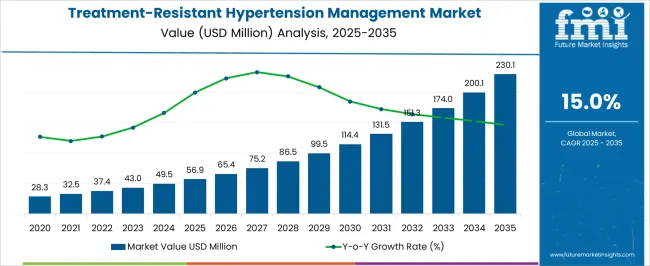

The Treatment-Resistant Hypertension Management Market is estimated to be valued at USD 56.9 million in 2025 and is projected to reach USD 230.1 million by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

| Metric | Value |

|---|---|

| Treatment-Resistant Hypertension Management Market Estimated Value in (2025E) | USD 56.9 million |

| Treatment-Resistant Hypertension Management Market Forecast Value in (2035F) | USD 230.1 million |

| Forecast CAGR (2025 to 2035) | 15.0% |

The treatment resistant hypertension management market is expanding due to the rising global prevalence of hypertension, growing awareness of cardiovascular complications, and the need for effective long term management strategies. Increasing incidences of patients showing limited response to conventional therapies have intensified the demand for specialized treatment approaches.

Advancements in pharmacology, improved treatment guidelines, and emphasis on combination therapy are supporting the adoption of new protocols. Healthcare systems are investing in personalized treatment pathways and monitoring solutions to improve patient compliance and outcomes.

Regulatory frameworks promoting evidence based treatment strategies and the growing burden of lifestyle related disorders are further accelerating the demand for structured management solutions. The outlook for the market remains promising as ongoing research, hospital initiatives, and payer support create stronger pathways for adoption of advanced management methods in resistant hypertension cases.

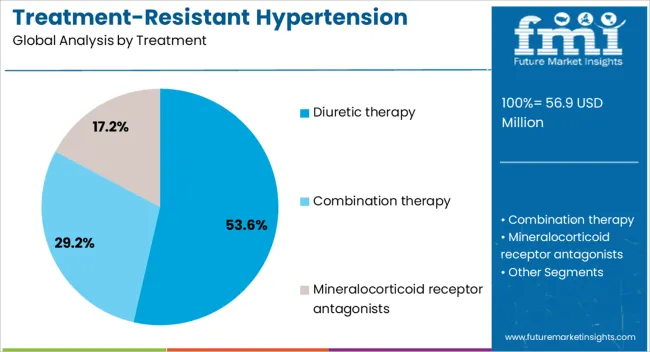

The diuretic therapy segment is expected to account for 53.60% of total market revenue by 2025 within the treatment category, establishing it as the leading segment. This dominance is driven by its effectiveness in reducing fluid retention, lowering blood pressure, and enhancing the impact of other antihypertensive medications.

Diuretics are widely recommended in clinical guidelines due to their cost effectiveness and long history of proven outcomes. Increased physician preference and strong availability across therapeutic settings have further reinforced their utilization.

The ability to combine diuretic therapy with other treatment classes to improve efficacy in resistant cases has strengthened its role as the most adopted therapy. These factors collectively ensure that diuretic therapy maintains its leading share in the management of treatment resistant hypertension.

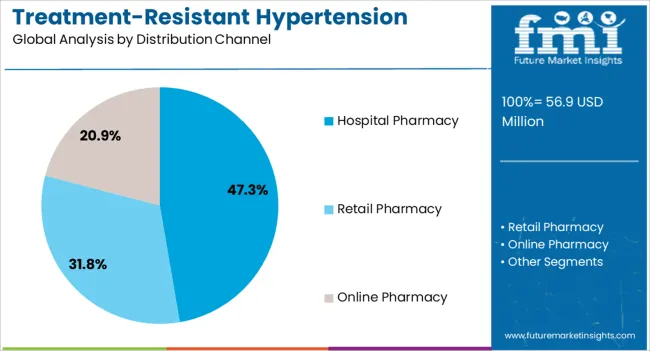

The hospital pharmacy segment is projected to hold 47.30% of market revenue by 2025 under the distribution channel category, positioning it as the dominant segment. This is primarily attributed to the rising number of hypertension patients requiring specialized and supervised medication management within hospital settings.

Hospital pharmacies provide enhanced access to complex drug regimens, specialist consultations, and close monitoring, which are critical for resistant cases. Additionally, the growing trend of hospital based chronic disease management programs has boosted reliance on this channel.

Stronger regulatory oversight, structured treatment protocols, and patient adherence monitoring further reinforce the preference for hospital pharmacies. Consequently, this segment continues to command the largest share, supported by its clinical reliability and ability to cater to high risk patient populations.

According to market research and competitive intelligence provider, Future Market Insights- the market for Treatment-Resistant Hypertension Management reflected a value of 11% during the historical period, 2020 to 2025. The Treatment-Resistant Hypertension Management market has been growing rapidly in recent years due to the increasing prevalence and the availability of effective drugs for its treatment. The market is expected to continue growing in the coming years as the aging population continues to grow.

