The turbidimeter market is expected to grow steadily through 2025 to 2035 period due to the rising and increasing regulatory focusing that is growing towards water quality, along with mass industrial wastewater treatment compliance and food & beverage and pharmaceutical applications. Particularly in environmental, municipal and industrial applications, turbidimeters, used to measure the cloudiness or haziness of a fluid, are critical when it comes to monitoring the levels of particles in a given environment, and keeping water clear.

The growing necessity for, real-time turbidity measurement to comply with standards for safety and mitigate the occurrence of trace level contamination without compromising product quality is fostering the increased adoption of portable and benchtop turbidimeters across both developed and emerging economies.

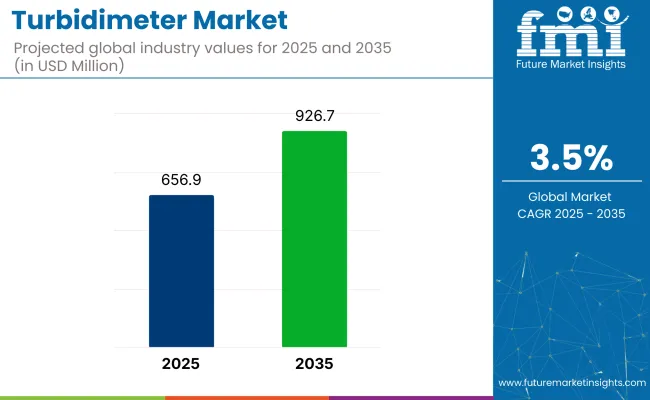

The market is projected to grow from USD 656.9 Million in 2025 to USD 926.7 Million by 2035, at a CAGR of 3.5% during the period of assessment. Such expansion is reliant on advancements in optical sensor precision, increasing investments toward modernizing water infrastructure, as well as demand for digital, user-friendly and IoT-enabled monitoring systems.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 656.9 Million |

| Market Value (2035F) | USD 926.7 Million |

| CAGR (2025 to 2035) | 3.5% |

The rise in urbanization and industrial activity across the planet, particularly in water-scarce areas, is driving the utilities and industry to embrace efficient turbidity monitoring tools. Strict water safety standards set at an international level, coupled with a significant steer towards sustainability are prompting public and private investments in cutting edge water monitoring solutions.

Demand for a contaminant business development operation in North America, especially in the USA, which include the EPA, is creating a stable, expanding marketplace for turbidimeters. Continuous turbidity testing is mandated by the USA Environmental Protection Agency (EPA) in drinking water systems, wastewater treatment plants, and other discharge streams from industrial plants.

Public water authorities and private water utilities are budgeting for smart, automated monitoring solutions that mitigate operational risks and facilitate compliance with regulatory guidelines. North America is expected to be one of the major markets for high-accuracy turbidimeters in food & beverage applications, especially in the USA and Canada, as a correlation between those product quality benchmarks and hygiene standards are driving its demand.

Europe remains a large market, with Germany, the UK, France, and the Netherlands being the largest contributors. Public investments in water quality management are strong in this high-income region, particularly in relation to EU directives, including the urban waste water treatment directive and drinking water directive.

European players are installing digital interfaces and wireless connectivity in turbidimeter systems to facilitate remote monitoring and predictive maintenance. Overall, turbidity monitoring systems are widely implemented in sectors, such as chemicals, pharmaceuticals, dairy, and others, to optimize production processes while minimizing the risk of effluents.

Global Turbidimeter Market, by region, led by China, India, and Japan. Strong demand is being driven by rapid industrialisation, urbanisation and growing focus on sustainable water management. Governments in India and Southeast Asia are funding modernization projects for rural and urban water supply systems that incorporate smart water quality monitoring.

Turbidimeter systems that are both cost and performance efficient can meet this high-volume demand while maintaining consistent, reliable results, so strict application of environmental laws in China and an increase in its manufacturing industries are on the rise. Japan is continuing to innovate cheap, portable and miniature water testing technologies to the context of more remote environment monitoring and disaster scientifically.

Challenge

Calibration and Maintenance RequirementsFrequent calibration and cleaning are essential to maintain accuracy for turbidimeters, especially in high-particulate or corrosive environments, and overcoming this critical challenge is half the struggle in adopting new technologies. Gas detection and leak detection instruments used in industrial or environmental field conditions are subject to wear and contamination, which may result in false readings or instrument failure.

However, manual maintenance not only adds to operational costs but also requires skilled personnel, which can be a barrier in decentralized or remote water systems. To mitigate this, manufacturers are innovating towards self-cleaning probes, automatic calibration capabilities, and ruggedized equipment that minimizes the need for service personnel and reduces downtime.

