Focusing on eco-friendly, unbleached kraft paperboard packaging solution is capturing significant share in food & beverage, consumer goods, and e-commerce industries. Unbleached kraft paperboard is made from virgin or recycled pulp and is known for its strength, durability, and biodegradability.

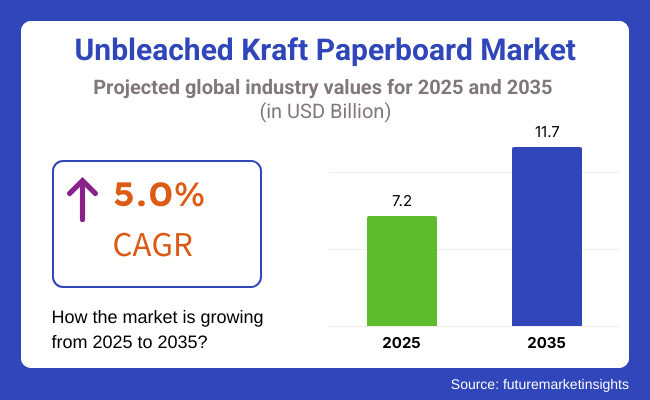

It is forecasted to witness impressive growth over the decade owing to increasing growing demand for sustainable alternatives to plastic and bleached paperboard. The unbleached kraft paperboard market size is expected to reach USD 7.2 Billion in 2025 and is anticipated to grow at a 5.0% CAGR during the period from 2025 to 2035, reaching USD 11.7 Billion by 2035.

These aspects are primarily driving the growth of this industry include rising regulatory barriers against plastic packaging, high consumer preference for sustainable products, and progress in paperboard manufacturing technologies. Improvements in barrier coatings and water-resistant treatments are further widening the application scope of unbleached kraft paperboard.

Other major growth drivers of development are increasing e-commerce activities and a transition toward recyclable and compostable packaging solutions. The growth of foodservice packaging, especially in takeaway and delivery applications, also supports the expansion. New lightweight kraft paperboard and high-strength formulations are expected to increase its popularity in various industries.

Explore FMI!

Book a free demo

From 2020 to 2024 the unbleached kraft paper board market grew steadily due to an increase in demand from the foodservice, retail and the e-commerce industry. Still, issues around cost and recyclability of coated paperboard continued to be major issues for suppliers.

In addition, enhanced investment in research toward paperboard is anticipated to provide flexibility in printing. Amid rising alarm over plastic pollution, regulatory bodies are pushing for sustainable alternatives. Advances in Paperboard technology also played a role in improved durability and lightweight design.

Biodegradable coatings, environmentally sustainable manufacturing processes, and production efficiencies that address industry expansion will be the focus going forward. AI and automation are being integrated into paperboard design and production processes which will increase competitive advantage in the industry.

Moreover, rising application of unbleached kraft paperboard in luxe and high-quality packaging will generate new potential growth opportunity. Companies recognize the importance of print quality and branding for premium packaging. The custom made kraft packaging solutions serve as a highly efficient and very niche-oriented product segments which are expected to rise in the coming years.

| Key Drivers | Key Restraints |

|---|---|

| Growing demand for sustainable packaging due to environmental concerns and regulations. | High production costs associated with raw material sourcing and energy-intensive manufacturing. |

| Rising e-commerce industry is driving demand for durable and recyclable packaging solutions. | Competition from alternative packaging materials such as plastics, coated paper, and biopolymers. |

| Government regulations promoting recyclability and reduced plastic use. | Supply chain disruptions affect raw material availability and production stability. |

| Advancements in paperboard strength and barrier properties, making kraft paperboard more versatile. | Limited moisture resistance compared to plastic-based alternatives, affecting certain applications. |

| Growth in food and beverage packaging, particularly for takeout, fast food, and premium goods. | Fluctuations in raw material prices, particularly for unbleached softwood kraft pulp. |

| Increased adoption in industrial and heavy-duty packaging due to high tear resistance and durability. | Consumer preference for aesthetically appealing packaging, which may favor coated or bleached alternatives. |

| Investment in automation and digitalized manufacturing, improving efficiency and cost-effectiveness. | Recycling challenges due to food contamination or multi-layer packaging complexity. |

Impact Assessment of Key Drivers

| Key Drivers | Impact |

|---|---|

| Growing demand for sustainable packaging due to environmental concerns and regulations. | High |

| Rising e-commerce industry is driving demand for durable and recyclable packaging solutions. | High |

| Government regulations promoting recyclability and reduced plastic use. | High |

| Advancements in paperboard strength and barrier properties, making kraft paperboard more versatile. | Medium |

| Growth in food and beverage packaging, particularly for takeout, fast food, and premium goods. | High |

| Increased adoption in industrial and heavy-duty packaging due to high tear resistance and durability. | Medium |

| Investment in automation and digitalized manufacturing, improving efficiency and cost-effectiveness. | Medium |

Impact Assessment of Key Restraints

| Key Restraints | Impact |

|---|---|

| High production costs associated with raw material sourcing and energy-intensive manufacturing. | High |

| Competition from alternative packaging materials such as plastics, coated paper, and biopolymers. | Medium |

| Supply chain disruptions affect raw material availability and production stability. | High |

| Limited moisture resistance compared to plastic-based alternatives, affecting certain applications. | Medium |

| Fluctuations in raw material prices, particularly for unbleached softwood kraft pulp. | High |

| Consumer preference for aesthetically appealing packaging, which may favor coated or bleached alternatives. | Medium |

| Recycling challenges due to food contamination or multi-layer packaging complexity. | Medium |

Foldable carton boxes are considered a sustainable and recyclable option, and more businesses are using them and similar boxes are an excellent fit due to their strength, lightweight composition, and printability and that's why they are in so much usage in food, beverages, and consumer goods industries. Digital printing provides faster lead times and the ability to create smaller-volume customized products, leading to growth in the packaging sector.

Companies are focusing on costly high-barrier coatings to enhance moisture and grease resistance and are extending their use in both fresh food and frozen packaging. Regulatory pressure to reduce single-use plastics is pushing industries to adopt unbleached kraft paperboard solutions to replace plastic-based containers. The booming e-commerce industry is propelling the demand for durable, customizable and foldable carton boxes that improve the branding and logistics efficiency of packaging.

As cosmetics, electronics, and fashion brands lean more into sustainable but robust packaging, rigid boxes are becoming increasingly popular as a premium packaging material. Many companies are exploring label designs that are both unique and eco-friendly, with embossed details, natural textures, and minimalist printing being the most sought-after features.

While rigid tubes; manufactured of unbleached kraft paperboard; have been gaining traction into cylindrical packaging applications for some time now; new applications are emerging across industries that need sustainable and durable cylindrically shaped packaging.

Cosmetic, gourmet food and spirits luxury brands are moving to these environmentally friendly tubes to enhance their branding. Inserts, dividers and mailers made from unbleached kraft paperboard are in demand due to e-commerce and sustainable shipping trends. To ensure product protection while minimizing plastic, logistics companies and retailers are focusing on sustainable internal packaging solutions. Instead of plastic fillers like foam and bubble wrap, manufacturers are creating lightweight but sturdy inserts.

Manufacturers' search for enhanced performance in printability, grease resistance, and barrier properties is expected to drive strong growth for coated unbleached kraft paperboard. Technical coatings, such as bio-based and water-resistant formulations, are improving the capabilities of kraft paperboard for the food, beverage and pharmaceutical packaging industries.

Brands are increasingly drawing towards coated variants for premium packaging due to the advantageous trait of supporting high-quality printing/branding elements. For companies that prioritize raw, natural and fully recyclable packaging, uncoated kraft paperboard is still the top choice.

It is well-suited for food containers, e-commerce mailers, and product wraps due to its high durability and breathability. The trends of minimalistic and eco-friendly branding have spurred the demand for uncoated kraft solutions. Retailers and consumer brands for sustainability are encouraging the usage of uncoated kraft substrates to eliminate packaging waste. The growth is driven by the demand for food-grade packaging that is free of plastic and extends to personal care and home goods sectors.

Brands competing in the food and beverage space are significant users of unbleached kraft paperboard, as they search for sustainable packaging alternatively. The kraft-based alternative is grease-resistant, heat-sealable, and moisture-resistant, so businesses are switching from plastic and Styrofoam containers. This transition is being fast-tracked by regulatory pressures on single-use plastics.

Recent innovations in fiber-based coatings and multilayer kraft structures are enhancing performance and recyclability. Sustainable efforts in the pharmaceutical industry are prompting the use of unbleached kraft paperboard in secondary and tertiary packaging. The trend of moving toward kraft-based solutions is also evident in medicine cartons, blister packaging carriers, and outer protective packaging due to eco-friendly regulations.

To fulfill sustainability commitments, consumer goods brands are quickly moving toward unbleached kraft paperboard packaging. From personal care products to home essentials, companies are designing kraft paperboard cartons, wraps, and pouches. The “natural,” biodegradable appeal of unbleached kraft corrugated fits in with eco-savvy branding trends. Experimenting with minimalist packaging designs, compostable adhesives, and foldable structures to create more functional packages. Facing pressure to adopt sustainable solutions, the electrical and electronics industry is shifting toward unbleached kraft paperboard for its protective and retail packaging.

