Due to the high adoption of smart home entertainment systems, introduction of new display technologies and demand for over-the-top (OTT) streaming platforms, the UK Connected TVs market is anticipated to grow at significant CAGR during the forecast period. The market is expected to reach USD 1,886.0 million by 2025, with a CAGR of 11.5% in the forecast years 2025 to 2035 reaching USD 5,601.2 million by 2035, indicating the growth of this market.

Market Growth Snapshot (2025 to 2035)

| Attributes | Values |

|---|---|

| Estimated UK Industry Size in 2025 | USD 1,886.0 million |

| Projected UK Industry Size in 2035 | USD 5,601.2 million |

| Value-based CAGR (2025 to 2035) | 11.5% |

The factors such as increasing consumer demand for high-definition content, integration of AI (artificial intelligence) in smart TVs and expansion of high-speed broadband connectivity are expected to propel the industry growth. Innovations in OLED and QLED displays paired with competitive pricing are important drivers as well. The increasing move to streaming services such as Netflix, Disney+, and Amazon Prime Video has turned connected TVs into a primary household entertainment tool, supplanting cable TV.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

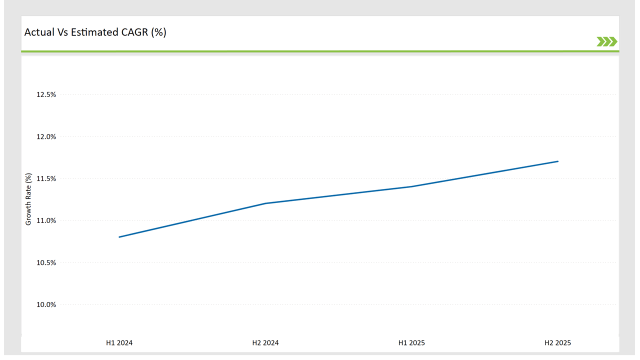

The table below provides an overview of the compound annual growth rate (CAGR) trends for the UK market, offering insights into short-term fluctuations and long-term patterns:

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 10.8% |

| H2, 2024 | 11.2% |

| H1, 2025 | 11.4% |

| H2, 2025 | 11.7% |

H1 represents January to June, while H2 covers July to December.

The increasing CAGR is driven by the accelerated adoption of 4K and 8K smart TVs and growing cloud-based gaming and streaming platforms. Driven by ever-evolving AI-powered recommendations and voice-enabled controls, UK consumers are rapidly adopting new TV technologies.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-2025 | Samsung expands its OLED and QLED smart TV offerings in the UK, introducing AI-powered display optimization. |

| Oct-2024 | Sony UK partners with Netflix to optimize HDR content on its Bravia series. |

| Mar-2024 | Sky TV launches "Sky Stream," an internet-based TV streaming device, eliminating the need for satellite dishes. |

| Sep-2024 | LG Electronics UK collaborates with Google to enhance voice assistant functionality in its smart TVs. |

| Dec-2023 | BBC iPlayer announces full integration with leading smart TV manufacturers for seamless native streaming. |

Strategic partnerships and innovations in content streaming, AI-enhanced features, and display technology are shaping the market landscape.

Smart TVs Drive Market Growth

The emergence of smart TVs, with their built-in streaming and AI-driven content recommendations, has further changed the face of UK television. Smart TVs are gaining favor among consumers, as they provide access to all major streaming services without requiring external devices.

Dominated by big names, including Samsung, LG and Sony, the segment now boasts high-end features such as voice commands, cloud gaming compatibility and AI-generative, personalized viewing experiences. The world is witnessing a paradigm shift in content consumption habits as streaming becomes the norm, leading to a spike in demand for smart televisions.

Analysts predict that by 2035, smart TV penetration will exceed 85% of UK households and, moreover, that the take-up is seen across all demographic groups. The shift is also sped up by declining hardware costs, better internet connectivity and an increase in partnerships between TV manufacturers and streaming service providers.

Streaming Devices Gain Popularity

Streaming devices such as Amazon Fire TV Stick, Apple TV and Roku are becoming increasingly popular among UK consumers who would rather upgrade their current TV than purchase new smart models. These devices are an affordable way for consumers to access streaming content while extending the life of their current TVs.

High-speed broadband accessibility and OTT (over-the-top) TV streaming trend support the segment increase. Software updates and new features, like voice assistants and multi-device synchronization, are also more common on streaming devices than on smart TVs, which makes them a more attractive option.

Analysts are forecasting the target market, which delivers flexibility and is cost-effective, to grow over the next five years in the UK at a CAGR of 7.1% in the forecast period.

OLED and QLED Transform Display Technologies

OLED and QLED are on the rise in the UK TV market, with LCD screens being phased out at a record pace. These technologies provide better contrast, better color accuracy, and better energy efficiency, greatly improving the overall viewing experience.

