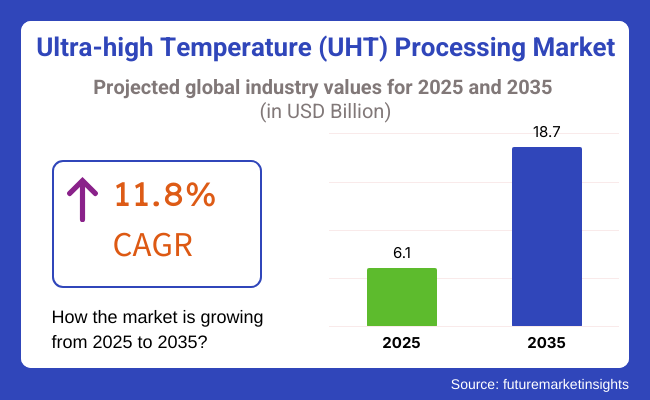

The ultra-high temperature (UHT) processing market will receive a strong boost with the estimated industry valued at over USD 6.1 billion in 2025. According to projections, during the assessment period, the overall industry is likely to demonstrate a CAGR of 11.8% between 2025 and 2035.

UHT processing is a separate thermal processing method which not only removes microorganisms from liquid food and drinks but also makes them safe to consume by increasing their storage period without adding preservatives. The industry valuation is anticipated to hit USD 18.7 billion by 2035.

UHT processing, a thermal treatment technique that heats liquid food and beverages above 135°C for a few seconds to sterilize them, is prevalent in the dairy, beverage, and food industries. The demand for UHT processing is rising due to its ability to maintain nutritional value and taste without the use of chemical preservatives while providing long shelf life. The growing popularity of ready-to-drink (RTD) beverages, dairy alternatives, and long-life milk products is the driver for industry growth.

The surge in shelf-stable food products' demand is the primary reason for the industry's growth. People are increasingly preferring UHT-treated dairy, plant-based sips, soups, and sauces, all because of their long shelf life and lower cold storage needs. The rise of the global food and beverage industry, particularly in developing countries, is further accelerating the adoption of the UHT processing method.

The new technologies being introduced in UHT processing machinery are resulting in higher energy efficiencies and quality of products that, in turn, makes it more attractive for manufacturers. While the innovations in aseptic packaging models are also the main guarantees of safety and sustainability of UHT-treated products so they become easily available to consumers around the globe.

Upfront capital requirement and need for specially designed machines for UHT processing are key challenges. Besides, some customers think that the UHT-treated products are not as fresh compared to the traditionally processed alternatives, which could influence the level of acceptance in different locations.

Though these hurdles exist, the possibilities for industry entry have been expanded by existing ones. The growing consumer demand for lactose-free and fortified UHT dairy products represents a good opportunity for the manufacturers. Moreover, the trend towards more sustainable and eco-friendly materials for packaging will further the application of UHT processing. The UHT processing sector is, therefore, naturally poised for dynamic growth in the coming years as the customers' preferences move toward convenience and food safety.

Explore FMI!

Book a free demo

The industry is expanding considerably, majorly due to the growing need for shelf-stable, long-shelf-life food and beverages. UHT processing is carried out by heating liquid foods between 135-150°C for a few seconds, killing the bacteria and improving shelf life at room temperature.

The most significant consumer is the dairy sector, where UHT-treated cream and milk hold sway in the industry. The beverage industry has UHT processing growing in soya milk, fruit juice, and functional beverages. The baby food industry is turning to UHT in order to preserve nutritional content and wholesomeness. The same applies to soups and sauces, where it offers longer shelf life as well as less food wastage.

In the pharmaceutical industry, UHT technology is employed for liquid drugs and probiotics, guaranteeing sterility. Flavor modification and significant capital investment in UHT machines are drawbacks. The convenience-oriented consumers will keep the industry on the growth path as they fuel demand for packaged foods of longer shelf life and better quality.

The industry also saw significant growth between 2020 and 2024, supported by the rise in demand for shelf-stable non-dairy and dairy foods. UHT processing, a method where liquid food products are heated above 135°C for a matter of seconds, became the need to prolong the shelf life of products without refrigeration.

