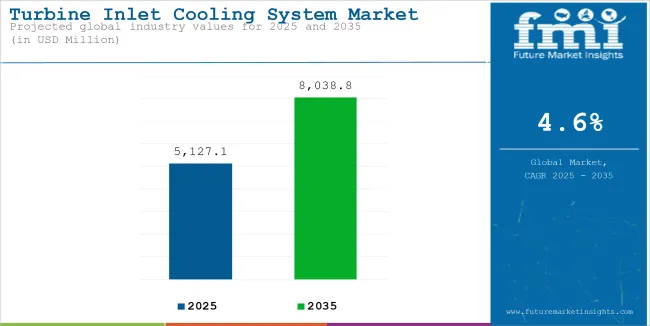

Global sales of turbine inlet cooling system were reported at USD 4,283.8 million in 2020. The market is anticipated to register a year on year growth of 3.6% in the year 2024, thus, leading to a market size of USD 5,127.1 million by end of 2025. During the assessment period (2025 to 2035), the market is projected to record a CAGR of 4.6% and reach USD 8,038.8 million by 2035.

Globally, the energy demand is increasing on a substantial rate owing to the rapid development of industries, urbanization, and the significant investments in development of renewable energy sources. Gas turbines primarily offer significant advantages due to compatibility, capability, efficient power generation, and their reliability to withstand increased loads in periods of high utility demands.

Operations of these turbines is largely affected by quality of ambient air temperatures. Turbine Inlet Cooling (TIC) systems are utilized and installed to enhance efficiency by maintaining desired temperature parameters and thus, reduce operational costs while ensuring constant power output.

| Attributes | Key Insights |

|---|---|

| Market Value, 2025 | USD 5,127.1 million |

| Market Value, 2035 | USD 8,038.8 million |

| Value CAGR (2025 to 2035) | 4.6% |

Turbine Inlet Cooling (TIC) systems are the key to the modernization of power generation, especially in the case of commercial and hybrid power plants. Apart from boosting the turbine efficiency, and, consequently, diminishing the emissions, TIC systems also help to stabilize the grid by absorbing the fluctuations from the renewable source of energy and, thus, enabling a reliable energy supply and cost-effective operations.

The modular design of the TIC system allows to achieve space savings in captive power plants and the optimization of the infrastructure without the necessity of a large expansion project.

Besides, the TIC installations in already existing facilities not only improve fuel efficiency but they also fulfil the newly established environmental regulations and provide a sustainable alternative to the construction of new facilities. Use of stainless steel in their design guarantees a lifetime of low-maintenance operation. Thus, these TIC systems ensure a smooth transition to a more eco-friendly, efficient, and reliable energy supply.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global Turbine Inlet Cooling System market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 3.9%, followed by a slightly higher growth rate of 4.1% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 3.9% (2024 to 2034) |

| H2 | 4.1% (2024 to 2034) |

| H1 | 4.3% (2025 to 2035) |

| H2 | 4.6% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 4.3% in the first half and remain relatively moderate at 4.6% in the second half. In the first half (H1) the market witnessed an increase of 40 BPS while in the second half (H2), the market witnessed an increase of 50 BPS.

Achieving Grid Dependability in Commercial Power Generation through TIC systems

TIC systems play a vital role in ensuring grid stability, particularly in regions where contribution of variable renewable energy sources like wind and solar is substantial to the total power generation. The operational reliability offered by these systems enable plants to maintain uninterrupted supply of energy throughput.

TIC systems further contribute to revenue growth by allowing plants to operate at greater utilization rate thus adding to power output during the course of peak demand fluctuations. For instance, a power plant can increase capacity by minimum 10% using TIC systems, enabling it to secure profitable contracts and expand its customer base.

These advantages illustrate how TIC systems not only improve operational efficiency but also drive sales growth by helping power plants meet energy demands reliably, cost-effectively, and with greater market competitiveness. These features with demonstrated use cases are expected to drive installation of these systems in commercial applications in near future.

