The ultrasonic cleaning market is valued at USD 2.11 billion in 2025. As per FMI's analysis, the market will grow at a CAGR of 5.3% and reach USD 3.53 billion by 2035.

According to FMI, industries requiring efficient and non-invasive cleaning technologies are adopting automated and high-frequency ultrasonic systems. Regulatory requirements related to hygiene and contamination control are increasing, which creates additional demand primarily in the pharmaceutical and food industries.

The year 2024 demonstrated high levels of development in ultrasonic cleaning technology automation process management controls and artificial intelligence control. FMI analysis found programmable ultrasonic equipment was common in hospitals, semiconductor companies, and aerospace companies, which used them to achieve clean room uniformity.

The PCB cleaning systems witnessed healthy demand from the electronics industry, particularly in the Asia-Pacific region, where semiconductor manufacturing facilities ramped up output. Strict environmental policies in North America and Europe, such as the Montreal Protocol, encouraged industries to adopt safer, biodegradable cleaning products and power-saving transducers.

In 2025 and beyond, manufacturers will likely focus on high-frequency ultrasonic systems for microelectronics and medical device sterilization. Affordable benchtop units will gain traction in emerging economies, while high-capacity industrial units will be adopted in aerospace and heavy machinery. This region is expected to show greater adoption than others, mainly due to government-sponsored incentives for industrial automation.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.11 billion |

| Industry Value (2035F) | USD 3.53 billion |

| CAGR (2025 to 2035) | 5.3% |

Explore FMI!

Book a free demo

The high-frequency wave cleaning industry is witnessing steady growth, led by growing demand for accuracy in healthcare, electronics, and automotive applications. FMI analysis discovered that innovations in transducer technology and environmentally friendly cleaners are speeding adoption, and strong regulatory requirements are encouraging industries toward non-toxic, high-efficiency substitutes.

FMI believes manufacturers investing in automation and industrial-scale ultrasonic equipment will gain advantages, while conventional solvent-based cleaning providers may face challenges.

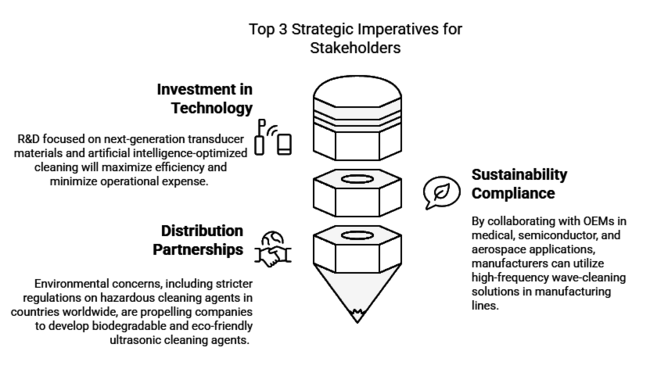

Invest in Next-Generation Ultrasonic Technology

R&D focused on next-generation transducer materials and artificial intelligence-optimized cleaning will maximize efficiency and minimize operational expense. Managers should direct R&D toward these areas while expanding automation capabilities to enhance competitiveness in the industrial and healthcare sectors.

Compliance with Sustainability and Regulatory Shifts

Environmental concerns, including stricter regulations on hazardous cleaning agents in countries worldwide, are propelling companies to develop biodegradable and eco-friendly ultrasonic cleaning agents. Strengthening compliance frameworks will create long-term industry positions and help them avoid facing forward-looking regulatory challenges.

Distribution and Strategic Partnerships

By collaborating with OEMs in medical, semiconductor, and aerospace applications, manufacturers can utilize high-frequency wave-cleaning solutions in manufacturing lines. Regional alliances and expanding international distribution networks will yield stable, growing revenue.

| Risk | Probability & Impact |

|---|---|

| Regulatory Restrictions on Ultrasonic Chemicals | Medium Probability, High Impact |

| Supply Chain Disruptions for Key Components | High Probability, Medium Impact |

| Technological Substitutes Gaining Traction | Low Probability, High Impact |

| Priority | Immediate Action |

|---|---|

| Advanced R&D in Next-Gen Transducers | Conduct a feasibility study on AI-driven cleaning efficiency |

| Strengthen Supply Chain Resilience | Secure alternative sourcing for critical ultrasonic components |

| Expand OEM Collaborations | Initiate strategic discussions with medical and semiconductor OEMs |

To stay ahead companies must need to step up investment in AI-facilitated precision sonic cleaning equipment and green formulations to outpace regulatory change and increasing sustainability needs. According to FMI analysis, long-term profitability depends on maintaining robust supply chains for transducer materials and forming OEM alliances in high-growth industries such as healthcare and semiconductors. FMI believes that over the next decade, firms focusing on automation, internationalization, and compliance-led innovation will lead the way.