Increasing demand for ready-to-drink (RTD) beverages, like plant-based milks and functional beverages, drove the use of UHT processing. Emerging technology, such as enhanced sterilization techniques and energy-saving equipment, improved product quality and efficiency of production. Still, significant capital investment and the pressure of regulations were stumbling blocks for makers.

Between 2025 and 2035, the industry will undergo dramatic change. Sophisticated UHT processes, such as direct and indirect heating systems, will facilitate high-speed processing with improved retention of nutrients. Increasing demand for functional and fortified beverages, which contain probiotics, vitamins, and minerals, will fuel industry growth.

Sustainability will gain prominence as manufacturers use energy-efficient processing processes and environmentally friendly packaging to limit the carbon footprint. AI and automation will be used to enhance UHT manufacturing efficiency, offering improved consistency with lower human intervention. Emerging markets in Asia-Pacific and Latin America will drive industry growth as increasing disposable incomes and urbanization boost demand for healthy and convenient beverages.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing UHT, shelf-stable dairy and RTD product demand. | Functional and enriched UHT beverages growth (probiotics, vitamins). |

| Improved sterilization methods enhanced product quality and shelf life. | Artificial intelligence (AI) and automation will make the UHT process more efficient and consistent. |

| Energy-saving UHT processing to reduce production cost. | Green packaging and sustainable operation commitment. |

| Capital-intensive and regulatory difficulties. | Improved regulatory compliance by automated monitoring. |

| Increase in plant-based UHT products (almond, soy, oat). | Growth in emerging economies fueled by increasing disposable income and urbanization. |

The primary reason for the rise in UHT processing sector is the increasing consumer demand for long-shelf-life dairy and beverage products. Nevertheless, strict food safety laws and compliance conditions for heat-treated products are the major obstacles. Firms need to observe global food processing standards, affix proper labels, and provide continuous quality assurance to be in consumer trust and industry approval, respectively.

Supply chain disruptions, such as unsteady supplies of raw materials, increasing equipment costs, and fluctuating energy consumption, are also affecting the industry. The need for specific processing machines and high energy costs involved makes the control of these costs very important. Companies are encouraged to fund in energy-saving technologies and different supplier networks so that the risks can be minimized and the productivity can be enhanced.

There is a noticeable shift in consumer choice for fresh and minimally processed foods which can, in some cases, really challenge the UHT-treated products. The public's perception of nutrient loss during UHT processing can also affect demand negatively. Companies should mainly concentrate on customer education, marketing the longer product shelf life, reliability, and safety issues without nutritional value reduction benefits.

The emergence of high-pressure processing (HPP) and aseptic packaging methods as competing preservation techniques has added to the pressure of the industry. To stay competitive, the enterprises have to invest in innovations, boost the efficiency of facilities, and create new product formulations that are attractive to health-minded clients.

Economic variations, coupled with erratic raw materials prices, lead to production costs and profit margins changes. To achieve growth in the long run, businesses should extend their applications of products, tap into new markets, and optimize logistics geared towards food industry evolution and regulatory demands.

In indirect UHT processing, the product is heated in contact with steam, and it is expected to dominate the industry segment with a 63.5% share in 2025, owing to its energy-efficient, cost-effective, and stable product characteristics.

Food giants worldwide, including Nestlé, Danone, and Lactalis, employ this technique with plate, tubular, or scraped-surface heat exchangers for products including long-life milk, plant-based beverages, and creamers. More than 70% of the total UHT-treated dairy around the world is treated through indirect methods owing to reduced operational expenses and ease of scalability, according to the International Dairy Federation (IDF).

Direct UHT processing will represent 36.5% of the industry share in 2025 as it becomes more widely used for premium dairy, infant nutrition, and specialty beverages. It injects superheated steam directly into the product, enabling rapid heating and cooling, and is designed to maintain natural taste and nutrient content.

Direct UHT processing will represent 36.5% of the industry share in 2025 as it becomes more widely used for premium dairy, infant nutrition, and specialty beverages. It injects superheated steam directly into the product, enabling rapid heating and cooling, and is designed to maintain natural taste and nutrient content.

Both indirect and direct UHT processing and equipment will witness considerable development as a result of technological and industrial developments due to the growing demand for shelf-stable dairy & plant-based products.

