The UK foley catheter market is expected to reach USD 78.2 million in 2025 and is projected to reach a total value of USD 165.5 million by 2035. This represents a CAGR of 7.8% during the forecast period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size (2025) | USD 78.2 million |

| Projected UK Value (2035) | USD 165.5 million |

| Value-based CAGR (2025 to 2035) | 7.8% |

The Foley catheter market of the UK represents a well-rounded competition between various established global players and several upcoming local players, all eager for a major share in the urological care market. The competitive environment in the UK is to a great extent formed by the focus of the country on the NHS, where quality, affordability, and patient safety are considered paramount.

With companies having strong R&D capabilities, advancement of latex-free, silicone-based catheters, self-lubricating designs, and longer-wear catheters is moving ahead, thereby better meeting the requirements of patients with chronic conditions, especially in the aging population.

More than that, collaboration between multinational companies and research institutions based in the UK has also increased; thus, specific solutions developed to suit the peculiar needs of the British healthcare market should trend positively.

Growing awareness regarding the importance of infection prevention, particularly in the hospital setting, and the push for sustainability in the design of medical products are also playing a part in how the market for Foley catheters is growing in the UK These are contributing toward making the market not just patient-care conscious but also environmentally conscious regarding healthcare practices.

Explore FMI!

Book a free demo

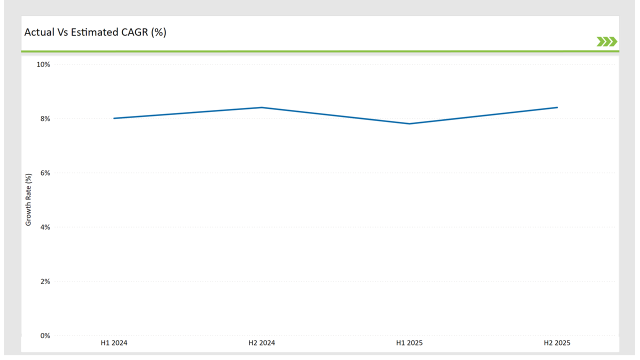

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the UK foley catheter market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The foley catheter sector for the UK market is expected to rise at 8.0% growth rate in the first half of 2023, which will increase to 8.4% in the second half of the same year.

In 2024, the growth rate is expected to slightly decline to 7.8% in H1 but is expected to rise to 8.4% in H2. This trend now reflects a decline of 23.0 basis points from the first half of 2023 to the first half of 2024, while in the second half of 2024, it has gone up by 3.0 basis points compared to the second half of 2023.

The UK Foley catheter market is influenced by the changing regulations, shifting dynamics in patient pools, and continuous technological evolution. With this trend, companies are able to update their strategies every six months by regular monitoring and analysis of the market.

This has led to recent reports on an increased proportion of silicone-based catheters due to their durability, biocompatibility, and infection-resistant nature. The urge for green solutions has also seen the demand for eco-friendly catheter products go high hence pressing manufacturers into innovating their products in line with this. Recent Developments

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Innovation: Convatec Group PLC, involved in the product innovations such as smart Foley catheters equipped with sensors to monitor bladder pressure, urine output, and early infection detection. |

| 2023 | Launches: Teleflex Incorporated, launched a new line of long-term Foley catheters specifically engineered with special features to enhance wearability, patient comfort, and ease of maintenance. |

| 2022 | Partnership: Medline Industries, LP has entered into a partnership with a research university to develop new materials for Foley catheters that resist infections occurring as a result of said long-term catheter utilization. |

Aging Population and Rising Incidence of Chronic Urological Conditions

The increase in the aged population of the UK is one of the primary factors responsible for driving the Foley catheter market. Many age-related urological conditions, such as benign prostatic hyperplasia, UI, and bladder disorders, have all contributed to increasing catheter placement, particularly in LTC and homecare environments. The need for long-term and effective catheterization in this aging population supports ongoing demand.

Focus on Infection Control and Patient Safety

Infection prevention in hospitals is one of the major concerns in the UK, therefore the increasing trend of Foley catheters with enhanced safety features.

The NHS's strategy to reduce HAIs has encouraged various manufacturing companies to develop catheters that have antimicrobial properties or offer safer and more comfortable catheterization experiences to patients. This is keeping the demand high for products that prevent catheter-related infections.

