The UK Aerial Imaging Market is expected to reach a market value of USD 468.8 million in 2025 and is projected to grow at a CAGR of 8.7%, reaching USD 1,535.8 million by 2035. The market is driven by the increasing demand for geospatial data, advancements in aerial imaging technology, and the growing adoption of unmanned aerial vehicles (UAVs) for various applications.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size in 2025 | USD 468.8 million |

| Projected UK Industry Size in 2035 | USD 1,535.8 million |

| Value-based CAGR from 2025 to 2035 | 8.7% |

The increased demand for aerial imaging solutions across applications such as defense and security intelligence, urban planning, disaster management, and environmental monitoring is generating demand for this market. As is the case with anything that is dealing with information, AI and automation injected in aerial imaging improves image processing, data analytics, and decision-making. The cloud-based aerial imaging platforms with scalability, flexible nature and real-time data sharing are holding up.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

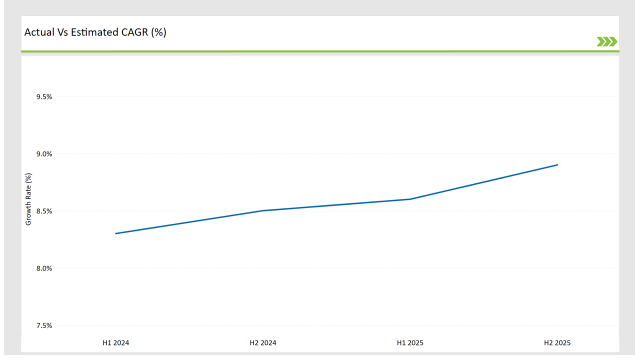

The following table highlights the compound annual growth rate (CAGR) trends for the UK Aerial Imaging Market over six-month intervals, providing insights into the market’s growth momentum.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 8.3% (2024 to 2034) |

| H2, 2024 | 8.5% (2024 to 2034) |

| H1, 2025 | 8.6% (2025 to 2035) |

| H2, 2025 | 8.9% (2025 to 2035) |

Market growth is driven by the increasing use of UAVs and drones, rapid technological advancements, and the rising demand for high-resolution imaging solutions. The incremental growth from 8.3% in H1 2024 to 8.9% in H2 2025 reflects the industry's expansion and adaptation to emerging aerial imaging technologies.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | DJI launched an AI-powered drone imaging system for geospatial applications. |

| Oct-24 | Esri acquired an aerial analytics firm to enhance its geospatial imaging solutions. |

| Mar-24 | The UK Ministry of Defence increased investments in aerial surveillance technology. |

| Sep-24 | Google partnered with major UAV manufacturers to develop advanced aerial mapping solutions. |

| Dec-23 | Microsoft introduced cloud-based aerial imaging software for smart cities. |

The data is sufficiently outdated and the technology providers are actively working on new solutions like automated AI-based image processing tools and leveraging the cloud for performing online imaging, along with higher resolution satellite imaging capabilities. Partnerships between imaging solution providers and government, military, and commercial sector organizations are leading to improved effectiveness and precision of aerial data acquisition.

Growing Demand for Urban Planning and Infrastructure Development

The UK's growing emphasis on urban planning and infrastructure initiatives is a major driver for the aerial imaging market. High-resolution aerial imagery is needed for urban planning, geospatial analysis, and mapping for government urban initiatives in smart city development as well as infrastructure expansion and multi-scale construction projects. Environmental impact assessments and land use monitoring have been made possible through aerial imaging, while it can also be used in optimizing infrastructure designs.

Moreover, increasing application of LiDAR and photogrammetry in construction & civil engineering is expected to improve the efficiency of the projects and cut down expenses. In line with UK investment on urban development, sustainable urbanization, and infrastructuredigitalization - aerial imagery for applications like 3D modeling and mapping is projected to see an increase in demand - further bolstered by policy-led spending in public works over the coming years.

Rising Adoption of UAVs for Environmental Monitoring

The UK has a strong focus on environmental sustainability, which is fuelling the growth of aerial imaging especially using Unmanned Aerial Vehicles (UAVs). Governments and environmental bodies are already putting drones to work monitoring deforestation, coastal erosion, air pollution and biodiversity. Armed with multispectral and thermal sensors, UAVs give real-time information on effects of climate change, which is helpful for disaster management and conservation.

Government-backed projects like the UK Environmental Observation Framework (UKEOF) and the Land Cover for England program emphasize how important aerial data is in ecological assessments. As stricter environmental regulations and an effort to minimize carbon footprints gain traction, UAV-based imaging solutions provide an efficient and cost-effective way to replace traditional surveying methods, leading to an even more rapid adoption across research institutions, governmental organizations, and private enterprises.

Integration of AI and Machine Learning in Aerial Imaging

In the UK aerial imaging market, AI and machine learning are enabling quicker image processing, image object detection, and geospatial analytics. Automated mapping and predictive analysis help improve the accuracy of land classification, infrastructure assessment, and disaster response. Machine learning and deep learning models help significantly reduce the time taken to identify the patterns in aerial data, allowing industries like agriculture, urban, and defence to reap the benefits.

