UK market, in cold laser therapy are significantly expanding. With rate of 3.4%, the market will reach to 7.6 million in 2035 from 5.5 million in 2025.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size (2025) | 5.5 million |

| Projected UK Value (2035) | 7.6 million |

| Value-based CAGR (2025 to 2035) | 3.4% |

The sales of cold laser therapy is expanding rapidly in the UK, with growing acceptance within physiotherapy and rehabilitation centers towards non-invasive methods of pain management, increase in the adoption of laser technology etc.

The upward trend of chronic pain prevalence, primarily musculoskeletal disorders and diseases of the joints, has led patients as well as healthcare providers to seek safer alternatives to surgery and pharmaceutical treatments.

Cold laser therapy has become one of the effective treatments that accelerate healing and minimize inflammation without causing any side effects. Cold lasers have become increasingly easier to use and more accessible due to advances in technology.

This has contributed to the growing adoption of these devices in both clinical and home-care settings. UK strong regulatory framework for medical devices and growing consumer awareness of holistic pain relief continue to drive expansion of this market, thus providing sustained growth over the next few years.

Explore FMI!

Book a free demo

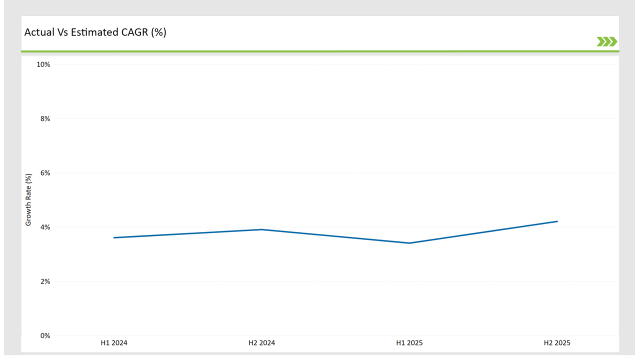

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the UK cold laser therapy market.

This semi-annual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The cold laser therapy sector for the UK market is expected to rise at 3.6% growth rate in the first half of 2024, which will increase to 3.9% in the second half of the same year. In 2025, the growth rate is expected to slightly decline to 3.4% in H1 but is expected to rise to 4.2% in H2.

This pattern shows a decline of 19.0 basis points from the first half of 2024 to the first half of 2025, while in the second half of 2024, it is higher by 26.0 basis points compared to the second half of 2024.

The nature of the UK cold laser therapy market is cyclical, with periodic shifts in government regulations, healthcare reforms, and patient needs. The performance review will, on a six-monthly basis, help any business stay competitive and correct course in changing market dynamics.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Product Launches: DJO Global, Inc. (Colfax Corporation) focuses on launching new products in the market to fulfill the demand of its customers and provide them a relief from pain. |

| 2024 | Innovation: BioLight Technologies LLC focuses on developing and innovating low-lever laser therapy products. |

| 2024 | Expansion: BTL focuses on launching innovative products to widen its presence in the market by targeting more customers. |

Growing Demand for Pain Management Solutions

One of the main reasons cold laser therapy is trending in the UK is its effectiveness in handling chronic pain symptoms such as the case of arthritis, back pain, and neuropathy. Sugars and inflammatory substances decreasing without invasive procedures or medicines make of the therapy the choice of both clinicians and patients.

Broader Use in Sports Medicine and Rehabilitation

The cold laser therapy is a effective tool, which is the responsible for the development of physiotherapy and sports medicine. This technology of rehabilitation is based on the sports culture of the UK, which is massive and also on the delivery of the therapy. The patients use it for faster recovery, to reduce inflammation and for better performance, so it has become a standard procedure in rehabilitation centers.

Portable and Multi-Wavelength Devices Developments

The advent of portable laser therapy devices has remote settings of the laser setup accessible for homecare. Moreover, multi-wavelength systems, which target multiple tissue depths, are gaining popularity for their versatility and enhanced outcomes.

