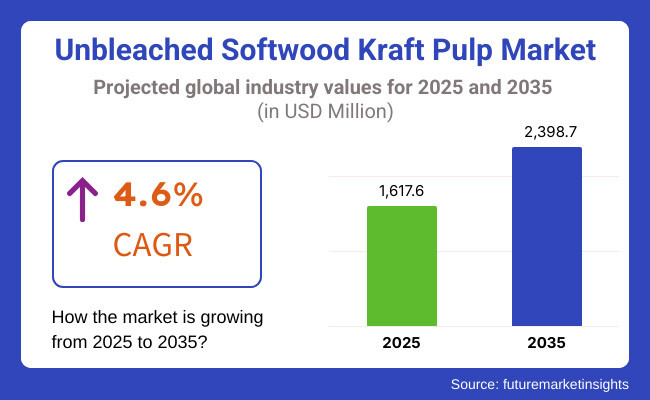

The global unbleached softwood kraft pulp market is expected to show a steady growth by reaching an estimated value of USD 1,617.6 million in 2025 and an expected value of USD 2,398.7 million in 2035, growing with a CAGR of 4.6% from 2025 to 2035.

The growing focus on sustainable packaging solutions is a crucial growth factor, as industries are seeking environmentally friendly packaging alternatives to traditional paper and plastic-based packaging. Another key driver for the unbleached kraft paper industry is the rising demand for sack kraft paper in packaging applications where physical performance equal to sustainability is a must.

In addition, the development of artificial intelligence (AI) and automation in pulp production can be projected in increasing the production efficiency, decrease waste generation, and improve the quality of kraft pulp products. Furthermore, the regulatory policies supporting green packaging are spurring the encouraging industries to adopt to incorporate chemical-grade unbleached softwood kraft pulp into their products, catering to a range of applications such as printing, food packaging, and industrial sacks, thereby bolstering the sector.

The landscape of this industry is being shaped by the innovations of emerging technologies and sustainable practices. Recognizing the industrial practices as well as consumer trends towards sustainable solutions, the Unbleached Softwood Kraft Pulp industry is anticipated to witness phenomenal growth, cementing its significance in global packaging and paper segments.

Explore FMI!

Book a free demo

The unbleached softwood kraft pulp landscape grew steady in between 2020 to 2024, with the expanding need for sustainable packaging solutions driving it. Both consumers and manufacturers would demand a greener alternative to traditional materials a trend that has resulted in greater interest in unbleached softwood kraft pulp, known for its recyclability and lower production costs. The booming e-commerce industry and the demand for sustainable food packaging also contributed to the sectors as companies looked to minimize their environmental impact.

From 2025 to 2035, the industry is positioned for explosive growth. In these years, the expansion of technology, specifically the utilization of machine intelligence in manufacturing methods, is projected to improve efficiency and product quality. Using AI to power automation, manufacturers will be able to improve operations, minimize waste and cater to an increasing need for quality pulp products.

Also, sustainability will remain a key driver as consumers seek lightweight and recyclable unbleached kraft pulp packaging solutions. This transition is expected to spur innovation and diversification in the industry as companies adapt to changing consumer preferences and regulatory demands.

| Key Drivers | Key Restraints |

|---|---|

| Growing demand for sustainable and eco-friendly packaging solutions | High production costs associated with unbleached softwood kraft pulp |

| Increasing regulations promoting the use of biodegradable materials | Fluctuations in raw material availability and pricing |

| Advancements in AI and automation improving production efficiency | Competition from alternative packaging materials like recycled paper and bioplastics |

| Expanding e-commerce sector driving demand for strong and durable packaging | Challenges in achieving uniform quality and performance standards |

| Rising consumer awareness about environmental sustainability | Supply chain disruptions impacting global trade and distribution |

| Preference for unbleached sack kraft paper in food and industrial packaging | Dependence on forestry regulations and sustainable wood sourcing practices |

Impact Assessment of Key Drivers

| Key Drivers | Impact Level |

|---|---|

| Growing demand for sustainable and eco-friendly packaging solutions | High |

| Increasing regulations promoting the use of biodegradable materials | High |

| Advancements in AI and automation improving production efficiency | Medium |

| Expanding e-commerce sector driving demand for strong and durable packaging | High |

| Rising consumer awareness about environmental sustainability | High |

| Preference for unbleached sack kraft paper in food and industrial packaging | Medium |

