The UAE sustainable tourism market is transitioning from a small niche industry to a strong player in the global tourism market, driven by government efforts, eco-conscious travelers and advanced technology. This is due to the country’s focus on renewable energy, cultural preservation, and environmental protection - all tenets of a new age of sustainable tourism. Findings of 2035 prediction brochures forecast that responsible tourism models will be more welcomed in the upcoming years which will bring the tourism market to the next level.

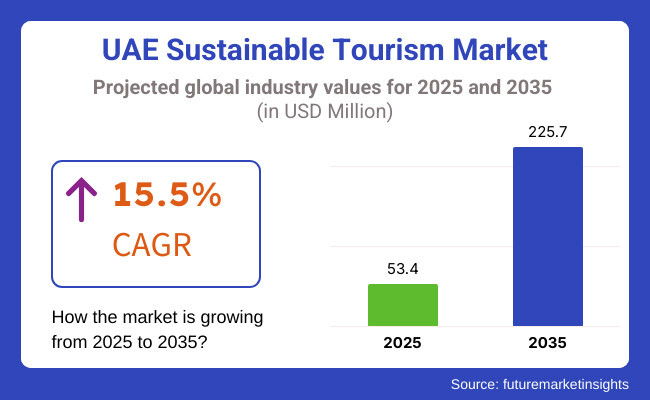

The market is anticipated to reach a valuation of approximately USD 225.7 Million by 2035, while growing at a rate of 15.5% during the forecast period.This sector continues to grow with continue government policies and investments from the private sector, which enables development of the balance of tourism while targeting tourism adapted for the environment.

The tourism industry can enhance sustainability when it integrates smart technologies, sustainable transport solutions, and renewable energy sources. Travel experiences that foster conservation and appreciation of cultures and nature are an ever-growing attraction for visitors.

On the whole the sustainable tourism market in the UAE is predicted to expand at an amazing rate, supported by government initiatives, growing awareness among travellers, and developments in green technologies.

Explore FMI!

Book a free demo

Focusing on green hospitality, transportation and infrastructure, Dubai has also taken the lead in the UAE’s sustainable tourism portfolio. The city promotes green hotels, sustainable architecture and nature-oriented activities such as the Dubai Desert Conservation Reserve.

Dubai’s sustainable tourism guide features carbon reduction, water conservation, and waste management. With the continued integration of renewable energy sources, and smart city technologies Dubai has established the global gold standard for responsible tourism, while never compromising its status as leading travel destination.

Abu Dhabi installed as center of cultural and enviro sustainability The emirate is dedicated to preserving heritage, wise urban development and sustainable tourism initiatives including Saadiyat Island, an upscale district in Abu Dhabi City that is home to a Zaha Hadid-designed Louvre Abu Dhabi, eco-development.

From energy-efficient buildings like the Sheikh Zayed Grand Mosque to sustainable waste practices at the Louvre Abu Dhabi, even major attractions use green practices. Recent Abu Dhabi investments in renewable energy and eco-tourism initiatives further render it a rightfully proud leader in sustainable tourism.

The Emirate of Sharjah has adopted a policy of eco-tourism and community-based tourism, with a focus on the preservation of natural and cultural factors. Kalba Eco-Tourism Project that consists of mangroves protection and wildlife conservation is one other sustainable development project.

The emirate encourages responsible tourism by caring for local artisans, preserving historic sites and encouraging community involvement. Such efforts are part of Sharjah’s wider drive to become recognized as a sustainable destination that successfully marries economic growth with environmental duty.

Adventure and nature-based sustainable tourism is a focus for Ras Al Khaimah. The emirate is committed to building environmentally conscious lodgings (among these will be mountain lodges and desert retreats with a low environmental footprint). Ras Al Khaimah’s focus on sustainability includes conservation projects in the Hajar Mountains and Jebel Jais, and wildlife protection initiatives. Its responsible adventure tourism angle appeals to environmentally-minded travellers looking for nature-based, immersive experiences.

