The UK tower mounted amplifier market is set to grow significantly over the next decade propelling due to the expansion of 5G networks, increasing demand for improved wireless coverage and government-backed telecommunications infrastructure initiatives. The market is projected to reach USD 495.1 million in 2025 and will continue expanding at a CAGR of 6.3%, reaching USD 903.5 million by 2035.

Market Attributes and Growth Projections

| Attributes | Values |

|---|---|

| Estimated UK Market Size in 2025 | USD 495.1 Million |

| Projected UK Market Size in 2035 | USD 903.5 Million |

| Value-based CAGR from 2025 to 2035 | 6.3% |

Explore FMI!

Book a free demo

The table below outlines the semi-annual growth rate of the market, reflecting industry trends.

| Period | Value CAGR (%) |

|---|---|

| H1, 2024 | 5.6% (2024 to 2034) |

| H2, 2024 | 6.0% (2024 to 2034) |

| H1, 2025 | 6.1% (2025 to 2035) |

| H2, 2025 | 6.6% (2025 to 2035) |

Growth is steady due to increasing 5G investments and telecom operator initiatives in both urban and rural areas. The market increased with 40 BPS between H1 2024 and H2 2024 while ending up with 6.6% CAGR in H2 2025.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | Filtronic expands TMA production capacity to support 5G rollout. |

| Oct-24 | Radiall acquires a local TMA manufacturer to strengthen its UK market presence. |

| Mar-24 | Comba Telecom partners with Vodafone to deploy low-noise amplifiers in urban networks. |

| Sep-24 | Pulse Electronics launches multi-band TMAs for enhanced efficiency and lower power consumption. |

| Dec-23 | Ofcom announces new spectrum allocations, increasing demand for tower-mounted amplifiers. |

5G Expansion Fuels TMA Demand

Tower Mounted Amplifiers (TMAs) play a pivotal role in the optimization of 5G network infrastructure by reducing signal loss and ensuring greater system efficiency. With 5G rollouts becoming even denser in major UK locations, telecom companies are targeting small-cell deployments, which significant TMAs will be supporting in order to guarantee the perfect signal in place. MNOs including Vodafone, EE, Three and O2 are deploying small-cell infrastructure to extend their 5G networks and improve user experience in cities and busy locations.

Lastly, TMAs are also crucial due to the emerging concept of massive MIMO (Multiple Input, Multiple Output) which forces extensive usage of TMAs to maintain good signal quality and enhance spectrum employment. The role of TMAs in noise interference reduction and uplink sensitivity improvement helps to support higher data speeds and greater network capacity, critically important for 5G applications.

Rural broadband expansion initiatives sponsored by the UK government are also contributing to the growth of TMAs, as operators look to fill this connectivity gap in less well-served areas. Such initiatives are intended to guarantee homogeneous high-speed connectivity nationally and are expected to boost TMA demand even further.

Smart Cities & IoT Growth Driving TMA Demand

The increasing dependence on advanced telecom infrastructure for smart city solutions in the UK is expected to drive adoption of Tower Mounted Amplifiers. As smart cities implement smart traffic management, public safety observation and energy-saving services, the demand for advanced TMAs increase. Such systems need networks that are robust and low-latency, and TMAs are essential in expanding the coverage and maintaining signal strength for the applications, no matter the requirements of the application.

IoT (Internet of Things) expansion across various industries such as healthcare, retail, logistics, and manufacturing is one more key driver for the adoption of TMA. Such devices find many applications in healthcare; in any case, they need continuous connectivity to facilitate real-time monitoring of patients, and thus robust network coverage is paramount.

In retail and logistics, for example, automatic inventory management, connected warehouses, and fleet management systems will also require seamless 5G connectivity, and the support of reliable TMAs will be necessary for these applications as well.

Furthermore, high-performance network solutions are needed due to the increasing penetration of connected home automation systems and industrial IoT applications. SH devices reside throughout the property but rely on stable wireless signals for optimal performance. Thus,TMAs are key in ensuring network availability. With more and more businesses and consumers adopting IoT-powered services, TMAs play an increasingly important part in ensuring 5G performs.