Newer therapies for Treatment-Resistant Hypertension management are emerging, including the use of novel antihypertensive agents, such as mineralocorticoid receptor antagonists, direct renin inhibitors, and renal denervation. These therapies are expected to drive the growth of the Treatment-Resistant Hypertension management market in the coming years.

The Treatment-Resistant Hypertension management market is also expected to benefit from the increasing adoption of digital health technologies, such as telemedicine and remote patient monitoring, which enable healthcare providers to monitor patients with Treatment-Resistant Hypertension more closely and adjust their treatment plans as needed.

Moreover, the adoption of digital health technologies, such as telemedicine and remote patient monitoring, is expected to drive the growth of the Treatment-Resistant Hypertension management market. These technologies enable healthcare providers to monitor patients with Treatment-Resistant Hypertension more closely and adjust their treatment plans as needed, which can improve patient outcomes and reduce healthcare costs.

Overall, the market for Treatment-Resistant Hypertension Management is expected to register a CAGR of 14% in the forecast period 2025 to 2035.

Increasing Prevalence of Hypertension to push market growth

The increasing prevalence of hypertension is one of the major factors driving the growth of the treatment-resistant hypertension management market. Hypertension, also known as high blood pressure, is a chronic medical condition in which the blood pressure in the arteries is persistently elevated. Hypertension is a leading risk factor for cardiovascular diseases, such as heart disease and stroke, which are major causes of morbidity and mortality worldwide.

The prevalence of hypertension is increasing globally, primarily due to lifestyle factors such as unhealthy diets, lack of physical activity, and stress. The World Health Organization (WHO) estimates that hypertension affects around 56.9 billion people worldwide, and this number is expected to increase to 1.56 billion by 2025. Hypertension is a major public health challenge, and its increasing prevalence is driving the demand for effective Treatment-Resistant Hypertension management strategies.

Patients with Treatment-Resistant Hypertension, who do not respond adequately to conventional antihypertensive therapies, represent a significant proportion of the overall hypertension patient population. According to estimates, the prevalence of Treatment-Resistant Hypertension is around 10% to 30% of all patients with hypertension. The increasing prevalence of hypertension is expected to drive the demand for Treatment-Resistant Hypertension management, leading to the growth of the Treatment-Resistant Hypertension management market.

The Treatment-Resistant Hypertension management market is expected to witness significant growth due to the increasing adoption of newer treatment options, including mineralocorticoid receptor antagonists, direct renin inhibitors, and renal denervation. These therapies have shown promising results in clinical trials and are expected to become more widely adopted as their efficacy and safety are established.

In summary, the increasing prevalence of hypertension is a major factor driving the growth of the Treatment-Resistant Hypertension management market. As the global burden of hypertension continues to rise, the demand for effective Treatment-Resistant Hypertension management strategies is likely to increase, leading to the growth of the Treatment-Resistant Hypertension management market.

Expensive Cost of Treatment to restrict Market Growth

The cost of Treatment-Resistant Hypertension management can be high, particularly when multiple medications and interventions are required. This can be a significant barrier to access for patients, particularly in low- and middle-income countries.

Additionally, Patients with Treatment-Resistant Hypertension may struggle with adherence to complex treatment regimens, which can limit the effectiveness of treatment. There is a need for interventions that can improve patient adherence and engagement in their care. In summary, the Treatment-Resistant Hypertension management market faces several challenges, including the lack of effective treatment options, high cost of treatment, limited awareness and screening, adherence to treatment, and resistance to novel therapies. Addressing these challenges will be critical to improving the outcomes for patients with Treatment-Resistant Hypertension and driving the growth of the Treatment-Resistant Hypertension management market.

Increasing awareness and diagnosis of the condition Shaping Landscape for Treatment-Resistant Hypertension Management in South & East Asia

The South and East Asia region has a high burden of hypertension, and treatment-resistant hypertension is becoming increasingly prevalent in the region. The market for Treatment-Resistant Hypertension management in South and East Asia is expected to grow significantly due to the increasing prevalence of hypertension and the need for more effective Treatment-Resistant Hypertension management strategies.

One of the main drivers of the Treatment-Resistant Hypertension management market in the region is the aging population, which is at an increased risk of developing hypertension and Treatment-Resistant Hypertension. In addition, lifestyle factors, such as unhealthy diets, lack of physical activity, and stress, are contributing to the rising prevalence of hypertension in the region.

Several countries in the region, including China, India, and Indonesia, have large populations and high rates of hypertension, providing a significant market opportunity for Treatment-Resistant Hypertension management. The increasing availability of healthcare services and the adoption of newer treatment options, such as renal denervation and baroreceptor activation therapy, are also driving the growth of the Treatment-Resistant Hypertension management market in the region.

Overall, the Treatment-Resistant Hypertension management market in South and East Asia is expected to grow, driven by the increasing prevalence of hypertension and the need for more effective management strategies. However, addressing the challenges faced by the market will be critical to ensuring that patients receive the best possible care and that the market can continue to grow and innovate.