Challenge

Reconstruction of the Infrastructure and Preservation of the Environment

Challenges include managing rapid urban expansion alongside sustainable development and ensuring that tourism in declining water availability does not compromise housing residents or environmentally sensitive areas alongside the virgin terrain. Faroe Islands has taken great steps towards a sustainable future with green procedures such as eco-friendly construction projects, green architecture and renewable energy investing.

Nonetheless, there remain challenges for high water and energy consumption, sustainable waste management, and verified ecological balance over time. To be sustainable, Companies and government institutions should connect green infrastructure, collect water saving parameters in tourism procedure, and integrate sustainable tourism.

Opportunity

Green and Sustainable Tourism and Growth in Eco-Tourism

The Sustainable and Eco-Conscious Global Tours and Travels Market is inching up, and the prospects for the UAE Sustainable Tourism Market have never been more substantial. Visitors are increasingly attracted to eco-resorts, desert conservation experiences and lodgings powered by renewable energy.

The growth of sustainable luxury travel - think eco-resort trips, carbon-neutral desert safaris and cultural preservation projects - is changing the industry. There are also partnerships being organized among government agencies, hospitality groups and conservation organizations to encourage responsible tourism. Sustainable hospitality, carbon-neutral experiences, and conservation-oriented tourism will be the pillars of the organizations responsible for driving the future of sustainable travel in the UAE.

The UAE Sustainable Tourism Market grew significantly between 2020 and 2024 due to government-led sustainability initiatives, increased awareness of eco-friendly travel, and the integration of green building practices in the tourism sector. The country implemented carbon-reduction regulations, environmentally responsible tourism initiatives and attractions powered by renewable energy.

Geopolitical tensions and rising fuel prices may help, but challenges remain around maintaining sustainability in extreme climates, reducing the carbon footprint of big tourism developments, and balancing tourism development with environmental protection. In response, businesses implemented water-efficient hospitality services, expanded eco-lodging, and adopted renewable energy solutions.

As we forecast 2025 to 2035, the market will see transformative developments through the growth of sustainable tourism hubs, technology-enabled energy-efficient travel infrastructure, and the wider implementation of zero-waste hospitality. A new “low-carbon luxury”-driven sector will emerge with the expansion of desert eco-lodges, green-certified urban hotels and eco-adventure suppliers.

The additional investment in carbon-offset programs, marine and desert conservation projects, and sustainable cultural tourism will enhance the UAE’s worldwide green tourism reputation further. The UAE Sustainable Tourism Market will evolve towards those companies whose foundation is green innovation, sustainable destination management, and eco-conscious guest experiences.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Adoption of green building codes and sustainability policy |

| Sustainable Tourism Growth | Rise of eco-friendly hotels, renewable energy-powered resorts and sustainable travel initiatives |

| Industry Adoption | Higher demand for sustainable hotels, conservation tours in desert, eco-sensible travel in the city |

| Supply Chain and Sourcing | Dependence on traditional hospitality supply chains and imported sustainable materials |

| Market Competition | Presence of luxury hospitality groups incorporating sustainability elements |

| Market Growth Drivers | Demand for environmentally conscious travel, government sustainability initiatives, and eco-luxury tourism |

| Sustainability and Energy Efficiency | Early adoption of renewable energy in tourism developments and green hotel certifications |

| Integration of Environmental Storytelling | Limited real-time education on eco-tourism impact |

| Advancements in Sustainable Tourism | Use of green certifications, eco-conscious hospitality services, and limited carbon reduction efforts |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Carbon-neutral tourism projects, regulations, and incentives for green tourism. |

| Sustainable Tourism Growth | Growth in zero-carbon hospitality, climate-conscious tourism infrastructure and sustainable adventure tourism |

| Industry Adoption | Expansion of green-certified resorts and eco-retreats are driving more immersive sustainable tourism experiences. |

| Supply Chain and Sourcing | Shift toward locally sourced eco-friendly materials, water conservation strategies, and renewable energy tourism projects. |

| Market Competition | Rise of fully carbon-neutral tourism companies, sustainability-focused travel agencies, and responsible tourism certification providers. |

| Market Growth Drivers | Increased investment in desert biodiversity conservation, sustainable cultural heritage tourism, and carbon-offset travel programs. |

| Sustainability and Energy Efficiency | Large-scale implementation of net-zero hotels, solar-powered tourism infrastructure, and sustainable transport solutions. |

| Integration of Environmental Storytelling | Increased emphasis on sustainable tourism education, guided eco-awareness tours, and conservation-focused visitor experiences. |

| Advancements in Sustainable Tourism | Evolution of net-zero tourism models, smart environmental monitoring, and fully sustainable tourism infrastructure. |

Northern UAE, including Ras Al Khaimah and Fujairah are quickly becoming a world-class destination for eco-tourism and nature-based travel with a lot of sustainable, eco-lodging and conservation-first experiences. The mountainous terrain and wadis, alongside unspoiled beaches ease travelers who enjoy low-impact adventure tourism and cultural heritage experiences.

The UAE government’s “Ras Al Khaimah Sustainable Tourism Strategy 2030” centres on carbon-neutral resorts, sustainable desert safaris and responsible wildlife tourism. The market is also being propelled by the launch of eco-resorts, sustainable hiking trails, and marine conservation programs.

| Region | CAGR (2025 to 2035) |

|---|---|

| Northern UAE | 16.2% |

The Northeast of the UAE, where you will find places such as Dibba, Kalba and Khor Fakkan, is fast becoming a haven for marine conservation tourism, eco-diving adventures and sustainable coastal excursions. A protected marine reserve, mangrove forests, and water sports that leave a soft footprint dot the region.

The region is witnessing the growth of green tours, carbon-neutral hotels and responsible experience through government-backed sustainability projects like the Kalba Eco-Tourism Hub. Wildlife conservation initiatives and mangrove reforestation projects are also generating interest in eco-tourism and biodiversity-themed travel.

| Region | CAGR (2025 to 2035) |

|---|---|

| North-eastern UAE | 15.8% |

The eastern UAE, especially Al Ain and its environs, is a hive of activity for heritage tourism, sustainable agritourism and desert conservation programs. The region’s emphasis on cultural preservation and sustainable desert tourism is a draw for sustainability-minded travelers.

Tips on Travelling Responsibly the Al Ain Oasis UNESCO World Heritage site and responsible desert safaris and eco-lodges are advocating low-impact tourism to the region. Moreover, the growth of sustainable farming projects and eco-resorts is propelling market expansion.

| Region | CAGR (2025 to 2035) |

|---|---|

| Eastern UAE | 15.9% |

Luxury eco-tourism, responsible wildlife safaris and desert sustainability programs in the southern UAE, especially in conservation areas and desert regions, are becoming top of mind. In the desert, the Dubai Desert Conservation Reserve (DDCR) and Al Marmoom Desert Conservation Reserve are spearheading low-impact tourism and protecting biodiversity.

Together, high-end desert resorts are adopting carbon-neutral initiatives as well as eco-friendly adventure tourism (including camel trekking, star-gazing tourism, and safari experiences with a focus on conservation) make Southern UAE a leading sustainable tourism destination.

| Region | CAGR (2025 to 2035) |

|---|---|

| Southern UAE | 16.1% |

Exclusive sustainable tourism and eco-adventure experiences are booming in the Southwestern UAE, which includes some areas bordering the Rub' al Khali (Empty Quarter). Now, the region’s untouched desert vistas and off-the-grid tourism offerings are drawing luxury travelers and adventure seekers.

With eco-conscious travel surging, and high-net-worth sustainable tourism booming, this region is focusing on desert eco-resorts, renewable energy-powered accommodations and sustainable exploration tours.

| Region | CAGR (2025 to 2035) |

|---|---|

| Southwestern UAE | 15.7% |

North-western emirates of UAE or particularly its combined Abu Dhabi region which lead sustainable urban tourism, cultural heritage tourism, and eco-friendly hospitality projects. Abu Dhabi, VAE: Abu Dhabi’s sustainability initiatives, such as Masdar City (the world’s first planned sustainable city), lead innovations in smart and sustainable travel.