Regional Variance:

Adoption Rates with High Variance:

Diverging ROI Attitudes:

Consensus:

62% worldwide preferred titanium transducers for durability and trusted performance at high-frequency applications.

Regional Variance:

Common Challenges:

Around 85% of these respondents cited inflation in materials, owing to 2024 transducer material costs rising by 27% and specialty cleaning solvents by 22%.

Regional Variations:

Manufacturers:

Distributors:

End-users (healthcare, electronics, and industries):

Alignment:

71% of the producers from around the world reported plans to invest in the automated and AI-powered cleaning solutions.

Divergence:

North America:

67% of the respondents identified new EPA solvent disposal regulations as a top industry challenge.

Europe:

80% viewed the EU's Green Cleaning Directive as a driver for green product innovation.

Asia-Pacific:

Only 35% cited regulatory reform as a top purchase driver, pointing to weak enforcement.

High Consensus: Global industry challenges include adherence to environmental regulations, rising pressure on costs, and demand for automation.

Key Variances:

Strategic Guidance: There is no universally applicable global strategy. It requires region-specific strategy adaptations-automation investments in North America, green solutions in Europe, and cost-effective space-efficient systems in Asia-Pacific.

| Country | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | Industrial cleaning solvents are strictly regulated for disposal by the Environmental Protection Agency (EPA), and so companies are left to use more environmentally sound ultrasonic alternatives. For medical devices, the FDA oversees sonicated cleaning via 21 CFR Part 820. |

| United Kingdom | The UK REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) legislation requires compliance with chemical safety, and it has implications for your choice of solvent used in ultrasonic cleaning. Brexit introduces the UKCA marking scheme for medical ultrasonic systems. |

| France | In terms of device usage in the healthcare industry, ultrasonic cleansing products must comply with ANSM (Agence Nationale de Sécurité du Médicament). The country's Green Industry Bill promotes low-energy ultrasonic technology. |

| Germany | The German Federal Emission Control Act (BImSchG) has stringent limits on VOC emissions and promotes ultrasonic cleaning over solvent-based cleaning. Industrial ultrasonic devices must have certification. |

| Italy | EU MDR (Medical Device Regulation) will oversee medical and pharmaceutical advanced sonic purification manufactured by the Italian Ministry of Health. New tax incentives encourage the adoption of energy-efficient industrial cleaning technologies. |

| South Korea | The Ministry of Environment operates hazardous chemical regulations under K-REACH, which influences the selection of cleaning solvents. Ultrasonic systems in industrial and medical grades also require KC certification. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA), similar to the FDA in the US, administers the standards for ultrasonic cleaning for medical use as part of Japan's Good Manufacturing Practice (JGMP). This is part of the country's legal requirement regarding the workplace safety of high-frequency equipment under the Industrial Safety and Health Act. |

| China | VOC emission limits are enforced by the Ministry of Ecology and Environment, thereby limiting solvent-based cleaning processes. The CCC (China Compulsory Certification) is required for commercial ultrasonic equipment. |

| Australia-NZ | Ultrasonic medical cleaning devices fall under the regulation of the Therapeutic Goods Administration (TGA). The Clean Energy Act ensures the promotion of industrial cleaning technologies that save energy in Australia. |

| India | The limits on the application of dangerous chemicals in industrial cleaning are issued by the Central Pollution Control Board (CPCB). For sonicated cleaning machines in medical and industrial spaces, BIS (Bureau of Indian Standards) certification is compulsory. |

Benchtop ultrasonic cleaning systems hold the largest industry share due to their extensive use in laboratories, medical settings, and small-scale industrial applications. These compact, cost-effective, and efficient systems cater to a wide range of end-users, particularly healthcare professionals, as well as precision optics and jewelry specialists.

FMI opines that the rising demand for point-of-use cleaning solutions in hospitals and dental clinics will drive long-term industry growth. In automotive, aerospace, and electronics manufacturing, precision cleaning at multiple stages of production is crucial. As a result, multistage and standalone systems-particularly Multistage-4-are seeing wider adoption. Integration of these automated and programmable sonicated cleaning units will further drive adoption across high-volume production lines, believes FMI.

The 500-1000 W segment holds the highest share owing to its wide application range in industries such as medical device sterilization, automotive parts degreasing, and PCB cleaning. Research by FMI found that high-demand power ranges of 1000-2000 W and 2000-5000 W are growing very fast, as many organizations are increasingly adopting high-intensity sono-cleaning processes of complex geometries and precision machined parts.