Kraft alternatives are also being used to find replacements for plastic-based trays, casings, and inner packaging components and manufacturers are fashioning anti-static and shock-absorbing kraft paperboard to safeguard delicate electronic components during transport. Automotive & Chemical Industrial and transport packaging panels are utilized within automotive and chemical companies that integrate unbleached kraft paperboard into their processes.

Kraft Paperboard solutions replace Plastic drums, wraps and separators for chemical transport The kraft-based solutions are being embraced by the automotive industry for spare part packaging, documentation folders, and protective casings. Moisture-resistant and oil-repellent kraft materials are advanced to enable themselves for new applications including chemicals and lubricant packaging.

Regulations on industrial packaging are getting tighter and forcing firms to transition to biodegradable and recyclable materials. Sustainable logistics & supply chain operations aimed at minimizing plastic waste to have long term relevance on demand for unbleached kraft paperboard in this segment

The USA unbleached kraft paperboard market is expected to grow at a CAGR of 15.5% by 2035, owing to the rising demand for sustainable packaging solutions for food, beverage, e-commerce, and consumer goods industries. Businesses are increasingly shifting away from plastic packaging due to regulatory pressures, which is driving adoption. They are investing in recyclable and compostable solutions to help themselves stay in line with strict environmental policies.

Emerging technologies, like AI-enabled production and digital printing, are improving the level of customization in products and the efficiency of their production. The sector is growing but faces rising raw material costs and competition from alternative materials. Nonetheless, high investments in sustainable innovation and automation will bolster the growth.

As businesses focus on sustainability and comply with severe environmental regulations, the UK unbleached kraft paperboard industry will experience nearly 3.7% CAGR between 2025 and 2035. Adoption across a range of applications from retail packaging to fresh produce and sustainable disposable tableware is surging as companies seek compostable, lightweight and high-barrier paperboard solutions.

Packaging industry environment-friendly initiatives and government norms to reduce plastic use and promote circular economy practices are driving companies to add recyclable and biodegradable kraft paperboard materials. Unbleached kraft paperboard with water-repellent or grease-resistant coatings is increasingly attractive for foodservice applications.

Unbleached kraft paperboard segment in Japan preferred to grow with a CAGR of 4.6% from 2025 to 2035 considering the rising the demand for sustainable, high-quality, and visually attractive nature-based packaging solutions, the unbleached kraft paperboards are expected to increase with the food, electronics and personal care industries.

To improve product protection or shelf life, companies are producing advanced kraft paperboard with anti-moisture coatings and excellent folding endurance. BoP-filled packaging waste reduction and recyclability are strictly regulated, so the industry is moving to biodegradable or FSC-certified kraft paperboard solutions. Moreover, innovations regarding barrier coated and laminated kraft paperboard are fueling demand for applications with moisture and grease resistance.

Exports of sustainable packaging solutions and the growing demand for eco-friendly alternatives to plastic will drive growth in the South Korea unbleached kraft paperboard market, which is projected to register a CAGR of 5.0% during the 2025 to 2035 period.

This has prompted the manufacturers to come up with cost-effective and high-performance kraft paperboard with better strength, progression, and wick barriers. Further industry growth is supported by government regulations which favor plastic-free packaging and biodegradable materials. Moreover, enterprises are embedding smart packaging technologies like RFID tags and QR codes on kraft paperboard to streamline supply chain operations.

Canada’s unbleached kraft paperboard industry is growing as regulatory pressure on single-use plastics increases. The government’s commitment to sustainability is driving businesses to embrace paper-based alternatives throughout foodservice as well as retail and industrial packaging. Increasing cold climate of the country is anticipated to result in the growth of high strength kraft board in frozen food & beverage carriers.

Manufacturers are working on advanced fiber-reinforcement technology for enhanced durability and moisture resistance. The country’s immense forestry resources ensure access to a steady supply of raw materials, fueling local production. But dependence on exports to the USA and Europe makes the industry vulnerable to possible trade swings.

Shifting to non-plastic packaging has become a necessity for the industry to adhere to stringent regulations regarding environment, leading to substantial growth in unbleached kraft paperboard market in France. Food and beverage is a major driver; brands are switching to kraft paperboard for bakery, dairy and fresh produce packaging.