Turbine Inlet Cooling Systems Help in Optimizing Space Utilization in Captive Power Generation Set-ups

The implementation of Turbine Inlet Cooling (TIC) systems in captive power plants is a revolution that provides both space- and energy-efficient solutions along with their adaptability to different process heat requirements. Many manufacturing, pharmaceutical, and refinery companies often operate in confined space areas where expansion of big infrastructures is not a practical option.

The modular and scalable designs offered by TIC systems solve this issue as they effortlessly get along with the already existing ones. The compactness of this arrangement allows the efficient cooling and better turbine performance without the need for land space or major infrastructure investment.

Apart from spatial economy, TIC systems are a great channel for utility of cogeneration plants. These plants, which generate both heating and electrical power, can use TIC systems in the combination of absorption chillers to effectively make use of waste heat.

This two-in-one feature is not only to cool the turbine inlet air but it also contributes to the processes that usually need heating or cooling. Through this, waste heat is used more effectively for cooling or for other operations, thus TIC systems result in the enhancement of the whole plant productivity, reduction of energy use, thus saving costs.

Retrofitting Power Plants with TIC Systems: Boosting Efficiency and Reducing Carbon Footprints

The installation of Turbine Inlet Cooling (TIC) systems incurs a large amount of initial capital costs but their benefits often outweigh these costs, especially in retrofitting. Retrofits of TIC systems in existing power plants often involve structural modifications and integration downtime, which end up increasing entire cost. On the flipside, benefits achieved such as increased power output of the plant, fuel efficiency, and reduced emissions lead to a considerable ROI.

The operational reliability and the better performance which the retrofitting of TIC brings to plants in high-demand and extreme weather situations make it worth the cost; in fact, a lot of installations manage to achieve cost recovery in a short time.

In the current period securing funds, environment clearance as well as permit to build new power plants is becoming cumbersome. In such circumstances, retrofitting the existing facilities with advanced technologies offer practical and sustainable alternatives. Installation of TIC not only improves efficiency, but it also conforms to the rules framed to promote environmental quality, being, therefore, a suitable option in the carbon-reductive regulatory setting.

TIC systems offer practicality in addressing the modern energy requirements and enable power plants to reduce peak loads with better efficiency, stabilization of the grid, and lower operational costs. Even with the high initial outlay, their long-term return on investment will drive their installations for energy production maximization in near future.

Advanced Materials like Stainless Steel and Copper Alloys Ensure Safe TIC System Design for Harsh Conditions

Use of materials such as carbon steel, stainless steel, and copper alloys for the design of Turbine Inlet Cooling (TIC) systems directly impact on reliability and durability of these systems in very stringent power plant environments. These materials offer excellent resistance to corrosion, extreme temperatures, and humid operating conditions.

These qualities impact on the service life and it helps in minimizing maintenance cost. This combination of high performance and cost savings leads manufacturers to utilize advanced materials in design of these turbine inlet cooling systems.

These systems made of high quality advanced materials help in meeting international rules and compliances outlined by agencies such as ASME, TEMA, and SQLO, which certify the equipment for usage. These certificates serve as evidence of compliance with stringent safety, quality, and operational criteria.

TIC systems provide operators and stakeholders with the surety that the devices will run properly under legally mandated conditions. Moreover, the conformity with these standards is easies out the approval process for the regulatory authorities in those areas where the environmental and safety regulations are particularly strict.

The robust design guarantees that turbine inlet cooling systems achieve reliability, cost savings, and operational efficiency. These systems are integral to retrofits and installations, ensuring both functionality and success. By incorporating technical advancements and meeting regulatory requirements, TIC systems have become a cornerstone of energy efficiency, making them an indispensable solution for sustainable and green power generation.

Increasing Adoption of Turbine Inlet Cooling Systems in Hybrid Power Plants

Hybrid power plants that combine renewable energy sources, such as solar or wind, with gas turbines are emerging as a practical solution to address the challenges of energy demand and grid stability. In the setups Turbine Inlet Cooling (TIC) systems are the key components.

Due to water vapour content present in the inlet air, TIC systems cooling intercoolers gain more cooling power resulting in more power output and less fuel intake. The hybrid plants, are flexible and maintain reliable balance for the intermittency of renewable sources and sustainable energy provision.

Natural gas, along with the wind and solar source, is considered as the most acceptable commercial energy option due to its lower carbon emissions compared to coal. TIC systems further optimize this transition by improving gas turbine efficiency, reducing emissions, and supporting environmental goals. TIC systems make hybrid power plants a greener alternative to be in line with global trends of decreasing reliance on fossil fuel use and lower environmental impacts.

Given that hybrid power plants are the best option for the transition to more of renewable energy by these technologies, they stand as a prima facie solution to address energy demand as well as reduce environmental impacts. In addition to that, TIC systems not only increase the performance of these plants but also support development of hybrid energy infrastructure.

Between 2020 and 2024, the global Turbine Inlet Cooling System sales experienced steady growth, expanding at a compound annual rate of 3.6% and reaching a market value of USD 4,948.9 million in 2024, up from USD 4,283.8 million in 2020. During the historical period, the market primarily experienced growth from retrofit and upgradation activities.

From 2025 to 2035 the market is expected to gain momentum and exhibit a CAGR of 4.6% over the same period. This growth is primarily attributed to the fact that various governments across the globe have targeted to mitigate carbon emissions and upgrade power generation facilities with advanced technologies that aid in efficiency gain. Considerable investments in the energy efficiency and renewable energy technologies are expected to be the key drivers contributing to rapid growth over the forecast period.

The market for turbine inlet cooling system is fairly concentrated with established players collectively commanding about 50% of the overall market. These technologies are capital intensive and require technological expertise and proven use-cases for end-user acceptance.

These companies also benefit from their ability to customize solutions, driving their dominance in high-demand regions like North America, the Middle East, and Asia-Pacific. These companies are referred as Tier-I players in the assessment. Examples of such players include Mee Industries, Johnson Controls, and TAS Turbine Inlet Chilling.

The next level of players collectively constitute about 25 to 30% of the market. These companies operate in specific regions and their offerings are limited to certain technologies or have niche specifications. These companies are referred as Tier-II players in the market assessment. Examples of such companies include ARANER and Stellar Energy.

The remaining share of the market is captured by smaller and specialized companies. These players focus on specific technologies or localized markets, such as smaller industrial setups or captive power generation. They often leverage flexibility and competitive pricing to compete effectively with larger firms. These companies are referred as Tier-III players in the market assessment. Examples of such companies include Caldwell Energy and PowerServ.

The countries that lead in adopting Turbine Inlet Cooling systems include USA, India, China, Saudi Arabia, and Germany which is primarily related to their priority of energy efficiency, renewable integration, and infrastructure modernization.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

| India | 5.8% |

| China | 5.5% |

| Saudi Arabia | 6.1% |

| Germany | 3.5% |

Power sector in China is witnessing a rapid change in the recent years. In 2023, China accounted for about one-third of energy related carbon emissions in the world. To address this issue, China aims to alter its power mix .i.e. the country aims to increase the contribution of renewables from current levels of 30% to 55% by 2035 and further 88% by 2050.

These aggressive targets will require a systemic change in the current format of the industry in China. As China is looking forward to prioritize energy security and stabilize its energy development strategy, it is believed that greater emphasis will be towards clean energy generation, energy loss mitigation, efficiency enhancement and moving towards cleaner burning fuel source and hybrid power generation.

In accordance to the same, it is anticipated that demand for clean energy technologies including turbine inlet cooling system will garner more focus and attention from the power producers in the country indicating to a strong market potential for these technologies in the market.