Liquid UHT processing will lead the industry with a 78.4% share in 2025, worth USD 8.3 billion. This is due to the high demand for UHT-treated milk, juices, soups, and creamers that provide convenience, extended shelf life, and easy storage.

More than 60% of global UHT milk consumption takes place in Europe and Asia, where the long-shelf life of dairy is prioritized by consumers, according to the Food and Agriculture Organization (FAO). Due to people increasingly turning to options like almond and oat milk out of necessity, the pre-made RTD industry is expanding more quickly than expected, perhaps fueling expansion for companies like Arla Foods and FrieslandCampina, who are introducing new UHT processing plants to meet demand.

The industry for pre-made, ready-to-drink (RTD) beverages is growing at a rapid rate as people increasingly turn to plant-based alternatives, such as almond and oat milk, for their needs, potentially fueling expansion for brands like Arla Foods and FrieslandCampina, which are investing in new UHT processing facilities to meet demand.

Strains the semi-liquid UHT process: 21.6% of the industry due to the increasing demand for yogurt, custards, and sauces. Another key driver for UHT-treated baby food and high-protein dairy formulations continues to gain popularity among consumers.

Danone and Nestlé are also adopting UHT technology for probiotic-rich dairy products to target consumer demand for on-the-go, shelf-stable dairy. Innovations in aseptic packaging have also ensured the integrity of semi-liquid UHT products; the success of this category of high-temperature products is firmly cemented in emerging markets, where cold storage infrastructure represents a barrier to growth.

As both the sectors of the dairy and the non-dairy plant-based markets evolve, also the technology behind both the liquid and/semi-liquid UHT processing, heading the markets of Global Food & Beverages to achieve the continual growth.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 11.7% |

| UK | 11.5% |

| France | 11.3% |

| Germany | 11.2% |

| Italy | 11% |

| South Korea | 11.5% |

| Japan | 11.7% |

| China | 11.7% |

| Australia | 10.8% |

| New Zealand | 10.5% |

2025 to 2035 CAGR is estimated at 11.7%. The USA industry continues to expand with growing demand from consumers for long-shelf-life plant-based and dairy foods. Industry leaders such as Dairy Farmers of America, Nestlé USA, and Dean Foods heavily invest in UHT technology to address changing consumers' demands.

Greater convenience emphasis, along with technological advancements in aseptic packaging, drives industry penetration. This growth is also supplemented by the rapid expansion of organic and lactose-free milk products as a result of health concerns and nutrition among American consumers.

New retail and shopping platforms have led to the development of stronger UHT-based products across supermarkets and the internet. There is also pressure towards sustainability due to the fact that companies invest in environmentally friendly packaging in a bid to match up with environmental policies.

Boosting from the United States government for dairy exportation also encourages industry opportunity. Increased usage of UHT treatment in non-milk drinks like almond milk and oat milk further broadens the industry. With more customers demanding the convenience of using drinks, companies continually invest in R&D to boost the taste of the products as well as the content of nutrients.

The CAGR for the period 2025 to 2035 is projected at 11.5%. The UK UHT processing industry is witnessing robust demand, led by expansion in usage of premium dairy products and uptake of products with extended shelf life. Key players such as Arla Foods and Müller UK & Ireland command significant industry shares, with an emphasis on technological innovation to enhance efficiency.

Increasing usage of plant-based products also leads to demand for UHT-processed soy milk, oat milk, and almond milk. Increasing urbanization and busy lives also propel the move towards ready-to-drink beverages, aided by UHT technology.

Chain retailers and supermarkets increasingly stock a larger range of UHTs, making shopping even more convenient. Increased pressure on manufacturers also comes from an environmental concern that packaging must be green in the future. Brexit also reordered trade policy, which in turn has propelled manufacturers to adopt more resilient supply chain solutions domestically.

The emphasis on minimizing food wastage also drives demand for UHT milk, which allows for longer shelf life when stored in non-chill conditions. With the trend among consumers moving towards quality dairy and vegetable products, the UK industry will look forward to consistent growth over the forecast period.

CAGR in 2025 to 2035 is 11.3%. France has a powerful dairy industry that is heavily dependent on UHT processing, with Lactalis, Danone, and Sodiaal dominating the majority of the industry share. High-quality nutritional drinks and specialty dairy products are becoming more popular, driving the industry.

