The tray sealer machines market is growing at a high rate, with an increasing demand for high-speed, automated, and cost-effective packaging solutions.

Companies are focusing on product innovation, sustainability, and the adoption of advanced manufacturing technologies to improve efficiency and reduce material wastage. The rise in convenience food consumption, stringent packaging regulations, and the growing preference for eco-friendly materials are further fueling market expansion.

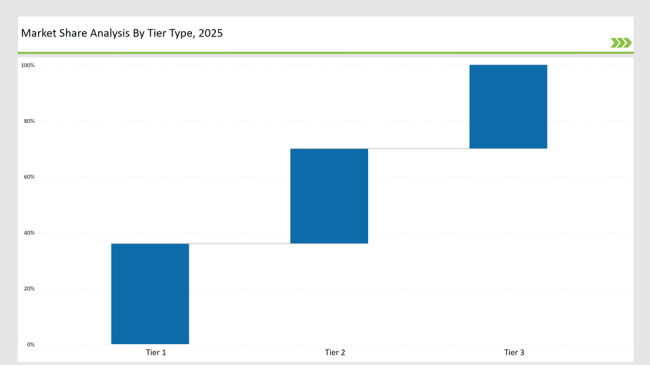

Tier 1: Market leaders like Multivac, Proseal, and ULMA Packaging together take a market share of 36%. They benefit from state-of-art automation, powerful global distribution networks, and perpetual R&D investment.

Tier 2: G. Mondini, Sealpac, and Ross Industries, with 34% of market share, will be included in the second tier. These businesses are medium sized and deliver high-performance customized solutions that abide by the regulatory requirements of their industry.

Tier 3: Remaining 30% of the market will come from regional and niche manufacturers that deal with food, pharmaceutical, and industrial applications. will account for the remaining 30% of the market. Their focus is on customized designs, localized distribution, and cost efficiency.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Multivac, Proseal, ULMA Packaging) | 19% |

| Rest of Top 5 (G.Mondini, Sealpac) | 10% |

| Next 5 of Top 10 (Ross Industries, Reepack, VC999 Packaging, Ilpra, Cpack) | 7% |

The tray sealer machines market serves multiple industries by providing high-speed, efficient, and flexible packaging solutions that improve productivity and sustainability. Companies are also developing advanced tray sealing technologies that enhance food preservation and extend shelf life. Additionally, the integration of smart tracking features is improving supply chain visibility and ensuring product integrity.

Manufacturers are focused on automation, material efficiency, and sustainability through advanced sealing technologies and intelligent control systems. Predictive maintenance features are also being added to minimize downtime and optimize the performance of the machine. Latest advancements in smart sensor technology are also improving the real-time monitoring, thereby maintaining consistent sealing quality and reducing wastage of material.

Manufacturing lines invest in automation, material innovation, and quality control through AI-based systems in efforts to advance the performance of packaging to meet new standards of changing industry practices. Large manufacturers indicate commitment to sustainability, reduction in waste, and improved efficiency in operations to enhance packaging performance.

There is also an integration on the horizon for biodegradable and compostable materials because of global initiatives for the sustainability of resources. Real-time monitoring systems are also incorporated in order to decrease the error margins of production and minimize downtime for further improvement in the operation's efficiency.

Technology providers should enhance automation, sustainability, and customization in tray sealing machine solutions. Partnering with manufacturers and material suppliers will drive cost efficiency and innovation.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Multivac, Proseal, ULMA Packaging |

| Tier 2 | G.Mondini, Sealpac |

| Tier 3 | Ross Industries, Reepack, VC999 Packaging, Ilpra, Cpack |

Manufacturers expand production capacity, integrate sustainable materials, and enhance automation features to meet industry demands. They are also developing energy-efficient tray sealers to reduce operational costs and carbon emissions. Additionally, increased adoption of IoT-enabled monitoring systems is enhancing real-time production control and predictive maintenance capabilities.

| Manufacturer | Latest Developments |

|---|---|

| Multivac | March 2024: Launched AI-driven, fully automated tray sealing machines. |

| Proseal | August 2023: Developed high-speed sealers using recyclable materials. |

| ULMA Packaging | May 2024: Introduced vacuum and gas flush tray sealers for extended shelf life. |

| G.Mondini | November 2023: Expanded pharmaceutical tray sealing solutions. |

| Sealpac | February 2024: Enhanced modular tray sealing machines for versatile applications. |

| Ross Industries | April 2024: Developed compact tray sealers for space-saving operations. |

| Reepack | June 2024: Launched innovative tray sealing solutions for food packaging. |

The tray sealer machines market remains competitive, with companies prioritizing automation, sustainability, and enhanced compliance measures to maintain their positions.

Manufacturers will drive growth by adopting smart packaging technologies, investing in sustainable materials, and optimizing production efficiency. The increasing demand in food, healthcare, and logistics industries will further accelerate market expansion.

Companies are integrating AI-driven automation to enhance accuracy and reduce waste in the sealing process. Additionally, advancements in energy-efficient sealing technologies are improving operational sustainability. The expansion of fully automated production lines is enabling higher output capacity while reducing labor dependency.

Leading players include Multivac, Proseal, ULMA Packaging, G.Mondini, and Sealpac.

The top 3 collectively control 19% of the global market.

Medium concentration, with top players holding 36%.

Sustainability, automation, material advancements, and regulatory compliance.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Medical Transport Box Market Trend Analysis Based on Material, Capacity, End-User and Regions 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.