The proliferation of eco-friendly luxury hotels, sustainable cultural tourism and green transport options are solidifying Abu Dhabi’s position as a global benchmark for sustainable urban tourism. The growing number of eco-friendly theme parks, smart city tourism, and carbon-neutral festivals is creating further growth opportunities for the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| North-western UAE | 16.3% |

The rising demand for eco-friendly travel experiences and nature-based tourism segments from both regional and international travelers, eco-tourism and green tourism segments account for a major share of the UAE sustainable tourism market during the forecast period. Such sustainable tourism activities are helping to fortify the UAE’s reputation as a global leader in sustainable tourism, protect pristine natural ecosystems, and reduce the environmental impact of travel, making them a necessity for hoteliers, tour operators, government tourism authorities, and sustainability-conscious investors alike.

Eco-tourism is one of the fastest-growing sectors in the UAE’s sustainable tourism category that has been experiencing a boom recently as being an eco-tourist gives travelers close insight into the rich natural environment available to tour in the country from deserts, to mountains, coastal areas and even wildlife reserves. Eco-tourism, unlike traditional tourism, places emphasis on environmental sustainability, responsible travel habits, and community-managed tourism programs.

Demand through protected nature reserves like Al Marmoom Desert Conservation Reserve, Al Wathba Wetland Reserve, Sir Bani Yas Island and the Hatta Mountain Conservation Area has also driven up market adoption as eco-conscious travelers search for outdoor experiences that harmonize with sustainability principles. Over 65% of international visitors to the UAE participate in one or more eco-tourism activities during their visit, creating a strong demand for this type of tourism segment according to several studies.

Structured eco-tourism experiences known as desert safari eco-lodges, mangrove kayaking tours, and wildlife conservation programs are becoming more abundant, thus enhancing market demand by creating greater accessibility and participation in nature-based tourism.

This increased adoption has been further bolstered by the integration of digital eco-tourism platforms with the likes of AI-powered travel guides, real-time wildlife tracking applications and online conservation donation portals for seamless eco-tourism planning and engagement.

First of all, the optimization of market growth, more active development of sustainable adventure tourism, solar power desert camps, off-grid eco resort, low-impact hiking trails, so that adventure travelers and sustainability advocates more popular.

The market expansion has also been reinforced via the adoption of eco-friendly infrastructure (inclusive of green-certified hotels, zero-emission transportation options to enable nature tours, and waste-free camping initiatives), ensuring better alignment with global eco-tourism standards.

While eco-tourism has clear benefits for preserving the environment and cultures in the long run, this segment also faces hurdles to overcome, such as the high cost of operation for conservation sites, pressure on sensitive ecosystems from over-tourism, and the need for stronger regulations around eco-tourism. For example, new technologies such as AI-powered environmental monitoring tools, blockchain-based sustainable tourism certifications, and smart tracking of eco-friendly traveller behaviour are enhancing efficiency, sustainability, and responsible travel practices, which will facilitate ongoing growth in the eco-tourism sector within UAE and the rest of global destinations.

The UAE is investing in the infrastructure needed to support low-carbon tourism, as well as developing green-certified resorts and renewable energy-powered tourism destinations: Green tourism has achieved strong market penetration among eco-friendly travelers, sustainability oriented organisations and green-minded hospitality providers. Green tourism, on the other hand, focuses on energy efficiency, waste reduction, and carbon-neutral tourism experiences, unlike conventional tourism.

Visitors want their tourism experience, including hotels and resorts, to align with sustainability initiatives resulting in the adoption of green tourism, of which Al Maha Desert Resort, The Sustainable City in Dubai and JA Hatta Fort Hotel are becoming increasingly popular. The latest study reflects that more than 50% of UAE’s hotel developments are aligned with green building practices and sustainability certifications built in, thus exhibiting healthy demand for this segment.

Availability of solar-powered transport service, electric vehicles (EV) rentals for tourists, and energy-efficient tourism infrastructure are some of the other initiatives contributing toward carbon-neutral travel projects and increased market demand ensuring adoption of green tourism in hospitality and travel segment.

AI-powered sustainability tracking, such as real-time carbon footprint tracking, AI energy efficiency recommendations for hotels, and eco certification verification systems have further accelerated the adoption and raising user awareness on the real experiences on the platform, increasing transparency in green tourism.

The emergence of eco-luxury tourism, including zero-waste fine dining, sustenance luxury spa resorts, and plastic-free tourism experiences, has maximized market growth, enhancing the affinity of high-net-worth travelers for premium sustainable tourism products.

Green aviation (the use of biofuels to power flights, net-zero airport infrastructure, carbon-offsetting programs for international travel, etc.) and sustainable airport initiatives have encouraged greater alignment with carbon reduction initiatives in the wider travel market.

Although it offers benefits in terms of energy efficiency, carbon footprint reduction, and improving the sustainability of long-term tourism as well, the green tourism segment faces several challenges, including high implementation costs, regulatory inconsistency across tourism operators, and a general lack of awareness among the public regarding green travel practices. Nonetheless, newer innovations, such as AI-based intelligent management of tourism, blockchain-verified carbon credit purchases for travelers, and continuing global eco-tourism efforts facilitate improved efficacy, scalability, and sustainable impact in an ecosystem that is set to thrive evermore in the UAE’s sustainable tourism environment.

The segments of online booking and in-person booking account for two of the key market dynamics, as sustainable tourists increasingly marry digital convenience with on-the-ground experiential decision-making when planning their travels.

The online booking segment has become one of the most common approaches for sustainable travel reservation, enabling green hotels, eco-tours, and carbon-neutral transportation to be pre-booked through digital platforms, OTAs & AI driven travel planners, by sustainable-minded travelers. Online platforms give you instantaneous sustainability scores, AI-driven itinerary optimization, and carbon footprint tracking, unlike conventional travel booking.

Online booking has been boosted as travelers increasingly demand AI-driven travel sustainability insights with features such as eco-friendly hotel ranking systems based on machine learning, green-certified tour operator listings and options for digital carbon-offsetting credits to travel, as well as the need for transparency and environmental accountability on behalf of the sustainable traveller.

Research shows that now more than 75% of sustainable tourism in the UAE book their green trip experiences through digital platforms which means there is a demand for this market.

While online booking is now considered superior because it increases access to availability, supports AI-driven personalization, and allows for immediately actionable insights on sustainability, it is still not without negatives including cybersecurity risks, lack of standardized eco-certifications, and disparate sustainability reporting from travel operators.

Nonetheless, recent breakthroughs in various sectors like Blockchain-based sustainability authenticity, Artificial Intelligence-based dynamic pricing for green hospitality and real-time carbon footprint monitoring for airlines and hospitality establish a brand-new episode of reasonableness, safety and customer satisfaction, safeguarding the dining table growth possibility for UAE online sustainable tourism reservations.

Market adoption of the on-the-go booking portion has been especially strong among experiential travelers, last-minute eco-tourists, and sustainable experience seekers as eco-tourists become more reliant on site-specific insights, last-minute advice, and immersive decision-making. In-person reservations allow travelers to scout real-time sustainable options and patronize locally owned eco-friendly businesses, in, say, Coconut Grove in Miami, rather than digital booking that was pre-planned.

The demand for flexible, on-the-ground, sustainable experiences with walk-in eco-tours, pop-up sustainable dining and real-time bookings for community-based tourism experiences has led to the continued adoption of in-person booking as travelers seek out spontaneous, authentic and low-impact travel options.

While in-person booking is superior in terms of spontaneity, part of the unique experience of travel, cultural engagement with locals and flexibility, it has disadvantages like limited availability for high-demand eco-lodges, pricing inconsistency, and lack of sustainability verification for last minute bookings. Still, new technologies - AI-generated local sustainability maps, create real-time availability tracking of green-certified hotels, and blockchain-based dynamic pricing for walk-in visitors, among others - facilitate efficiency, make local sustainability impacts more accessible, and drive the field’s sustainability and impact growth, which means the book-in person will continue to grow in the UAE sustainable tourism eco-system.

Increasing demand for eco-friendly travel, green hospitality and sustainable tourism initiatives observed in UAE due to the goals of Vision 2030 & Net Zero 2050 are driving the UAE sustainable tourism market. Another critical part of sustainable travel is the aspect of sustainability, cultural heritage conservation, and responsible tourism. This market consists of various entities from government tourism boards to luxury eco-resorts and travel aggregators, as well as hospitality brands, all which play a role in creating smart tourism parks, sustainable infrastructure and AI-generated carbon footprints.

Market Share Analysis by Key Players & Eco-Tourism Facilitators

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Dubai Sustainable Tourism (DST) - Dubai Tourism Board Initiative | 20-25% |

| Abu Dhabi Department of Culture & Tourism (Eco-Tourism Programs) | 12-16% |

| Masdar City (Sustainable Urban Tourism & Smart Green City) | 10-14% |

| The Green Planet Dubai (Eco-Experiential Tourism Destination) | 8-12% |

| Anantara Hotels, Resorts & Spas (Luxury Sustainable Resorts) | 5-9% |

| Other Hospitality Brands & Eco-Tourism Operators (combined) | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Dubai Sustainable Tourism (DST) | Leads government-backed green tourism policies, smart carbon footprint tracking, and eco-tourism regulations. |

| Abu Dhabi Department of Culture & Tourism | Develops nature-based tourism experiences, desert conservation programs, and cultural sustainability initiatives. |

| Masdar City | Focuses on sustainable urban tourism, AI-powered green energy infrastructure, and eco-friendly transport systems. |

| The Green Planet Dubai | Provides eco-conscious travel experiences, rainforest conservation awareness, and immersive sustainability education. |

| Anantara Hotels & Resorts | Specializes in luxury eco-tourism experiences, sustainable resort operations, and marine conservation projects. |

Key Market Insights

Dubai Sustainable Tourism (DST) (20-25%)

Leading the way in this emerging sector is the UAE Sustainable Tourism (DST) initiative a drive to implement eco travel policies, AI integrated carbon trackers, as well as smart green hospitality technologies.

Abu Dhabi Department of Culture & Tourism (12-16%)

Abu Dhabi is focused on innovation in eco-tourism development, ensuring nature-based tourism development and smart sustainability-focused visitor/tourism experiences.

Masdar City (10-14%)

With AI-powered energy savings, zero net places to stay, sustainable infrastructure, Masdar City is leading the way in smart green tourism of cities.

The Green Planet Dubai (8-12%)

Through the training of our AI on rainforest conservation awareness and sustainability education, the Green Planet Dubai provides eco-experiential tourism for all guests.

Anantara Hotels & Resorts (5-9%)

Anantara builds luxury eco-tourism resorts, including marine conservation projects and stays that are carbon-neutral and eco-friendly luxuries.

Other Key Players (30-40% Combined)

Next generation green tourism innovations, machine learning trip travel sustainability tools and smart carbon-offset products are all possible thanks to a number of sustainable travel agencies, luxury hospitality brands and eco-tourism facilitators. These include:

The overall market size for UAE sustainable tourism market was USD 53.4 Million in 2025.

The UAE sustainable tourism market expected to reach USD 225.7 Million in 2035.

The demand for the UAE’s sustainable tourism market will be driven by government initiatives promoting eco-friendly travel, increasing investment in green infrastructure, rising awareness of sustainable practices, growth in eco-tourism experiences, and the adoption of renewable energy solutions in hospitality and tourism sectors.

The top 5 countries which drives the development of UAE sustainable tourism market are USA, UK, Europe Union, Japan and South Korea.

Eco-Tourism and Green Tourism Growth to command significant share over the assessment period.

Evaluating Social Media and Destination Market Share & Provider Insights

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Key Players & Market Share in the Spa Resort Industry

Analyzing Surrogacy Tourism Market Share & Industry Leaders

China Destination Wedding Market Insights – Growth & Forecast 2025-2035

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.