Increasing Focus on Technological advancements Shaping Landscape for Treatment-Resistant Hypertension Management in North America

Hypertension is highly prevalent in North America, and the aging population is at an increased risk of developing Treatment-Resistant Hypertension. This provides a significant market opportunity for Treatment-Resistant Hypertension management. North America has a well-established healthcare system, which provides access to a wide range of treatment options for patients with Treatment-Resistant Hypertension. This includes access to specialty care and advanced therapies, such as renal denervation and baroreceptor activation therapy.

There is a strong research and development infrastructure in North America, which supports the development of new therapies for Treatment-Resistant Hypertension management. This includes collaboration between academia, industry, and government, which can accelerate the development and adoption of new treatments.

Combination therapy segment to hold a significant share and push market growth

The combination therapy segment is likely to account for a significant share of the treatment-resistant hypertension management market. Combination therapy refers to the use of two or more medications with different mechanisms of action to achieve adequate blood pressure control in patients with Treatment-Resistant Hypertension.

Combination therapy is often necessary in patients with Treatment-Resistant Hypertension who do not respond to monotherapy or have significant comorbidities. Commonly used combinations include diuretics with ACE inhibitors or ARBs, beta-blockers with CCBs, and MRAs with ACE inhibitors or ARBs.

The combination therapy segment is likely to account for a significant share of the Treatment-Resistant Hypertension management market due to several factors. First, combination therapy is often more effective at lowering blood pressure than monotherapy, particularly in patients with Treatment-Resistant Hypertension. Second, the availability of multiple medications with different mechanisms of action allows physicians to tailor treatment to individual patients, which can improve treatment outcomes. Finally, the development of fixed-dose combination medications, which combine two or more medications in a single pill, is driving innovation in the market and providing new treatment options for patients with Treatment-Resistant Hypertension.

Hospital pharmacies segment to hold a significant share and push market growth

Hospital pharmacies play a critical role in the management of Treatment-Resistant Hypertension, as they are often the first point of contact for patients with severe hypertension and Treatment-Resistant Hypertension. Hospital pharmacies provide access to a wide range of medications and specialized treatment options, including invasive procedures and advanced imaging techniques, which are essential for the management of Treatment-Resistant Hypertension.

In addition, hospital pharmacies have access to a multidisciplinary team of healthcare professionals, including physicians, nurses, and pharmacists, who can collaborate to provide comprehensive care to patients with Treatment-Resistant Hypertension. This team-based approach is critical for the management of Treatment-Resistant Hypertension, as it allows for individualized treatment plans that address the unique needs of each patient

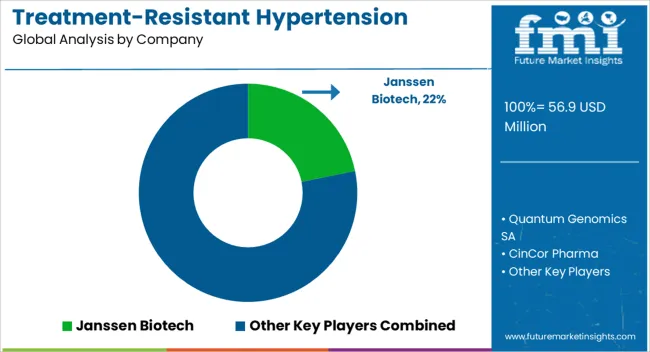

Key players in the market include companies such as Competition Deep Dive, Janssen Biotech, Quantum Genomics SA, CinCor Pharma, Ionis Pharmaceuticals, Vifor Pharma, KBP Biosciences, Abbott, Kona Medical, Inc., Medtronic along with healthcare providers and technology companies among other global players.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 43 Million |

| Market Value in 2035 | USD 159.41 Million |

| Growth Rate | CAGR of 14% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Distribution Channel, Treatment, Region |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Rest of Latin America, Germany, United Kingdom, France, Spain, Italy, Rest of Europe, Malaysia, Singapore, China, India, Thailand, Rest of South Asia, Gulf Cooperation Council, Japan, South Korea, Australia, New Zealand, GCC countries, South Africa, Israel, Rest of MEA |

| Key Companies Profiled | Competition Deep Dive; Janssen Biotech; Quantum Genomics SA; CinCor Pharma; Ionis Pharmaceuticals; Vifor Pharma; KBP Biosciences; Abbott; Kona Medical, Inc.; Medtronic |

| Customization | Available Upon Request |

The global treatment-resistant hypertension management market is estimated to be valued at USD 56.9 million in 2025.

The market size for the treatment-resistant hypertension management market is projected to reach USD 230.1 million by 2035.

The treatment-resistant hypertension management market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in treatment-resistant hypertension management market are diuretic therapy, combination therapy and mineralocorticoid receptor antagonists.

In terms of distribution channel, hospital pharmacy segment to command 47.3% share in the treatment-resistant hypertension management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Portal Hypertension Management Market Trends - Size, Growth & Forecast 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Exam Management Software Market

Asset Management Services Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA