The UK fish protein market is set to reach USD 33.9 million by 2025, with continued expansion driving its value to USD 62.2 million by 2035. This represents a compound annual growth rate (CAGR) of 6.3%, fueled by rising demand for protein-enriched dietary supplements, functional food products, and pharmaceutical applications. The market is benefiting from advancements in extraction technologies, the shift toward sustainable marine ingredients, and the increasing consumer preference for high-quality protein sources in various end-use industries.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size in 2025 | USD 33.9 million |

| Projected UK Industry Size in 2035 | USD 62.2 million |

| Value-based CAGR from 2025 to 2035 | 6.3% |

The market for fish protein in the UK is expanding at a steady pace due to greater usage in food and beverages, dietary supplements, and pharmaceuticals. The preference for protein from fish sources is increasing among users, which is why companies are investing in sustainable fishing, better extraction methods, and product development.

Some of the prominent shifts within the industry include the incorporation of fish protein into high-performance sports nutrition supplements, the greater use of hydrolyzed protein in functional foods, and the expansion of collagen extracted from fish for skincare and other cosmetics. Leading companies in the industry such as New England Seafood International, Young’s Seafood and Marine Harvest UK are also focusing on supply chain sustainability, novel product development, and clean-label offerings for brand differentiation.

Explore FMI!

Book a free demo

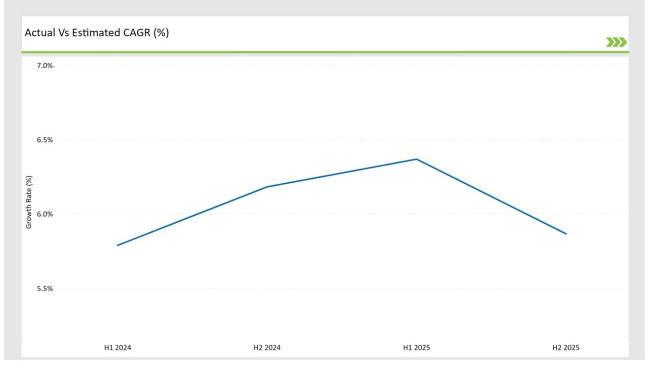

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UKFish Protein market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 5.8% |

| H2 Growth Rate (%) | 6.2% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 6.4% |

| H2 Growth Rate (%) | 5.9% |

For the UK market, the Fish Protein sector is projected to grow at a CAGR of 5.8% during the first half of 2024, with an increase to 6.2% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 6.4% in H1 and reach 5.9% in H2.

| Date | Details |

|---|---|

| Nov-2024 | Scottish salmon processor MacKenzie Ltd launched a new line of hydrolyzed fish protein powders for sports nutrition. The products demonstrate superior amino acid absorption in clinical trials. |

| Sept-2024 | Ocean Harvest Technology expanded their Grimsby facility to increase fish protein isolate production. The expansion doubles their capacity to process white fish by-products into high-value protein ingredients. |

| July-2024 | MarineProtein UK acquired sustainable fish processing company SeaValue for £20M. The acquisition includes advanced protein extraction technology for maximizing yield from fish processing waste. |

| Apr-2024 | Biomega Group opened their first UK facility in Aberdeen for fish protein production. The facility focuses on producing bioactive peptides from salmon by-products for nutraceutical applications. |

| Jan-2024 | Atlantic Proteins launched a new range of fish protein hydrolysates for pet food applications. The products are sourced from sustainable UK fisheries and processed using gentle enzymatic methods. |

Rising Demand for Hydrolyzed Fish Protein in Sports and Functional Nutrition

With the ever-growing consumption of sports nutrition products, hydrolyzed fish protein is becoming an essential ingredient due to its high biological value and excellent digestibility. Athletes and health-conscious people in the UK are increasingly using fish protein hydrolysate as supplementation due to its undeniable benefits. Biomega UK and Rossyew Ltd are at the forefront of this major shift by adopting new proprietary technologies for advanced hydrolysis in order to produce high quality protein powders for muscle recovery, joint health, and overall wellness.

Sustainable Fish Sourcing and Zero-Waste Processing in the Marine Protein Industry

The goal of achieving sustainability has surfaced as an important concern for the UK fish protein industry, as fish companies are now implementing responsible fish sourcing practices and zero-waste production techniques. New England Seafood International and Young’s Seafood are incorporating elements of the circular economy by having fish trimmings and by-products processed for protein extraction, thus minimizing waste and its negative environmental impact.

This shift is also in response to certified sustainable fisheries and traceable supply chains preferred by the UK, which in turn aligns with government policies regarding eco-friendly marine harvesting as ethical and commercially viable fish protein production.

