This is anticipated to have the UK mobile sterile units market grow to a USD 16.2 million value by 2025, and should total USD 29.3 million in value by 2035 with a compound annual growth rate of 6.1% CAGR during this 2025 to 2035 forecast period.

| Attributes | Values |

|---|---|

| Estimated Industry Size 2025 | USD 16.2 million |

| Projected Value 2035 | USD 29.3 million |

| Value-based CAGR from 2025 to 2035 | 6.1% |

UK promotes good standards of hygiene in all healthcare settings. The government's efforts to upscale health care provision, through investment in outpatient clinics and regional surgical hubs, have increased the requirement for mobile sterile units. This has become a critical demand in emergency operations, whether through natural disasters, health emergencies, or in isolated regions that lack infrastructure for conventional sterilization.

Technological aspects are also essential to the shaping of the market. UK focus on sustainability encourages mobile units with efficiency in energy, low impact on the environment, and easy portability. All these innovations aim to fulfill the ever-growing demand for operational efficiency and sustainable healthcare solutions, which has led to further adoption of mobile sterile units in the country.

Explore FMI!

Book a free demo

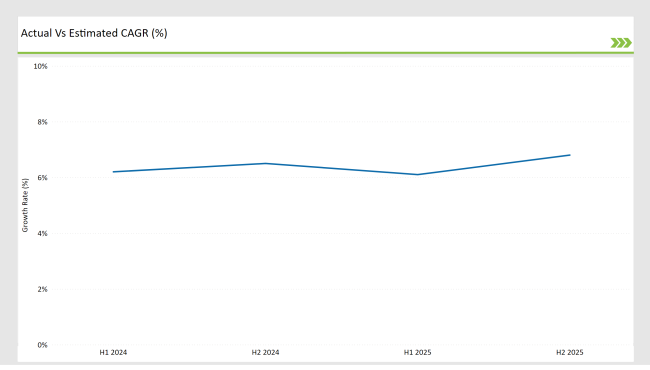

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the UK mobile sterile units market.

This semiannual analysis draws out essential shifts in market dynamics and lays down the patterns of revenue realization for the stakeholders, hence enabling a clearer picture of growth throughout the year. That portion of the year from January through June is defined as H1, and the other half-from July through December-is referred to as H2.

H1 represents the period of January to June, H2 Represents the period of July to December

The mobile sterile units sector for the UK market is estimated to grow at a CAGR of 6.2% in the first half of 2023 that is anticipated to go up to 6.5% in the second half of the same year. The growth rate for the year 2024 is slated to come down slightly at 6.1% in H1, but is expected to rise up at 6.8% in H2.

This pattern presents a decrease of 10 basis points from the first half of 2023 to the first half of 2024 while, in the second half of 2024, it is higher by 24 basis points compared to the second half of 2023.

These figures represent a dynamic and fast-changing UK mobile sterile units market, largely influenced by regulations, consumer trends, and improvements in mobile sterile units. This semestral breakup is crucial to businesses that chart their strategies, taking into consideration the growth trends and navigating market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Portfolio Expansion: The BELIMED focuses on widening its product portfolio to increase its presence and market value. The company aims to develop existing technology and introduce new products in the market. |

| 2024 | Expansion: The Metall Zug is headquartered from which it carries out its product sales and marketing. The company is part of Metall Zug Group, which pushes up the investment in R&D for new product development and updating technology. |

| 2024 | Technological Advancements: The Getting group aims to enhance its technological aspects so that it can serve its customers with quality products and make the process easy and efficient. |

Focus on Infection Control and Hygiene Standards

The UK's strenuous health care regulations and emphasis on keeping hygiene standards high are thus fueling the demand for mobile sterile units. These units ensure patients meet infection prevention protocols, especially in out-patient clinics, surgical hubs, and emergency healthcare set-up where fast and reliable sterilization is critical.

Government Investments in Healthcare Infrastructure

The UK government's continuous investments in health infrastructure, in the form of expanding regional surgical centers and modernization of hospitals, have created the need for mobile sterile units. In fact, this unit offers the flexibility and scalability in sterilizing solutions, especially when large patient volumes must be handled, or in servicing rural or underserved regions.