Increased Investments in Network Infrastructure

UK government initiatives for expanding rural broadband are resulting in significant investments in telecom infrastructure, further leading to TMA adoption. Such initiative of the government is expected to transform digital penetration and will drive high-speed internet services for businesses and individuals in rural and remote areas. As a result, telecom operators have started using advanced network solutions (such as TMAs) to enable optimal coverage and avoid signal loss in sparsely populated areas.

Public&-private partnerships (PPPs) are also critical to network expansion. The need to integrate high-performance TMAs owing to such collaborations between telecom companies and government agencies to build or upgrade a network infrastructure. As businesses are focusing more and more on cloud computing and investing in data centers, hence high network accessibility further promote TMAs demand to provide high rate data streaming.

Increasing demand for 5G uninterrupted connectivity in urban & rural areas would boost TMA market growth. With businesses, industries, and consumers increasingly depending on high-speed wireless networks, investment in 5G infrastructure will increasingly cement TMA adoption. It highlights the importance of Tower Mounted Amplifiers in the advancing telecommunications landscape, providing the vital performance and efficiency needed across next-generation networks.

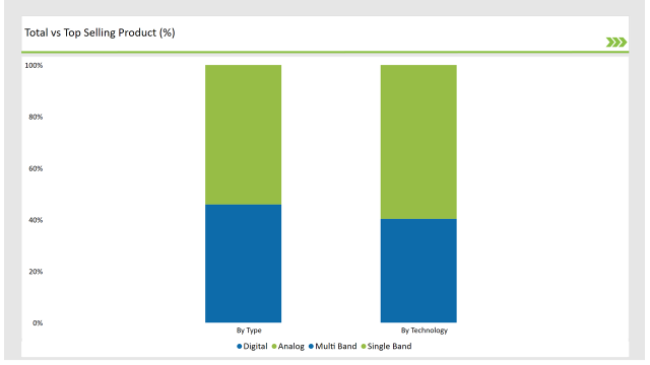

| Type | Market Share (2025) |

|---|---|

| Single Band | 54.1% |

| Multi Band | 45.9% |

| Technology | Market Share (2025) |

|---|---|

| Analog | 59.7% |

| Digital | 40.3% |

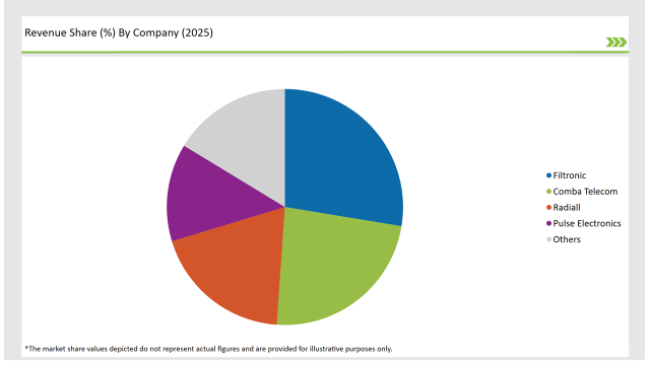

The UK tower mounted amplifier market is highly competitive, with several key players driving innovation and growth.

| Vendors | Market Share (2025) |

|---|---|

| Filtronic | 27.6% |

| Comba Telecom | 23.5% |

| Radiall | 19.2% |

| Pulse Electronics | 13.4% |

| Others | 16.3% |

The market will grow at a CAGR of 6.3% from 2025 to 2035.

The industry is projected to reach USD 903.5 million by 2035.

5G deployment, smart city initiatives, and increasing telecom infrastructure investments.

London and South East England dominate due to high telecom infrastructure density.

Major players include Filtronic, Comba Telecom, Radiall, and Pulse Electronics.

Single-band and multi-band amplifiers cater to diverse network needs.

The transition from analog to digital amplifiers continues to evolve.

Network operators dominate, while infrastructure providers play a key role in telecom expansion.

Electric Switches Market Insights – Growth & Forecast 2025 to 2035

Electrical Bushings Market Trends – Growth & Forecast 2025 to 2035

Edge Server Market Trends – Growth & Forecast 2025 to 2035

Eddy Current Testing Market Growth – Size, Demand & Forecast 2025 to 2035

3D Motion Capture Market by System, Component, Application & Region Forecast till 2035

IP PBX Market Analysis by Type and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.