The UK Freeze Dried Fruits market is poised to reach a value of USD 409.7 million in 2025, and further expand at a CAGR of 3.1% to reach USD 761.3 million by the year 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 409.7 million |

| Industry Value (2035F) | USD 761.3 million |

| CAGR (2025 to 2035) | 3.1% |

The UK freeze-dried fruits market has been witnessing remarkable growth due to the increasing consumer preference for nutritious, long-lasting, and convenient food choices. Freeze-drying technology is the technique used to keep the fruits' natural flavor, color, and nutritional composition unchanged while offering the products' outdoor shelf life, i.e., as an extended shelf life, these products become for the consumer as an alternative to the fresh and traditionally dried fruits. With more people becoming interested in healthy eating, ingredient transparency, and going plant-based, it has only made the acceptance of freeze-dried fruits in more consumer sectors.

One of the main motors of the sector is the increase in the use of freeze-dried fruits in the food and beverage sector. The products are predominant in breakfast cereals, smoothie powders, snack bars, and bakery products in which they are utilized due to their overall weight and flavor traits. Additionally, the trend in the food sector to use only natural substances in functional foods and food supplements has increased the popularity of freeze-dried fruits among manufacturers of this type of food.

With the increasing concern over the food waste problem, freeze-dried fruits have become a viable choice as they provide a solution to the sustainability issue by getting rid of the preservatives found in other methods of fruit storage. Retaining nutritional values without adding artificial preservatives is a practice that goes in line with the UK's efforts toward cleaner and less processed foods.

The market is likely to continue to rise due to the widespread distribution via supermarkets, online grocery platforms, and health specialty stores. The incorporation of imaginative fruit combinations, functional ingredient pairings, and easy-to-use packaging formats will also boost the growth of the UK freeze-dried fruits market.

Explore FMI!

Book a free demo

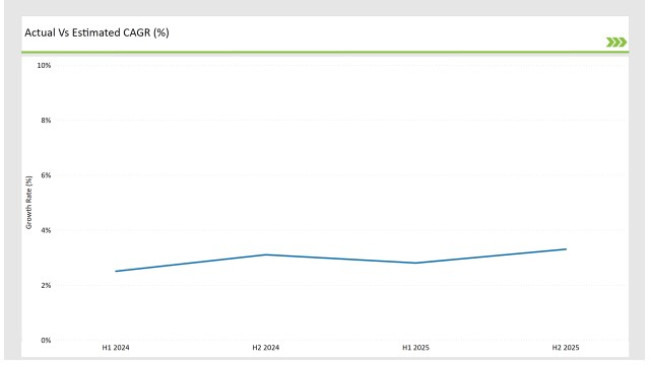

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Freeze Dried Fruits market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Nature’s Heart expanded its freeze-dried fruit range by introducing a mixed berry blend with no added sugar, catering to health-conscious consumers. |

| March 2024 | Urban Fruit launched single-serve freeze-dried fruit packs targeted at school lunchboxes and on-the-go snacking. |

| May 2024 | Lio Licious announced a partnership with a leading UK bakery brand to supply freeze-dried fruit ingredients for premium dessert lines. |

| August 2024 | A report by UK Health & Wellness Insights indicated a 15% rise in demand for freeze-dried fruit powders in sports nutrition products. |

| October 2024 | Tesco introduced a private-label freeze-dried fruit range in its organic product section, enhancing accessibility to mainstream shoppers. |

Growing Demand for Freeze-Dried Fruit Powders in Functional Foods

Freeze-dried fruit powders are now taking the market by storm as they offer a more convenient way for clients to manage their nutritional intake. Fruit powders are, for instance, being added in smoothies and shakes to enhance nutrition. These powders offer the health benefits of concentrated nutrients while being free of artificial additives; this makes formulations with health priority the ideal candidates for these powders.

Major brands are taking the lead on the freeze-dried fruit powder market by formulating them with superfood blends, meal replacements, and snacks that are charging probiotics. Also, freeze-drying technology that retains vitamins is a great asset; as a result, the powders will not only appeal to sports nutrition but also to medical foods. Furthermore, food processors are creating fruit mixes that combine acai, pomegranate, and dragon fruit powders, not only for additional antioxidant properties but also for the latest consumer trends.

Premiumization of Freeze-Dried Fruit Snacks

The United Kingdom is seeing a rise in demand for freeze-dried fruit products, and it is no longer just about the standard organic versions as brands are now coming out with high-quality fruit varieties from sustainable farms. There is a growing trend of shoppers who are ready to pay the extra price for single-origin freeze-dried fruits, blends of exotic fruits, and ethically sourced ingredients, which is mainly evidenced in the gourmet and health-food retail markets.

To mention a new trend, companies are using sustainable packaging to build a rapport with environmentally-conscious consumers, who support biodegradable and recyclable products. This luxury fruit product category in the frozen dry range also comes with innovation, for example chocolate-covered and yogurt-covered types, which are targeted in particular to consumers who balance out their desires for taste with health.