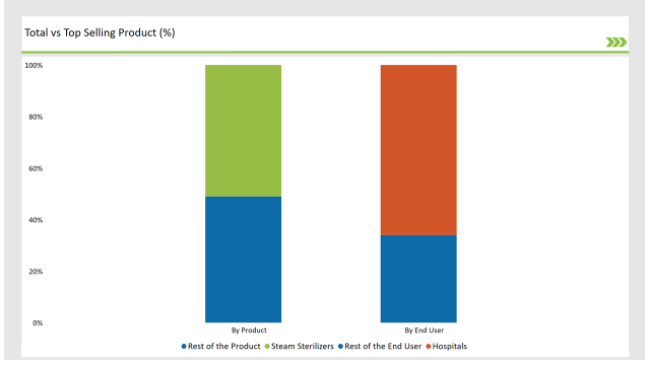

% share of Individual categories by Product Type and End User in 2025

Steam Sterilizers records significant surge in UK Mobile Sterile Units applications

Steam sterilizers dominate the mobile sterile units market due to their proven effectiveness and adaptability in achieving sterilization. Their ability to rapidly and consistently eliminate bacteria, viruses, and spores makes them indispensable across a variety of healthcare and emergency applications. Additionally, steam sterilizers are versatile, capable of sterilizing a wide range of equipment and materials, further solidifying their position as a preferred choice.

Hospitals lead the mobile sterile units market because of the rising emphasis on ensuring patient safety and minimizing healthcare-associated infections. The growing prevalence of complex surgical procedures and the need for rapid sterilization during emergencies or high patient turnover make mobile sterile units a vital solution.

Moreover, hospitals increasingly rely on these units to address sterilization needs in temporary setups, such as during renovations or expansions, as well as in off-site or remote healthcare services.

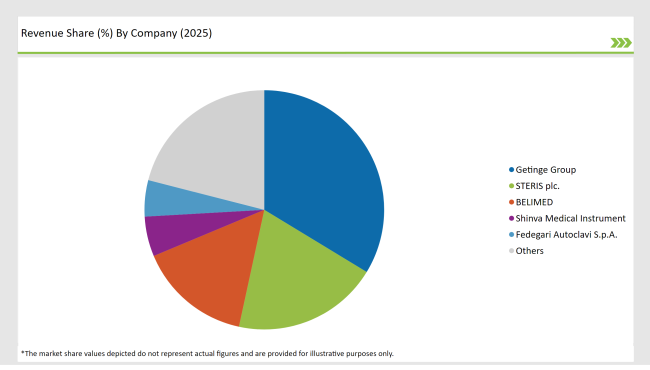

UK Mobile Sterile Units is a moderately diversified market. Big players are also accompanied by agile regional innovators. Some top players of this market are leaders in advanced technologies of sterilizations, huge after-sales services available in the global markets, and strong relationships established over long term with the respective customers. Thereby, leaders of the marketplace can compete significantly due to highly functional, reliable offerings suited to strictly regulatory environments followed by the NHS of UK.

The more recent regional players, who are responding to niche demands in the marketplace, such as solutions for rural healthcare facilities, mobile field hospitals, and disaster response units, are gaining market share. Their capability to offer tailored, cost-effective products positions them as key contributors to the market's growth. A focus on technological innovation and sustainability is also dominant in the competitive landscape.

2025 Market share of UK Mobile Sterile Units suppliers

Note: above chart is indicative in nature

By 2035, the UK mobile sterile units market is expected to grow at a CAGR of 6.1%.

By 2035, the sales value of the UK mobile sterile units industry is expected to reach UK is USD 29.3 million.

Key factors propelling the UK mobile sterile units market include focus on infection control and hygiene standards and government investments in healthcare infrastructure.

Prominent players in the UK mobile sterile units manufacturing include Getinge Group, STERIS plc. , BELIMED, Shinva Medical Instrument, Fedegari Autoclavi S.p.A., Systec GmbH, Steelco S.p.A., Hitech Ultraviolet Pvt. Ltd, Abzil, Tuttnauer among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various product type such as Steam Sterilizers (Gravity Displacement Autoclave and High-speed pre-vaccum sterilizer), Gaseous Sterilizer (Ethylene oxide sterilizer, Nitrogen dioxide sterilizer, Chlorine dioxide sterilizer and Ozone sterilizer), Ultraviolet Sterilizer (Low pressure mercury lamp , Pulsed Xenon Lamps and Light-emitting diodes(LEDs)) and Cold Plasma Sterilizers.

Available in end user like hospitals, speciality clinics, and research institutes among others.

Specialty Medical Chairs Market Trends - Size, Growth & Forecast 2025 to 2035

Surgical Drapes Market Overview - Growth, Demand & Forecast 2025 to 2035

Super Resolution Microscope Market Insights - Size, Share & Forecast 2025 to 2035

Portal Hypertension Management Market Trends - Size, Growth & Forecast 2025 to 2035

Precocious Puberty Treatment Market Overview – Growth, Trends & Demand Forecast 2025 to 2035

Pleural Diseases Therapeutics Market – Drug Trends & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.