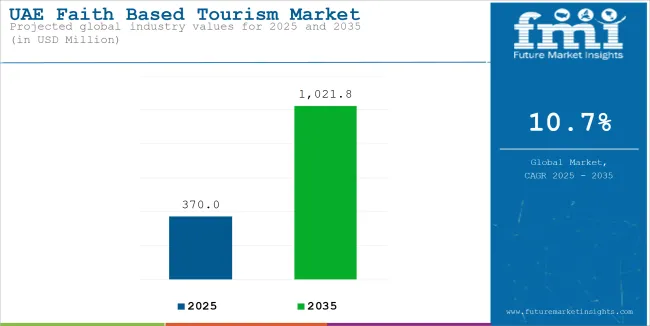

The UAE Faith Based Tourism Market is expected to increase from USD 369.3 million in 2025 to USD 1,021.8 million by 2035, at a 10.7% CAGR from 2025 to 2035.

The UAE is an exceptional blend of historical traditions and cutting-edge modernity, celebrated for its top-tier infrastructure, soaring skyscrapers, and luxurious way of life. However, it is also deeply connected to its cultural roots, where values like hospitality, family, and faith are central to daily existence. These attributes has proved vital for UAE’s tourism industry in general and faith-based tourism industry in particular.

| Attribute | Key Insights |

|---|---|

| Estimated UAE Faith Based Tourism Market Size (2024) | USD 334.2 Million |

| Projected Market Size (2035) | USD 1,021.8 Million |

| Value-based CAGR (2025 to 2035) | 10.7% |

| Top Players Share in 2024 | 15% to 20% |

During the period 2020 to 2024, the sales grew at a CAGR of 11.3%, and it is projected to continue to grow at a CAGR of 10.7% during the forecast period of 2025-35. Faith-based tourism industry in UAE has been growing with the strategic initiatives by key stakeholders, which includes the following:

Strategic Infrastructure Development

The UAE has invested heavily in religious tourism infrastructure. The Sharjah Mosque, which was completed in 2019 and can accommodate 25,000 worshippers, is now a popular destination that has attracted more than 1 million visitors in 2023. The Mohammed bin Rashid Library in Dubai, which contains one of the largest collections of Islamic texts and manuscripts, attracted 400,000 visitors in its first year of operation, significantly contributing to Islamic cultural tourism.

Interfaith Initiatives

It includes the construction of the Abrahamic Family House, a place with a mosque, church, and synagogue under one roof. Diverse religious tourists have visited the complex. The number of visitors since opening has exceeded 50,000 monthly, evidencing the commitment of the UAE to religious pluralism and tolerance.

Investment in Religious Events

The key religious events have also spurred the growth of tourism. For example, the Dubai International Holy Quran Award has attracted participants from over 100 countries each year. Thousands of delegates attend the International Islamic Economic Summit held in the UAE interested in Islamic finance and halal tourism.

Innovative Religious Tourism Products in UAE Pushing the Market Forward

The country has cultivated niche religious tourism products. Sharjah's "Islamic Culture Capital" initiative brought forth themed Islamic heritage tours that combine the visitation of historical mosques with informative workshops on calligraphy and Islamic architecture. This type of tour experienced a 70% surge in international attendance between 2022 and 2023.

Digital Integration Further Increasing Revenue through Niche Tourists

The UAE has employed technology to transform religious tourism. The "Digital Hajj Services" is the newly introduced online platform launched by Dubai for organizing Hajj and Umrah travel; it was servicing more than 100,000 pilgrims during 2023. The application of virtual tours at Jumeirah Mosque in Dubai will allow people to experience the richness of Islamic architecture and history in an immersive fashion.

Culinary Traditions Merged with Faith-based Tourism Enhance the Impact of Tourism Marketing Campaigns in UAE

Emirati cuisine has been shaped by the desert landscape and proximity to the sea. It is characterized as rather simple yet delicious dishes such as rice, fish, lamb, and dates. Two of the more popular traditional Emirati dishes are Machboos, which is spiced rice dish with meat or fish, and Harees, which is slow-cooked wheat and meat.

