Tray former machines market is seeing huge growth with a huge increase in demand for automation, high speed, and cost-efficient packaging solutions. The company's main focus areas include innovation of product, sustainability, and the adoption of latest manufacturing technologies for improving efficiency and material wastage.

Rising e-commerce, packaging regulation, and use of green materials further support this expansion.

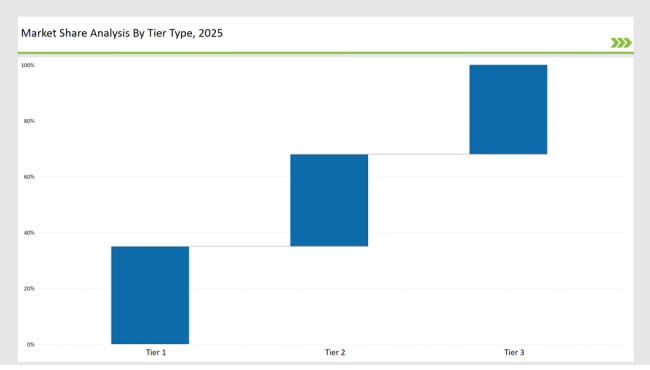

Tier 1: Bosch Packaging Technology, WestRock, and Douglas Machine Inc are considered the market leaders and take up 35% of the market share collectively. These companies use high technology in automation, global distribution channels, and continuous R&D investment, thus keeping themselves competitive.

Tier 2: Edson Packaging Machinery, Combi Packaging Systems, and AFA Systems comprise 33% of the market. They cater to mid-sized businesses with high-performance, customizable solutions that are in line with industry regulations.

Tier 3: Regional and niche manufacturers, specializing in food, pharmaceutical, and industrial applications, make up the remaining 32% of the market. These companies focus on tailored designs, localized distribution, and cost-effective solutions.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Bosch Packaging Technology, WestRock, Douglas Machine Inc.) | 18% |

| Rest of Top 5 (Edson Packaging Machinery, Combi Packaging Systems) | 10% |

| Next 5 of Top 10 (AFA Systems, Delkor Systems, PakTech, MGS Machine, ADCO Manufacturing) | 7% |

The tray former machines market serves multiple industries by providing automated, high-speed, and flexible packaging solutions that enhance productivity and sustainability.

Companies are continuously improving machine adaptability to accommodate different tray sizes and materials. Additionally, the incorporation of energy-efficient components is reducing operational costs while maintaining high performance.

Manufacturers focus on developing better automation, material efficiency, and sustainability with high-performance components and intelligent control systems.

In addition, real-time diagnostics is incorporated to increase the effectiveness of machine monitoring while minimizing downtime from operations. Improvements in servo-driven technology enhance the precision and speed in tray forming operations.

Manufacturers are focusing on automation, material innovation, and AI-driven quality control in response to emerging industry standards. Sustainability, waste reduction, and increased operational efficiency have become top priorities for leading players in packaging performance.

These companies are also making use of cloud-based data management systems for improved real-time production tracking and analytics.

Technology providers should enhance automation, sustainability, and customization in tray forming machine solutions. Partnering with manufacturers and material suppliers will drive cost efficiency and innovation.

Additionally, investing in AI-driven diagnostics can improve machine performance and predictive maintenance capabilities. Emerging trends in smart manufacturing are also creating opportunities for real-time data monitoring and remote system optimizations.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Bosch Packaging Technology, WestRock, Douglas Machine Inc. |

| Tier 2 | Edson Packaging Machinery, Combi Packaging Systems |

| Tier 3 | AFA Systems, Delkor Systems, PakTech, MGS Machine, ADCO Manufacturing |

Manufacturers expand production capacity, integrate sustainable materials, and enhance automation features to meet industry demands. They are also developing energy-efficient tray formers to reduce operational costs and carbon emissions. Additionally, increased adoption of IoT-enabled monitoring systems is enhancing real-time production control and predictive maintenance capabilities.

| Manufacturer | Latest Developments |

|---|---|

| Bosch Packaging Technology | March 2024: Launched AI-driven, fully automated tray forming machines. |

| WestRock | August 2023: Developed high-speed tray formers using recyclable materials. |

| Douglas Machine Inc. | May 2024: Introduced energy-efficient tray formers for logistics packaging. |

| Edson Packaging Machinery | November 2023: Expanded pharmaceutical tray forming solutions. |

| Combi Packaging Systems | February 2024: Enhanced modular tray forming machines for versatility. |

| AFA Systems | April 2024: Developed compact tray formers for space-saving operations. |

| Delkor Systems | June 2024: Launched innovative tray forming solutions for food packaging. |

The tray former machines market is competitive, with firms focusing on automation, sustainability, and newer measures of compliance that will keep companies ahead. Businesses are now more interested in predictive maintenance, which could reduce downtime and help optimize machine performance.

Added improvements in real-time data analytics are further building efficiency within production tracking, thereby allowing manufacturers to enhance the quality of output and its control over operations.

Manufacturers will continue to drive growth with smart packaging technologies, sustainable material investments, and production efficiency. The increase in demand by food, healthcare, and logistics industries will add momentum to further the market. Companies are integrating AI-powered robotics to streamline production and improve accuracy.

Additionally, advancements in modular tray forming systems are allowing greater flexibility for manufacturers adapting to diverse industry needs. The expansion of fully automated packaging lines is also contributing to higher efficiency and cost reduction.

Leading players include Bosch Packaging Technology, WestRock, Douglas Machine Inc., Edson Packaging Machinery, and Combi Packaging Systems.

The top 3 collectively control 18% of the global market.

Medium concentration, with top players holding 35%.

Sustainability, automation, material advancements, and regulatory compliance.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Medical Transport Box Market Trend Analysis Based on Material, Capacity, End-User and Regions 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.