And luxury labels are employing unbleached kraft paperboard for upscale, sustainable packaging. Bio-based coatings extend the material's use in moisture-sensitive items, and research into them is on the rise. High production costs and limited domestic forestry resources create supply chain hurdles, though. It is a highly competitive industry which is rapidly investing in recyclable and compostable packaging technologies to strengthen their position in the sector.

The share of Germany in the unbleached kraft paperboard sector is expected to experience a small decrease, a result of competition from cheap alternatives in Eastern Europe and Asia. But demand stays healthy in freight and industrial packaging that favor tough kraft, said the analyst.

The foodservice and e-commerce sector are seeing adoption driven by sustainability initiatives. It helps improve the production efficiency and cut down on the operational cost which drives advanced automation and digitalization in the manufacturing process.

As China expands its domestic production capacity and exports, its unbleached kraft paperboard market is steady and growing is expected to grow to a CAGR of 10.9% in 2035. Key drivers to this transformation from plastic to kraft-based packaging are government regulations encouraging recyclability and lower carbon emissions.

The rapid rise of the e commerce industry is driving the demand for durable and light weight kraft material for shipping and logistics. Innovations in pulping and coating technologies are enhancing kraft paperboard’s strength and versatility.

The unbleached kraft paperboard industry in India is witnessing rapid growth due to considerable demand for sustainable packaging from the food, retail and fast-moving consumer goods (FMCG) sectors. Policies encouraging plastic use reduction and adoption of environmentally friendly alternatives are boosting adoption.

The rise of organized retail and e-commerce is continuing to drive the need for lightweight, cost-effective, and biodegradable packaging materials. In turn, manufacturers are focusing on the quality and reliability of supply by investing in localized pulp production and more automated paperboard processing.

The unbleached kraft paperboard segment is highly consolidated, with Tier 1 players holding 90% of the market share. A few dominant global manufacturers control most of the production and distribution, leveraging advanced technologies, large-scale production facilities, and strong supply chain networks.

These companies benefit from economies of scale, extensive R&D investments, and established relationships with major end-use industries. Smaller players face challenges in competing due to high capital requirements, stringent environmental regulations, and the need for sustainable innovations. The industries consolidation allows leading firms to influence pricing, product innovations, and industry trends, maintaining a competitive edge over emerging players.

In 2024, the unbleached kraft paperboard segment was dominated by several key players who emphasized the sustainability and innovation of their products as they aimed to solidify their positions. In March 2024, for example, Aptar launched one of Halo Pack's projects, a paperboard tray that is made from Forest Stewardship Council-certified waste cardboard and reduces plastic usage by 90%.

This tray is in any form you can imagine skin pack, clamshell, freezable, microwave, and openable options reinforce the consumer drive toward sustainable packaging alternatives. In the same vein, Sappi Europe introduced Algro Volume in June 2024, a recyclable paperboard that uses only virgin fibers. This product is designed to meet stringent safety standards including requirements of the German Federal Institute for Risk Assessment and USA Food and Drug Administration for use in the food & beverage, pharmaceutical, and personal care industries.

And in 2024, emerging startups focused on sustainable innovations dominated as well. Brisbane startup Earth odic secured USD 6 million to scale up its fully recyclable coating for paper and cardboard packing. This sustainable coating, made from lignin a waste product of the pulp and paper industry strengthens boxes and makes them waterproof, providing an eco-friendly alternative to coatings that are not recyclable.

As more packages are dropped at our doors from online shopping, Earth odic wants to step in as a viable alternative to all the petrochemical and plastic-based packaging solutions. These advances in 2024 represent a trend in the industry toward sustainability and innovation, with both established players and startups working towards green packaging solutions.

The demand is primarily driven by sustainability trends, regulatory restrictions on plastic use, and the growing need for recyclable and compostable packaging in industries like food & beverage, e-commerce, and consumer goods.

High production costs, moisture resistance limitations, and competition from alternative materials like coated paper, plastics, and biopolymers are major challenges.

Food & beverage, e-commerce, pharmaceuticals, and consumer goods industries are the largest consumers, with increasing adoption in electronics and industrial packaging.

Advancements in barrier coatings, AI-driven manufacturing, and sustainable printing techniques are improving product durability, branding capabilities, and overall efficiency.

Folding Carton Boxes, Rigid Boxes, Rigid Tubes, and Others (Inserts, Dividers, Mailers, etc.)

Coated and Uncoated

Food & Beverage, Pharmaceutical, Consumer Goods, Electrical & Electronics, and Automotive & Chemical

North America, Latin America, Europe, East Asia, South Asia, Oceania, and The Middle East & Africa (MEA)

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.