Gahwa, Arabic coffee, welcomes the tourists, as they consume the intense, cardamom- and saffron-flavored beverage from small cups during their discussions.

Emirati culinary traditions are influenced by a large number of expatriate communities that inhabit the country. The result is that the food scene has been very rich and diverse. While traditional Emirati dishes are important to the culture, the UAE also boasts the world's top restaurants serving a wide variety of cuisines.

Accommodation and Pricing Pressures

Religious tourism has been largely seasonal in UAE, and this seasonality has brought about a significant price volatility in the hospitality sector. During major religious events and festivals, hotel prices in Dubai and Abu Dhabi have increased by up to 200%, which could discourage budget-sensitive religious tourists. The scarcity of mid-range Shariah-compliant hotels has made accommodation for religious tourists even more challenging.

Workforce Development Challenges

There is a severe lack of competent religious tourism guides with both theological knowledge and modern skills in tourism management in UAE. Religious destinations and tour operators report problems recruiting staff who could effectively communicate the religious and cultural contexts to a very diverse international visiting public while meeting professional standards for tourism.

Personalized Religious Experiences

UAE-based travel agencies have been developing tailored religious tourism experiences according to various schools of Islamic thought and practice. This trend is most notable in Dubai, where tour operators create specific packages of religious activities intertwined with cultural ones that match the religious interpretations and preferences of visitors.

Multi-Faith Tourism Integration

Other than Islamic sites, the faith-based tourism sector in the UAE is also expanding its religious tourism packages beyond them. For instance, The Abrahamic Family House has been catalyzing a new trend in multi-faith tourism. With Abrahamic Family House, tour operators developed interfaith dialogue programs and cultural exchange initiatives.

Jumeirah Mosque, Masjid Sheikha Misa Bint Rashid, Al Farooq Omar Bin Al Khattab Mosque And Centre, Sheikh Mohammed Bin Salim Al Qasimi Mosque, and Sheikh Zayed Mosque are the key places in UAE that attracts numerous tourists every year. To offer ease and convenience to pilgrims, UAE has implemented several programs that promote pilgrims to stay longer.

Dubai's "Religious Tourism Plus" initiative combines pilgrimage travel with luxury shopping and cultural experiences and has increased average pilgrim stay duration from two to five days. This extension has significantly boosted revenue from accommodation, dining, and retail spending. Owing to this, pilgrimages account for over 30% revenue in UAE faith-based tourism sector.

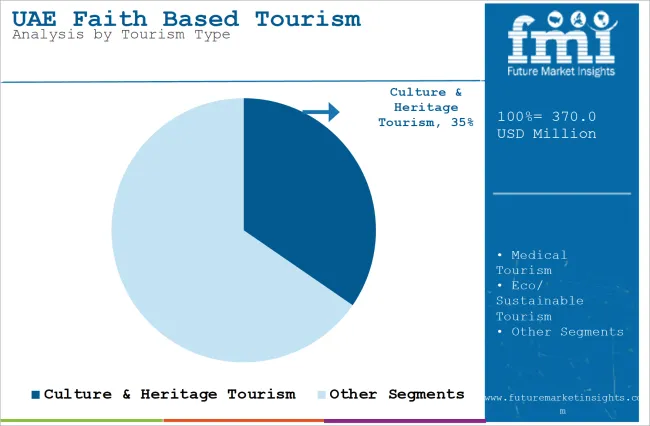

| Segment | Tourism Type (Pilgrimages) |

|---|---|

| Value Share (2024) | 34.6% |

There are several package tours available in most countries with significant Muslim population. While package tours generate a pooled revenue to the travel agencies and hotels alike, they are also beneficial for individual tourists as per person cost comes down significantly due to several discounts. Faith-based tourism revenue through package travellers in UAE account for over 40% of the total revenue.

