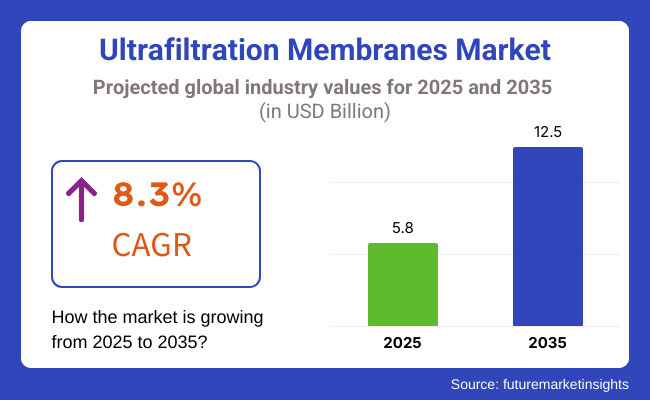

The global ultrafiltration membranes market is set to encounter USD 5.8 billion in 2025. The industry is poised to observe an 8.3% CAGR from 2025 to 2035 and register USD 12.5 billion by 2035.

From 2025 to 2035, the industry is projected to have moderate growth, mainly due to the high demand for water purification, the implementation of environmental laws, and improvements in filtration technology. The key applications in food and beverage processing, wastewater treatment, biopharmaceuticals, and chemicals are the main drivers of this upturn.

Ultrafiltration membranes are increasingly being used in industries because they are the most effective technology for the separation of bacteria, viruses, suspended solids, and macromolecules from different liquids. A case in point is the municipal water treatment plants, where ultrafiltration membranes are basically used to pre-process the water to achieve higher purity, and beverage companies use PEG for clarification and microbial removal in juice and dairy processing. The growing awareness regarding safe drinking water and the treatment of industrial wastewater is adding to the industry expansion.

The ultrafiltration membrane industry has been on the rise due to the global pressure on wastewater discharge and the promotion of water reuse programs. Both municipal and industrial applications see the increased deployment of ultrafiltration systems, which is the main theme of this development. The water infrastructure investments, especially in the developing countries, are among the main factors that help the industry grow. The food and beverage sector benefits from ultrafiltration membranes in high-purity filtration, which subsequently translates into improved product safety and quality.

Notwithstanding the strong growth projections, there are still some issues in the field: membrane fouling, high upfront investment, and the struggle from other filtration methods. The issue of membrane fouling that stems from the organic buildup, biofilm formation, and scaling can bring losses to the efficiency and lead to an increase in energy expenditure.

Explore FMI!

Book a free demo

The ultrafiltration membranes market is driven by several factors affecting water treatment plants, industrial customers, municipalities, and equipment manufacturers. Filtration performance and longevity are of great concern in all segments, highlighting the demand for dependable and long-lasting membrane products. Cost and value are a medium concern, indicating the trade-off between price and quality. Energy efficiency is a top priority for industrial customers and water treatment facilities, where operating expenses need to be minimized.

Operation and maintenance simplicity is important to all parties, providing seamless operation and little downtime. Compliance with regulations is an area of utmost importance, especially for municipalities and water treatment plants, due to strict environmental laws requiring high-performing filtration systems. Equipment suppliers face medium-level issues in the majority of the criteria, which mirrors the need for innovation in low-cost and environmentally friendly filtration technology. As markets advance, efficiency, durability, and compliance are at the top of industry innovations, driving investments in high-performing membrane technologies.

The industry has observed high growth over the period 2020 to 2024 owing to the growing demand for sophisticated water treatment technologies, growing environmental regulations, and expanding industrial demand for high-purity filtration systems. The advances in polymeric and ceramic membrane technology and the expansion of municipal and industrial wastewater treatment facilities have been some important factors shaping the industry. Looking ahead into 2025 to 2035, the industry will increasingly evolve on the basis of improved filtration efficiencies, sustainable practices, and embedding smart monitoring technologies.