Another trend is that the use of AI-based software is on the rise for UAV and satellite imaging, lessening the need for manual data processing and supporting real-time strategic decisions. In light of the advancements in AI capabilities, the need for smart aerial imaging solutions is only predicted to increase, as commercial and government sectors utilize automation to enhance business efficiency and operational effectiveness.

Expansion of Cloud-Based Aerial Imaging Platforms

Cloud-based solutions enable the on-demand availability of commercial aerial imagery and are thus likely to grow at a significant rate in the UK aerial imaging industry. Such platforms allow for real-time sharing and processing of aerial data that would help various industries including agriculture, construction, and security. Cloud-based imaging innovations drive workflow efficiencies by providing multiple stakeholders access to, annotation and processing of high-resolution imagery from any location.

Furthermore, strong recent developments in cloud security and data encryption meet regulatory compliance requirements and promote adoption in the public and private sectors. Cloud-based aerial analatas will continue to grow in popularity, providing improved collaboration and streamlined decision-making based on real-time information as demand for geospatial intelligence grows.

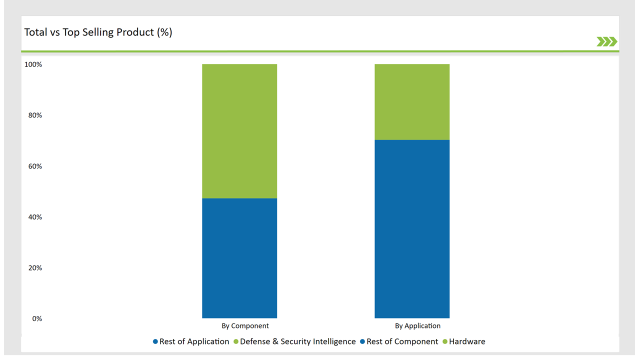

| Component | Market Share (2025) |

|---|---|

| Hardware | 52.80% |

| Services | 47.20% |

Based on the components, the hardware segment is anticipated to have the largest market share of 52.80% in the Germany aerial imaging market during 2025. Advancements in UAVs, high-resolution cameras, LiDAR sensors, and thermal imaging systems have been responsible for this dominance. Hardware adoption is also driven by the growing need for aerial data collection as it used in different field like agriculture, construction and defense.

| Application | Market Share (2025) |

|---|---|

| Defense & Security Intelligence | 29.80% |

| Others | 70.20% |

Germany's aerial imaging market is forecast to be dominated by the defense & security intelligence segment, which is estimated to account for 29.80% market share in 2025. High demand for high-resolution imaging, UAV-derived monitoring, as well as AI-driven geospatial analysis are driven by rising government investments in real-time surveillance at the borders, civil military reconnaissance, and detection of threats with ground imagery.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

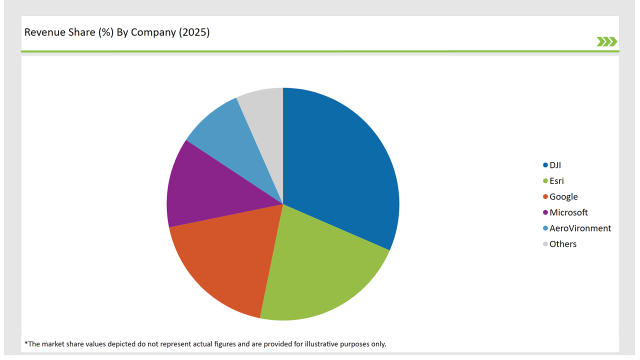

The major players in the UK Aerial Imaging Market are help for leveraging AI, cloud, and UAV technologies to differentiate their offerings. Companies such as DJI, Esri, Google, Microsoft and AeroVironment are dominating in market shares due to their expertise in aerial imaging and geospatial intelligence.

| Vendors | Market Share (2025) |

|---|---|

| DJI | 31.5% |

| Esri | 21.7% |

| 18.6% | |

| Microsoft | 12.5% |

| AeroVironment | 9.1% |

| Others | 6.6% |

Hardware, Software, and Services. Hardware leads due to advancements in UAV technology and high-resolution imaging sensors.

Defense & Security Intelligence, Geospatial Mapping, Urban Planning & Development, Disaster & Response Management, Energy & Natural Resource Management, and Others.

Government, Military & Defense, Agriculture & Forestry, Energy & Mining, Media & Entertainment, Construction & Engineering, and Others.

The UK Aerial Imaging Market will grow at a CAGR of 8.7% from 2025 to 2035.

By 2035, the industry is projected to reach USD 1,535.8 million.

Key drivers include AI-powered aerial imaging, increasing UAV adoption, and rising government investments in surveillance and security applications.

The Hardware segment holds the highest share at 52.8%, driven by technological advancements in UAVs and high-resolution imaging sensors.

Leading players include DJI, Esri, Google, Microsoft, and AeroVironment, along with emerging aerial imaging technology providers.

Explore Digital Transformation Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.