| Segment | Tour Type (Package Travelers) |

|---|---|

| Value Share (2024) | 43.2% |

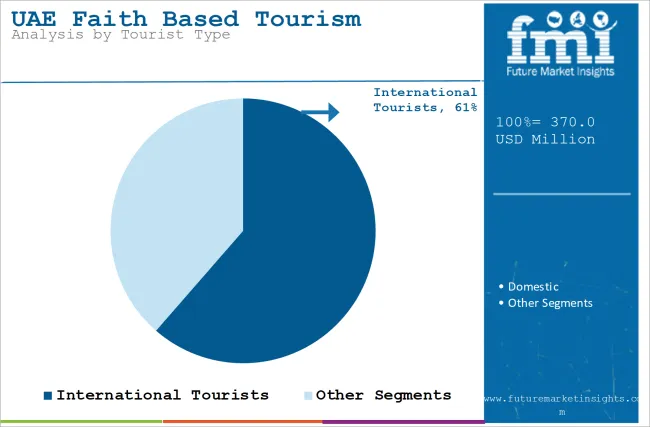

International tourists add more than 60% of the revenue generated in UAE faith-based tourism industry. The international tourists visit UAE for faith-based tourism, especially during festive seasons and generate significant revenues during the occasion. UAE also does significant expenditure in welcoming and hospitality of the faith-based tourists to promote their tour recurrence.

| Segment | Tourist Type (International Tourists) |

|---|---|

| Value Share (2024) | 61.4% |

Competitors in the UAE Faith-based tourism industry have been focusing on partnerships and expansion. This is done in order to meet the demand from increasing number of tourists in the country.

Table 1: Market Value (US$ Million) Forecast by Tourism Type, 2018 to 2033

Table 2: Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 3: Market Value (US$ Million) Forecast by Tour Type , 2018 to 2033

Table 4: Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 5: Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 6: Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Figure 1 :UAE Faith Based Tourism Market Value (US$ Million) by Tourism Type, 2023 to 2033

Figure 2 :UAE Faith Based Tourism Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 3 :UAE Faith Based Tourism Market Value (US$ Million) by Tour Type , 2023 to 2033

Figure 4 :UAE Faith Based Tourism Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 5 :UAE Faith Based Tourism Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 6 :UAE Faith Based Tourism Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 7 :UAE Faith Based Tourism Market Value (US$ Million) Analysis by Tourism Type, 2018 to 2033

Figure 8 :UAE Faith Based Tourism Market Value Share (%) and BPS Analysis by Tourism Type, 2023 to 2033

Figure 9 :UAE Faith Based Tourism Market Y-o-Y Growth (%) Projections by Tourism Type, 2023 to 2033

Figure 10 :UAE Faith Based Tourism Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 11 :UAE Faith Based Tourism Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 12 :UAE Faith Based Tourism Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 13 :UAE Faith Based Tourism Market Value (US$ Million) Analysis by Tour Type , 2018 to 2033

Figure 14 :UAE Faith Based Tourism Market Value Share (%) and BPS Analysis by Tour Type , 2023 to 2033

Figure 15 :UAE Faith Based Tourism Market Y-o-Y Growth (%) Projections by Tour Type , 2023 to 2033

Figure 16 :UAE Faith Based Tourism Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 17 :UAE Faith Based Tourism Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 18 :UAE Faith Based Tourism Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 19 :UAE Faith Based Tourism Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 20 :UAE Faith Based Tourism Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 21 :UAE Faith Based Tourism Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 22 :UAE Faith Based Tourism Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 23 :UAE Faith Based Tourism Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 24 :UAE Faith Based Tourism Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 25 :UAE Faith Based Tourism Market Attractiveness by Tourism Type, 2023 to 2033

Figure 26 :UAE Faith Based Tourism Market Attractiveness by Tourist Type, 2023 to 2033

Figure 27 :UAE Faith Based Tourism Market Attractiveness by Tour Type , 2023 to 2033

Figure 28 :UAE Faith Based Tourism Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 29 :UAE Faith Based Tourism Market Attractiveness by Age Group, 2023 to 2033

Figure 30 :UAE Faith Based Tourism Market Attractiveness by Booking Channel, 2023 to 2033

The market is expected to reach USD 1,021.8 million by 2035.

From 2020 to 2024, the market expanded at 11.3% CAGR.

Day trips and local gateways are mostly preferred by domestic tourists in UAE.

Online booking will account for the significant market revenue by 2035.

The market rose at a CAGR of 10.7% from 2025 to 2035.

Several interfaith initiatives are being taken by the UAE government to promote faith-based tourism industry.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA