Laminating tube industry is fast growing as manufacturers need more protection for the product, improved esthetics, and eco-friendly packaging options. Responding to mounting pressure from the food pack, personal care, and pharma markets, companies are manufacturing recyclable, flexible, and high-barrier laminates. Companies create multi-layer film structures, digital print solutions, and eco-coatings for added branding, strength, and sustainability.

It is now more prevalent for manufacturers to aim at high-performance polymer blends, solventless adhesives, and light materials in order to enhance performance and lower the environmental footprint. The market is shifting to recyclable and biodegradable laminating films that are functional and compliant with regulations.

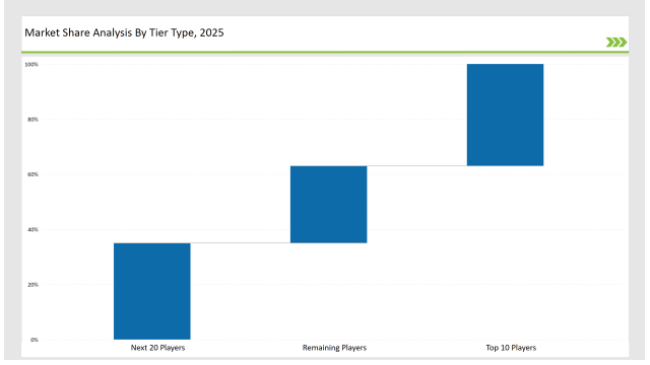

Tier 1 competitors like Amcor, Berry Global, and Huhtamaki dominate the market with a 37% market share because they possess leadership in high-barrier films and sustainable technology with deep global supply.

Tier 2 players, including Essel Propack, Mondi Group, and Sealed Air, hold 35% of the market by creating affordable, high-performance laminates for pharmaceutical packaging, food packaging, and personal care.

Tier 3 are regional and niche players that specialize in customized biodegradable and smart tube laminating films holding a market share of 28%. They concentrate on local production, specialty coatings, and smart packaging integration.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Berry Global, Huhtamaki) | 19% |

| Rest of Top 5 (Essel Propack, Mondi Group) | 12% |

| Next 5 of Top 10 (Sealed Air, Clondalkin Group, Constantia Flexibles, Bischof+Klein, Glenroy) | 6% |

The tube laminating films industry encompasses several industries where protection, flexibility, and sustainability are paramount. Companies are developing new laminating technologies to enhance branding and product protection. They are providing high-gloss and matte finish solutions to meet a broad spectrum of design requirements. Companies are also enhancing chemical resistance to make the products more resilient under harsh environments.

Manufacturers are creating tube laminating films with higher-barrier protection, sustainable materials, and smart packaging solutions. They are adding new coating technologies to extend moisture barrier and product life. In addition, companies are simplifying heat-sealable laminates for improved manufacturing efficiency and sealing performance.

Sustainability and novel manufacturing technologies are transforming the business of tube laminating films. Companies are adopting solvent-free lamination, biodegradable polymers, and AI-based defect detection for better efficiency and minimal waste. Companies are applying lighter, high-endurance laminates in their combined solutions to meet enhanced product protection with reduced material use. Producers are creating tamper-evident laminating films containing embedded security features. Companies are also expanding digital print capabilities to provide high-end, customized branding solutions.

Year-on-Year Leaders

Technology suppliers should focus on automation, sustainable material innovations, and AI-driven defect detection to support the evolving tube laminating films market. Collaborating with personal care, pharmaceutical, and food brands will accelerate adoption and market growth.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Berry Global, Huhtamaki |

| Tier 2 | Essel Propack, Mondi Group, Sealed Air |

| Tier 3 | Clondalkin Group, Constantia Flexibles, Bischof+Klein, Glenroy |

Industry leaders are developing tube laminating films with AI-based quality control, green materials, and excellent barrier properties. They have optimized multilayered film structures to improve flexibility and durability. Companies are also developing solvent-free adhesives for enhanced sustainability without loss of adhesive strength.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched fully recyclable tube laminates in March 2024. |

| Berry Global | Developed bio-based, lightweight laminating films in April 2024. |

| Huhtamaki | Expanded high-barrier laminates for pharmaceutical packaging in May 2024. |

| Essel Propack | Released security-embedded tamper-proof laminates in June 2024. |

| Mondi Group | Strengthened digital printing for premium tube packaging in July 2024. |

| Sealed Air | Introduced ultra-thin, high-strength laminating films in August 2024. |

| Constantia Flexibles | Pioneered multi-layered sustainable laminates in September 2024. |

The tube laminating films market is transforming as businesses are investing in lightweight, eco-friendly, and intelligent packaging solutions. They are optimizing high-barrier laminates to enhance product protection and shelf life. The manufacturers are also incorporating bio-based polymers to lower environmental footprint while preserving performance and durability.

Manufacturers will continue to integrate AI-driven defect detection, high-barrier coatings, and sustainable materials. Companies will streamline ultra-thin, high-strength laminates to improve product protection with reduced environmental impacts. Companies will expand tamper-proofed solutions with embedded security layers. Intelligent packaging applications will drive innovation in freshness indicators and anti-counterfeit technology. In addition, AI-driven quality control will maximize production and reduce costs. Companies will also enhance biodegradable laminates to address global sustainability requirements. Also, businesses will incorporate advanced nanotechnology coatings for durability of the product.

Leading players include Amcor, Berry Global, Huhtamaki, Essel Propack, Mondi Group, Sealed Air, Clondalkin Group, Constantia Flexibles, Bischof+Klein, Glenroy

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 37%.

Key drivers include sustainability, lightweight alloys, AI-driven quality control, and smart packaging solutions.

Disposable Tea Flask Market Trends – Growth & Forecast 2025 to 2035

Disposable Lids Market Analysis – Growth & Forecast 2025 to 2035

Stretch Blow Molding Machines Market Segmentation based on Technology Type, Orientation Type, End Use, and Region: A Forecast for 2025 and 2035

Cup Carriers Market Insights - Growth & Forecast 2025 to 2035

Custom Boxes Market Trends – Growth & Forecast 2025-2035

Degassing Valves Market Analysis - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.