The UK Structured Product Label (SPL) Management Market is anticipated to reach a market value of USD 6,365.3 million in 2025 and is projected to expand at a CAGR of 11.9%, reaching USD 19,550.1 million by 2035. The market's growth is driven by stringent regulatory mandates, increasing digitization of product labeling, and rising adoption of cloud-based SPL solutions.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size 2025 | USD 6,365.3 million |

| Projected UK Industry Size 2035 | USD 19,550.1 million |

| Value-based CAGR from 2025 to 2035 | 11.9% |

Market dynamics are complex and influenced by a variety of factors, including escalating regulatory compliance standards set forth by the Medicines and Healthcare products Regulatory Agency (MHRA) and an increasing demand for automation in labeling workflows, which are becoming key forces within this market. Structured labeling processes are being increasingly aided by the adoption of artificial intelligence (AI) and machine learning (ML), delivering accuracy and efficiency while providing real-time compliance checks.

Furthermore, increasing emphasis on digital transformation in the pharmaceutical labeling process is driving the adoption of cloud-based labeling solutions. They improve data availability, allow seamless updates, and ensure compliance with ever-evolving regulatory standards, resulting in efficiency in the UK structured product label market.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

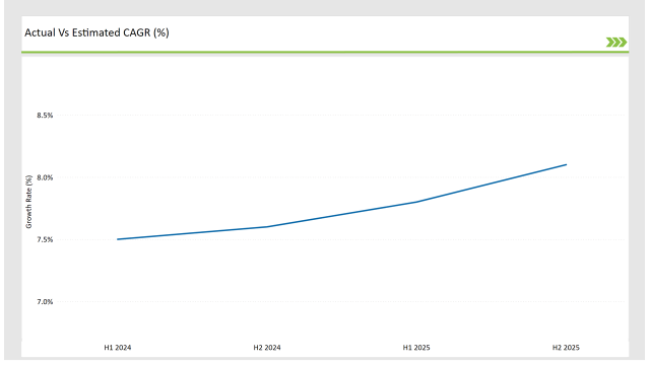

The following table presents the compound annual growth rate (CAGR) trends for the UK SPL market over six-month intervals, providing a precise overview of its growth trajectory.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 11.5% |

| H2, 2024 | 11.6% |

| H1, 2025 | 11.8% |

| H2, 2025 | 12.1% |

H1 signifies January to June, while July to December analysis is signified through H2.

The market’s expansion is primarily driven by the shift toward digital labeling solutions, increased reliance on cloud-based platforms, and regulatory requirements for electronic submission of labeling content. The growth rate has accelerated from 11.5% in H1 2024 to 12.1% in H2 2025, illustrating a strong market momentum.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-2025 | Veeva Systems expanded its cloud-based SPL platform to cater to UK regulatory requirements. |

| Oct-2024 | Oracle acquired a UK-based SPL compliance firm to strengthen its regulatory solutions. |

| Mar-2024 | MHRA introduced new guidelines for structured label submissions, emphasizing real-time updates. |

| Sep-2024 | SAP launched AI-powered SPL automation tools for pharmaceutical firms in the UK. |

| Dec-2023 | IBM introduced blockchain-enabled SPL tracking for pharmaceutical and medical device companies. |

Key industry players are focusing on cloud-based solutions, automation, and AI-driven regulatory compliance to enhance SPL processes. The collaborations between regulatory agencies and SPL vendors are fostering greater transparency and efficiency in digital labeling.

AI-Driven Automation Enhances SPL Compliance

With the growing complexity of the regulatory landscape, pharmaceutical companies and medical device manufacturers are adopting AI-powered SPL solutions to maintain compliance precision by minimizing manual errors. The use of AI-based SPL tool facilitates submission process faster, enables real time updates of products in the authorized locations, as well as helps automate regulatory workflows.

Cloud-Based SPL Platforms Gain Prominence

Demand for Cloud-based SPL Solutions to Witness Exponential Growth Due to Cost-effective, Scalable, and Easy integration of SPL Solutions These solutions enable life sciences companies to manage labeling compliance across jurisdictions seamlessly while keeping in line with the most recent regulations.

Regulatory Authorities Strengthen Digital Labeling Compliance

The agency is encouraging the MPD (Medicinal Product Division) to further digitise SPL submissions-including enforcing attack compliance mandates for corresponding pharmaceutical and medical device firms. This regulatory change has spurred investment into digital labeling platforms.