Good quality milk and cheese products are something French culture is used to, and they are highly compatible with UHT processing to last longer and reduce the use of preservatives. Government initiatives promoting sustainable dairy processing and production also drive industry growth.

The growing export industry also develops the industry, with French UHT dairy foods being in high demand in export markets. As urbanization increases, convenience remains a key driver in embracing UHT products.

Consumers prefer the convenience of storing milk and dairy foods for extended periods at room temperature, which also aligns with modified lifestyle patterns. Increased health-aware consumers' power also supports the trend towards innovation in plant-based and functional UHT-processed drinks, with potential for consistent growth in the French industry.

2025 to 2035 CAGR is expected to be 11.2%. The industry in Germany is growing steadily, with the demand for long-life milk and milk substitutes rising. Industry leaders such as DMK Group, Müller, and Hochwald Foods are investing in advanced UHT technology to boost production efficiency. Growing interest among German consumers for organic and lactose-free dairy products fuels industry demand, which encourages manufacturers to expand product lines.

UHT processing benefits balance the emphasis of the retail sector on sustainability and reducing wastage, as long-shelf-life items reduce food wastage. The strong export value chain of Germany also positions its UHT milk and dairy products in foreign markets, further increasing growth opportunities.

The increasing demand for plant-based beverages also propels demand, with soy, almond, and oat milk labels gaining more popularity. Since Germany is also focused on innovation and sustainability in food processing, the UHT industry is likely to increase gradually.

The UHT processing industry in 2025 to 2035 will grow at 11% CAGR. Italy has a strong dairy heritage and a high rate of demand for high-quality milk products from consumers, which drives the UHT processing industry. Players such as Parmalat and Granarolo adopt the most recent UHT technology to provide high-quality products with enhanced shelf life. Italian consumers are looking for more organic and specialty dairy, which fuel premium UHT milk and cheese consumption.

Supermarkets and internet shopping stores extended more to support wider distribution of UHT-processed beverages. Additionally, the actions taken by the Italian government toward developing support for the dairy industry, as well as the incorporation of sustainable standards, further fuel the growth of the industry. The increasing application of UHT in vegetative food also comes in accordance with changing consumer tendencies, which provide wider expansion within Italy's industry for UHT processing.

CAGR for the period 2025 to 2035 shall be 11.7%. The UHT processing industry in Japan is fueled by the strong demand for long-shelf-life convenience dairy and non-dairy beverages. Industry leaders such as Meiji, Morinaga Milk, and Yakult Honsha have invested heavily in new UHT technology to cater to evolving consumer demands. Rising demand for fortified and functional dairy products fuels industry growth.

Retail and online retailing growth also enhance product availability across Japan. Growing consumption of plant-based foods, including soy and rice milk, also enhances UHT processing demand. With food safety and sustainability concerns still in Japan, companies are adopting innovative packaging solutions, offering opportunities for long-term industry growth.

CAGR for the period 2025 to 2035 has been projected at 11.7%. UHT processing business in China has developed robustly owing to rising urbanization and shifting food consumption behavior. The industry is controlled by powerful players such as Mengniu Dairy and Yili Group, which are involved in product innovation and capacity expansion. Rising demand for premium and protein-rich milk offerings drives the business growth.

Internet selling leadership in China provides an effective channel for distributing UHT products. Vegetable drink sailing and lactose-free demand further fuel industry growth. Government intervention facilitating the modernization of dairy companies also stimulates long-term UHT industry growth in China.

2025 to 2035 CAGR is forecasted at 10.8%. Australia's industry is supported by increasing dairy exports and strong domestic demand for long-shelf-life milk products. Bega Cheese and Devondale are among the companies that use UHT processing in an effort to meet consumers' requirements. Sustainability and eco-friendly packaging trends propel industry expansion. In addition, the growing demand for non-dairy UHT milk products, including almond and macadamia milk, propels the industry's growth.

CAGR over 2025 to 2035 stands at 10.5%. New Zealand's UHT industry has strong dairy exports to back it, and Fonterra drives innovation in this area. Exponential demand for grass-fed as well as organic dairy fuels industry growth. Its focus on sustainable dairy farming and value-added export also fuels growth. The increased popularity of plant-based UHT also drives industry diversification.

