The UK Fermented Ingredients market is estimated to be worth USD 2,743.5 million by 2025 and is projected to reach a value of USD 6,133.4 million by 2035, growing at a CAGR of 8.4% over the assessment period 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2,743.5 million |

| Industry Value (2035F) | USD 6,133.4 million |

| CAGR (2025 to 2035) | 8.4% |

The UK market for fermented ingredients is on the rise, primarily due to the strong demand across industrial sectors such as food, drink, pharmaceuticals, and animal feed. Fermented ingredients are additives, such as amino acids, organic acids, and enzymes, which are essential for food preservation, nutritional enrichment, and texture improvement.

The growing consumer trend towards natural and clean-label food products has been the driving force behind the increase in the consumption of fermented ingredients in the UK food and beverage sector.

Key manufacturers in the UK market include Cargill, Kerry Group, DSM, Corbion, BASF, and DuPont. These companies are committed to expanding their product lines and are optimizing fermentation processes and investment in research and development to create innovative solutions to stay ahead of consumers' changing preferences.

The market is also affected by food safety regulations and the demand for consumer understanding of gut health and functional foods. Fermented ingredients specifically probiotics and post biotic are increasingly promoted for their health benefits such as better digestion and immune function. Besides, the developments in biotechnology and fermentation processes lead to the efficiency of production as well as cost reductions.

Even though the situation with high production costs and fluctuating raw material prices is tough, the spirit is still unbroken in the UK fermented products sector.

The upward trend in the use of fermentation-derived amino acids and enzymes in alternative protein sources and dairy-free formulations is expected to drive the market's growth in the future. They are also collaborating with food and beverage manufacturers to develop special ingredient solutions and to expand their market footprints.

Explore FMI!

Book a free demo

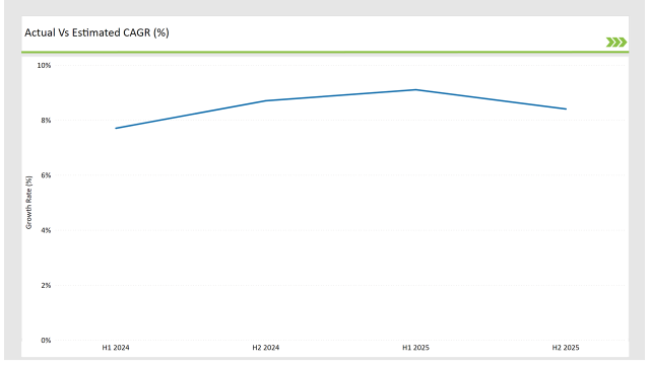

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Fermented Ingredients market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | A UK-based ingredient supplier launched a new range of fermented amino acids for plant-based meat formulations. |

| Oct 2024 | A leading manufacturer expanded its enzyme production facility to cater to the growing demand for fermentation-derived food stabilizers. |

| Sep 2024 | A partnership between a biotechnology firm and a UK food producer introduced a fermented probiotic ingredient for functional beverages. |

| Aug 2024 | A major UK dairy alternative brand incorporated fermentation-derived proteins into its plant-based cheese range. |

| Jul 2024 | A global food ingredient company acquired a UK-based fermentation specialist to strengthen its portfolio in bioactive ingredients. |

Fermentation of clean-label ingredients

Consumers in the UK show a preference towards clean-label products, while the demand for naturally fermented ingredients keeps growing. The naturally fermented ingredients are characterized by extended shelf life, improved flavors, and increased nutrient value; they do not contain any artificial additives.

Some food manufacturers adjust to the market by altering their products to include fermentation-derived ingredients instead of artificial additives, which are more popular with consumers.

By the way, the trend of clean-label is increasingly turning to honesty that is why brands are bringing in fermentation-based clean-label methods as a competitive advantage in the market, which in turn assures the trust and preference of customers.

Innovations in Fermented Proteins for Alternative Meat and Dairy Products

The sector of alternative proteins has been greatly benefitting from recent advances in the field of fermentation technology. Food enzymes and amino acids that are obtained from fermentation are commonly added up to boost the texture, taste, and nutritional content of plant-based meat and dairy alternatives.

On the road to sustainability, the transformation of the food industry into one that is more environmentally friendly is brought about by this path of development. Future ropes are being created by companies through the introduction of precision fermentation methods, which let them produce dairy proteins that are identical to animal ones, without using animals in the first place.

Biotechnology is leading the expansion in fermentation industry

Biotechnology is the driving force behind the efficiency of fermentation and the reduction of production costs. The innovative concept of precision fermentation has led to the manufacture of custom ingredients more stable and biocompatible than before.

Fermentation is now a key technology that is well-positioned with the pharmaceutical, nutraceutical, and food industries. The integration of AI in fermentation monitoring also means more yield and better quality therefore the manufacturers are now able to increase production while maintaining consistency in their outputs

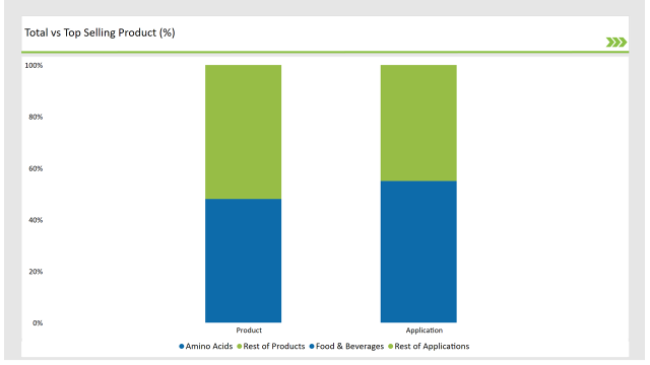

% share of Individual categories by Product Type and Applications in 2025

Amino acids make up the majority of the UK fermented ingredients market with a 48% share. These essential elements are widely utilized in the areas of food fortification, sports nutrition, and pharmaceuticals. Consumers are choosing syrups with a lower caloric content, because of their health, and security issues.

The fermentation process produces lysine, glutamine, and tryptophan which, unlike their usual synthetic counterparts, are prebiotic, and their uptake is better. They assist with muscle healing, and cognitive ways of functioning, and with the whole body metabolism their consumption is greatly increased through a variety of channels.

Moreover, the panting protein-rich diets are today being driving the use of amino acids in dietary supplements that are considered this segment as the main driver of the UK fermented compounds market.

Food and beverages are responsible for 55% of the total market for fermented ingredients in the UK. Fermented ingredients have become ammoniac in the bakery, dairy substitutes, and functional beverages for seasoning, stabilization, and nutritional value attractive taste.

Venturing into the field of probiotics-rich and gut-based health concerns the fermented ingredients are picking up fast to be a dominant ingredient in new product formulation. The rise in the popularity of functional foods, especially those that are aimed at supporting digestive systems and immune responses, has, in turn, led to the increased consumption of probiotic and post biotic ingredients in both the food and drink sectors.

Note: above chart is indicative in nature

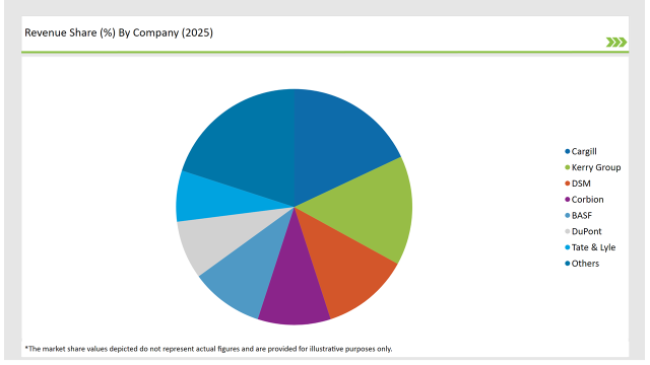

The UK fermented ingredients market is moderately competitive, with key players focusing on product innovation, sustainability, and strategic partnerships. Dominant companies in this market comprise Cargill, Kerry Group, DSM, Corbion, BASF, DuPont, and Tate & Lyle.

They are the major players since they have a large share in the market and are actively funding R&D to create new fermentation techniques and to grow their businesses. The emphasis on producing bio-based, affordable, and high-functional fermented goods is being increased, hence helping in keeping competitive edge.

There is a new trend in investing in molecular fermentation, where companies reach out to biotechnology to develop high-quality and functional ingredients with little damage to the environment. Collaborations with food manufacturers have also introduced suppliers to customer-oriented fermentation solutions that are tailored to specific industries.

The dynamic field of mergers and acquisitions is intensifying competition as firms acquire operational expansion and broaden their product scope to stay in the lead on this burgeoning market.

Within the Forecast Period, the UK Fermented Ingredients market is expected to grow at a CAGR of 7.2%.

By 2035, the sales value of the UK Fermented Ingredients industry is expected to reach USD 6,133.4 million.

Key factors propelling the UK Fermented Ingredients market include Growing consumer demand for natural, clean-label, and sustainable food and beverage products, leading to increased use of fermented ingredients. Advancements in fermentation technology and the development of novel fermented ingredients with diverse applications across various industries.

Prominent players in the UK Fermented Ingredients manufacturing include Cargill, Kerry Group, DSM, Corbion, BASF, DuPont, and Tate & Lyle. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various natural color types such as carotenoids, anthocyanins, By Form: Liquid, Dry

Amino Acids, Organic Acids, Biogas, Polymer, Vitamins, Antibiotics, Industrial Enzymes

Food & Beverages, Pharmaceuticals, Paper, Feed, Others.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.