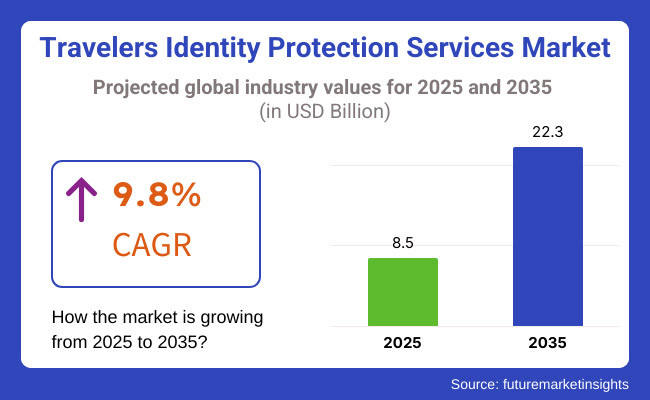

The global travelers identity protection services market is projected to reach USD 8.5 billion by 2025 and grow significantly to USD 22.3 billion by 2035. The industry is expected to expand at a CAGR of 9.8% during 2025 to 2035, fueled by increasing incidents of identity theft, rising cross-border digital transactions, and stringent data security regulations.

Companies specializing in identity protection are enhancing their offerings with AI-driven fraud detection and blockchain-based verification. Industry leaders such as LifeLock (Norton), Experian, and ID Watchdog provide real-time credit monitoring, dark web scanning, and biometric-based authentication to combat identity theft.

Frequent travelers and business professionals are particularly vulnerable to cybercrime, with phishing scams, synthetic identity fraud, and data breaches becoming more sophisticated. The need for advanced security solutions increased, prompting government agencies and financial institutions to employ multi-layered protection services.

Mobile identity protection products are increasingly popular, with offerings such as IdentityForce and myFICO providing real-time notifications and secure digital wallets. The expansion of embedded identity protection in travel insurance policies by companies like Allianz and AXA is another driver for the market to expand.

Explore FMI!

Book a free demo

Between 2020 and 2024, the identity protection services market expanded at a CAGR of 7.1%, driven by rising data breaches and increasing consumer awareness. The market, valued at USD 7.6 billion in 2024, is expected to grow at a CAGR of 9.8% during 2025 to 2035, reaching USD 22.3 billion by 2035.

Key drivers of growth are the increase in mobile transactions, regulatory requirements for compliance with identity protection, and fraud detection technologies powered by AI. Organizations are utilizing blockchain to provide added security, and biometric authentication is rising to prominence in government and financial organizations.

| Global Identity Protection Services Market | Comprehensive Fraud Prevention Market |

|---|---|

| 2020: USD 5.2 Billion (Surge in Online Scams) | 2020: USD 3.8 Billion (Initial Cybersecurity Integration) |

| 2024: USD 7.6 Billion (AI-driven Protection Gains Traction) | 2024: USD 6.1 Billion (Machine Learning-based Fraud Detection) |

| 2025: USD 8.5 Billion (Embedded ID Security in Travel Services) | 2025: USD 7.0 Billion (Cross-industry Cybersecurity Expansion) |

| 2035: USD 22.3 Billion (Widespread Blockchain Adoption) | 2035: USD 17.5 Billion (Automated Threat Intelligence Implementation) |

The rise in sophisticated cyber threats has forced identity protection service providers to adopt sophisticated machine learning and predictive analytics. Norton LifeLock, McAfee, and Kaspersky are some of the firms that are integrating AI-driven identity theft protection, enabling real-time fraud notifications and account recovery services.

The development of blockchain-enabled digital identity wallets and biometric authentication is revolutionizing the marketplace. Financial organizations and governments around the USA, UK, and Singapore are implementing decentralized identity verification for security improvements.

Regulatory compliance, including GDPR in Europe and the Consumer Data Protection Act in the USA, is forcing enterprises to enhance identity security solutions. Financial firms such as JPMorgan Chase and American Express are embedding ID protection into their digital banking services.

| Factor | Impact on Identity Protection Services Industry |

|---|---|

| AI-Powered Fraud Detection | Enhancing real-time monitoring and reducing identity theft rates significantly. |

| Blockchain-Based Digital Identity | Offering decentralized and tamper-proof authentication solutions. |

| Biometric Security Adoption | Increasing fingerprint, retina, and facial recognition implementation. |

| Integration with Travel and Finance | Identity protection embedded in travel insurance and digital banking. |

| Regulatory Compliance Expansion | Strengthening data security laws globally. |

| Consumer Behavior Trend | Statistics & Market Insights |

|---|---|

| Rising Demand for Biometric Security | 65% of global consumers prefer biometric authentication for transactions. |

| Surge in Mobile-Based Protection Services | 75% of identity protection services now offer mobile apps with real-time alerts. |

| Growing Preference for AI-Driven Security | 80% of cybersecurity firms integrate AI for fraud monitoring. |

| Increasing Awareness of Dark Web Risks | 50% of consumers actively monitor dark web activity related to their data. |

| Integration with Digital Banking Services | 60% of digital banks now offer embedded ID theft protection. |

The rapid expansion of global travel has made it a pressing concern for tourists to be protected against identity theft. With increasingly more online reservation systems, mobile payments, and electronic visa issuance being utilized, cybercriminals find new ways to take advantage of tourists' information. A latest research by the International Air Transport Association (IATA) finds that internet reservation of travel is responsible for over 60% of all travel transactions in 2024, thus increasing the danger of electronic fraud.

Hotels and airports are spending more on cybersecurity to protect overseas visitors. Overseas airlines like Delta and Emirates introduced biometric-based check-in and boarding to minimize identity fraud risks. Additionally, hotel chains like Marriott and Hilton have implemented AI-powered fraud watch in their reservation processes to detect suspicious access attempts at guests' accounts.

Identity theft protection companies are aggressively working with travel companies and insurance firms to provide bundled security offerings. Travel insurance policies from firms such as Allianz and World Nomads now offer real-time fraud alerts, identity restoration services, and credit monitoring in emergency situations. Such associations enable travelers to protect their online reputation while traveling abroad.

In addition, mobile security products are also becoming increasingly popular among regular travelers. Products such as Norton 360 that offer VPN encryption, dark web monitoring in real-time, and travel identity protection are becoming increasingly popular. Fintech firms like Revolut and Monzo have also increased the security features of their travel-oriented banking apps to include instant notification alerts for transactions and AI-driven fraud detection protocols.

With cyber threats growing at a tremendous rate, the governments are also enhancing steps to protect travelers. The European Union's Digital Identity Regulation puts higher authentication standards on airlines and travel agencies for making online bookings. Likewise, the USA Department of Homeland Security has heightened security levels for electronic travel authorization, which poses little risk to foreign travelers.

As the pandemic recovers, tourism is experiencing increased demand for robust identity protection services. Vendors continue to innovate with blockchain and AI-driven security to ensure data remains safe from breaches and misuse. The intersection of tourism and cybersecurity will drive the next growth wave for identity theft protection services, ensuring travel experiences are secure and safe worldwide.

With increasingly global travel, travelers also increasingly book their reservations, payment, and identity verification online, which presents them as valuable targets for cybercriminals. Identity theft protection measures are no longer a luxury but a reality for travelers as they now have to travel through unfamiliar digital terrains.

Airports and travel hubs are at the forefront of protecting traveler identities. For instance, London Heathrow and Singapore Changi airports employ biometric check-in and blockchain-based digital passports to facilitate convenient and secure verification of travelers. Likewise, major airlines such as Delta and Lufthansa have incorporated identity protection elements in their loyalty programs, protecting frequent flyers from cyber theft and unauthorized transactions.

Hotels and hospitality groups are also paying attention to guest identity protection. Marriott International and Hilton Hotels have joined forces with cybersecurity companies to implement AI-based fraud detection in their reservation systems, mitigating reservation fraud and data breaches. Vacation rental platforms such as Airbnb have also tightened verification processes through AI-based identity verification to thwart customer impersonation and bogus property listings.

Banks are incorporating identity protection into travel-centric banking services. Online banks like Revolut and Monzo already have real-time transaction monitoring, foreign transaction two-factor authentication, and emergency card freeze capabilities for traveling customers facing unauthorized access problems. Such functionality provides comfort to international travelers while navigating unfamiliar financial systems.

Cybersecurity firms are expanding their services to cover the distinct requirements of global visitors. Norton LifeLock and Kaspersky, for example, have created mobile identity protection software that monitors for phishing attacks, public Wi-Fi threats, and leaked passport numbers on the dark internet. These technologies allow travelers to protect confidential information when they are using unsecured networks at restaurants, hotels, and transportation hubs.

Governments all over the world are ratcheting up controls to collect information on travelers. The European Union's Digital Identity Regulation requires airlines, hotels, and visa issuers to implement more secure authentication technologies for traveler identity verification. The USA Department of Homeland Security is introducing more secure digital passport initiatives coupled with biometric security, minimizing possibilities of passport forgery and unauthorized sharing of traveler information.

As cyber threats keep evolving, identity protection service providers are incorporating advanced technology to counter new risks. AI-powered fraud detection, blockchain identity verification, and biometric authentication will define the future of traveler security. With global tourism expected to surpass pre-pandemic levels by 2030, the need for advanced identity protection solutions will continue to be a top priority for governments, travel firms, and financial service providers.

The USA leads the charge in AI-based identity protection services, with Norton LifeLock and Experian employing advanced fraud detection systems. With the rise of digital banking, payment fraud attempts have grown by 35% annually. The Federal Trade Commission (FTC) processed a record 5.7 million fraud complaints in 2024, indicating the need for robust identity protection.

Banks like Bank of America and Citibank now integrate AI-powered biometric authentication into their mobile banking apps, reducing fraud cases by over 40%. IBM's Trusteer, which is an AI-powered cybersecurity tool, halts account takeovers with behavioral biometric analysis. Besides, top airlines like Delta and American Airlines have introduced facial recognition-based boarding, enabling secure identity verification for travelers.

Government agencies such as the Cybersecurity and Infrastructure Security Agency (CISA) began nationwide identity fraud awareness campaigns. Additionally, the Department of Homeland Security funded blockchain-secured digital IDs to strengthen passport security for bolstering confirmation efficiency at ports of entry.

The UK is witnessing a revolution in digital identity verification driven by increasing cyber fraud and tight financial regulations. The Financial Conduct Authority (FCA) requires all digital banks to have AI-based identity fraud prevention, and fintech participants such as Revolut and Monzo are implementing behavioral analytics for flagging suspicious activity.

Barclays introduced voice recognition via AI into its banking platforms, reducing unauthorized access to accounts by 47%. The UK government's 2023 Digital Identity and Attributes Trust Framework aims to put all industries, but particularly finance and travel, on to secure standardised identification. British Airways partnered with iProov to trial contactless check-in via biometric facial recognition, accelerating airport security procedures.

In addition, ID checking via blockchain is picking up steam. Onfido and Yoti are two such providers of decentralized identity checks, enabling companies to check customers' identities without holding their sensitive information, minimizing the scope for data breaches. At a time when cybercrime is already costing UK commerce more than GBP 3 billion a year, companies are investing increasingly in fraud detection software. AI-enabled identity protection solutions will become the standard as digital payments continue to be the financial norm.

The Travelers Identity Protection Services industry is competitive, driven by technological developments, regulatory needs, and increasing cybersecurity threats. Market players include established giants such as NortonLifeLock, Experian, TransUnion, and Kroll, and emerging digital identity firms such as Idemia and Clear. The competitors compete on data protection, biometric authentication, artificial intelligence-driven fraud detection, and full-service identity monitoring solutions. Partnerships with travel companies, airlines, and financial institutions are top among forces pushing market expansion. Compelling competition as well is the merger and acquisition trend, as companies build more enhanced cybersecurity capabilities to offer more integrated identity protection offerings amid growing concerns about data compromise and fraud.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, MEA |

| Key Segments Covered | Service Type, Subscription Model, End User, Nationality |

| Key Companies Profiled | Norton LifeLock, Experian, Equifax, McAfee, Kaspersky, IBM, TransUnion, Mastercard, Visa, American Express, Idemia |

The global travelers identity protection services market is valued at approximately USD 7.6 billion in 2024. The market is projected to reach USD 8.5 billion in 2025 and expand to around USD 22.3 billion by 2035, with an estimated CAGR of 9.8%.

Rising concerns over data breaches, increasing digital travel transactions, and stricter regulations on identity verification are fueling market growth.

Leading companies in the industry include NortonLifeLock, Experian, TransUnion, Kroll, Idemia, Clear Secure, AU10TIX, GB Group, Giesecke+Devrient, and Daon.

AI-powered identity verification, biometric security solutions, and decentralized identity management are revolutionizing the industry.

Biometric authentication and blockchain technology are strengthening traveler identity protection by reducing fraud risks and ensuring seamless verification across borders.

Growing cybercrime and identity theft incidents are pushing service providers to adopt end-to-end encryption, multi-factor authentication, and proactive fraud monitoring systems.

Travelers are demanding frictionless, secure, and privacy-focused identity solutions.

Winning Strategies in Social Media and Destination Market Share Analysis: A Competitive Review

Winning Strategies in the Global Tourism Industry Loyalty Program Sector: A Competitive Review

Winning Strategies in the Global Animal Theme Parks Industry: A Competitive Review

Winning Strategies in the Global Spa Resorts Industry: A Competitive Review

Winning Strategies in the Global Winter Adventures Tourism Industry: A Competitive Review

Surrogacy Tourism Industry – Competitive Analysis and Market Share Outlook

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.