The industry is booming with developments in demand for long-shelf-life dairy as well as beverage products, especially in regions where cold-chain infrastructure is not well developed. Increases in consumption of ready-to-drink (RTD) beverages, plant-based milk, as well as fast and convenient food have increased competition among key players.

Global leaders in the industry, such as Tetra Pak, GEA Group, SPX FLOW, Alfa Laval, and JBT Corporation, provide advanced UHT processing equipment and aseptic packaging solutions, pushing new startups and niche suppliers targeting energy-efficient and modular UHT systems to small and mid-sized food producers.

As innovations come up in ways to heat treat products, indirect vs. direct UHT processing, and eco-friendly sterilization technologies, the industry continues evolving. For example, with OneStep UHT processing, Tetra Pak cuts down the energy input and ensures the quality of the final product is maintained. Likewise, recent advancements in enzymatic treatment helped to alter the sensory profile of UHT-treated plant-based beverages.

Asia-Pacific and Latin America are two regions experiencing rapid growth as a result of urbanization, increased consumption of dairy, and demand for non-refrigerated beverages. However, Europe and North America mainly focus on premium UHT dairy, lactose-free, and organic products under their RTD portfolios.

Sustainability, cost-effectiveness, and regulatory compliance serve as key competitive factors. Companies invest in low-carbon processing, recyclable packaging, and digital monitoring solutions with a view to maximizing production efficiency while meeting new consumer demands.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Tetra Pak | 20-25% |

| GEA Group | 15-20% |

| SPX FLOW | 10-14% |

| Alfa Laval | 8-12% |

| JBT Corporation | 6-10% |

| Other Players (Combined) | 20-30% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Tetra Pak | Industry leader in UHT processing solutions including aseptic-processing, integrated packaging as well as energy-efficient equipment. |

| GEA Group | Supplies modular UHT processing units for dairy, plant-based beverages and RTD drinks with emphasis on automation and sustainability. |

| SPX FLOW | Continuous UHT sterilization systems utilize high-efficiency heat exchangers to reduce energy consumption. |

| Alfa Laval | Specialized in relevant heat treatment solutions under the UHT term to solve high-performance plate heat exchangers as well as optimized process control. |

| JBT Corporation | Associated with UHT lines producing tailored fruit juices, dairy alternatives, and soups with advanced sterilization methods. |

Key Company Insights

Tetra Pak (20-25%)

A world leader in UHT processing and aseptic packaging, utilizing sustainable processing technologies to increase product shelf life.

GEA Group (15-20%)

Dominant position in modular UHT systems, with emphasis on tailored processing lines for dairy and plant-based applications.

SPX FLOW (10-14%)

Introduces advanced sterilization and heat recovery systems with high efficiency, using them to save costs in processing and reduce environmental impacts.

Alfa Laval (8-12%)

Trailblazer in plate heat exchanger technology achieves optimal thermal efficiency and the lowest product degradation.

JBT Corporation (6-10%)

Developing more UHT solutions for non-dairy and functional beverages by adding automated process control for higher efficiency.

Other Key Players

The industry is expected to generate USD 6.1 billion in revenue by 2025.

The industry is projected to reach USD 18.7 billion by 2035, growing at a CAGR of 11.8%.

Key players include Tetra Pak, GEA Group, SPX FLOW, Alfa Laval, JBT Corporation, MicroThermics, Elecster Oyj, IMA Group, TESSA Dairy Machinery, and Shanghai Triowin Intelligent Machinery.

Asia-Pacific and Europe, driven by growing dairy consumption, increasing preference for packaged beverages, and advancements in food processing technology.

Dairy-based UHT products dominate due to their high demand in milk, cream, and plant-based alternatives, ensuring longer shelf life without refrigeration.

By mode, the industry is classified into direct and indirect processing methods.

By form, the industry includes liquid and semi-liquid products.

By application, the industry is classified as milk, dairy products, dairy alternatives, others.

By region, the industry is divided as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, Middle East and Africa.

Japan Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Korea Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Korea Texturized Vegetable Protein Market Analysis – Size, Share & Trends 2025 to 2035

Japan Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Korea Customized Premix Market Analysis – Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.