Samsung QLED and LG OLED TVs are leaders in the premium market - these brands’ next-generation panel technology has defined a market standard. DiGilmo said consumers have shifted in greater numbers toward these high-end models, especially as both 4K and 8K resolution are more mainstream.

The shift towards OLED and QLED displays is being fueled by a desire for enhanced picture quality, with deeper blacks and more vivid colors making those technologies the number one choice for home entertainment fans. Moreover, manufacturers are still improving these technologies with features such as higher title rates or better HDR performance to cover a broader segment.

Commercial Adoption Expands

Residential users are the biggest consumers of connected TVs, yet commercial use is growing across multiple verticals. Businesses use smart TVs for digital signage, corporate presentations and customer engagement in hotels, conference rooms and retail stores.

For example, hospitality providers integrate connected TVs to deliver personalized guest experiences and engage them with entertainment options, while retailers use them for client interactions and advertising. These technologies are used in the corporate sector too where they are deployed in video conferencing and collaborative workspaces. Running a business across borders has never been more frequent, and connected TVs are integral to the modern battlefronts of digital transformation.

The commercial segment is expected to reach at USD 14,397.44 Million by 2030, growing at a CAGR of 7.0%, which is attributed to growing investment in digital signage solutions and interactive display technologies, say the industry experts.

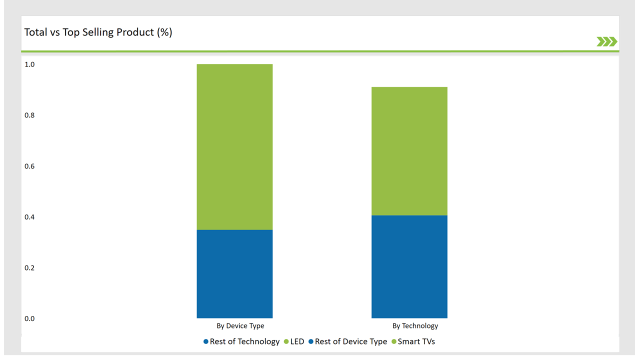

| Device Type | Market Share (2025) |

|---|---|

| Smart TVs | 65.2% |

| Others | 34.8% |

Smart TVs dominate due to rising broadband connectivity, direct integration with streaming services, and affordability. Streaming devices also see steady growth as cost-effective alternatives.

| Technology | Market Share (2025) |

|---|---|

| LED | 50.5% |

| Others | 40.5% |

Even though LED is becoming the norm, OLED and QLED are also slowly gaining traction among consumers with their futuristic capabilities. As consumers demand better screen quality, LCD technology is slowly being retired.

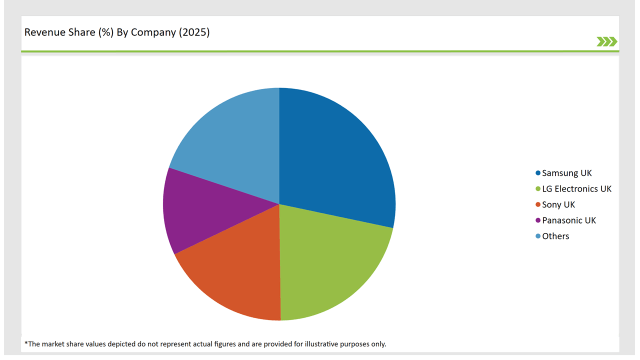

Major players in the UK connected TVs market are focusing on product innovation, strategic partnerships, and price differentiation to maintain their competitive edge.

Samsung and LG continue to dominate the market with their innovative display technologies and extensive retail coverage. Panasonic targets for a smaller audience looking for high-performance display panels and Sony concentrates on premium TV segments.

| Vendor | Market Share (2025) |

|---|---|

| Samsung UK | 28.3% |

| LG Electronics UK | 21.5% |

| Sony UK | 18.1% |

| Panasonic UK | 12.2% |

| Others | 19.9% |

Smart TVs, Streaming Devices, Others

LED, LCD, OLED, QLED

Residential, Commercial

The market will expand at a CAGR of 11.5% from 2025 to 2035.

By 2035, the UK connected TVs market will reach USD 5,601.2 million.

Key drivers include the rise of smart TVs, increasing demand for streaming services, advancements in OLED and QLED displays, and the growth of AI-powered TV features.

London and urban metropolitan areas have the highest adoption rates due to strong broadband penetration and tech-savvy consumers.

Major players include Samsung UK, LG Electronics UK, Sony UK, and Panasonic UK.

| Estimated Size, 2025 | USD 16,978.4 million |

| Projected Size, 2035 | USD 60,110.2 million |

| Value-based CAGR (2025 to 2035) | 13.5% CAGR |

Explore Electronics & Components Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.