Impact Assessment of Key Restraints

| Key Restraints | Impact Level |

|---|---|

| High production costs associated with unbleached softwood kraft pulp | High |

| Fluctuations in raw material availability and pricing | High |

| Competition from alternative packaging materials like recycled paper and bioplastics | Medium |

| Challenges in achieving uniform quality and performance standards | Medium |

| Supply chain disruptions impacting global trade and distribution | High |

| Dependence on forestry regulations and sustainable wood sourcing practices | Medium |

This variety is popular among manufacturers for its its durability in high-performance applications as well as high-performance applications such as premium packaging and specialty-grade paper products. The long fibers provide superior tensile strength, making it an excellent option for industries that value quality over quantity and are sustainable. Southern unbleached softwood kraft pulp is expected to be a second-largest segment, with a CAGR of 6.4% by 2035.

As environmental regulations tighten, it's increasingly likely industries will opt for northern unbleached softwood kraft pulp to reach sustainability goals while still outperforming other materials. The increasing demand for sustainable packaging from food and beverage, e-commerce, and retail sectors further drives the adoption of sustainable packaging. Southern unbleached softwood kraft pulp will see strong demand in applications where cost is critical.

This grade will be adopted by companies that will need to balance cost with sustainability across a range of industrial applications. With developing countries ramping up their infrastructure and retail sectors, demand for southern unbleached softwood kraft pulp will grow steadily. Specific applications will benefit from other product types, serving the needs of niche industries. This provides customized fiber blends and alternative softwood kraft pulps to satisfy unique industry needs such as high-absorbency materials or specialty-grade paper solutions.

The industry will also be influenced by the superior durability, strength, and flexibility of chemical pulp. It will remain the preferred option for the packaging and printing industries, where mechanical performance is key. In the food and beverage sector, it will be used in biodegradable food packaging as an alternative to plastic-based packaging.

Manufacturers will be required to develop sustainable cellulosic solutions, prompting more innovations in chemical-based pulp processing, as mandates and growing environmental worries force the adoption of pulp-based solutions. Improvements in pulp enhancement through AI will lead to more efficient production with sustainable output. Mechanical pulp will remain important in newsprint, inexpensive packaging and high-volume paper products.

Digitalization has cut down on the use of traditional print media, but sustainability concerns will motivate paper manufacturers to add recycled mechanical pulp to their product offerings. With companies working on minimizing production costs while retaining sustainability, the adoption of mechanical pulp will depend on it & use where applications demand a higher volume but lower-cost substitutes.

Additional pulp types will take hold in niche industrial uses. There will be increased demand for high-performance pulp formulations tailor-made for specific applications, including insulation materials, industrial-grade packaging, and absorbent paper products. The industry's expansion into non-traditional applications will be through advances in pulp processing that present new avenues.

The biggest application for unbleached softwood kraft pulp will continue to be in the packaging sector, with high levels of demand from sectors like food and beverage, e-commerce, and retail. Unbleached kraft pulp will be used more in corrugated boxes, cartons, liners, bags, sacks and wrapping materials, as they are sustainable and cost-effective. Sustainable packaging solutions will be the new normal as businesses strive to meet carbon-neutral targets.

With the focus towards recyclable and biodegradable materials, packaging derived from unbleached kraft pulp would be on top of manufacturers list, which is likely to be the key to industrial growth over the forecast period. Unbleached softwood kraft pulp will have stable demand in paper printing and writing applications, especially for premium quality grades.

Unbleached kraft pulp has proven its value as a durable and environmental friendly paper product and will continue to make its mark in premium book printing, stationary and other applications that require the best quality. Demand for conventional printing has eased due to digitalization, but new growth opportunities will emerge from sustainable and specialty paper solutions.

Tissue and toilet paper applications will experience strong growth as consumers seek better hygiene and sustainability. The segment will grow as eco-friendly brands offer unbleached products instead of traditional pulp. Specialty wrapping and other niche industrial uses will also spring up as companies look for creative ways to add unbleached kraft pulp to their product mix.

Demand for unbleached softwood kraft pulp will continue to be pushed by growth in the packaging sector, as companies seek green substitutes to plastic and traditional paper-based products. The unbleached pulp is aimed at some of the largest packaging companies, who will incorporate the material into products such as corrugated boxes and flexible packaging.

The packaging industry is the leading segment, with a CAGR of 4.6% by 2035. Moreover, an 88.9% market share is expected during the forecast period due to the unique properties of softwood pulp. The upcoming Sustainability targets and government laws will further boost the uptake of pulp-based packaging across industries.