Retailers Expanding Private-Label Freeze-Dried Fruit Offerings

The growing trend of healthy snacks has led supermarkets and specialty retailers to expand their offerings of their own private label freeze-dried fruits. Tesco, Sainsbury's, and Waitrose have unveiled their freeze-dried fruit ranges, which provide a cost-efficient choice for consumers as an alternative to the branded products.

The process of increasing market competition is happening whilst retailers are also diversifying product lines with the development of exclusive blends and multipack options making them more diverse and handy to consumers. Furthermore, private-label brands are trying, for example, strawberry slices enriched in vitamin C through organic and fortified freeze-dried fruit products to satisfy health-conscious customers who demand added functional benefits.

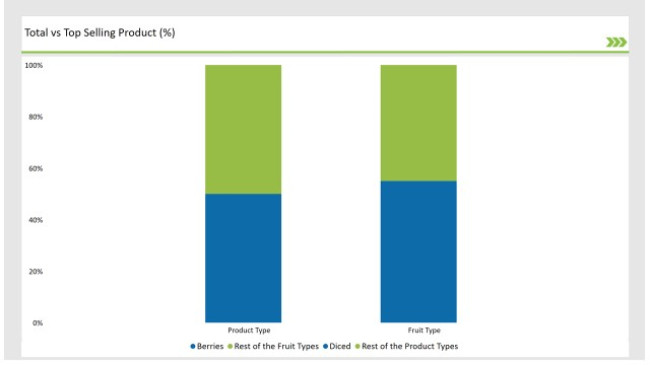

% share of Individual categories by fruit Type and product format in 2025

Thanks to their antioxidants quantity, the UK freeze-dried fruits market has a 55% share of berries, which are attractive as they are antioxidant-powerful, colorful, and pleasing to consumers. Strawberries, blueberries, raspberries, and blackberries are commonly utilized in muesli, snack bars, and yogurt toppings. The attendance of freeze-dried berries in the UK market has further boosted their popularity through new products that help support the immune system and offer anti-aging effects.

Diced freeze-dried fruits hold the largest share of 50% in the market as they can be utilized in various dish applications. Small in size, uniform, ideal for granola, ready-to-eat palates, and baking products, they are the sought-after form. Food companies have shown a preference for diced types since they are easier to manufacture and ensure a uniform taste in the final packaged products.

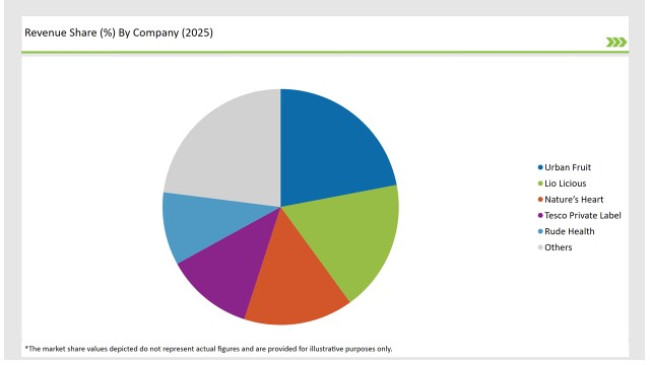

The UK freeze-dried fruits industry is a medium-competitive segment consisting of both international and local participants mainly focusing on product innovation, distribution expansion, and strategic partnerships. Urban Fruit, Lio Licious, Nature's Heart, and Tesco Private Label are the leading private labels dominating the market and they are using retail strength and consumer loyalty as weapons.

2025 Market share of UK Freeze Dried Fruits suppliers

Note: above chart is indicative in nature

For the market-segment's leadership, the companies involved in the industry have placed organic certification, sustainable sourcing, and innovation of product blends as the main objectives to accomplish. The adoption of online sales and direct to consumer delivery modes is increasingly influencing the competition profile, thus, the brands are more effectively reaching the health-conscious customers.

The freeze-dried fruits market in the UK is projected to grow further with the innovation and consumer demand for healthier and functional, long-shelf-life fruit products taking the lead.

Within the Forecast Period, the UK Freeze Dried Fruits market is expected to grow at a CAGR of 3.1%.

By 2035, the sales value of the UK Freeze Dried Fruits industry is expected to reach USD 761.3 million.

Key factors propelling the UK Freeze Dried Fruits market include the increasing consumer demand for nutritious, long-lasting, and convenient food options.

Prominent players in the UK Freeze Dried Fruits manufacturing include Urban Fruit, Lio Licious, Nature’s Heart, and Tesco. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Organic, Conventional

Whole, Diced, Powdered/Granulated

Food & Beverages Products, Retail/Household

Berries, Exotic & Tropical Fruits, Orchard & Citrus Fruits

Business to Business, Business to Consumer.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.