In heavy industry services, systems above 10,000 W have become particularly prevalent in bulk metal and machinery cleaning and aerospace engine servicing. FMI opines that the evolution of high-powered, customizable ultrasonic systems will create lucrative opportunities in industrial automation and advanced manufacturing.

In terms of capacity, the 10-50L and 50-100L segments dominate the market owing to the high demand in industries, which require mid-size ultrasonic tanks for batch cleaning processes. A recent FMI study shows that 100-150L and 150-200L systems are gaining popularity in the automotive and aerospace industries.

This is because these industries need large-volume systems to clean up big parts using multi-stage ultrasonic solutions. Industrial applications requiring bulk component cleaning and high-throughput activities are increasing, so 300L ultrasonic tanks or larger are appropriate. FMI predicts that the expansion of high-capacity systems will be driven by stricter regulations mandating contaminant-free manufacturing in precision engineering and pharmaceuticals.

By verticals, the medical and healthcare industries lead, with ultrasonic cleaners playing a crucial role in sterilizing surgical tools, dental equipment, and diagnostic devices. As per the FMI study, the food & beverages and pharmaceutical industries are changing into high-growth segments with the application of strict hygiene laws.

The aerospace and automotive sectors have started adopting engine parts, fuel injectors, and precision parts, while the optics industry is reliant on ultrasonic cleaning for lens manufacture and sensitive glass processing. FMI also believes that the electrical & electronics industry, stimulated by PCB cleaning and semiconductor manufacturing, will continue to be a key growth driver in the future, especially across Asia-Pacific and North America.

Between 2025 and 2035, the USA ultrasonic cleaning industry is set to grow at 4.1% CAGR, attributed to EPA solvent regulations and FDA medical cleaning requirements. In aerospace, automotive, and semiconductor industries, there is growing demand, and automation and AI are improving efficiency.

The CHIPS Act is driving the expansion of semiconductor fabrication plants, though potential supply chain disruptions remain a concern. According to FMI's analysis, high-efficiency, environmentally friendly ultrasonic systems are expected to be the most popular generator types. According to FMI, OEM alliances and aftermarket growth will be key to sustaining long-term domination.

UK REACH regulations and UKCA medical certifications will drive the growth of the sonicated cleaning industry in the United Kingdom at a 4.4% CAGR between 2025 and 2035. This makes them ideal industries to embrace low-energy ultrasonic solutions, as highlighted in their Net Zero programs.

Brexit-related import duties are a concern. The FMI analysis points toward a shift toward localized manufacturing and biodegradable cleaning products, which is gathering momentum. According to FMI, UK medical and industrial equipment companies will strengthen partnerships with manufacturers to expand their market presence.

Initiatives like the Green Industry Bill along with the ANSM sterilization regulations in the healthcare industry will drive the high-frequency wave cleaning industry in France, with a CAGR of 4.9% during 2025 to 2035. Airbus and Safran dominate the aerospace market, where there is increased investment in automated ultrasonic systems.

These include high prices and slow uptake by SMEs. According to the FMI research, precision sonic cleaning incorporating multi-frequency and AI-based technologies will gain traction. Collaboration with sector-supported sustainability initiatives for the government will boost growth, FMI believes.

Stringent BImSchG VOC regulations and TÜV certification requirements will contribute to the growing adoption of ultrasonic cleaning technology in Germany, where the industry will index a CAGR of 5.5% from 2025 to 2035. Energy-efficient, AI-driven systems are becoming ubiquitous, with the automotive, medical device, and electronics sectors leading the charge.

The industry is characterized by high costs for both energy and labor. According to the FMI research, demand for predictive maintenance and intelligent ultrasonic technology remain key factors driving the market. FMI expects that R&D, enticements for sustainability, and Germany’s environment will be the way to success in that market.

The Italian advanced sonic purification industry is predicted to grow at a 4.7% CAGR through 2025 to 2035, driven by EU MDR medical regulations coupled with energy-efficient industrial support. The pharmaceutical and automotive industries are big users. However, the high initial capital investment presents a barrier to SME adoption.

According to an analysis done by FMI, there will be an increased demand for customized, budget-friendly ultrasonic systems. Much of the industry growth will depend on alignment with Italy's industrial modernization programs, FMI opines.

Driven by K-REACH, along with surging applications in semiconductors and precision manufacturing with K-USE, the South Korean high-frequency wave cleaning industry is expected to grow at a remarkable 5.4% CAGR from 2025 to 2035. The healthcare sector is also increasingly adopting ultrasonic sterilization systems.

Cost concerns and a reliance on imported parts are barriers. According to FMI's analysis, AI-enabled and automated ultrasonic systems will set trends in the coming few years. FMI forecasts significant growth drivers are OEM partnerships and government-sponsored R&D initiatives.