There will also be a substantial uptick in the number of food and beverage products that utilize unbleached kraft pulp as their main form of packaging, providing a compostable alternative to plastic wraps, food cartons, and takeaway containers. Increased consumer awareness of environmental sustainability will compel brands to switch to more sustainable eco-friendly packaging solutions, leading to steady demand for high-quality unbleached pulp.

Unbleached softwood kraft pulp also finds its use in building and construction applications such as insulation, protective barriers, and industrial grade wrapping material. In agriculture, pulp-based wraps and protective coverings will replace plastic to preserve functionality while reducing ecological footprint.

The chemicals, cosmetics and personal care industries will push ahead with their migration to sustainable packaging, such as natural unbleached kraft pulp for product containers and eco-friendly wrapping. The electrical and electronics industry will replace plastic-based shipping and storage protective packaging with pulp. The variety of applications will also continue to expand in other consumer goods industries, which will also forward the widespread use of unbleached softwood kraft pulp in various sectors.

The Unbleached Softwood Kraft Pulp market in the United States is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.1% from 2025 to 2035, reaching a market value of USD 286 million by 2035. This has allowed the country to remain a key producer, with major companies allocating resources towards research and development in order to improve both the quality and sustainability of their products.

The growth of e-commerce also drives the need for sustainable packaging items such as paper boxes, bags, and cartons. Moreover, governmental programs promoting sustainable forestry and waste reduction further stimulate the growth. Unbleached softwood kraft pulp is anticipated to be crucial for the development of the country's packaging industry as companies pivot towards greener consistencies.

From 2025 to 2035, the market for unbleached softwood kraft pulp in Canada is set to grow at a CAGR of 4.5%. With its abundance of forestry resources and thoughtful environmental regulations, the country is among the leading global suppliers of sustainable pulp materials with approximately market value of USD 66 million.

Demand for sustainable packaging solutions, especially in food and beverage and e-commerce sectors, is fueling growth. Canada’s emphasis on advanced pulp processing technologies makes it more competitive. Increasing government policies promoting sustainable forest management as well as recyclable raw materials is further bolstering the industry, resulting to continued growing throughout the forecast period.

The United Kingdom Unbleached Softwood Kraft Pulp segment is expected to grow at a significant CAGR of 4.9% during the forecast period 2025 to 2035 and the market value is USD 64 million. Demand is being driven by the country’s strict environmental policies and commitment to sustainable packaging. Considering government regulations and consumer preferences, an increasing number of businesses are moving toward recyclable and biodegradable materials.

The UK packaging industry continues to investigate new uses for unbleached softwood kraft pulp, in particular within the retail and food industries. Consumer awareness regarding alternatives to plastic is increasing, hence, the demand for sustainable pulp-based products will continue to grow in the long-run in the UK, leading to steady growth.

The country has a well-established paper and packaging industry that has a growing focus on sustainability, and it is widely adopted in a variety of applications and the Germany has an expected 4.0% by 2035. Regulations by the government that require producers to cut down on plastic waste are hastening the transition to sustainable materials.

The growing industry is further facilitated by investments in advanced manufacturing processes and resource-efficient production techniques. Germany can expect strong demand from diverse industries including food and beverages, retail, and logistics, and is likely to remain a key player in the European unbleached softwood kraft pulp industry.

Japan’s sector for unbleached softwood kraft pulp is growing steadily with a CAGR of 4.7% during 2025 to 2035. The increasing need for sustainable, high-quality, and durable fiber-based materials is driving growth in the printing, paper packaging, and hygiene product industries. Companies are developing advanced kraft pulp with superior fiber bonding strength and increased opacity to improve product performance.

With strict regulations on packaging waste reduction and recyclability, businesses are transitioning toward FSC-certified and carbon-neutral kraft pulp solutions. Additionally, advancements in enzyme-assisted pulping and High-retention refining processes are driving demand in applications requiring enhanced paper strength and absorbency.

Businesses are also investing in energy-efficient kraft pulp mills to improve production sustainability. Furthermore, the rise of premium and high-performance paper-based packaging in Japan is fueling demand for high-quality, sustainable kraft pulp materials.

South Korea's unbleached softwood kraft pulp segment is experiencing significant growth with a CAGR of 5.1%. Due to increased exports of eco-friendly packaging solutions and the growing demand for biodegradable alternatives in the paper and tissue sectors. The need for cost-effective and high-performance kraft pulp has led manufacturers to develop fiber with enhanced tear resistance, printability, and barrier properties.

Government regulations promoting forest sustainability and eco-friendly raw materials further support the expansion. Additionally, businesses are integrating automated pulping technologies such as AI-driven fiber classification and digitalized process control to improve efficiency.

The growing demand for premium tissue and specialty paper products is further boosting adoption. Moreover, research into antimicrobial kraft pulp coatings and moisture-resistant fiber composites is helping businesses develop innovative solutions tailored to hygiene and food packaging applications.

The unbleached softwood kraft pulp market in China is predicted to grow at a compound annual growth rate of 6.0% from 2025 to 2035. The country’s quick industrial revolution, coupled with an increasing focus on environmentally friendly sustainability is driving the demand for green packaging materials with approximately USD 174 million.

With China tightening its environmental regulations and enforcing bans on plastic waste of various forms, unbleached kraft pulp is increasingly being adopted in the packaging, e-commerce, and retail sectors. Also, improvement in local pulp production, together with rising investments in sustainable supply chains, boosted the industries. Being a key producer in global packaging industry China acts as a crucial contributor to total packaging growth, especially in Asia-Pacific region.

India's unbleached softwood kraft pulp market is anticipated to grow at a CAGR of 6.7% from 2025 to 2035. Strong demand is being fueled by the country’s booming packaging industry, spurred on by rapid urbanization and growing awareness of sustainability among consumers with approximately USD 107 million.

Government initiatives supporting eco-friendly materials and bans on single-use plastic bags are further propelling the growth. Unbleached kraft pulp is gaining momentum in the food and beverage, e-commerce, and agricultural industries. Additionally, India is ramping up domestic pulp production and recycling infrastructure, boding well for continued the growth in the next few years.

Tier 1 players dominate the market with a 90% share, while smaller companies sustain themselves by serving localized demand, niche applications, and specialized product segments that larger firms may not prioritize. This dominance indicates that a few major global companies control most of the industries, benefiting from economies of scale, advanced manufacturing technologies, and strong distribution networks.

These key players invest heavily in R&D, sustainability initiatives, and product innovation, further strengthening their segment position. The remaining 10% of the industry is fragmented, comprising smaller regional players and niche manufacturers. These companies primarily cater to localized demand or specialized applications, but they face challenges in competing with industry giants on cost, production capacity, and global reach.

Sustainability and transparency were key trends in the 2024 unbleached softwood pulp industry, emerging as crucial factors influencing end-user preferences and purchasing decisions. P&G had promised to publish more extensive audits of its wood-pulp suppliers to meet environmental concerns and investors' demand for sustainable sourcing. This effort is part of a larger industry trend to hold supply chains more accountable.

Companies like Circ sought strategic partnerships to more efficiently scale operations. To this end, it partnered with Birla Cellulose, a part of Aditya Birla Group, to embed recycled pulp into the mainstream production process. Such a partnership not only confirmed Circ's new recycling technology but also aligned with the industry's circular economy trends. Both established companies and new entrants increasingly invest in research and development to strengthen product quality and environmental performance.

They are currently investigating other raw materials and high-tech processing methods, with the aim of minimizing ecological footprints. In doing so, this program seeks to address the increasing demand for sustainable packaging solutions in line with worldwide goals for environmental sustainability.

To sum up, the unbleached softwood kraft pulp sectors in 2024 saw a collective push towards sustainability. Longer established businesses improved visibility and supplier transparency, whereas upstarts were able to build partnerships to scale initiatives. Together, these strategies help create a more sustainable and resilient industry landscape.

The demand for sustainable packaging solutions, increasing regulations on biodegradable materials, and advancements in AI-powered production are key growth drivers.

The packaging, food and beverage, and e-commerce sectors are the largest consumers, using it for eco-friendly packaging solutions.

It offers superior strength, durability, and recyclability, making it a preferred choice for high-performance packaging applications.

Sustainability is a major focus, with companies investing in responsible sourcing, transparency, and circular economy initiatives to meet environmental goals.

Northern, Southern, and Others

Chemical Pulp, Mechanical Pulp, and Other Pulp

Printing and Writing, Newsprint, Packaging, Corrugated Boxes, Cartons, Liners, Bags and Sacks, Wrapping, Other Packaging Products, Tissue & Toilet Paper, and Others

Packaging, Food and Beverages, Building and Construction, Agriculture and Allied Industries, Chemicals, Cosmetics and Personal Care, Electrical & Electronics, Other Consumer Goods, and Non-Packaging

North America, Latin America, Europe, East Asia, South Asia, Oceania, and The Middle East & Africa (MEA)

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.