Opportunity

Smart Water Networks and Real-Time MonitoringAs investments in smart water infrastructure are increasing, there is huge opportunity for turbidimeters with IoT, cloud analytics and transmitting real-time data. These sophisticated devices provide early detection of water quality issues as well as automated alerts and performance analytics that help utilities better manage distribution networks.

The drive towards digital transformation in utilities and industrial water management is creating new revenue opportunities for turbidimeter manufacturers. Now, the firms providing turbidity meters that are interoperable, modular, and low-maintenance will be in a prime position to tap into the future-ready demands of smart cities, industrial automation, and remote water monitoring initiatives.

The global turbidimeter market showed a steady increase from 2020, which is expected to continue until 2024 due to rising awareness about water quality and stringent environmental regulations. Increasing demand for accurate water quality monitoring in industries such as water treatment, food and beverage, and pharmaceuticals also greatly helped in market growth.

Turbidimeter innovation and efficiency were aided by combining IoT capabilities. The first such devices were, however, limited from wider use in the paradigm of the time due to cost of investment and requiring trained personnel to use such advanced instruments.

The turbidimeter market is estimated to grow steadily from 2025 to 2035, driven by a focus on technological advancements and sustainability. Smart sensors & automation integration are expected to enhance measurement accuracy and operational efficiency, meeting the demands of the changing industries.

Moreover, the growing construction of water treatment plants in developing economies and rising adoption of strict water quality standards worldwide are expected to boost the market. However, during these times, the market dynamics are likely to be affected by factors, for instance, the availability of other methods of measuring water quality and economic limitations in developing regions.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Industry Applications | Predominantly used in water treatment, environmental monitoring, and industrial processes. |

| Regulatory Environment | Influenced by increasing environmental regulations emphasizing water quality monitoring. |

| Technological Integration | Adoption of basic digital interfaces and initial IoT capabilities. |

| Market Expansion | Growth concentrated in developed regions with established industrial infrastructures. |

| Consumer Preferences | Demand driven by regulatory compliance and basic operational efficiency. |

| Market Shift | 2025 to 2035 |

|---|---|

| Industry Applications | Diversification into sectors such as pharmaceuticals, food and beverage, and research laboratories. |

| Regulatory Environment | Anticipated implementation of more stringent global water quality standards and compliance requirements. |

| Technological Integration | Advancement towards fully integrated smart systems with real-time data analytics and remote monitoring. |

| Market Expansion | Expansion into emerging markets driven by industrialization and heightened focus on environmental sustainability. |

| Consumer Preferences | Shift towards advanced features offering higher accuracy, automation, and user-friendly interfaces to enhance operational efficiency. |

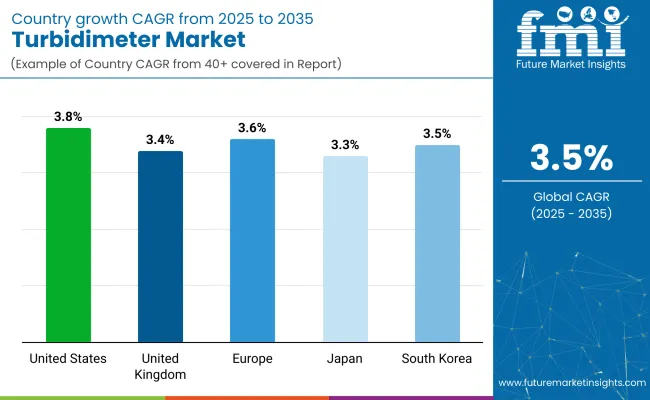

The USA turbidimeter market is anticipated to grow at a CAGR of 3.8% over the forecast period, 2025 to 2035. The growth is driven by strict regulatory standards for water quality monitoring in industrial, municipal, and environmental sectors. Due to mandatory turbidity testing in drinking water treatment plants implemented by the Environmental Protection Agency (EPA), the demand for high-precision turbidimeters has increased.

Industrial consumers, especially in food & beverage, pharmaceuticals, and chemicals sectors are also upping their investments in real-time turbidity analysing tools to maintain process consistency and compliance. And, the growing inclination toward smart water infrastructure, including grants to increase the smart count of systems, is likely to create potential market for digital-turbidimeter with remote monitoring capabilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

The UK The market will grow at a CAGR of 3.4% until 2035, driven by increasing demand in water safety and the modernization of water utilities. Increasing adoption of portable and laboratory turbidimeters in water treatment plants is due to the enforcement of water quality enhancement directives and environmental regulations.