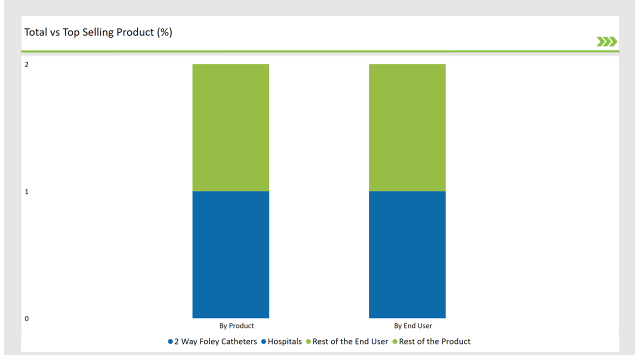

% share of Individual categories by Product Type and End User in 2025

2-way foley catheters records significant surge in UK foley catheter market

The 2-Way Foley catheters are the most prominent because of the ease and efficiency with which they can handle a wide range of clinical settings. These catheters are used strictly in surgical suites, post-surgical recoveries, and management of chronic care.

They are designed to accommodate continuous urine drainage and balloon retention for long-term use and easy management. In addition, they are cost-effective and available in various sizes and materials, which makes them one of the main preferences among both healthcare professionals and patients.

Within the UK Foley catheter market, the end-user segment of hospitals has remained dominant owing to high demand from acute care, surgery, and critical care unit applications.

The number of surgeries has been increasing, especially among elderly patients, along with rising cases of urological complications driving the use of Foley catheters in hospitals.

In addition, tight infection control policies in hospitals and the use of high technology catheters that limit the possibility of infection are vital in a hospital setting. This trend makes the hospital segment the biggest adopter of Foley catheters.

Note: above chart is indicative in nature

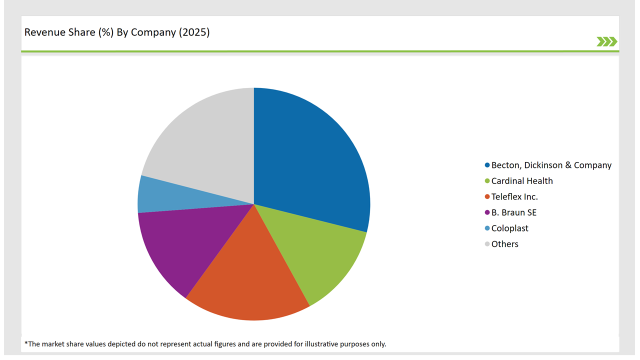

The UK Foley catheter market is relatively competitive, and among these, major players include Becton, Dickinson & Company, Medtronic, Coloplast, and Teleflex Inc.

These companies focus on leveraging their good R&D capabilities and huge distribution networks to provide innovative products that match the requirement of the UK healthcare system. The market is also witnessing an increased number of collaborations between global players and UK-based medical institutions, which is driving localized product innovations tailored to meet the needs of British patients.

Polymedicure and AdvaCare Pharma are other emerging players in the market, but the former could be considered a strong contender by providing more affordable and specialized catheter solutions in the market, mainly in the homecare and long-term care segments.

Eco-friendly and sustainable practices are becoming an important differentiation point, and with the growth of demand for environmentally-conscious products, players are adjusting their priorities accordingly. Infection control remains a significant factor in the market's evolution and is prompting manufacturers to continue developing safer and more effective Foley catheter designs.

By 2035, the UK foley catheter units market is expected to grow at a CAGR of 7.8%.

By 2035, the sales value of the UK foley catheter units industry is expected to reach UK is USD 165.5 million.

Prominent players in the UK foley catheter units manufacturing include Becton, Dickinson & Company, Cardinal Health, B. Braun SE, Coloplast, Medtronics, ConvaTec Group Plc, Teleflex Inc., Medline Industries, LP., Optimum Medical Limited, Polymedicure , AdvaCare Pharma, Well Lead Medical Co.,Ltd. and Advin Health Care.

The industry includes various product type such as 2-way foley catheter, 3-way foley catheter and 4-way foley catheter

The industry includes various materials such as latex foley catheter, silicone foley catheter and other materials.

The industry includes various indications such as urinary incontinence, urethral stricture, chronic obstruction, neurogenic bladder, enlarged prostate gland/bph, prostate cancer and other indications.

Available in end user like hospitals, long-term care facilities, ambulatory surgical centers.

Digital Scale Market Analysis by Product, Age Group, Modality, End User, and Region 2025 to 2035

The Graft Versus Host Disease (GvHD) Treatment Market is segmented by Monoclonal antibodies, mTOR inhibitors, Tyrosine kinase inhibitors and Thalidomide from 2025 to 2035

The Liquid Biopsy Market Is Segmented by Biomarker Type, Sample Type & End User from 2025 to 2035

The Positron Emission Tomography (PET) Scanners Market is segmented by Full-ring PET Scanner and Partial-ring PET Scanner from 2025 to 2035

The onychomycosis treatment market is segmented by treatment, disease indication, age group, gender and distribution channel from 2025 to 2035

The Breast Cancer Drug Market is segmented by Drug Class, and Distribution Channel from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.