Blockchain Technology Strengthens SPL Security

As concerns about label fraud and data integrity grow, SPL tracking on blockchain is being adopted. Blockchain improves the security of labels, ensures a tamper-proof digital audit chain, and enables traceability of regulatory changes.

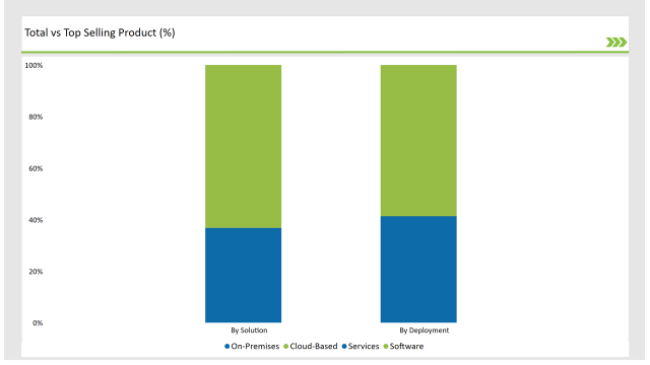

| Solution | Market Share (2025) |

|---|---|

| Software | 63.2% |

| Services | 36.8% |

The software segment dominates the market as SPL management software solutions are extensively employed for the automation, compliance tracking, and data accuracy. Services, which include managed SPL solutions and consulting services, continues to grow.

In addition, AI-enabled analytical solutions, as well as cloud solutions, are improving real-time data verification and regulatory compliance. This transition is helping pharma companies to improve their structured labelling processes, mitigate manual errors, and make sure that the compliance to the MHRA guidelines are made quickly.

| Deployment Type | Market Share (2025) |

|---|---|

| Cloud-Based | 58.7% |

| On-Premises | 41.3% |

As cloud-based SPL solutions provide greater scalability, cost, and compliance are dominating this market. But for large organizations that need additional data control and security, on-premises deployments require greater data control and security.

Moreover, the increasing adoption of blockchain technology in SPL solutions is improving data integrity, traceability, and transparency. This development is especially important to meet the need for compliance with regulations and to reduce risks from counterfeit or mislabelling problems in the UK pharmaceutical industry.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

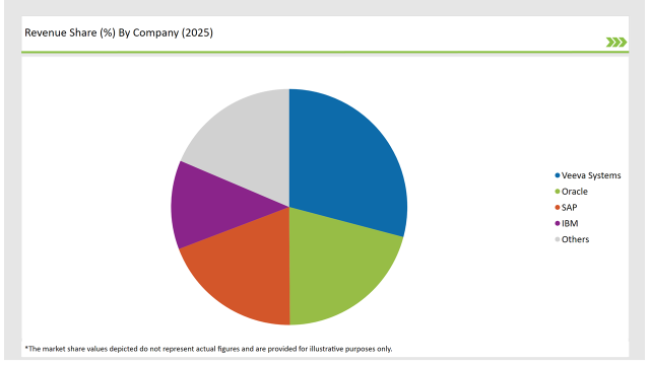

The UK SPL market is highly competitive, with key players focusing on AI integration, blockchain security, and cloud-based automation. Major companies dominating the market include Veeva Systems, Oracle, SAP, and IBM.

| Vendors | Market Share (2025) |

|---|---|

| Veeva Systems | 29.1% |

| Oracle | 20.8% |

| SAP | 19.3% |

| IBM | 12.2% |

| Others | 18.6% |

Software and Services. Software holds a higher share due to compliance automation and integration.

Cloud-Based and On-Premises. Cloud solutions are growing rapidly due to ease of scalability.

Pharmaceutical Companies, Biotechnology Companies, Medical Device Companies, Regulatory Authorities, and CROs. Pharmaceuticals and biotech firms are key adopters.

The UK Structured Product Label Management Market will expand at a CAGR of 11.9% from 2025 to 2035.

By 2035, the market is estimated to reach USD 19,550.1 million.

Key drivers include regulatory compliance mandates, AI-based SPL automation, and the increasing adoption of cloud platforms.

The Software segment dominates with 63.2% market share, driven by regulatory compliance automation.

Leading players include Veeva Systems, Oracle, SAP, and IBM, along with emerging tech-driven regulatory compliance providers.

| Estimated Size, 2025 | USD 64,983.6 million |

| Projected Size, 2035 | USD 210,576.2 million |

| Value-based CAGR (2025 to 2035) | 12.5% CAGR |

Explore Vertical Solution Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.