Steadily increasing market growth is also being driven by the adoption of compact and user-friendly instruments in environmental testing and research laboratories. Moreover, digital water monitoring solutions are on the rise in alignment with the country’s sustainability and smart city initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.4% |

Europe, with Germany, France and Italy being lucrative markets, is projected to register 3.6% CAGR throughout the forecast period. Rigorously enforced EU directives covering environmental conservation and water quality are pressuring municipalities and industries to modernize water treatment systems with sophisticated turbidity measurement equipment.

Furthermore, strengthening focused on wastewater management and observation of ISO compliant testing equipment are supporting the overall development of the market. IoT-enabled and low-maintenance turbidimeters are also being integrated at an increasing rate, as part of Europe’s green infrastructure initiatives.

| Region | CAGR (2025 to 2035) |

|---|---|

| Europe | 3.6% |

On the back of favourable government policies and the growing public health and water sanitation concern in the country, the turbidimeter market in Japan is expected to grow at a CAGR of 3.3% during next 10 years. National turbidity standards are driving municipal water authorities and industrial operators to adopt high-accuracy turbidimeters.

Miniaturization of Optical and Laser-Based Sensors electronic circuits is gaining traction, especially in laboratories and portable water quality testers. This potential is being bolstered by real-time monitoring and new, low-power consumption turbidimeters, enabling expansion into industrial and remote field applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.3% |

The South Korea market is also expected to lead the growth with implementation of digital instrumentation and excellent environmental policies, which will result in a CAGR of 3.5% through 2035.

With the industry's water utility sector rapidly modernizing, there is demand for high-efficiency turbidimeters with wireless connectivity and remote diagnostics; the surge in industrial utilization, particularly within the semiconductor and food processing industries, can be attributed to the demand for accurate turbidity measurement in critical operational procedures. Turbidimeter adoption across the United States continues to grow steadily as governments invest in environmental safety and water infrastructure.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.5% |

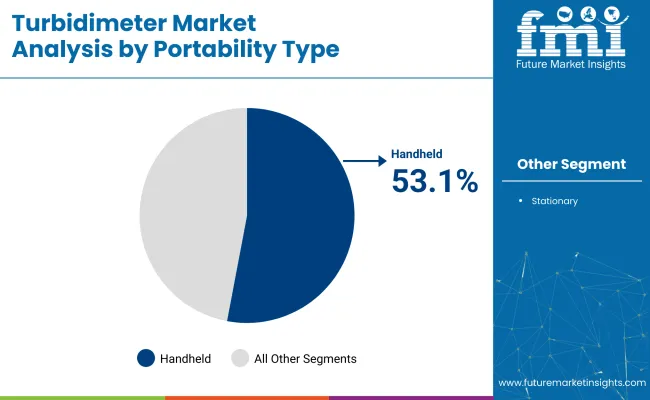

| By Portability Type | Market Share (2025) |

|---|---|

| Handheld | 53.1% |

Handheld turbidimeters are the predominant type used in the global turbidimeter market owing to their convenience and portability, along with a growing adoption rate for field-based water quality analysis.

Unlike its bulkier counterparts that are better suited for labs or treatment plants, handheld turbidity meters tend to be the choice of technicians and environmental scientists who need to obtain fast, accurate turbidity readings in the field or outdoors without the need for complex infrastructure. Their small size and battery-powered architecture make them ideal for monitoring rivers, lakes, industrial outfalls and municipal water systems in real time.

Handheld turbidimeters are widely used by water utilities, environmental protection agencies and research institutions for compliance, site inspection and changes in water clarity. These devices allow users to identify button sediment, microbial pollution, and chemical pollutants on-site, which shortens decision-making immediately. The usability, accuracy and data logging capabilities of handheld devices have also been vastly improved due to advances in sensor technology and digital interfaces.

Handheld turbidimeters are compatible with smartphones and cloud platforms, allowing users to save and share data remotely. This feature aids in preventive maintenance, reducing the dependency of laboratories and improving the efficiency of water quality management programs. The adoption of handheld turbidimeters is growing enormously though sectors, as regulators across the world begin to increase monitoring requirements.

