The UK car rental industry is changing as the focus shifts toward affordability, convenience, and sustainable mobility by businesses and travelers. The growth in digital platforms, contactless transactions, and integration of electric vehicles is leading the sector through a transformative shift. Companies with focus on fleet diversity, app-based reservations, and flexible rental options are the current market leaders.

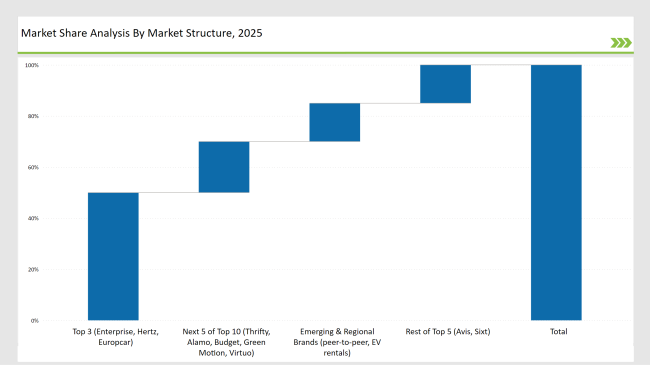

The leading companies like Enterprise, Hertz, and Europcar together take up 50% of the market share with large fleets, corporate deals, and a seamless digital experience. Independent and regional car rental companies make up 30% of the market share with low-cost services and localized offerings. Finally, new entrants in electric vehicle rentals, peer-to-peer car-sharing, and AI-driven pricing models make up 20% of the market.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Enterprise, Hertz, Europcar) | 50% |

| Rest of Top 5 (Avis, Sixt) | 15% |

| Next 5 of Top 10 (Thrifty, Alamo, Budget, Green Motion, Virtuo) | 20% |

| Emerging & Regional Brands (peer-to-peer, EV rentals) | 15% |

Online & App-Based Car Rental Services dominate with 60%, as mobile-first consumers favor instant reservations and digital check-ins. Airport & Travel Hubs hold 25%, catering to tourists and business travelers. Corporate & Long-Term Leasing accounts for 10%, serving enterprises with company fleet rentals. Peer-to-Peer & Subscription-Based Car Rentals make up 5%, promoting flexibility and alternative ownership models.

Short-Term & Daily Rentals are at the top with a share of 40% due to tourism and urban mobility. Long-Term & Corporate Leasing is at 30% as a flexible solution for fleet management solutions to businesses. Luxury & Premium Car Rentals occupy 20%, offering exclusivity to the clientele for a variety of specific events. Electric & Sustainable Car Rental Services constitute a 10% share of UK's green mobility initiatives.

As customer preferences changed with time, market leaders and new players made strategic decisions which helped to diversify and change the UK car rental industry.

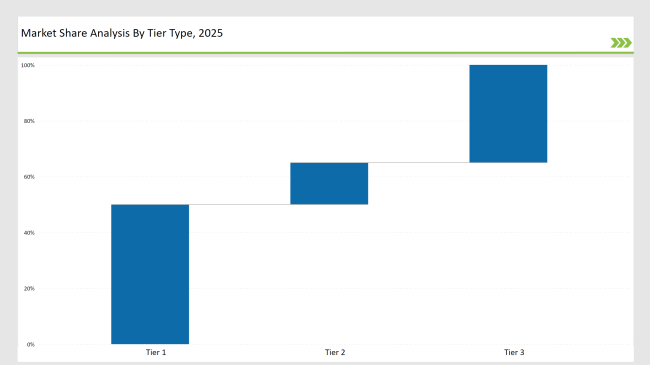

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Enterprise, Hertz, Europcar |

| Market Share (%) | 50% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Avis, Sixt |

| Market Share (%) | 15% |

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Thrifty, Alamo, Budget, Green Motion, Virtuo |

| Market Share (%) | 35% |

| Brand | Key Focus Areas |

|---|---|

| Enterprise | Electric vehicle expansion & corporate leasing |

| Hertz | Digital-first reservations & contactless check-ins |

| Europcar | Flexible return options & long-term rentals |

| Sixt | AI-based pricing models & fleet optimization |

| Emerging Brands | App-driven EV rentals & subscription leasing |

The car rental industry in the United Kingdom is evolving with a strong focus on sustainability, digital transformation, and flexible mobility solutions. As electric vehicle adoption accelerates, rental companies integrating EV fleets, AI-driven fleet management, and contactless rental experiences will lead the industry.

The demand for app-based, peer-to-peer car rentals is reshaping traditional ownership models. Subscription-based car leasing and corporate rental programs are gaining traction. More consumers and businesses are prioritizing flexible, cost-effective alternatives over car ownership.

Additionally, rental brands emphasizing environmental responsibility and carbon offset programs are positioning themselves for long-term success. With convenience, affordability, and sustainability at the forefront, the future of the UK car rental industry is smart, eco-friendly, and built for modern urban mobility.

Leading players such as Enterprise, Hertz, and Europcar collectively hold around 50% of the market.

Online and app-based rentals represent approximately 60% of the market, driven by digital convenience.

Green mobility solutions account for about 10% of the market, with growing adoption of EV rentals.

Flexible, app-driven rental services hold around 15% of the market, with increasing consumer demand.

High for companies controlling 50%+, medium for 30-50%, and low for those under 30%.

Porcelain Tableware Market Trends - Growth & Demand Forecast 2025 to 2035

Toothpaste Market Trends - Growth, Sales & Forecast 2025 to 2035

Snus Market Growth - Demand, Sales & Forecast 2025 to 2035

Sparkling Bottled Water Market Growth - Demand & Trends 2025 to 2035

Luxury Fine Jewellery Market Growth - Trends & Forecast 2025 to 2035

Sneaker Boots Market Insights - Size & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.