The UK Dehydrated Onions market is estimated to be worth USD 76.3 million by 2025 and is projected to reach a value of USD 131.4 million by 2035, growing at a CAGR of 6.2% over the assessment period 2025 to 2035

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 76.3 million |

| Industry Value (2035F) | USD 131.4 million |

| CAGR (2025 to 2035) | 6.2% |

The United Kingdom's market for dehydrated onions is testament to the power of the unwavering growth that is fueled by the rise in demand for convenience, extended-shelf-life, food items in both foodservice and packaged food sectors.

Dehydrated onions are extensively added to the liking of chefs and consumers in many dishes such as soups, sauces, snacks, and ready-to-eat meals due to their capacity to keep the full taste and nutritional value as well as to provide a longer time for storage. Food manufacturers are more and more adding dehydrated onions to their formulations as consumer’s expression preference for processed yet natural ingredients.

The pronounced contributive cause to the market growth is the accelerating acceptance of the usage of dehydrated onions in the fast-food sector which is really a new sector. The quick-service restaurant (QSR) sector in the UK, which consists mainly of burger chains, pizza facilities, and sandwich brands, has a significant reliance on the use of dehydrated onions because they ensure the constant flavor and easy storage.

Besides, the utilization of dehydrated onions in powdered and granule forms in spice blends, seasonings, and snack foods has further stimulated the demand.

Another equally essential driver is the improving educating of the public and food manufacturers about preventing food waste. As onions provide a more extended shelf life compared to fresh ones, dehydrated onions do the same and help to reduce waste as well as to optimize the supply chain. This is a side which is in line with the targets for sustainability that are now very often the main reason behind purchases in the food sector in the UK.

Vision of growth in the UK dehydrated onions industry is, supported by, ceaseless refinements in dehydration technologies and the widening of distribution networks, that will be seen. The industry leaders are devoted to the perfection of operational methods by innovation in the provision of quality supply, and the adaptation to the needs of the customer.

Explore FMI!

Book a free demo

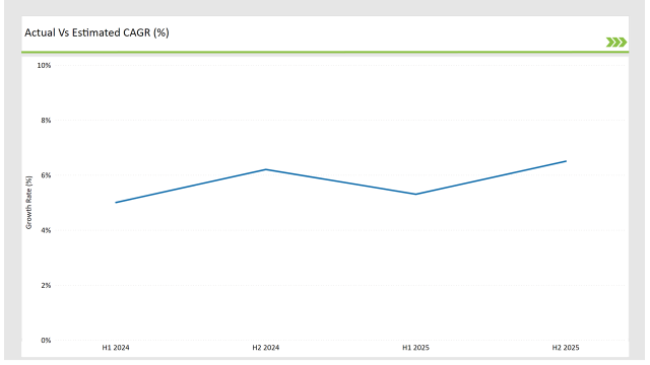

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Dehydrated Onions market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | Van Drunen Farms expanded its UK operations with a new facility focusing on air-dried white onions, increasing production capacity. |

| May 2024 | Olam Food Ingredients (OFI) launched a premium range of organic dehydrated onions for the UK market, targeting clean-label food manufacturers. |

| July 2024 | Sensient Technologies introduced a new dehydration process that enhances the flavor retention of air-dried onions, improving ingredient quality for food processors. |

| September 2024 | A study by UK Food & Beverage Insights highlighted a 10% rise in demand for dehydrated onions in snack manufacturing, reflecting evolving consumer preferences. |

| November 2024 | British Pepper & Spice partnered with major UK supermarket chains to supply private-label dehydrated onion products, increasing retail availability. |

Increasing Demand for Dehydrated Onion Seasonings

The need to use dehydrated onions in spice blends and premix seasoning powders is rising as discerning buyers choose easy-to-use, quality-enhancing ingredients. Food companies add dehydrated onion granules and powder into snack seasonings, instant meals, and dry soup mixes because of the strong taste and durability.

Additionally, the trend of the pre-mixed spice blends and ethnic seasonings market has been very supportive for the application of dehydrated onions in it. More and more people are cooking at home instead of eating out, after the pandemic, which boosted the demand for ready-to-use seasonings.

With the growing popularity of world flavors and international food traditions in the UK, the need for dehydrated onion-based seasonings is beyond traditional usage now. Mostly, foodservice retailers that are more competitive with others, work to add dry onions to their scheme as an ingredient that assures the same taste for customers.

Developments in Technology Leading to Onion Dehydration

The drying process is going through a paradigm shift with the advancements being seen in it in terms of the overall efficiency and quality of the dehydrated onion industry. More sophisticated air-drying processes are being used to maintain onion flakes' structure while also enhancing the oleoresin retention thus leading to higher consumer acceptance.

Companies are prioritizing uniform moisture content and precise heat control by also bringing in automation which lowers the overall costs. Some of the manufacturers are introducing newer methods of dehydration which include both air drying and vacuum drying, the latter being a very modern method, that not only diminishes overall time but also helps to keep the original pungency of the onions.

This innovation is part of the industry efforts for power optimization and lower carbon footprint. Moreover, endeavor put into the healthier non-thermal methods of drying are ventilating of nutrient loss and the more nutritious dehydrated onion product creation.

Some companies are also using artificial intelligence driven quality control systems to catch the dehydration processes in real-time for consistency purposes.

Dehydrated Onion Usage in Plant-Based and Fake Meats

As plant-based foods gain space in the UK, one could use dehydrated onions as the main component in the fake meats or meat substitutes. The umami properties are natural so the plant-based meats thus created are much healthier, that is, they will be free from artificial additives.

They are also making these changes due to the increasing number of vegan and flexitarian consumers who are sometimes not eating animal-based foods. As well as that the wanted but non big brand products have made many brands to be transparent and truthful about their crafting and employing of products like dehydrated onions as the only non-artificial ingredient.

Green tech is even helping by the food scientists' studies that look at how moisture content, for instance, affects the taste of onions in plant-based dishes.

Also, the join-up of plant-based food producers and dehydrated onion suppliers is increasing because they want to partner with companies that have a good reputation for sourcing sustainable, top-quality ingredients.

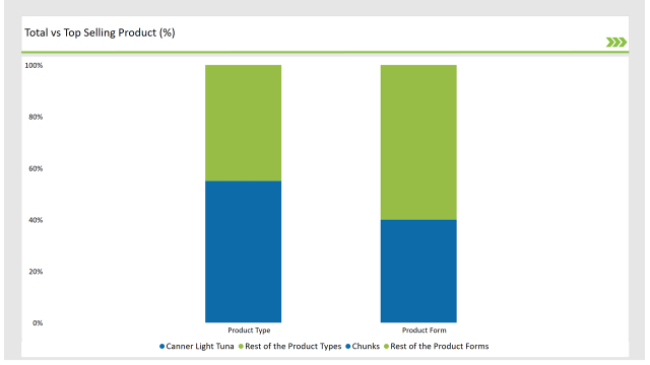

% share of Individual categories by Product Variety and Processing Technology in 2025

As of now, the dehydrated onions sector is almost entirely reliant on white onions. That is to say, they are widely used in the dehydrated onions industry because of the gentler flavor, and high adaptability in the food industry. Mainly, their use in soups, sauces, and snack seasonings has brought them the largest share in the market. Furthermore, their neutral taste profile makes them an ideal choice for manufacturers creating spice blends, instant meals, and convenience foods.

Air drying persists as the most commonly employed processing technology for dehydrated onions, mostly due to its cost efficiency and the consequent adherence to the onion taste. It is thus the first choice for food manufacturers, who want to fast-track their production and form a more uniform product, while also keeping the costs down. Air-dried onion powders, flakes, and granules are used in spice mixes, seasonings, and dehydrated soup bases due to their superior shelf stability.

Note: above chart is indicative in nature

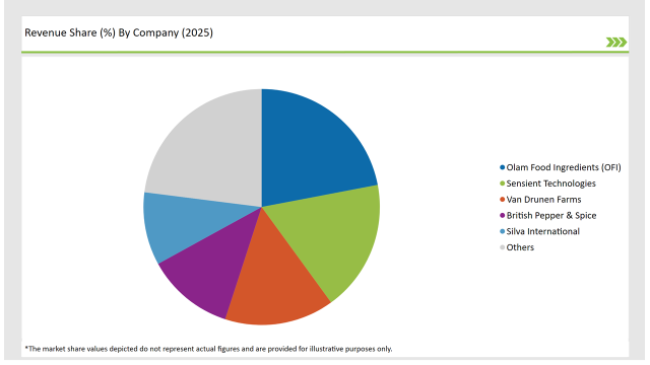

The UK dehydrated onions sector is moderately fragmented and focused on technological progress, supply chain optimization, and quality improvements by key players. The market is dominated by major companies like Olam Food Ingredients (OFI), Sensient Technologies, and Van Drunen Farms, which also establish their authority in the field of large-scale production and distribution networks.

Meanwhile, the tier 2 organic and private-label brands battle with their specialized organic and clean-label dehydrated onion products to broaden their footprint in the Market.

In order to retain their competitive edge, the manufacturers are channeling resources to new processing technologies and forming retail partnerships, expanding their organic product lines. The strategic collaboration of food producers and QSR chains has also laid a strong market presence, ensuring the stable demand for dehydrated onions in the food industry of the UK.

The UK dehydrated onions market will continue its steady growth, thanks to the innovative dehydration processes, the increasing demand for convenience foods, and the sustainable production initiatives.

Within the Forecast Period, the UK Dehydrated Onions market is expected to grow at a CAGR of 6.2%.

By 2035, the sales value of the UK Dehydrated Onions industry is expected to reach USD 131.4 million.

Key factors propelling the UK Dehydrated Onions market include the increasing demand for convenient, long-shelf-life food ingredients in both foodservice and packaged food industries.

Prominent players in the UK Dehydrated Onions manufacturing include Tate & Lyle, Bart Ingredients, Sleaford Quality Foods, Olam Europe, Symrise, Fuchs Group, Daregal, Ardo, Baxters Food Group Dehydration Technology. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

White Onions, Red Onions, Pink Onions, Hybrid Onions

Chopped, Minced, Granules, Powder, Flakes, Others

Air Drying, Freeze Drying, Microwave Drying, Others

B2B(Direct), Food Service, Retail(B2C).

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Bouillon Cube Market Analysis by Type and Distribution Channel Through 2035

Food Fortification Market Analysis by Type, Process and Application Through 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Bone and Joint Health Supplement Market Analysis by Product Type, Form and Sale Channels Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.