Additionally, growing industrialization and urbanization have accelerated industry growth, primarily in regions with high sustainability demands and water reuse regulations. Governments all over the world have recognized the importance of advanced filtration techniques to fight pollution and enhance efforts to conserve water. The COVID-19 pandemic highlighted the extreme necessity of high-quality filtration in healthcare and pharmaceutical industries, supporting the long-term sustainability of the industry. In the future, ultrafiltration membranes will be likely to see constant innovation and convergence with digital technologies in order to maximize performance and efficiency.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| Industry Shift | 2020 to 2024 → 2025 to 2035 |

|---|---|

| Regulatory Environment | Governments implemented tighter water discharge regulations, which raised the demand for ultrafiltration membranes → Tighter international sustainability requirements and circular economy initiatives encouraging water reuse. |

| Technological Developments | The emergence of polymeric and ceramic membranes enhancing filtration accuracy → AI-driven membrane monitoring, self-cleaning membranes, and nanocomposite materials enhancing efficiency. |

| Industry-Specific Demand | Commonly employed in wastewater treatment, pharmaceuticals, and food and beverage processing → Growing applications for biopharmaceuticals, semiconductor fabrication, and high-performance chemical processing. |

| Sustainability & Circular Economy | Initial research on membrane recyclability and mitigating fouling effects → Growing emphasis on biodegradable membranes and energy-efficient consuming filtration systems. |

| Production & Supply Chain | Dependence on traditional manufacturing processes, local supply chain disruption → Production localization, artificial intelligence-based supply chain forecasting, and increased focus on raw material sustainability. |

| Industry Growth Drivers | Higher water scarcity, industrial expansion, and stricter environmental regulation → Smart filtration systems, higher investment in desalination, and developments in green chemistry. |

Dependency on raw materials is one of the major threats in the ultrafiltration (UF) membrane business. UF membranes are made from polymeric materials such as polyethersulfone (PES), polyvinylidene fluoride (PVDF), and polysulfone (PS), as well as ceramic alternatives. Disruptions in the supply chain, geopolitical tensions, or fluctuations in the cost of petrochemical-based raw materials can lead to increased production costs and supply shortages.

Technological risks related to future advances and product innovation need to be adequately addressed. The UF membranes domain is experiencing rapid advances, mainly due to regular improvements in membrane permeability, fouling resistance, and durability. Thus, firms that don’t invest in the development of new technology may find it hard to hold ground against their competitors, who offer better performances, prolonged operational life, and more efficient energy use.

The industry faces strong competition, as the global and regional players are offering both polymeric and ceramic UF membranes. Price wars, mainly in sectors that are sensitive to cost, such as municipal water treatment, can take a toll on profit margins. Companies that do not have the right differentiation strategies might see a fall in their industry share.

Polymers are the most commonly used material for ultrafiltration membranes because they are cost-effective, flexible, and highly efficient in filtration. Ultrafiltration membranes based on polymers, which are widely produced from polyethersulfone (PES), polyvinylidene fluoride (PVDF), and polysulfone (PSU), are the industry leaders because they possess superior chemical resistance, mechanical strength, and hydrophilicity, which make them suitable for water and wastewater treatment processes.

The wastewater treatment industry dominates the ultrafiltration membrane industry, as countries turn their focus on water pollution to combat the problem. As a result, both governments and industries are investing extensively in upcoming membrane filtration systems that will help develop water reuse and also reduce the energy-intensive pollution.

Ultrafiltration membranes play a vital role in the treatment of municipal and industrial wastewater as they effectively remove viruses, bacteria, and suspended solids. Diffused aeration systems are extensively used in China, the USA, and Germany owing to stringent discharge regulations and increasing demand for sustainable wastewater reuse. Companies like DuPont Water Solutions, SUEZ Water Technologies & Solutions, and Pentair are innovating ultrafiltration technology to make it more efficient and less expensive.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.3% |

| UK | 9.2% |

| China | 8.8% |

| Japan | 9.4% |

| South Korea | 9.7% |

The ultrafiltration membrane market in the USA is being driven by the demand for clean and safe water owing to surging industrialization, increasing levels of water pollution, and growing government regulations. The expanding application of advanced water treatment technologies in municipal and industrial sectors is influencing the growth rate of the industry.