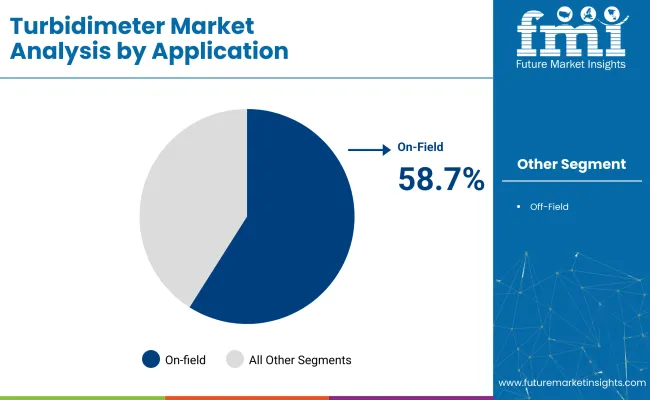

| By Application | Market Share (2025) |

|---|---|

| On-field | 58.7% |

The turbidimeter market is dominated by on-field applications, as industries and environmental agencies seek for real-time, in-situ monitoring of their water systems. Therefore, turbidity meters are most important for detecting turbidity levels directly from the source, such as rivers, reservoirs, water treatment plants, mining sites, and aquaculture facilities. These applications require rapid and accurate measurements to prevent waterborne diseases, minimize environmental impact, and ensure compliance with regulations.

Turbidimeters have been used by field operators who need to detect rapid changes in turbidity caused by erosion, algal blooms, industrial discharge, or sedimentation. In case of contamination events, the response time is significantly reduced if onfield measurements act as the major data sources when centralized testing infrastructure is not available.

On-field turbidimeter deployment is progressively important for government-led water quality programs, agricultural runoff monitoring, and construction site inspections. The convenience of being able to conduct such tests under variable environmental conditions, without sacrificing accuracy, has made the on-field application the leading use case for portable and rugged turbidimeter systems.

With increasing urbanization and climate variability, water quality challenges are exacerbated and stakeholders are investing continuously in on-field measurement analysis tools to preserve the integrity of the ecosystem and meet sustainable development goals.

The Turbidimeter Market is expanding with rising adoption in water treatment environmental monitoring pharmaceuticals and food processing sectors. Regulated industries and process optimization are fuelling investments in high-precision, real-time and automated solutions for turbidity measurement. Optical technology, portable instrumentation, and digital data integration are among the key areas of technology innovation that remain a strategic priority for key players.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thermo Fisher Scientific | 17-19% |

| Danaher ( Hach ) Corp. | 15-17% |

| Xylem Inc. | 12-14% |

| Other Companies (combined) | 50-56% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thermo Fisher Scientific | In 2025 , introduced an enhanced benchtop turbidimeter with improved detection limits for industrial labs and utilities. |

| Danaher ( Hach ) Corp. | In 2024 , launched a next-gen portable turbidimeter integrated with Bluetooth data sync and cloud-based analytics. |

| Emerson Electric Co. | In 2025 , expanded its Rosemount Analytical line with advanced turbidimeters tailored for continuous process control. |

| Xylem Inc. | In 2024 , developed compact turbidimeter modules optimized for municipal water systems and remote field deployment. |

| METTLER TOLEDO | In 2025 , focused on lab-grade optical turbidimeters with real-time calibration alerts and precision verification tools. |

| Merck KGaA | In 2024 , released multi-parameter photometers with built-in turbidity measurement for environmental monitoring. |

| PCE Instruments | In 2025 , added handheld and lab turbidimeters supporting ISO 7027 compliance for water quality audits. |

| Hanna Instruments Inc. | In 2025 , improved user interface and data logging capabilities in its range of portable turbidity meters. |

| Tintometer Inc. | In 2024 , upgraded its Lovibond ® turbidity solutions with higher accuracy for pharmaceutical and beverage testing. |

| LaMotte Company | In 2025 , launched digital field kits with integrated turbidimeters for educational and environmental testing. |

Key Company Insights

Thermo Fisher Scientific (17-19%)

Thermo Fisher leads with high-precision lab instruments and has expanded its benchtop portfolio to cater to pharmaceutical and industrial QA/QC labs.

Danaher (Hach) Corp. (15-17%)

Danaher maintains strong market presence by emphasizing rugged, portable, and smart turbidimeters tailored for water treatment operations and fieldwork.

Xylem Inc. (12-14%)

Xylem strengthens its market position through compact and robust solutions optimized for decentralized water infrastructure and environmental agencies.

Emerson Electric Co.

Emerson focuses on inline and process-integrated turbidimeters, enhancing real-time control for manufacturing and chemical plants.

Other Key Players (50-56% Combined)

A number of players contribute to the market through targeted innovations:

The overall market size for the Turbidimeter Market was approximately USD 656.9 million in 2025.

The Turbidimeter Market is expected to reach around USD 926.7 Million By 2035.

The demand is driven by increasing awareness about water quality, stringent government regulations regarding environmental monitoring, and the expansion of industries.

The top 5 regions driving market growth are USA, UK, Europe, Japan, and South Korea.

The wastewater treatment segment is expected to command a significant share over the assessment period.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.