The UK Energy Gels market is currently valued at around USD 34.3 million, and is anticipated to progress at a CAGR of 9.4% to reach USD 83.9 million by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 34.3 million |

| Industry Value (2035F) | USD 83.9 million |

| CAGR (2025 to 2035) | 9.4% |

The UK energy gel market is gaining rapid momentum, as the consumer interest in endurance sports, fitness activities, and high-performance nutrition is increasing. Energy gels are made to be easily accessible and can supply the necessary carbohydrates and electrolytes and this way they help the athletes and active people to have the right energy for a longer time. These products are commonly used by runners, cyclists, triathletes, and outdoor sports lovers.

The major propellant which has a positive effect on the growth of the UK energy gel market is the increasing number of participants in marathons, cycling events, and endurance training programs.

With an increase in people's awareness of their nutrition and performance necessities, fast-absorbing, easy-to-digest energy sources are provided. Furthermore, the switch to plant-based and clean-label formulations has stimulated the manufacturers to come up with innovative ideas to create organic, natural, and gluten-free energy gels.

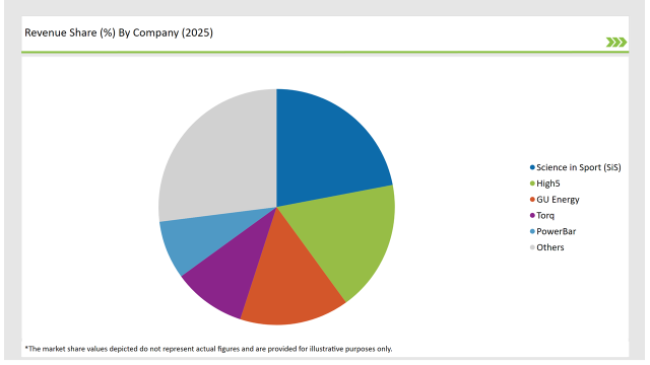

Brands that are in the lead like Science in Sport (SiS), High5, GU Energy, Torq, PowerBar, and Clif Bar are commanding the UK market through product innovation, sponsorship by professional athletes, and strong brand loyalty.

These are the companies which have been developing and marketing goods that are more enriched by amino acids, caffeine, and electrolytes as a way to promote endurance and recovery.

Moreover, the sector is gaining from the fact that the energy gels are increasingly sold through indirect B2C channels like supermarkets, sports retailers, and e-commerce platforms. This transformation is making energy gels accessible both to professional athletes and to casual fitness enthusiasts.

Advertising outlines that stress on the added benefits of hydration, convenience, and performance are a great influencer of product propagation in the UK.

Thanks to strategic retailer partnerships and event organizers, coupled with continuous research in product innovation, the UK energy gel market promises a regular and positive growth rate that caters to the diverse demands of fitness-driven customers.

Explore FMI!

Book a free demo

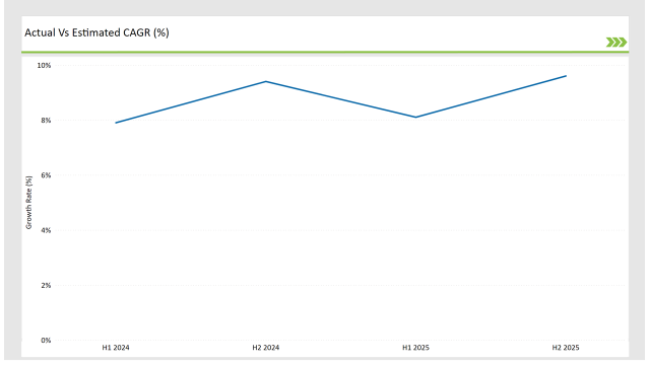

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Energy Gels market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | Science in Sport (SiS) launched a new caffeine-infused fruit-flavored energy gel aimed at endurance athletes. The formulation includes electrolytes and natural flavors for improved taste and hydration. |

| May 2024 | High5 partnered with UK cycling events to promote their range of sugar-free and organic energy gels. This partnership aims to increase brand visibility among professional and amateur cyclists. |

| July 2024 | Torq introduced a new line of tropical fruit-flavored energy gels with added amino acids to enhance muscle recovery post-exercise. The new range is targeted at triathletes and long-distance runners. |

| September 2024 | A report from UK Sports Nutrition Association highlighted a 15% increase in energy gel sales year-over-year, driven by higher demand in endurance sports and gym-goers. The report also indicated a growing preference for fruit-based flavors. |

| November 2024 | GU Energy expanded its distribution network by securing partnerships with major UK supermarkets, making its fruit-flavored energy gels more accessible to mass-market consumers. |

Electrolyte-Enriched Formulations Gaining Popularity

Energy gels that contain extra electrolytes are the new item in demand among athletes. Consumers of nowadays time often reject the ones that are free from the electrolytic balance and thus they are fond of the hydration-supportive formulations which retain it during the extensive workout.

Some such companies which are in this line of energy gels are Science in Sport (SiS) and High5, both of which are manufacturing gels that are consumed, during workouts and rapidly replace the lost minerals, hence ensuring good performance and non-fatigue.

Gel-Based Recovery Solutions Acquire a Demand

Besides working as fuel, another area where there is now greater interest is in energy gels that help with post-workout recovery. Some brands are creating products loaded with branched-chain amino acids (BCAAs) and glutamine for assistance during muscle repair and reducing soreness. Torq has come up with recover-enhancing sports gels that are primarily for athletes who desire to recover faster.

Rise of Single-Use, Eco-Friendly Packaging

The focus on sustainability is resulting in the packaging of energy gels in biodegradable and recyclable containers. Brands are benefitting from the explorations of the plant-based or reduced-waste packaging that fits the profiles of eco-conscious consumers. GU Energy and Clif Bar companies were at the front of the innovation, with the launch of single-use gel packs containing less plastic.

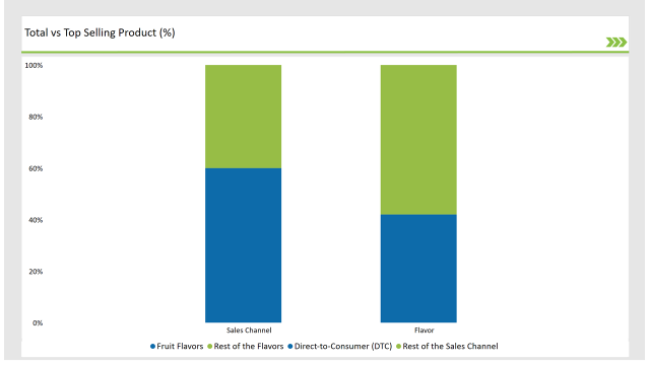

% share of Individual categories by Product Type and Applications in 2025

Fruit flavors dominate the UK energy gel market, with 42% market share, showcasing a customer preference for natural and refreshing taste. Runners and cyclists are fans of the citrus and berry-flavored gels because of the latter's mild acidity and easier digestion.

High5 and Torq are the brands which are providing the fruit-flavored mixtures and they also demonstrate increasing interest in developing tropical and exotic blends to draw people in. Furthermore, studies affirmed that consumers have the opinion that fruit flavors can hydrate better, therefore, they are more popular.

Indirect B2C sales channels, such as supermarkets, e-commerce platforms, and sports retailers, have a share of 60% in the energy gel sales. The growing presence of energy gels in mainstream retail stores has not just attracted professional athletes but has also increased the consumer base.

Through indirect sales, major brands are targeting casual fitness enthusiasts, marathon participants, and gym-goers, in turn, enhancing their market position. Online sites like Amazon and sports nutrition retailers have significantly influenced the annual sales growth.

Note: above chart is indicative in nature

The UK energy gel market is somewhat consolidated, which has a mix of traditional sports nutrition brands and start-ups. Science in Sport (SiS), High5, GU Energy, Torq, PowerBar, and Clif Bar have a significant share of the market and are known for their brand recognition, strong retail partnerships, and innovative products, thus they are in the Tier 1 category. On the other hand, Tier 2 companies are into niche items like organic and caffeine-free energy gels that focus on certain consumer segments.

To stay competitive, manufacturers put pressure on product differentiation, such as innovations on natural flavors, the addition of electrolytes, and eco-friendly packaging. Collaborations with fitness influencers, endurance events sponsorship, and direct-to-consumer (DTC) marketing are also underway to reach their target audience more effectively.

The UK energy gel market's promising future is rooted in enhanced functionality, the widespread adoption of retail stores, and the consumers' preference for fruit flavors which are on the rise. With the increase of health-conscious people and more fitness-consumed customers, the market is set for steady growth in the decades to come.

Within the Forecast Period, the UK Energy Gels market is expected to grow at a CAGR of 9.4%.

By 2035, the sales value of the UK Energy Gels industry is expected to reach USD 83.9 million.

Key factors propelling the UK Energy Gels market include the increasing consumer interest in endurance sports, fitness activities, and high-performance nutrition.

Prominent players in the UK Energy Gels manufacturing include Science in Sport (SiS), High5, GU Energy, Torq, PowerBar, and Clif Bar. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Fruit Flavours, Lemonade/Limeade Flavours, Chocolate Flavour, Coffee/Espresso Flavour, Others

Single-Serve, Multi-Serve

Direct B2B, Indirect B2C.

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Bouillon Cube Market Analysis by Type and Distribution Channel Through 2035

Food Fortification Market Analysis by Type, Process and Application Through 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Bone and Joint Health Supplement Market Analysis by Product Type, Form and Sale Channels Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.