The underground mining equipment market is estimated to grow at 2.2% in the forecast period. The global underground mining equipment market is estimated to reach approximately USD 21.3 billion by 2035. Such growth is mainly attributed to a higher demand for both precious and industrial minerals, increasing safety issues, and automation of mining processes.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 21.3 billion |

| CAGR during the period 2025 to 2035 | 2.2% |

Industry is slowly turning towards electrification, an autonomous vehicle, and AI-driven monitoring systems to make it more efficient and safe. Increasing demand for strict regulations regarding worker safety, emission controls, and green mining practices has led companies to focus on low-emission electric equipment and IoT-enabled real-time monitoring technologies.

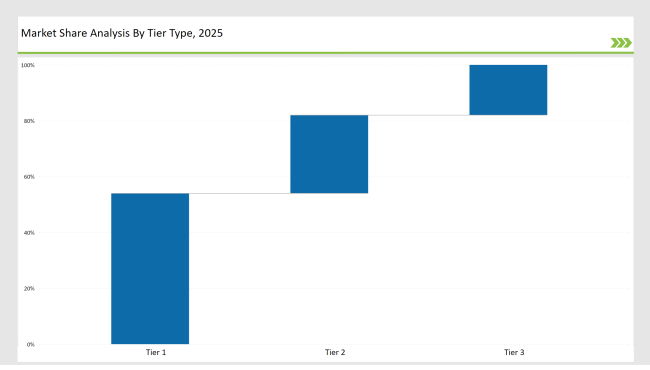

The market is oligopolistic with strong players like Caterpillar Inc., Komatsu Ltd., Sandvik AB, Epiroc AB, and Hitachi Construction Machinery Co., Ltd., that lead the market with an aggregate share of 54%. Mining loaders are the most significant segment within this market with 30% share, but demand will come from hard rock mining during which the demand will be 61%, based on needs for base metals, rare earth, and powerful mining equipment.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 Players (Caterpillar Inc., Komatsu Ltd., Sandvik AB) | 35% |

| Next 2 of 5 Players networks. Tier 2 players (Epiroc AB, Hitachi Construction Machinery Co., Ltd.) | 30% |

| Rest of the Top 10 | 35% |

The market is fairly consolidated, with leading firms investing in AI-driven autonomous mining vehicles, hybrid-powered drilling rigs, and real-time mine condition monitoring technologies.

Several key players contributed to market advancements in 2024

| Tier | Examples |

|---|---|

| Tier 1 | Caterpillar Inc., Komatsu Ltd., Sandvik AB |

| Tier 2 | Epiroc AB, Hitachi Construction Machinery Co., Ltd. |

| Tier 3 | Regional and niche players |

| Company | Initiative |

|---|---|

| Caterpillar Inc. | Engineered unmanned electric mining load-haul dumps with substantial large-cell battery storage capacities |

| Komatsu Ltd. | Unveiled zero-emission, hydrogen fuelled, underground mining truck |

| Sandvik AB | Designed AI-driven automated mining drill utilizing real time production data optimizations |

| Epiroc AB | Expanding reach for range of battery-operated excavators for hard rock mining under terms of sustainable mining |

| Hitachi Construction Machinery Co., Ltd. | Automate mineral extraction of underground minerals deep under earth technology |

Underground mining by 2035 will be much changed with the advent of AI-powered, fully autonomous, and electrified machinery. These innovations would soon transform mining operations, and the operators would look to incorporate the latest AI technologies to make operations more efficient.

Autonomous equipment will free humans from the laborious and potentially dangerous work for better safety outcomes since workers would be better shielded from hazards in underground areas. Advanced systems of artificial intelligence and AI decision-making within these autonomous machines will be able to offer real-time recommendations, optimize mine processes, and ensure very accurate operation.

The zero-emission, hydrogen and battery-powered mining vehicles will play a crucial role in reducing the environmental impact of underground mining. Companies will meet the stricter environmental regulations and sustainability targets by avoiding traditional diesel-powered machinery, which emits harmful pollutants. The adoption of these clean energy solutions will align with the industry's growing emphasis on carbon footprint reduction.

Streamlined mining operations through effective use of systems and infrastructure supported by advanced management, analytics in real time-mine management on the basis of predictive analytics with very effective plays to prevent streamlining downtime: enabling proactive minimum overall improved operating efficiency and drilling automation smart will improve the boost, minimizing a more operation sustainable to have this as one ideal future direction as far as is concerned, shape 2035's and efficiently green underground mines.

Caterpillar Inc., Komatsu Ltd., Sandvik AB holds significant share in the Underground Mining Equipment Market.

Mining Loaders is the leading product in the Underground Equipment Market.

The regional and domestic companies hold around 35% of share in the market.

Market is fairly consolidated, representing top 10 players commanding significant share in the market.

Hard Rock Mining offers significant growth potential to the market players.

Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Dry Washer Market Insights - Demand, Size & Industry Trends 2025 to 2035

Composting Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.