is widening the potential consumer market.

The adding and driving forces of flexible charities to multi-culture and vegan diets are why companies are flourishing with the production of frozen plant-based and vegan meals. The companies are constantly battling the heads to deliver better meals which in turn builds consumer faith to try out frozen ready meals.

IQF accounts for 46% of the freezing methods used in the frozen food sector in the United Kingdom. The IQF method is widely chosen because it preserves the original shape, taste, and texture of the food products and at the same time, the clumping issue is avoided. IQF mainly freezes the vegetables, fruits, seafood, and meat, thus is a major contributor to frozen food quality. The increased demand for frozen produce and high-quality frozen meals has brought about more facilities in processing that adopt the IQF technique.

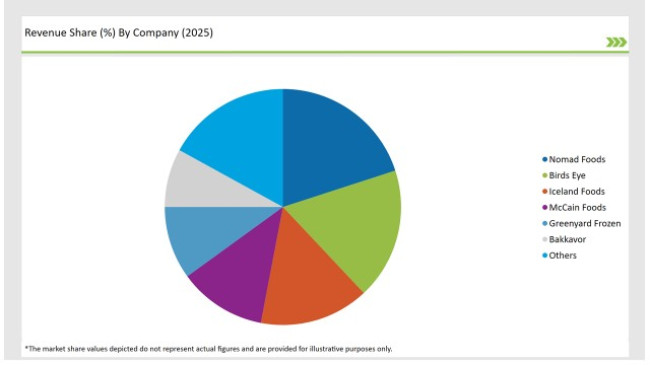

The UK frozen food market is fairly competitive, with key players emphasizing product innovation, sustainability, and strategic partnerships. Key enterprises dominating the market sphere are named Nomad Foods, Birds Eye, Iceland Foods, McCain Foods, Greenyard Frozen, Bakkavor, and Dr. Oetker.

These producers not only have a significant market share but also keep striving to push the boundaries of technological freezing, sustainable delivery, and a wide array of products to stay competitive. Increasingly, the companies are promoting their frozen products by collaborating with supermarket chains and online grocery stores.

2025 Market share of UK Frozen Food suppliers

Note: above chart is indicative in nature

The surge in e-commerce has allowed frozen food brands to form direct-to-consumer (DTC) links, thereby increasing their digital marketing footprint and establishing new avenues, such as subscription meal services. Furthermore, the brands unveil the limited edition meals through incorporating global native cuisines and emphasizing on a quest for unusual taste.

Sustainability has become a front-runner in the normalization of manufacturers with introducing environmentally freeze techniques, reducing carbon footprints, and setting up carbon neutral frozen food production plants. The competitive atmosphere is speeding up changes concerning both well-established players and new dealers using innovation to enhance frozen food quality and flood the market with the needs of the consumer.

Within the Forecast Period, the UK Frozen Food market is expected to grow at a CAGR of 6.7%.

By 2035, the sales value of the UK Frozen Food industry is expected to reach USD 36,933 million.

Key factors propelling the UK Frozen Food market include Changing consumer lifestyles and the need for convenient, time-saving meal options, leading to increased demand for frozen food products. Advancements in freezing technology and packaging, which have improved the quality, taste, and shelf-life of frozen foods, making them more appealing to consumers.

Prominent players in the UK Frozen Food manufacturing include Nomad Foods, Birds Eye, Iceland Foods, McCain Foods, Greenyard Frozen, Bakkavor, and Dr. Oetker. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Frozen Ready Meals, Frozen Seafood & Meat Products, Frozen Snacks & Bakery Products, Frozen Fruits & Vegetables, Others

Supermarkets/Hypermarkets, Convenience Stores & Independent Retailers, Online Retail, Food Service/HoReCa, Others

Individual Quick Freezing, Belt Freezing, Blast Freezing, Plate Freezing, Cryogenic Freezing.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.