The tube filling machine industry is seeing substantial growth as pharmaceutical, cosmetic, and food manufacturers look for high-speed, accurate, and sustainable filling solutions. Companies are focusing on automation, sustainability, and flexibility to increase productivity and reduce material waste.

Manufacturers are upgrading tube filling machines with smart technology, modular designs, and the ability to work with biodegradable materials, as brands strive for more efficient, hygienic, and eco-friendly packaging options. Furthermore, the demand for sustainable packaging and single-dose applications is fueling innovation in the industry.

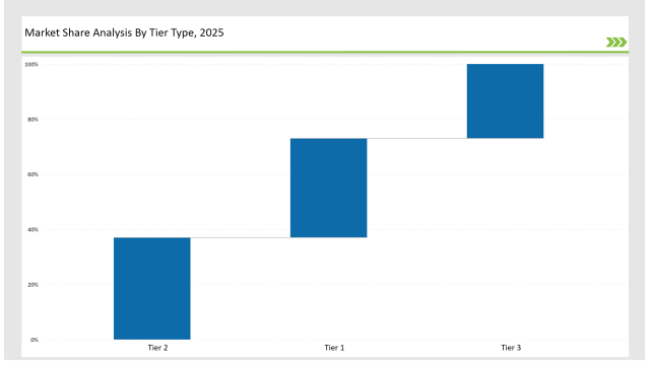

Tier 1 companies such as IMA Group, Norden Machinery, and ProSys Fill lead the market with a 36% share, leveraging cutting-edge automation, precision filling technology, and global service networks.

Tier 2 companies, including Bosch Packaging, GEA Group, and Coesia Group, hold 37% of the market by offering cost-effective, customizable, and high-speed filling solutions designed for mid-sized and enterprise-level manufacturers.

Tier 3 consists of regional and specialized manufacturers focusing on compact, energy-efficient, and industry-specific tube filling machines, holding 27% of the market. These companies emphasize localized service, customized solutions, and emerging material applications.

Explore FMI!

Book a free demo

Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (IMA Group, Norden Machinery, ProSys Fill) | 18% |

| Rest of Top 5 (Bosch Packaging, GEA Group) | 11% |

| Next 5 of Top 10 (Coesia Group, JDA Progress, Accutek Packaging, KALIX, Unette) | 7% |

The tube filling machine market serves industries that require precise, high-speed, and hygienic filling solutions. Companies are investing in smart technology and automation to ensure consistency and minimize product waste.

Manufacturers are enhancing efficiency, flexibility, and sustainability in tube filling machines.

Innovation in sustainability and efficiency drive the tube filling machine industry forward. Manufacturers embrace AI-powered monitoring systems, machinery that wastes no material, recyclable and biodegradable tubing, and digital printing to facilitate personalization. Brands invest further in predictive maintenance and automation with the goal of streamlining the production process as much as possible and avoiding wastage due to downtime.

Year-on-Year Leaders

Technology suppliers should focus on automation, sustainability, and digital integration to meet evolving industry demands. Partnering with personal care and pharmaceutical brands will drive adoption and technological advancements.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | IMA Group, Norden Machinery, ProSys Fill |

| Tier 2 | Bosch Packaging, GEA Group |

| Tier 3 | Coesia Group, JDA Progress, Accutek Packaging, KALIX, Unette |

Leading manufacturers are integrating automation, enhancing material adaptability, and improving machine efficiency to meet growing consumer demand.

| Manufacturer | Latest Developments |

|---|---|

| IMA Group | Launched high-speed, AI-powered tube filling machines in March 2024. |

| Norden Machinery | Developed modular, recyclable tube-compatible filling systems in April 2024. |

| ProSys Fill | Introduced hybrid tube filling machines optimized for sustainability in June 2024. |

| Bosch Packaging | Strengthened its sterile, pharmaceutical-grade filling solutions in July 2024. |

| GEA Group | Expanded high-precision, food-grade tube filling technology in August 2024. |

| Coesia Group | Released compact, multi-format filling machines in May 2024. |

| JDA Progress | Focused on AI-driven monitoring and digital tracking in September 2024. |

| Accutek Packaging | Innovated with fully automated, refillable tube filling systems in October 2024. |

The competitive landscape in the tube filling machine market is evolving as key players prioritize automation, smart technology, and sustainable solutions to maintain strong market positions.

Manufacturers will incorporate AI-driven diagnostics and predictive maintenance to enhance efficiency. The push for sustainable packaging will drive advancements in biodegradable and recyclable tube materials. Production precision will be boosted by smart packaging solutions, including IoT-enabled monitoring and track-and-trace capabilities. Automation will continue streamlining production, reducing costs while improving precision. As demand for single-dose and personalized packaging grows, flexible and high-speed tube filling machines will play a key role in meeting industry needs.

Leading players include IMA Group, Norden Machinery, ProSys Fill, Bosch Packaging, and GEA Group.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 36%.

Key drivers include automation, sustainability, and smart technology integration.

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Vinyl Extrusion Equipment Market Insights - Growth & Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.