The rising utilization of ultrafiltration membranes across healthcare, food & beverage, and pharmaceutical industries is also contributing toward augmenting demand. Emphasis on wastewater recycling and desalination ventures, alongside technological improvement in the shape of membrane filtration, also aids the growth of the industry. The increasing demand for sustainable and energy-efficient water purification solutions also drives growth. The USA ultrafiltration membrane market is expected to expand at 8.3% CAGR during the forecast period, according to FMI.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| The Trade Demand for Clean & Safe Water | Rising water pollution and contamination concerns are creating the need for advanced filtration systems. |

| Strict government regulations | Rigorous Environmental Laws on Water Treatment and Industrial Discharge |

The UK ultrafiltration membrane market is growing owing to rising worries regarding water contamination, higher demand for improved water treatment technologies, and stringent government regulations on water quality. Industrial and municipal sectors are increasingly adopting sustainable and energy-efficient filtration technologies, driving growth.

Also, the growing need for wastewater recycling and desalination projects and growth in the pharmaceutical, food, and healthcare industries are further supporting industry demand. Membrane filtration system advancements and the growing transition toward more eco-sustainable water purification methods also help expedite industry growth. The UK industry will grow at a 9.2% CAGR during the forecast period, according to FMI.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Growing Concerns About Water Pollution | Increasing contamination levels increase demand for permeable membrane technologies. |

| Strict Government Regulations | Strict laws on water quality and treatment of wastewater. |

Chinese ultrafiltration membranes market is growing significantly because of fast industrialization, urbanization, and increasing water pollution threats. The need for stringent government regulations associated with water treatment and the aspect of environmental sustainability are fueling the demand for advanced filtration techniques.

The growing number of industrial and municipal water treatment facilities combined with the increasing use of wastewater recycling and desalination projects are acting as drivers for the industry. Also, rapidly growing pharmaceutical, food, and beverage sectors are driving the demand for good-quality water filtration. Industry expansion is also aided by technological advancements in membrane filtration systems and a move toward energy-efficient, sustainable water purification solutions. FMI anticipates China's industry to grow at an 8.8% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Fast Industrialization & Urbanization | Rising industrial activities and increasing population are other factors. |

| Tight Environmental Regulations | Government policies require strict water quality and wastewater treatment standards. |

Growing concerns regarding water pollution, stringent government regulations on the quality of water, and advancements in water treatment technologies are driving the ultrafiltration membrane market in Japan. The leading focus on environmental protection and sustainability in Japan has driven the country's adoption of ultrafiltration membrane systems in wastewater recycling and desalination projects.

Furthermore, the rising demand for high-purity water in the pharmaceutical, food & beverage, and healthcare industries, among others, is also contributing to the industry's growth. The expansion of the industry further extends due to technological innovations in energy-efficient and high-performance filtration systems as well as investments in municipal and industrial water treatment. FMI anticipates Japan’s industry to grow at 9.4% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Several Strict Water Quality Regulations | Low government regulations establish stringent criteria for water treatment and waste management policies. |

| Growing Concerns About Water Pollution | Growing need for high-level filtration systems to remove contamination. |

The country’s emphasis on the sustainable management of water resources has led to the implementation of advanced membrane filtration technologies. Moreover, the growing pharmaceutical, biotechnology, and food & beverage sectors relying on high-purity water are also impacting demand. Growing government investments in modernized water infrastructure and desirable continuous developments of energy-efficient and high-performance filtration systems by the technological vendors are expected to boost the industry over the stipulated period. The South Korean industry will expand at 9.7% CAGR during the study period, according to FMI.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| Strict Water Quality Rules | Waste water management and water purification-government regulations |

| Emerging Water Pollution Threats | Expansion in innovation in zones, for example, nanotechnology or biomedicine |

The ultrafiltration membranes market remains a competitive one in view of escalating demands for clean water, strict environmental regulations, and technological advancement in membrane filtration. This industry services all manner of applications, from water and wastewater treatment through biotechnology and pharmaceuticals to food and beverage processing.

Companies currently focus on the delivery of highly efficient membranes with sustainability and emerging industry expansion as other advantages of competitive edge over the others.

Industry-leading players, for instance, include DuPont, Asahi Kasei Corp., Toray Industries Inc., Alfa Laval, and Pentair. They have all emerged as leaders in the field due to significant R&D investments, a wide range of product offerings as well as strategic acquisitions.

For instance, DuPont is increasingly expanding its ultrafiltration portfolio through acquisitions, with an improvement in its water treatment status. It is also noted that these firms emphasize innovative product design, advanced membrane materials, and energy-efficient filtration solutions to meet changing customer needs.

In addition to M&A and technology investments, collaboration and partnerships are also adopted to expand distribution reach and improve filtration efficiency. Regional- and niche-specific manufacturers also win favor by offering ultrafiltration customized according to the specific requirements of the industry.

Those earmarked as future decision-making courses of sustainability and cost-effectiveness will consolidate their competitive positioning in the global ultrafiltration membranes market by investing in next-generation membrane technology, eco-friendly materials, and operational efficiencies.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| DuPont | 20-25% |

| Asahi Kasei Corp. | 15-20% |

| Toray Industries | 12-18% |

| Alfa Laval | 10-15% |

| Pentair | 8-12% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| DuPont | Offers high-performance ultrafiltration membranes for industrial and municipal water treatment. |

| Asahi Kasei Corp. | Specializes in hollow fiber membrane technology for medical and water treatment applications. |

| Toray Industries | Develops polymeric ultrafiltration membranes for wastewater and biopharmaceutical processing. |

| Alfa Laval | Provides membrane filtration solutions with a focus on energy efficiency and durability. |

| Pentair | Focuses on advanced water purification systems, serving municipal and industrial applications. |

DuPont (20-25%)

A market leader in water filtration, DuPont continues to expand its ultrafiltration membrane offerings through strategic acquisitions and innovation.

Asahi Kasei Corp. (15-20%)

Known for its expertise in hollow fiber membranes, Asahi Kasei provides solutions across medical, industrial, and municipal sectors.

Toray Industries (12-18%)

A major player in polymeric ultrafiltration membranes, Toray Industries, focuses on wastewater treatment and biopharmaceuticals.

Alfa Laval (10-15%)

A specialist in energy-efficient membrane filtration systems, Alfa Laval serves the food, beverage, and pharmaceutical industries.

Pentair (8-12%)

Offers high-performance ultrafiltration solutions, targeting municipal and industrial water treatment markets.

Other Key Players (20-30% Combined)

The industry is set to hit USD 5.8 billion in 2025.

The market is projected to reach USD 12.5 billion by 2035.

Key companies include DuPont, Asahi Kasei Corp., Toray Industries Inc., Alfa Laval, Pentair, 3M, BASF SE (Inge AG), Baxter International, Dow Chemical Co., Fresenius Medical Care, GE, Cantel Medical, Entegris Inc., Corning Inc., and GEA Westfalia Separator Inc.

South Korean industry, set to witness 9.7% CAGR during the study period, is slated to experience fastest growth.

Polymers are being widely used.

The segmentation is as ceramics, polymers, and other material types.

The segmentation is as hemodialysis, industrial processes, food & beverage, potable water, biopharmaceuticals, and wastewater.

The market is divided into North America, Europe, the Middle East & Africa, Latin America, and Asia Pacific.

Ceiling Tiles Market Growth - Trends & Forecast 2025 to 2035

Hydraulic Fluids & Process Oil Market Size 2025 to 2035

Fabric Filter System Market Size & Forecast 2025 to 2035

Sulphur Coated Urea Market Growth - Trends & Forecast 2025 to 2035

Silicone Fluid Market Growth - Trends & Forecast 2025 to 2035

Triethylenediamine Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.