The power industry in Germany is characterized by use of renewable energy and high environmental standards. Notably, Germany is world-renowned for its successful energy transition, which it has been through since the decision to eliminate the use of the fossil fuel coal and nuclear energy sources, and give more priority to renewables, such as wind and solar.

But, the random nature of these energy sources does not get easy for grid stability, and it is often necessary for the gas turbines to be used in hybrid power systems in order to ensure the reliable energy supply during the peak demand period or when there is a fluctuation in renewable generation.

The turbine inlet cooling (TIC) systems are one of the important elements in this arrangement that maximize the efficiency and output of gas turbines through enhancing the air intake process. TIC systems such as advanced fogging and evaporative cooling technologies have been proven to reduce the turbine heat rates and emissions besides, achieving the very same objectives Germany has for the environment.

The adoption of TIC systems is a part of the initiative to ensure reliable integration of gas turbines into hybrid energy solutions, as the country is focused on high performance and affordability of technologies being environmentally rational. With the ongoing modernization of the energy infrastructure, TIC systems will be more prevalent in retrofitting existing gas turbines and further, in supporting the operation of hybrid plants.

Saudi Arabia energy sector is primarily dependent on conventional energy sources. In 2022, about 67% of electricity is generated using fossil gas and rest from the oil. Saudi Arabia has set aggressive plans to become carbon neutral by 2030 and in light of the same significant investments have been made in the renewable sector.

NEOM and The Renewable Energy Project are some of the examples where the country has invested USD 500 billion and USD 200 billion respectively. This Vision 2030 framework is expected to provide substantial boost to the power sector.

Turbine inlet cooling technologies offer significant advantages in terms of efficiency gain when integrated with gas-fired power plants and renewable energy sources. The operating climatic conditions in Saudi Arabia are quite harsh and in such scenario modernizing of gas-powered and renewable infrastructure becomes quite critical and crucial. To address these concerns, it is believed that the incorporation of turbine inlet cooling technologies will generate lot of interest amongst power producers, thus providing growth to the market.

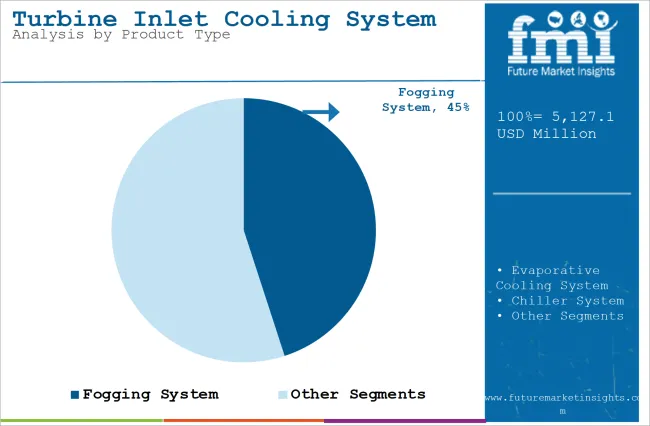

Fogging systems and medium-capacity TIC setups are highly preferred for their cost-effectiveness, adaptability, and efficiency. Fogging boosts turbine output up to 25%, while medium-capacity systems excel in retrofits and hybrid power setups, improving performance by 15-25%. These technologies drive demand across industrial, commercial, and renewable energy applications.

| Product Type | Fogging System |

|---|---|

| Value Share, 2024 | 45% |

Fogging systems are highly preferred type of Turbine Inlet Cooling (TIC) technology owing to several advantages offered by this technology such as cost-effectiveness, improved operational efficiency, and versatility.

Fogging systems are cost-efficient as these systems require relatively small initial investment in relation to the mechanical chillers or hybrid systems, which are considered the more advanced options. The short duration of installation (which is sometimes done with no significant changes in the building) is another reason that leads to their increasing preference amongst end-users.

Fogging systems are very productive as they can provide up to 25% additional power under specific conditions. The introduction of these systems, which by means of cooling the incoming air to gas turbines, increases turbine output while conserving energy, is a step forward in the area of technology. Their flexible design, which allows them to be used in both small industrial and utility projects, is a further testimony to their suitability even in various commercial set-ups.

With the capacity of not only making substantial performance improvements but also saving cost, fogging systems are likely to still be the primary TIC technology thus providing trustworthy, efficient, and low-cost energy generation for a long time.

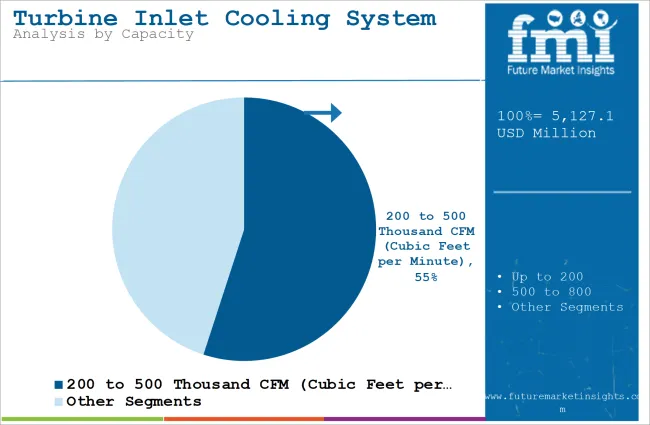

| Capacity | 200 to 500 Thousand CFM (Cubic Feet per Minute) |

|---|---|

| Value Share, 2024 | 55% |

Medium capacity turbine inlet cooling are highly preferred systems amongst the end-users owing to its affordability and practicality to integrate with existing set-ups. These systems are well suited for commercial retrofits as well as captive power generation set-ups. As the end-users transition towards renewable energy, these types of systems are gaining prevalence for integration into hybrid power generation set-ups as well.

These types of systems help to improve power output up to 15% and in some advanced energy set-ups these can even lead to improvement up to 25%. Fogging type of technology can be easily configured for medium capacity, which is one of the preferred type of technologies and the suitability of the same technology directly impacts on increasing demand for medium capacity set-ups.

The industry is observing a consistent shift towards incorporation of the advanced technologies with hybrid systems and modular designs gaining significant attention. This transition is a reflection of a broader trend of customization, with solutions being specifically tailored according to the demands of end-users either for retrofitting obsolete infrastructure or joining TIC systems in hybrid power generating plants utilizing the latest technology.

The competition between TIC manufactures has grown more severe where producers are competing to obtain the market leadership in high-growth regions such as Asia-Pacific and the Middle East. These regions, where climatic conditions and increased energy demand are prevailing, altogether are pushing for the need of cooling with greater reliability and durability.

The priority in innovation stands out as manufacturers strive to get ahead of the competition through improved system performance and reducing expenses. The market remains fairly concentrated with key sustaining strategies include product customization and regional expansion.

Industry Updates

On the basis of Turbine Inlet Cooling System types the market is categorized into Evaporative Cooling System, Fogging System, Chiller System, Thermal Energy Storage (TES) System, Combined Cooling Systems and Other types

On the basis of system capacity (Thousand Cubic Feet Per Minute), the market is categorized into Up to 200, 200 to 500, 500 to 800 and Above 800

On the basis of application the market is categorized into Commercial Power Plant and Captive Power Plants

Key regions considered for the study include North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa

The overall market size for Turbine Inlet Cooling System was USD 4,948.9 million in 2024.

The Turbine Inlet Cooling System Market is expected to reach USD 5,127.1 million in 2025.

Increasing adoption in hybrid power set-up and efficiency enhancement objectives will drive growth.

The Turbine Inlet Cooling System Market is projected to reach USD 8,038.8 million in 2035.

Fogging system is expected to command significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA