The size of the Osteoporosis Fracture Healing market in the UK is expected to reach USD 738.6 million by 2025 and is expected to grow at 3.2% CAGR during the period of 2025 to 2035 and is expected to reach around USD 1,012.1 million by the end of 2035.

| Attributes | Values |

|---|---|

| Estimated Industry Size 2025 | USD 738.6 million |

| Projected Value 2035 | USD 1,012.1 million |

| Value-based CAGR from 2025 to 2035 | 3.2% |

The UK anti-Osteoporosis fracture healing market is slowly developing due to various reasons such as the increasing old population, prevention programs implemented by the NHS and public awareness toward osteoporotic fractures. Interestingly, fractures constitute a major health problem among adults as over 3.5 million individuals of the UK population are reported to have osteoporosis, in particular hip fracture in women elderly population.

The NHS FLS are a key driver for early identification, treatment, and post-fracture monitoring, which significantly impact market demand for both pharmacological and surgical fracture-healing solutions. Furthermore, the UK is one of the European countries with the highest incidence of osteoporotic fractures; thus, sustained demand will continue for effective drug therapies and advanced interventions in bone healing.

Global players including Pfizer, Roche, and Teva Pharmaceuticals have been reshaping their approach according to cost-effectiveness benchmarks by the NHS and strict rules and regulations framed by NICE, National Institute for Health and Care Excellence in the UK. Pfizer is taking real-world evidence and AI predictive modeling to exhibit the long-run advantages of the treatment of osteoporosis presented by it in front of procurement boards of NHS.

Explore FMI!

Book a free demo

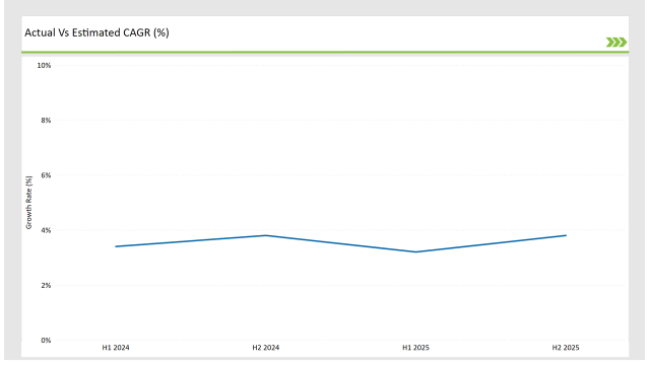

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the UK acetaminophen market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

UK market is expected to grow in the Anti-Osteoporosis Fracture Healing sector at a CAGR of 3.4% in H1 of 2023, and by second half, it should be greater than 3.8%. This is expected to decline a bit at 3.2% in H1 of 2024. The same, however, should be up by H2 to 3.8%. This pattern presents decline of 19 basis points in the first half of 2023 through to the first half of 2024, whereas it is higher in the second half of 2024 by 5 basis points compared with the second half of 2023.

These figures represent a dynamic and fast-changing UK acetaminophen market, largely influenced by regulations, consumer trends, and improvements in acetaminophen. This semestral breakup is crucial to businesses that chart their strategies, taking into consideration the growth trends and navigating market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Business Expansion: Pfizer is integrating real-world patient data analytics and AI-driven risk assessments to optimize its osteoporosis drug offerings in the UK. By working closely with NHS procurement systems, Pfizer is developing predictive models to demonstrate long-term cost savings of its fracture prevention therapies. |

| 2024 | Expansion: Roche is extending the reach of its biologic treatment for osteoporosis through a series of partnerships with NHS bodies. |

| 2024 | Teva is using biosimilars and aggressive NHS cost-reduction strategies to penetrate deeper into the UK market. The company has focused on the large-scale production of generics in bisphosphonates, providing NHS hospitals with high-quality, low-cost osteoporosis treatments. |

NHS Fracture Liaison Services (FLS) and Preventative Screening

The UK program on Fracture Liaison Service is the most comprehensive in the world. It helps promote early osteoporosis diagnosis and intervention for those affected. This initiative by the Royal Osteoporosis Society has ensured bone density screenings as part of routine post-fracture care and this increased demand for anti-osteoporosis medication and fracture-healing solutions.

Greater awareness about the various pharmacological interventions and advanced orthopedic implants among the population contributes to an active, sustained market created by the NHS to reduce preventable fractures.

Digital Health and AI-Based Risk Assessment Are Expanding

The UK has among the most digitized healthcare systems in Europe with electronic patient records and AI-driven risk prediction tools deployed in the majority of the nation's hospitals under the NHS umbrella. This technology picks early high-risk patients, expanding prescriptions for anti-osteoporosis drugs before fractures happen.

AI-driven analytics also are helping pharmaceutical companies like Pfizer and Roche provide data-driven arguments for drug use, which, therefore, secures long-term NHS procurement contracts.

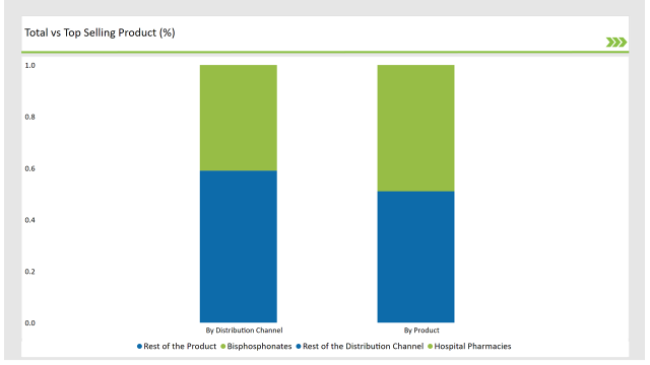

% share of Individual categories by Drug Type and by Distribution Channel in 2025

The British still consider bisphosphonates as the primary treatment for osteoporosis since they are well-priced and highly established as effective treatments. The NHS will also first consider treating osteoporosis with bisphosphonates, for they are available, well-studied, and included in the National Reimbursement Drug List. Additionally, the UK has seen increased generic bisphosphonate production, making the treatment affordable for a larger patient base. With the aging population and NHS-driven fracture prevention programs, bisphosphonates continue to dominate prescription volumes, particularly in primary care settings.

In the UK, hospital pharmacies play a crucial role in osteoporosis drug distribution due to NHS prescription policies and integrated care pathways. Unlike other countries with a strong retail pharmacy market, most osteoporosis treatments in the UK are initiated through hospital-based specialists following a fracture diagnosis.

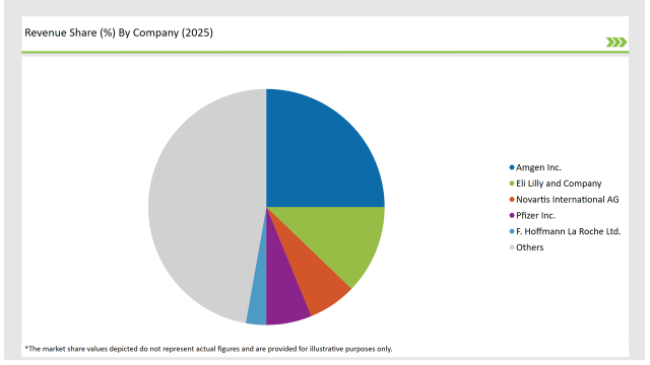

The UK anti-osteoporosis market is highly concentrated. Besides, most of the key players control the market through NHS contracts and NICE-approved guidelines for the treatment. Major players in the UK anti-osteoporosis market are Pfizer, Roche, and Teva Pharmaceuticals. It is majorly because of their older relationships with NHS procurement bodies and their ability to prove cost-effectiveness standards.

However, domestic UK pharmaceutical manufacturers and biosimilar producers are rapidly taking away business from multinational firms through low-cost alternatives that account for the scarcity of the NHS budget. Biotech startups that specialize in personalized medicine and have AI-driven osteoporosis risk assessment are emerging as new forces for disruption-creating and opportunities for precision-based osteoporosis therapies.

Moreover, the uptick in digital health technologies and preventative care through government policies is also changing competition as companies continue to spend on integrated digital platforms for sustaining long-term adherence and monitoring. While multinational corporations continue to lead the biologics and innovative therapy segments, the rise of cost-effective generics and AI-driven treatment pathways is driving a shift in the UK’s competitive osteoporosis landscape.

2025 Market share of UK Anti-Osteoporosis Fracture Healing suppliers

Note: above chart is indicative in nature

By 2025, the UK Anti-Osteoporosis Fracture Healing market is expected to grow at a CAGR of 3.2%.

By 2035, the sales value of the UK acetaminophen industry is expected to reach UK is USD 1,012.1 million.

The key drivers fueling the growth of the UK acetaminophen market include government-supported bone health programs and high demand for bioengineered and resorbable implants.

Prominent players in the UK acetaminophen manufacturing include Pfizer Inc., Sanofi, Janssen Pharmaceuticals (Johnson & Johnson), Bayer AG, GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd, Cardinal Health Inc., Novartis AG, Abbott, Sun Pharmaceutical Industries Ltd, Procter & Gamble Company, Amneal Pharmaceuticals among Others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

In terms of drug type, the industry is divided into Bisphosphonates (Osteoporosis and Others), Calcitonin (Osteoporosis and Others), Estrogen or Hormone Replacement Therapy (Osteoporosis and Others), Anabolics (Osteoporosis and Others), others (Osteoporosis and Others)

In terms of route of administration, the industry is segregated into oral and injectable.

In terms of distribution channel, the industry is divided into Hospital Pharmacies, Retail Pharmacies, Drug Stores, E-commerce and Others.

Specialty Medical Chairs Market Trends - Size, Growth & Forecast 2025 to 2035

Surgical Drapes Market Overview - Growth, Demand & Forecast 2025 to 2035

Super Resolution Microscope Market Insights - Size, Share & Forecast 2025 to 2035

Large Molecule Bioanalytical Testing Services Market - Growth & Demand 2025 to 2035

Remote Healthcare Market – Growth & Innovations 2025 to 2035

Prosthetics and Orthotics Market - Growth & Future Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.