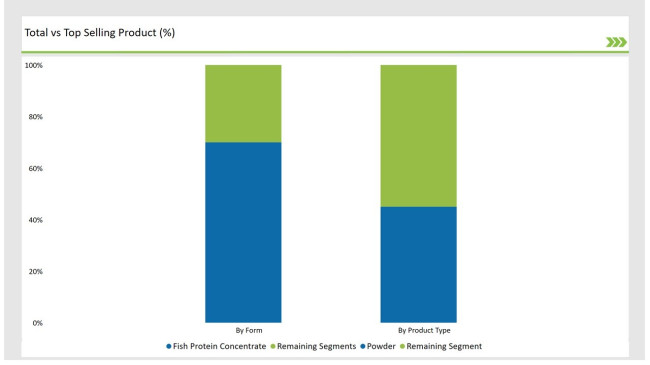

| Product Type | Market Share |

|---|---|

| Fish Protein Concentrate | 45% |

| Remaining Segments | 55% |

Fish protein concentrate continues to dominate the UK market as the most widely used fish-derived protein, especially in food and beverage applications owing to its high nutritional value and formulation flexibility. Fish protein isolate is on the rise, but it is still more expensive to produce, which limits its appeal for mass marketing endeavors. The market is also seeing a slow increase in fish protein hydrolysates, which is attributed to their functional health benefits and ease of absorption, making them very useful in sports nutrition and medical formulation.

| Form | Market Share |

|---|---|

| Powder | 70% |

| Remaining Segments | 30% |

The powdered form of fish protein is still the most popular format due to its long shelf life and easy transport, as well as its wide use in food, nutritional supplements, and even pharmaceuticals. Liquid fish protein, however, is starting to become more popular, especially among ready-to-drink beverages and cosmetics, which require higher bioavailability and solubility. As consumers continue to prefer more convenient and faster digesting forms of protein, producers are turning to liquid hydrolysates to provide added functional value in multiple industries.

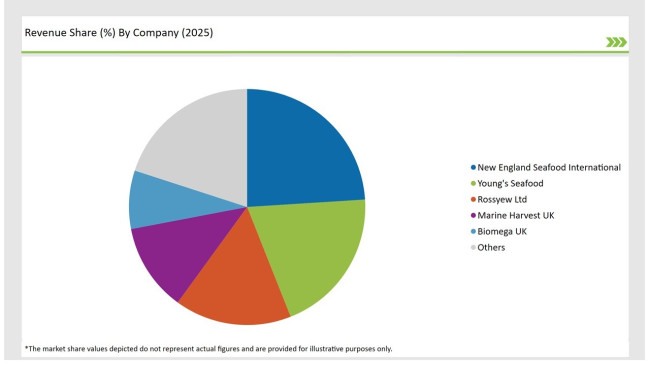

The United Kingdom fish protein market is not heavily concentrated, featuring a blend of international and local firms competing for market share. Long established seafood processing companies such as New England Seafood International and Young’s Seafood have significant market power due to their vertically integrated supply chains and broad distribution networks.

They are being challenged by marine protein specialists like Rossyew Ltd and Biomega UK, who target high-value fish protein hydrolysates and concentrates. There is a growing trend in the market towards improved methods of producing fish protein sustainably, in which traceability and minimizing waste are integrated into the main competition strategies.

| Company | Market Share (%) |

|---|---|

| New England Seafood International | 24% |

| Young’s Seafood | 20% |

| Rossyew Ltd | 16% |

| Marine Harvest UK | 12% |

| Biomega UK | 8% |

| Other Players | 20% |

The major players in the fish protein sector in the UK have built their processing facilities in Scotland and along the coast of England, where a major portion of the fishing activities take the place. New England Seafood International and Young’s Seafood Practise sustainable capture fisheries and operate large seafood stores to guarantee an endless supply of raw materials.

Rossyew Ltd and Biomega UK are focusing on new hydrolyzed fish protein concentrates for nutritional and cosmetic premixes. Their customer base as well as retail chains, catering services and DTC brands is growing with market and marine sustainability certifications becoming more prominent in branding the products.

By 2025, the UK fish protein market is expected to grow at a CAGR of 6.3%, supported by increasing demand for marine-based functional proteins in food and health applications.

By 2035, the UK fish protein industry is projected to reach USD 62.2 million, reflecting growing adoption of high-value protein isolates and sustainable marine protein solutions.

The market is expanding due to rising consumer interest in alternative protein sources, growing demand for sports nutrition and dietary supplements, increasing innovations in hydrolyzed fish proteins, and sustainability-driven production practices.

The Scotland and Northern England regions lead the UK fish protein market, benefiting from strong seafood processing infrastructure and proximity to major fisheries, while London drives demand for premium marine-based supplements and functional foods.

Major companies in the UK market include New England Seafood International, Young’s Seafood, Rossyew Ltd, Marine Harvest UK, and Biomega UK, alongside specialty marine protein firms like Copalis Sea Solutions and Seven Seas Ltd.

Fish Protein Concentrate, Fish Protein Isolate, Fish Protein Hydrolysate

Powder, Liquid

Food & Beverages, Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care, Others

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.