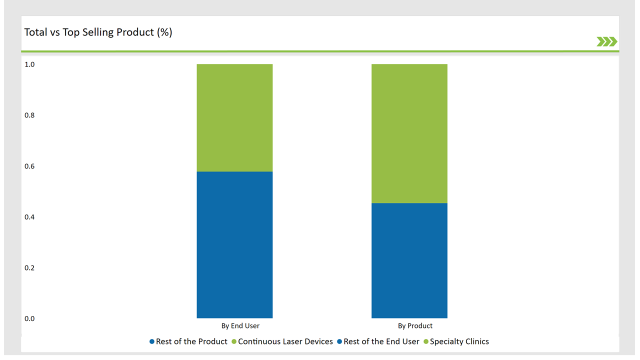

% share of Individual categories by Product Type and End User in 2025

Continuous laser devices records significant surge in cold laser therapy market

Continuous devices dominate due to the efficacy of the treatments, ease of use, and increasing demand for non-invasive pain management solutions in the UK cold laser therapy market.

These continuous laser beams guarantee the accurateness and effectiveness of the therapy in treating musculoskeletal conditions, post-surgical recovery, and relieving chronic pain. Other than that, advancement in laser technology to portable and customizable treatment has further extended its marketability, thereby corroborating with a country believing in innovation and care for its citizens.

Specialty clinics form the major end-user segment in the UK cold laser therapy market, instrumental in providing targeted physiotherapy, chiropractic, and rehabilitation treatments.

Continuous laser devices are preferred in specialty clinics as they help in enhancing the healing of tissues, reducing inflammation, and hence are effective in pain management. Further, the emphasis on prevention and alternative therapies within the UK healthcare system has favoured wider diffusion of cold laser therapy in specialized clinical settings.

Note: above chart is indicative in nature

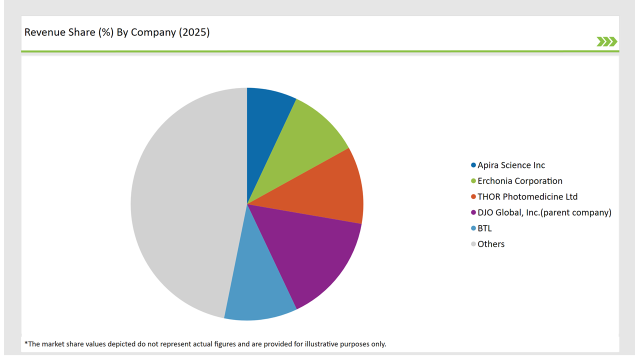

The competition in the UK cold laser therapy market is dominated by leading companies like Erchonia Corporation, DJO Global, Inc., BTL, THOR Photomedicine Ltd, and BioLight Technologies LLC, with the largest market share through constant innovation and clinical research.

These Tier 1 companies invest heavily in the development of high-precision, CE-marked LLLT devices, adhering to the strict medical regulations of the UK Moreover, their concentration on the extension of therapeutic uses-mostly pain and rehabilitation-has kept them ahead of the market.

However, Tier 2 companies such as Irradia, Omega Laser Systems, and Multi Radiance Medical are gaining remarkable market traction with cost-effective and user-friendly solutions for mid-size clinics and home-use applications.

The fortunes of companies involved in such fortunes are that demand for portable and easy-to-operate LLLT devices is improving continuously at home amongst patients. It was competitive by making the treatments for musculoskeletal conditions, wound healing, and post-injury rehabilitation more personalized affordable, all under the purview of growing demands for prevention and non-invasive healthcare in the UK

The market is expected to grow at a CAGR of 3.4% from 2025 to 2035.

Continuous laser devices are the leading products in the market.

Key players include Apira Science Inc, BioLight Technologies LLC, B-Cure laser Australia, Erchonia Corporation, Theralase Inc., THOR Photomedicine Ltd, DJO Global, Inc., BTL, Spectro Analytic Irradia AB, and Photomedex.

The industry includes various product type such as continuous laser devices pulse laser devices and combination laser devices

The industry includes various materials such as single wavelength cold laser therapy devices, multiple wavelength cold laser therapy devices.

The industry includes various indications such as pain management, arthritis wound healing, nerve regeneration, dermatology, musculoskeletal and others

Available in end user like hospitals, specialty clinics, ambulatory surgical centers, and homecare settings.

Anti-hyperglycemic Agents Market: Growth, Trends, and Assessment for 2025 to 2035

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.