The Japan high-frequency wave cleaning industry will register a 4.5% CAGR between 2025 and 2035 to expand due to PMDA regulations for medical devices and the need for precision manufacturing. However, slow technology adoption and cost pressures impede growth. According to FMI's research, small, efficient ultrasonic devices will expand into more applications. This move will lead to the long-run appeal of automation and robotics markets in Japan, FMI says.

The Chinese ultrasonic cleaning industry will grow at a 6.1% CAGR over 2025 to 2035, the highest globally due to VOC emission limits and the fast pace of industrial growth. The electronics, automotive, and healthcare industries are driving the expansion. According to an analysis of Future Industry Insights, high-volume production of low-cost ultrasonic systems will be a trend. FMI sees enormous opportunities by investing in China's medical and semiconductor industries.

The Australia-NZ industry is expected to grow at a CAGR of 4.6% between 2025 and 2035, driven by TGA medical device regulations and Clean Energy Act policies. Some of the major adopters include the medical and mining sectors. As per the FMI study, environmentally friendly and solar-powered ultrasonic systems will gain greater preference. FMI expects adoption will depend on local partnerships and government incentives.

India’s industry is expected to grow at a CAGR of 5.9% between 2025 and 2035, driven by CPCB pollution control regulations and rapid growth in the pharmaceutical and automotive industries. The high demand for affordable ultrasonic systems is driving local production. Low-cost, high-efficiency options were among the leaders, according to FMI research. The FMI report noted that tapping into the 'Made in India' initiative will significantly accelerate industry growth.

The top players in the industry differentiate themselves through their pricing strategy, technology, alliances, and regional footprint. According to the FMI study, Branson Ultrasonics, Crest Ultrasonics, and Mettler-Toledo emphasize advanced automation and AI-based cleaning solutions to provide higher precision.

Chinese companies like GT Sonic Skymen Cleaning Equipment and many other similar alternative Chinese instruments are hitting the shelves at a reasonable price. It is a constant push for growth in Asia-Pacific and Europe, where major players are strategically investing in regional manufacturing clusters.

According to FMI, strategic consolidation, dialogues with OEMs, and R&D on green alternatives will shape the competitive landscape, especially in light of soaring demand from healthcare, aerospace, and electronic industries.

Crest Group

Industry Share: ~20-25%

The industry covers aerospace, automotive, and healthcare applications, with a focus on industrial ultrasonic cleaning systems and high-efficiency solutions.

Emerson Electric Co. (Branson)

Industry Share: ~18-22%

Emerson Electric was a leading global provider of ultrasonic cleaning technology, using its automation solutions to develop advanced cleaning systems.

Sonics & Materials, Inc.

Industry Share: ~12-15%

Sonics & Materials, Inc. manufactures high-performance ultrasonic cleaners designed for precision applications, including electronics and laboratory equipment.

Blue Wave Ultrasonics

Industry Share: ~10-12% (similar sources)

Mostly used in North America and Europe, they are primarily benchtop and industrial ultrasonic cleaners.

Telsonic AG

Industry Share: ~8-10%

The Swiss company specializes in customized ultrasonic applications, particularly for the automotive and medical sectors;

Elma Schmidbauer GmbH

Industry Share: ~5-8%

A German firm is sought after for eco-friendly sonicated cleaning systems and sustainable industrial cleaning.

Other Players (Combined Share): ~10-15%

Regional manufacturers and specialists for niche ultrasonic cleaning applications

Regulations governing precision cleaning in healthcare, aerospace, and electronics are a major driver of adoption.

Companies are advancing automation, integrating artificial intelligence, and designing energy-efficient machines to enhance performance and reduce costs.

Healthcare, automotive, and semiconductor manufacturing are experiencing the fastest adoption rates.

Manufacturers are investing in eco-friendly solvents and energy-efficient transducers to reduce their carbon footprint.

The Asia-Pacific region is increasing incredibly quickly on account of its skyrocketing electronics and manufacturing, while North America is concentrating on its medical and aerospace applications.

The industry is segmented into benchtop, standalone, multistage-2, and multistage-4.

Output it is segmented into up to 250 W, 250-500 W, 500-1000 W, 1000-2000 W, 2000-5000 W, 5000-10000 W, and more than 10000 W.

It is segmented up to 5L, 10-50 L, 50-100 L, 100-150 L, 150-200L, 200-250 L, 250-300 L, and more than 300 L.

It is fragmented into medical & healthcare, automobile, aerospace, optics, metal & machinery, electrical & electronics, food & beverage, jewellery & gems, pharmaceuticals and others.

The industry is fragmented among North America, Latin America, Europe, Asia-Pacific, and Middle East & Africa.

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Aerospace Valves Market Growth - Trends & Forecast 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.